Archive for Finance

Bernie Sanders Proposes Estate Tax of Up to 77% for Billionaires

Posted by: | Comments-

Senator’s plan would cut estate tax exemption to $3.5 million

- Independent is considering a second presidential run in 2020

Senator Bernie Sanders. Photographer: David Paul Morris/Bloomberg

Independent Senator Bernie Sanders is proposing to expand the estate tax on wealthy Americans, including a rate of as much as 77 percent on the value of estates above $1 billion.

Sanders of Vermont, who’s considering a second run for president, said in a statement that his plan would apply to the wealthiest 0.2 percent of Americans. It would set a 45 percent tax on the value of estates between $3.5 million and $10 million, increasing gradually to 77 percent for amounts more than $1 billion. The current estate tax kicks in when an estate is worth about $11 million…

Fed Looks Like Just an ‘Average Investor’ After Market Tantrum

Posted by: | Comments-

Dovish turnaround puzzles investors, spurs rate-cut bets

- Notion of data-dependent policy is gone, says DB’s Saravelos

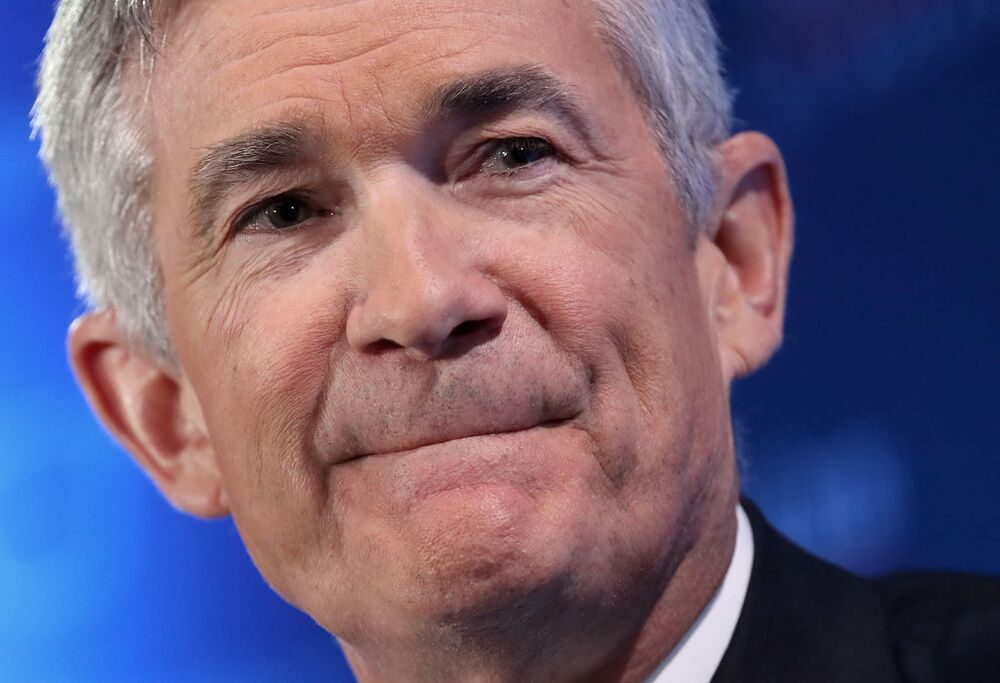

Jerome Powell on Jan. 30. Photographer: Al Drago/Bloomberg

Jerome Powell on Jan. 30. Photographer: Al Drago/Bloomberg

Federal Reserve Chairman Jerome Powell has long promised to be flexible when setting monetary policy. After Wednesday’s performance, many on Wall Street are questioning whether that flexibility means bending over backward to placate jittery financial markets.

At firms from London to Los Angeles, investors and analysts are not mincing words about the significance of the Fed’s decision to stop signaling that more interest-rate increases may be coming. The surprise triggered a rally in stocks, gains in Treasuries and weakness in the dollar — not dissimilar to what investors were used to when the Fed was deploying its financial crisis-fighting stimulus…

Trump Started 2019 With $19.3 Million in 2020 Campaign Account

Posted by: | Comments-

President’s re-election effort spent $23 million in quarter

- Committee raised more than $21 million during same period

The silhouette of Donald Trump. Photographer: Andrew Harrer/Bloomberg

President Donald Trump’s re-election committee finished 2018 with $19.3 million in the bank after spending more than $23 million during the fourth quarter, according to a filing made late Thursday with the Federal Election Commission.

The campaign raised more than $21 million during the fourth quarter through both direct contributions and donations raised by its joint fundraising committees with the Republican National Committee, according to a statement from the re-election committee…

CEO Made $357 Million From Small Businesses, $3.50 at a Time

Posted by: | Comments-

FleetCor paid Clarke as much as Visa, Mastercard CEOs combined

- Customers accuse fuel-card company of charging excessive fees

In her 35 years running a small business, Maria Kirk dealt with only one company that made her physically ill: fuel-card provider FleetCor Technologies Inc. and the thousands of dollars in fees it charged.

“Many companies try to nickel-and-dime you, but this can’t even compare,’’ said Kirk, the owner of an ice-delivery firm in Orlando, Florida. She said her health deteriorated in the years it took to resolve the dispute. “It felt like: ‘Let’s wear everybody down and see how much money we can glean from those that stop fighting back.’’’…

Saudi Arabia Collects $107 Billion as Prince Ends Crackdown

Posted by: | Comments-

Commission headed by Crown Prince ‘completes its mission’

- Settles cases with 87 individuals after 381 people testifies

Saudi authorities said they’ve recovered about $107 billion from people implicated in what the government has described as a crackdown on graft that has rattled the kingdom’s business elite and weighed on economic growth.

An anti-corruption commission headed by Crown Prince Mohammed Bin Salman said the funds received from 87 individuals came in cash, real estate, companies and securities. It wasn’t clear whether the amount was collected in full. Prince Mohammed said in October the state has received about $35 billion, while the rest would take about two years. Officials didn’t immediately respond to requests for comment…

Fed Signals End of Interest Rate Increases

Posted by: | CommentsWASHINGTON — The Federal Reserve signaled on Wednesday that its march toward higher interest rates may be ending sooner than expected, suspending its previous plans to continue raising rates this year.

The Fed’s chairman, Jerome H. Powell, said economic growth remained “solid” and the central bank expected growth to continue. But in a sharp reversal of the Fed’s stance just six week ago, Mr. Powell said the Fed had “the luxury of patience” in deciding whether to raise rates again…

Trump Met Heidi Cruz for World Bank Job But Passed on Her, Sources Say

Posted by: | Comments-

David Malpass remains the clear frontrunner for the position

- Cruz is wife of Senator Ted Cruz and a Goldman Sachs executive

Heidi Cruz and husband Ted Cruz. Photographer: Daniel Acker/Bloomberg

Heidi Cruz and husband Ted Cruz. Photographer: Daniel Acker/Bloomberg

President Donald Trump interviewed Heidi Cruz for the job of World Bank president although he’s not offering the post to the Goldman Sachs Group Inc. executive and wife of Senator Ted Cruz of Texas, people familiar with the matter said.

Treasury Undersecretary David Malpass remains the clear frontrunner for the job, but Trump has continued to consider others, including Cruz and prominent investor Mohamed El-Erian, the people said. A decision could come as soon as this week, one of the people said…

Starwood Capital Seeks $500 Million to Chase Tax Break Criticized by Its CEO

Posted by: | Comments

Barry Sternlicht Photographer: John Lamparski/Getty Images

Barry Sternlicht’s Starwood Capital Group is seeking to raise $500 million to fund investments in low-income areas deemed “opportunity zones” under a new U.S. tax policy — of which he’s been a vocal critic…

Starwood Capital Seeks $500 Million to Chase Tax Break Criticized by Its CEO

Eight Asian Billionaires Aged Over 90 Control $125 Billion

Posted by: | CommentsIt’s been a mournful start to 2019 for two of Asia’s richest families.

Eka Tjipta Widjaja, who began as a coconut and palm-oil trader at age 15 before building a multibillion-dollar empire in Indonesia, died Saturday at 98. A week earlier, Henry Sy, a shoe salesman who became the wealthiest man in the Philippines, died at 94. Their combined fortunes exceeded $16.5 billion…

A Watershed’s Coming for China’s $11 Trillion Bond Market

Posted by: | CommentsBeijing has an incentive to push yields below 3 percent. With deflation threatening, it may not be too late to join the rally.

A dip below 3 percent could open the debt floodgates. Photographer: Goh Chai Hin/AFP/Getty Images

A watershed moment is approaching for China’s $11 trillion bond market: The 10-year sovereign bond yield looks poised to tumble below 3 percent.

The yield slumped to as low as 3.08 percent this month from 3.7 percent in September as the government fixed-income market rallied. The last time it fell below 3 percent for a sustained period was in 2016, when China was battling deflation…

U.K. Fund Managers Face New Guidelines Demanding Transparency

Posted by: | Comments-

New rule will require asset managers to report what they did

- FRC has no research on whether the stewardship code works

An endangered U.K. regulator is demanding that asset managers change the way they interact with investors under new rules that require funds to provide more information on their business culture.

A key difference in the updated stewardship code from the Financial Reporting Council is that asset managers will have to report what they’ve actually done, rather than just their policies on stewardship. The effectiveness of the current rules is unknown, nine years after the industry first signed up…

Where Europe’s Biggest Fund Manager Is Putting Its Cash (And Where It’s Avoiding)

Posted by: | CommentsEurope’s largest asset manager favors India, Russia and Chile among emerging markets, arguing they fare better against those with weaker fundamentals and political risks amid an expected global slowdown.

Amundi Asset Management, which oversees the equivalent of about $45 billion of developing-nation assets, also likes stocks and bonds in China, Indonesia, Czech Republic, Brazil, and Peru, Pascal Blanque, group chief investment officer, said in an interview in Singapore…

Where Europe’s Biggest Fund Manager Is Putting Its Cash (And Where It’s Avoiding)

Eight Asia Billionaires Aged Over 90 Control $125 Billion

Posted by: | CommentsIt’s been a mournful start to 2019 for two of Asia’s richest families.

Eka Tjipta Widjaja, who began as a coconut and palm-oil trader at age 15 before building a multibillion-dollar empire in Indonesia, died Saturday at 98. A week earlier, Henry Sy, a shoe salesman who became the wealthiest man in the Philippines, died at 94. Their combined fortunes exceeded $16.5 billion…

Australia Firms See Worst Slump in Conditions Since Financial Crisis

Posted by: | Comments-

Money markets now pricing in a 70% chance of interest-rate cut

- Weaker business conditions dovetail with lower economic growth

Australian firms suffered the worst slump in conditions since the 2008 global financial crisis as evidence mounts that the economy slowed in the latter part of last year.

The business conditions index — measuring hiring, sales and profits — dropped to 2 in December from 11 a month earlier, a National Australia Bank Ltd. report showed Tuesday. A gauge of employment fell to 4 from 9 in November, while profitability plunged to zero from 8. A separate confidence index was unchanged at 3…

Silver Shortage Promises to Boost Price in 2019

Posted by: | Comments-

Smallest output seen since 2013 as miners avoid new projects

- Use growing for solar cells, touch screens, even medicine

Think of it as a potential silver lining for investors. A burgeoning shortage of the precious white metal is promising to boost its price as 2019 rolls out.

Silver surged 9.1 percent in December, its biggest monthly gain in almost two years. This year, with miners avoiding new projects amid global economic uncertainty, the price could spike as high as $17.50 an ounce from about $15.36 now, according to a Bloomberg survey of 11 traders and analysts…

Saudi Arabia Kicks Off $426 Billion Infrastructure Bonanza

Posted by: | Comments-

Saudi Arabia looking to break reliance on oil sales for income

- Investment target ‘growing as we speak,’ energy minister says

Saudi Arabia unveiled a sweeping plan to develop infrastructure and industry across the world’s leading oil-exporting nation.

Crown Prince Mohammed bin Salman, who’s embarked on the biggest overhaul of the Saudi economy in its modern history, on Monday presided over the signing of agreements in planned deals before an invite-only crowd in Riyadh. The program will net more than $426 billion in investments by 2030 and add 1.6 million new jobs, according to a government statement…

Malaysia to Terminate $20 Billion China-Backed Rail Project

Posted by: | CommentsMalaysia will terminate a $20 billion rail project with contractor China Communications Construction Co., Economic Affairs Minister Mohamed Azmin Ali said.

The Cabinet decided the East Coast Rail Link project was “beyond the government’s financial capability,” he told reporters on Saturday. Malaysia Finance Minister Lim Guan Eng wouldn’t corroborate Azmin’s comments, saying an official announcement would be issued if necessary by next week on the instructions of Prime Minister Mahathir Mohamad…

The $200 Trillion Gold Rush That Has Reshaped Private Banking

Posted by: | CommentsFrom Hong Kong to Miami, private bankers are finding new ways to serve the growing ranks of the world’s wealthy.

Illustration: Peter Oumanski for Bloomberg Businessweek

Illustration: Peter Oumanski for Bloomberg Businessweek

Ten years ago, stock markets plunged, major banks faltered, and the global economy teetered on a precipice. Few would have predicted that the ensuing decade would produce an explosion in wealth.

But that’s just what happened. An unprecedented infusion of central bank funds into the world’s largest economies bolstered asset prices, making many people richer and exacerbating inequality. Global personal wealth reached a record $201.9 trillion last year, according to Boston Consulting Group Inc…

Why the Fed Is Likely to Signal Greater Policy Flexibility

Posted by: | CommentsThe central bank must balance continuing to please markets and responding to domestic economic strength.

Spotlight on Jay Powell. Photographer: Win McNamee/Getty Images

One of the major questions facing the Federal Reserve when its policy-making committee meets this week is whether to counter the recent big change in the way markets characterize its policy mindset. In the last few weeks, markets have come to believe that the central bank led by Chair Jerome Powell is behaving, and will continue to behave, much more like its two predecessors: averse to bouts of financial volatility, and willing to use words and actions to both counter and minimize them. This is a notable change from the earlier view that this new Fed leadership is focused on normalizing monetary policy as a means of creating greater policy flexibility to deal with a future economic downturn, while also reducing the probability of severe financial instability down the road…

China’s Banks Are Desperate for Capital

Posted by: | CommentsLenders can’t continue this pace of loan growth without a bigger cushion. Beijing needs to make fundraising easier.

Trouble on the horizon. Photographer: Qilai Shen/Bloomberg

Trouble on the horizon. Photographer: Qilai Shen/Bloomberg

The way China handles this challenge will determine its economic health. With 267 trillion yuan ($39.4 trillion) of total assets, and home to the world’s four largest banks by this measure, the country’s financial system doesn’t operate in isolation. Whatever happens in China will have a global impact…

Thai Property Can Stay Hot in Chillier Times

Posted by: | CommentsChinese demand and a tourism boom will soften the impact of overbuilding and weakening global growth.

Clouds are gathering, but the sun’s still shining. Photographer: Dario Pignatelli/Bloomberg

Thailand’s booming property market is at risk of cooling this year as rampant construction threatens an oversupply of apartments amid increasing global economic headwinds.

The country has been a relative bright spot in an otherwise lackluster Southeast Asian real estate market. Thai residential property has experienced substantial growth in recent years, much of it fueled by buyers from China, Japan and Singapore. The thriving hospitality sector has also drawn money from foreign and local investors to fund the building of many new hotels and resorts…

Carlos Slim Buys Businesses From Rival Telefonica for $648 Million

Posted by: | Comments-

Telefonica sells Guatemala, El Salvador units to America Movil

- Both companies have been battling for years in Latin America

Carlos Slim’s phone empire is set to grow larger with the purchase of operations in Guatemala and El Salvador from longtime rival Telefonica SA.

America Movil SAB will buy all of Telefonica’s Guatemalan operation and 99.3 percent of those in El Salvador for $648 million, the Mexican telecom giant said in a filing Thursday. The deal is subject to regulatory approval…

Carlos Slim Buys Businesses From Rival Telefonica for $648 Million

U.K. Launches Inquiry to Find Advantages for Banks in Brexit

Posted by: | CommentsU.K. lawmakers will investigate how the country can take advantage of Brexit to remove regulatory barriers for British banks.

Parliament’s Treasury Committee will launch an inquiry on Friday into the future of the financial-services industry after the U.K. leaves the European Union. It will look into what the government’s priorities on banking should be as it negotiates future trading relationships and whether current regulatory barriers that apply to third-party countries should be maintained…

U.K. Launches Inquiry to Find Advantages for Banks in Brexit

Ken Griffin Spends Extra $38 Million On New York Pied-À-Terra Because Of Course He Did

Posted by: | Comments$200 million does not buy enough comfort for the three or four days KG spends in the Big Apple every year.

Ken Griffin doesn’t live in New York. He also doesn’t live in Miami, Palm Beach or London. Still, he now owns (or owned) the most expensive residence in the first three of those places (as well as his actual hometown, Chicago), and one of the most expensive residences in the fourth.

Leveraged-Loan Protections Go From Bad to Worse

Posted by: | CommentsCovenants moved to “uncharted territory,” Moody’s research shows. But the year-end slump may have restored some balance between buyers and sellers.

Look before you leap. Photographer: Leon Neal/Getty Images Europe

If a day of reckoning does arrive in the market for leveraged loans or collateralized loan obligations, as suggested most recently by Barclays Plc Chief Executive Officer Jes Staley, investors can’t say Moody’s Investors Service didn’t warn them.

Elizabeth Warren’s Wealth Tax Would Cost Jeff Bezos $4.1 Billion in First Year

Posted by: | Comments

Jeff Bezos, the world’s richest person, would have to pay $4.1 billion in the first year under U.S. Senator Elizabeth Warren’s soon-to-be proposed wealth tax, based on his current net worth of $137.1 billion.

The Amazon.com Inc. founder and the other 174 Americans on the Bloomberg Billionaires Index, a ranking of the world’s 500 richest people, would collectively owe $61 billion.

Elizabeth Warren’s Wealth Tax Would Cost Jeff Bezos $4.1 Billion in First Year

Bank of Korea Stands Pat on Interest Rates

Posted by: | Comments-

Economic growth likely to be slightly below October projection

- Korea will maintain its accommodative monetary policy stance

South Korea’s central bank kept its key interest rate unchanged as it assesses the impact of an increase in borrowing costs in November and mounting economic risks at home and abroad.

All but one of 25 analysts surveyed by Bloomberg had forecast the Bank of Korea would keep the seven-day repurchase rate at 1.75 percent on Thursday, while one projected a 25-basis-point cut…

Once the World’s Greatest Port, Hong Kong Sinks in Global Ranking

Posted by: | Comments-

City was likely overtaken by Guangzhou and Busan last year

- Li Ka-shing’s terminal operator freezes pay to cut costs

The Hong Kong container terminals under the super blood wolf moon on Jan. 22. Photographer: Anthony Kwan/Bloomberg

The Hong Kong container terminals under the super blood wolf moon on Jan. 22. Photographer: Anthony Kwan/Bloomberg

Hong Kong’s continued slide down the rankings of the world’s great ports has pushed billionaire Li Ka-shing’s freight-terminal operator to take action.

HongKong International Terminals Ltd., the city’s biggest container-terminal operator and part of Li’s CK Hutchison Holdings Ltd., is freezing salaries for all its staff this year due to rising competition and the U.S.-China trade war. It has also formed an alliance with rival dock operators in Hong Kong in a bid to cut costs…

Zermatt’s $60 Million, Glass-Bottomed, Swarovski-Encrusted Gondola

Posted by: | CommentsEurope’s longest and tallest has Pininfarina-designed seats—and is an attraction unto itself.

It’s easy to live the sky-high life in Zermatt: The Swiss ski resort lives in the eternal shadow of the Matterhorn, one of Europe’s tallest peaks, and its slopes are among the Continent’s steepest. Now you can also see it all from the world’s highest tri-cable gondola lift, which rolls in and out of—you guessed it—Europe’s highest mountain station.

Already dizzied by the thought of it? Try adding a $60 million price tag, a glass floor, and more than 1 million sparkling crystals…

Chilling Davos: A Bleak Warning on Global Division and Debt

Posted by: | CommentsDAVOS, Switzerland — As business and political leaders arrive in the Swiss Alps for the annual meeting of the World Economic Forum, a surprisingly alarming letter from an influential investor who studiously eschews attention has already emerged as a talking point.

The letter, written by Seth A. Klarman, a billionaire investor known for his sober and meticulous analysis of the investing world, is a huge red flag about global social tensions, rising debt levels and receding American leadership…

Hong Kong’s Billion-Dollar Plunges Highlight Share Pledge Danger

Posted by: | Comments-

Company founders can use stock as collateral and not reveal it

- Jiayuan’s 89% drop was only the latest case to hit investors

Hong Kong’s share pledge problem is raising its head once again.

Jiayuan International Group Ltd. sank as much as 89 percent on Thursday on what turned out to be a margin call on stock used as collateral by its chairman. The sudden plunge, the biggest decline in the world this year of a company worth more than $1 billion, was the latest example of a Hong Kong-listed business losing almost all its value in a matter of minutes and then revealing that an insider had pledged a substantial amount of their shares for loans…

Fleeing Clients Are Grim Reality in Banks’ Push to Manage Money

Posted by: | Comments-

UBS not immune to market swings that’s made clients nervous

- Credit Suisse warns of ‘difficult’ quarter despite resilience

Managing money for the wealthy — once touted as a panacea for banks burned by investment banking’s cutthroat rivalry and lenders’ smothering capital requirements — is proving to be anything but.

UBS Group AG, the world’s largest wealth manager, predicted lower revenue from its asset management and wealth divisions in coming weeks after seeing $13 billion yanked during the final months of 2018. Credit Suisse Group AG signaled that its assets under management were resilient during the recent equities meltdown, but warned it’s been a “very difficult quarter.”…

Asian Stocks Pare Early Losses; Yen Declines: Markets Wrap

Posted by: | Comments-

Technology shares lead U.S. stocks lower; yen holds gains

- West Texas crude oil extends decline; dollar steadies

Asian stocks reversed early losses Wednesday as traders juggled continuing doubts about the prospects for Sino-American trade progress with signs of China stimulus and moves in Congress to end the U.S. government shutdown. The yen slid.

Shares in Hong Kong, China and Korea led the turnaround, even after all major U.S. benchmarks declined. White House adviser Lawrence Kudlow said that negotiations scheduled for next week will be “very, very important” and “determinative.” Meantime, the Senate scheduled a vote for Thursday on Democratic-backed legislation to reopen the government, the first sign of a possible way out of the shutdown. China’s central bank pumped liquidity into the banking system through a new tool…

Tycoon Mistry’s Asset Sales in Focus After Downgrades

Posted by: | Comments-

Credit ratings of five group firms revised lower in two months

- 154-year-old group is in process of divesting more assets

Pallonji Mistry in 2006. Photographer: India Picture/UIG via Getty Images

Pallonji Mistry in 2006. Photographer: India Picture/UIG via Getty Images

Reclusive billionaire Pallonji Mistry is trying to offload more assets and pay down debt after some of his companies had their debt ratings cut late last year.

Ratings on debt instruments of at least five companies in the 154-year-old Shapoorji Pallonji Group were cut in the last two months. The conglomerate’s businesses range from construction to real estate and financial services…

U.S. Futures, Europe Stocks Dip Amid Growth Noise: Markets Wrap

Posted by: | Comments-

IMF cuts world growth forecast; trade outlook as murky as ever

- Markets lack conviction as U.S. exchanges shutter for holiday

U.S. equity futures and European stocks slipped on Monday while Asian markets posted modest gains as investors weighed the latest batch of competing headlines on global growth and trade. The dollar was steady and bonds in Europe were mixed.

Fund Managers Who Called China Stock Bottom See More Gains Ahead

Posted by: | Comments-

Deutsche Bank Wealth says China shares will lead Asia advance

- Investors cite earnings growth, government stimulus as reasons

At the end of October, when Chinese shares were in freefall, the chief investment officers at Deutsche Bank Wealth Management made a bold call: the worst was over for the world’s second-largest equity market.

Since the start of November, the MSCI China Index of the nation’s shares has rebounded more than 7 percent…

Fund Managers Who Called China Stock Bottom See More Gains Ahead

Wells Fargo Admits That It Will Remain In A Bad Bank Time Out For 2019

Posted by: | CommentsAmerica’s naughtiest lender will stay under Fed punishment for the whole year.

How is your 2019 going so far, Tim Sloan?

Wells Fargo will continue to operate under a Federal Reserve restriction on its growth through the end of this year, its CEO said on Tuesday, longer than previously estimated.

Shares of the San Francisco bank fell nearly 3 percent on Tuesday.

We’ll take that as a “so-so”?…

Wells Fargo Admits That It Will Remain In A Bad Bank Time Out For 2019

Central Banks Struggle With Policy Settings

Posted by: | CommentsECB outlook reflects a global shift in central banking

FRANKFURT—The eurozone’s economic slowdown has taken European Central Bank officials by surprise, potentially disrupting their plans to lift short-term interest rates this year.

The shift underlines the difficulties central banks face getting back to growth rates and policy settings that were considered normal before the global financial crisis…

Goldman’s M&A Bankers Shine, Traders Stumble as Malaysian Scandal Looms

Posted by: | CommentsThe Wall Street firm’s profit rises, stock responds by rising 9.5%, its best day in nearly a decade

Goldman Sachs Group Inc.’s merger bankers bailed out its bond traders, who fared badly in late 2018’s choppy markets and saw their bonuses shrink as a result.

Goldman’s fourth-quarter profit of $2.54 billion, or $6.04 a share, rose from a year ago and easily beat the $1.64 billion, or $4.27 a share, predicted by Wall Street analysts. Quarterly revenue of $8.1 billion was flat, while full-year revenue was the highest since 2010…

Goldman’s M&A Bankers Shine, Traders Stumble as Malaysian Scandal Looms

House Passes Latest Plan to Fund the Government: Shutdown Update

Posted by: | CommentsThe partial shutdown of the government entered its 26th day with no public signs from President Donald Trump’s White House or Congress of any negotiations to end it.

House Passes Latest Plan to Fund Government (5:50 p.m.)

The House on a 237-187 vote passed the latest in a series of bills to end the partial government shutdown with little Republican support…

House Passes Latest Plan to Fund the Government: Shutdown Update

Bonds That Were Ground Zero for China Debt Woes Now Top Pick

Posted by: | Comments-

Investors recommend buying more LGFV notes in 2019: survey

- Stepped-up stimulus measures boost demand for such bonds

China’s stimulus measures are seen easing financial stress at the nation’s debt-laden town builders, making them among the top picks for investors this year, a Bloomberg survey showed.

Some 15 out of 20 analysts and portfolio managers recommend adding more bonds of local government funding vehicles to their portfolios in 2019, according to the survey done in recent weeks. After Chinese government bonds, LGFVs are the most sought after by respondents in the survey, followed by convertible notes…

Cracks Start to Show for U.A.E. Banks as Bad Loans Set to Rise

Posted by: | Comments-

Provisions could rise by as much as 20 basis points: analysts

- Defaults are likely to increase in property and SME business

Cracks are starting to show in the United Arab Emirates’ banking sector as a property and retail slump take its toll on lenders.

One of the country’s smallest banks is being bailed out, problem loans are expected to rise this year and lenders are exploring mergers to stay competitive. Slow property sales, higher interest rates and a rise in lending amid improved economic growth could mean provisions jump as much as a quarter, according to analysts…

Four Chinese Tycoons Just Transferred $17 Billion to Trusts

Posted by: | Comments-

Sunac chair transfers $4.5 billion to trust on New Year’s Eve

- China’s rich rush to protect their wealth as taxes loom

Four Chinese tycoons transferred more than $17 billion of their wealth into family trusts late last year, underscoring how the rich are scrambling to protect their fortunes from the nation’s newly toughened tax regime.

Asian Stocks Are Caught in the Longest Sell-off in 16 Years

Posted by: | Comments-

MSCI Asia Pacific falls for tenth consecutive session

- Trade tensions, EM turmoil, stronger dollar behind move

It’s a losing streak investors haven’t seen since 2002.

The benchmark MSCI Asia Pacific Index fell for a tenth consecutive day Wednesday, extending its recent decline to almost 5 percent and bringing the loss in value to almost $700 billion this year…

Meituan Raises $4.2 Billion in IPO Priced Toward Top

Posted by: | CommentsMeituan Dianping, the Chinese food review and delivery giant, has raised about $4.2 billion after pricing its Hong Kong initial public offering toward the top end of a marketed range, according to people with knowledge of the matter.

The company priced its sale of 480.27 million new Class B shares at HK$69 apiece, the people said, asking not to be identified because the information is private. The shares were offered at HK$60 to HK$72 each…

How Bank Workers Emerged From the Crash $12.5 Billion Richer

Posted by: | Comments-

Goldman options granted in December 2008 have soared in value

- BofA, Citi among those whose options expired out of the money

Stock options granted at the depths of the financial crisis have yielded billions of dollars for employees at some of the biggest U.S. banks, while others saw the promise of massive payouts vanish as shares of their firms languished.

Goldman Sachs Group Inc., Wells Fargo & Co. and JPMorgan Chase & Co.employees reaped about $12.5 billion from stock options exercised in the decade since the collapse of Lehman Brothers Holdings Inc., as some bank stocks rebounded smartly…

Tech Investors Prepare to Say Goodbye to Facebook, Google

Posted by: | CommentsNew S&P 500 communication-services sector will include companies currently in the tech, consumer-discretionary sectors

Billionaire Who Once Built Robots to Trade Goes to War With Them

Posted by: | Comments-

Interactive Brokers is first to move its stock listing to IEX

- Chairman Peterffy says investors to get ‘better executions’

Thomas Peterffy helped launch the electronic-trading revolution that transformed the U.S. stock market. And while the billionaire hasn’t soured on automation, he’s taking a lead role fighting back against the speediest traders.

Interactive Brokers Group Inc. announced Wednesday that it will list its shares on an exchange run by IEX Group Inc., which was made famous by Michael Lewis in “Flash Boys.” The 2014 book documented the market’s efforts to use a 350-microsecond speed bump to eliminate advantages IEX believed the fastest traders had in U.S. stocks. When shares of Interactive Brokers move over from Nasdaq Inc., it will be IEX’s first win in its delayed plan to list corporations…

JPMorgan CEO James Dimon Said He Could Beat Trump in a Presidential Election

Posted by: | CommentsMr. Dimon said he’s “as tough as [Trump] is, I’m smarter than he is.” After the event concluded, the executive backtracked on his comments

Rich Asians See Crazy Big Losses Amid Longest Market Sell-Off

Posted by: | Comments-

More than two-thirds of the toll is from China and Hong Kong

- Combined wealth of billionaires from other regions rose 2.7%

Asia may be minting the most billionaires these days, but the fortunes held by the very richest are shrinking.

The region’s 120 wealthiest people have collectively lost $99 billion this year, according to the Bloomberg Billionaires Index. By comparison, the 173 richest Americans have gained $132 billion…

Rich Asians See Crazy Big Losses Amid Longest Market Sell-Off

U.S. Asks China for New Round of Trade Talks Led by Mnuchin

Posted by: | Comments-

Trump hasn’t yet issued $200 billion round of tariffs

- President has threatened to tax nearly all Chinese goods

The U.S. government has proposed another round of trade talks with Beijing to avoid further escalation in Donald Trump’s trade war with China, the president’s top economic adviser said. U.S. equities rose on expectations the development could ease growing tensions.

Senior officials led by Treasury Secretary Steven Mnuchin recently extended the invitation to counterparts in China, said three people familiar with the matter, speaking on condition of anonymity. One of the people said the talks, if agreed to by the Chinese, are likely to take place in Washington…

Wall Street Is Bullish on Global Economy Despite Emerging Markets

Posted by: | Comments-

JPMorgan, Goldman economists see global growth just below 4%

- Economists see U.S. strength despite emerging markets, trade

Wall Street economists are sticking with their forecasts for the global economy to enjoy its strongest growth since the start of the decade even as emerging markets wobble and trade wars escalate…

Wall Street Is Bullish on Global Economy Despite Emerging Markets

Fidelity Expands Zero-Fee Lineup With Two New Index Mutual Funds

Posted by: | CommentsFidelity Investments said it will start two additional zero-expense-ratio mutual funds, stepping up its push to lure cost-conscious individual investors.

The Fidelity Zero Large Cap Index Fund and the Fidelity Zero Extended Market Index Fund will be available beginning Sept. 18, Boston-based Fidelity said in a statement Wednesday…

Fidelity Expands Zero-Fee Lineup With Two New Index Mutual Funds

Florence Shuts Down Businesses and Sticks Insurers With the Tab

Posted by: | Comments-

Hartford, FM Global send staff to region as claims expected

- Wells Fargo shut branches as Daimler, Cargill halted work

Days before Hurricane Florence is expected to slam into the U.S. East Coast, insurers are starting to see potential claims costs tick upward as people flee and companies halt operations.

Evacuations, already affecting more than 1 million people in and around North Carolina, start the clock ticking on business-interruption insurance policies, which help replace lost income for companies when natural disasters strike. Hartford Financial Services Group Inc. and FM Global are among insurers with exposure in the region that are sending staff to help with anticipated claims…

Barclays Plants $1.1 Billion Into U.K. Government Housing Fund

Posted by: | CommentsBarclays Plc, one of the world’s biggest investment banks, will invest about 875 million pounds ($1.1 billion) in a U.K. property fund that will lend to home builders.

The fund will make “competitively priced” loans to developers ranging from 5 million pounds to 100 million pounds in a bid to increase the pace and volume of housing provision, the London-based bank said in a statement. The U.K. government’s housing agency will invest 125 million pounds in the venture…

Barclays Plants $1.1 Billion Into U.K. Government Housing Fund

Earnings a Bright Spot for Top India Brokerage Amid Rupee Slump

Posted by: | Comments-

Rupee ‘catching up’ after ‘benign period of stability’: I-Sec

- Evidence supports market view for 15%-20% earnings growth

India’s rupee has been battered along with its emerging-market peers in recent weeks, but stock investors would do well to look beyond the currency’s slump and pay attention to an improving earnings picture, according to the nation’s largest brokerage.

“We have moved away from the past when currency sneezed and the equity markets caught a cold,” Shilpa Kumar, chief executive officer of ICICI Securities Ltd., said in an interview. “The broad view is for a 15 percent to 20 percent earnings growth from here on for the next two years and the evidence of that is there.”…

The Government May Want to Buy Your Dying Mall

Posted by: | CommentsLocal governments across the U.S. are taking over dying shopping malls.

These municipalities, concerned that vacated retail centers will blight the landscape and drag down surrounding property values, have been buying up malls they fear are being starved of capital by the private sector…

Argentina Holds Rate at World-High 60 Percent to Fight Inflation

Posted by: | Comments-

Central bank committed to not lowering key rate until December

- Data shows inflation accelerating in August and September

Argentina’s central bank kept its key interest rate on Tuesday at 60 percent, the highest in the world, following a surprise hike two weeks ago after the peso plunged.

Central bank officials said in their statement that inflation accelerated in August and continues to do so September, citing high-frequency data. They forecast the economy to be in recession this year and next. They also reaffirmed their commitment from August to not lower rates until December in an effort to stabilize the peso, which is down more than 50 percent so far this year…

‘Bankrupt’ Pakistan Grid Adds to Imran Khan’s Economic Quandary

Posted by: | Comments-

Khan needs to overhaul ‘collapsed’ distribution system: Engro

- Engro coal power project running four months ahead of schedule

In Pakistan’s Tharpakar desert, Chinese and Pakistani workers toil in the blistering heat to complete the construction of a massive open pit coal mine and an adjacent 660 megawatt power plant four months before schedule. The roadblocks will come soon after.

When Engro Corp., one of Pakistan’s largest conglomerates, which is partnering with China, begins generating electricity from the plant in December it will hit a distribution and transmission network that is essentially “bankrupt,” according to Shamsuddin Shaikh, the chief executive officer of Engro’s energy arm…