Archive for Uncategorized

For the World’s Biggest Wealth Fund, Only Two Countries Drive Global Risks

Posted by: | Comments-

CEO says will continue to be a long-term investor in Europe

-

Fund rallied 6.9% in 2016 after Trump-fueled stock gains

Bothered about Brexit? Fretting over Frexit? Don’t worry.

Norway’s $900 billion wealth fund, which owns 1.3 percent of global stocks, says politics in only two countries constitute a global financial risk: China and the U.S.

Thor Equities Signs Three New Tenants at The Shoppes at Cinco Ranch

Posted by: | Comments

Houston—Thor Equities announced the expansion of The Shoppes at Cinco Ranch’s tenant roster. Three restaurants have leased 7,150 square feet of space in the new 35-acre retail development at 9423 Spring Green Blvd. in Katy, Texas.

Salad bar restaurant Salada signed a long-term lease for 3,000 square feet, while Super Yummy Mongolian Stir-Fry and Sushi took on 2,610 square feet. Bambu, serving Vietnamese chè, coffee, tea and smoothies, opted for 1,540 square feet…

Thor Equities Signs Three New Tenants at The Shoppes at Cinco Ranch

U.K. Finance Jobs at Risk From Brexit Aren’t Confined to London

Posted by: | CommentsDavid Whitehouse has two business cards: one for his office in London’s Shard skyscraper, the other for a rundown building in Manchester.

Most days, the Duff & Phelps Corp. restructuring specialist works up north in Manchester, a city better known as the 19th-century heart of Britain’s industrial revolution than as a financial center. A couple of days each week, he catches the 6:59 a.m. train to the nation’s capital, just two hours away…

U.K. Finance Jobs at Risk From Brexit Aren’t Confined to London

The Top Hedge Funds of 2016 Share Their Best Bets for This Year

Posted by: | Comments-

No. 1 Jason Mudrick sees opportunity in commodity-related debt

-

Michael Hintze, No. 4, likes asset-backed notes as rates rise

A global depression caused by a trade war. An overhaul of health care. Rising inflation and deregulation.

To find out what hedge fund managers are looking out for in 2017, we asked several who topped Bloomberg’s 2016 global ranking of the 50 best-performing hedge funds with more than $1 billion in assets. After riding a jump in equities, oil and high-yield debt in the past year, some of the managers see more opportunity in commodities, energy and corporate debt…

Philip Bilden, Nominee for Secretary of the Navy, Withdraws

Posted by: | CommentsPresident Trump’s nominee for secretary of the Navy withdrew from consideration on Sunday, saying that meeting the government’s ethics guidelines would require too great a financial sacrifice.

The nominee, Philip Bilden, a former military intelligence officer who ran the Hong Kong branch of a private equity firm, said in a statement that he had informed Defense Secretary Jim Mattis that he did not want to continue to seek confirmation a month after he had been named for the post…

Hines Breaks Ground on Mixed-Use Community in Jacksonville

Posted by: | CommentsThe 105-acre live-work-play development will bring retail, office, hotel and residential space.

Jacksonville, Fla.—Hines has broken ground on Southside Quarter, located at the intersection of I-295 and J.T. Butler Boulevard in Jacksonville.

The 105-acre, mixed-use development will offer retail, office, and residential space, as well as a hotel, to create a live, work, play environment. Office sites in the first phase include up to two 125,000-square-foot buildings, offering lake views, ample parking and walkability to future residential and retail components…

As Wall Street Thrives, America’s Little Guy Chokes on Paperwork

Posted by: | Comments-

Small businesses are getting a shrinking share of lending pie

-

From QE to compliance, post-crisis policy has favored bigness

If some American banks are too big to fail, others have begun to feel they’re too small to succeed.

Just ask Joey Root, the president of First Liberty Bank in Oklahoma City with $310 million in assets. Root says small banks like his are being squeezed hard these days, even as the likes of JPMorgan Chase & Co. prosper. Small borrowers are losing out to big ones, too.

The Brokerage Firm CLSA Shuts Part of Its U.S. Business

Posted by: | CommentsThe Chinese-owned brokerage firm CLSA Americas unexpectedly shut down its stock research unit and related functions on Monday, sending some employees and analysts scrambling to pack their things.

CLSA’s cut in functions affects 90 people, more than half of them research analysts like Michael Mayo, who specializes in banking and has often been a colorful commentator on television and during quarterly conference calls with executives of the largest American banks. The firm was hiring senior research executives for its New York office as recently as last fall.

CBRE Secures $60M Financing for Miami Luxury Hotel

Posted by: | CommentsThe Nautilus South Beach is part of Sixty Hotels, a portfolio of five boutique properties located in New York City, Los Angeles and Miami.

Miami—CBRE Capital Markets’ debt & structured finance team recently secured a bridge financing in the amount of $60 million for The Nautilus South Beach, a 250-key hotel situated in Miami Beach, in the heart of the city’s Art Deco district.

The two-year floating rate loan provided by Apollo Commercial Real Estate Finance includes three one-year extension options. Mark Owens and Shawn Rosenthal of CBRE’s Midtown Manhattan office placed the loan on behalf of the borrower, Quadrum Global…

Foreigners’ Bets on Canada’s Housing Market Start With Its Banks

Posted by: | Comments-

Lenders more than doubled external debt since recession

-

Nation’s current account probably narrowed on oil rebound

One puzzle around the run-up in Canadian home prices is the extent to which foreign money is the driver. The idea is that rich people from places like China are buying up homes as an investment with no intention of ever living in Canada, pushing up the cost of housing for every one else.

Facing complaints about a lack of data, governments are racing to gather more information about just how much non-Canadian cash is fueling meteoric gains in Vancouver and Toronto real estate…

In Case of Shkreli and Lawyer, Finger-Pointing Comes First

Posted by: | Comments Martin Shkreli, former pharmaceutical company executive, is facing trial on securities fraud charges.CreditBrendan Smialowski/Agence France-Presse — Getty Images

Martin Shkreli, former pharmaceutical company executive, is facing trial on securities fraud charges.CreditBrendan Smialowski/Agence France-Presse — Getty Images

When children get caught doing something wrong, they often point the finger at one another while proclaiming “I didn’t do it. He did.”

We are seeing something of that dynamic in the prosecution of Martin Shkreli, once described by the BBC as the “most hated man in America” because of how his company increased the price of a drug used to treat a rare disease by 5,000 percent, and a former corporate lawyer, Evan Greebel, who advised Mr. Shkreli’s company…

HFF Arranges Sale of Houston’s Renaissance Center

Posted by: | CommentsHouston—HFF announced it has closed the sale of Renaissance Center, a value-add, grocery-anchored retail center located near the Texas Medical Center in Houston. Williamsburg Enterprises Ltd. acquired the asset from Lionstone Investments for an undisclosed amount and clear of existing debt.

HFF marketed the property on behalf of the seller. Managing directors Ryan West and Rusty Tamlyn led the investment sales team…

What Housing Bubble? Canadian Confidence Hits 6-Month High

Posted by: | Comments-

Real estate optimism climbs even amid warnings about Toronto

-

Views on economic prospects reach highest since September

Canadians aren’t buying recent warnings about the dangers of escalating home prices, weekly telephone polling shows.

The Bloomberg Nanos Canadian Confidence Index climbed to 58.1, the highest since early September as the disparity between real-estate optimists and pessimists widened. Views on the prospects for the economy also improved, while overall sentiment was tempered by deteriorating personal-finance scores…

What Housing Bubble? Canadian Confidence Hits 6-Month High

UPS to Build $275M Salt Lake City Hub

Posted by: | CommentsSalt Lake City—UPS will build a $275 million, new regional operations hub in Salt Lake City, an 840,000-square-foot facility that will process 69,000 packages per hour as a complement to the existing 200,000-square-foot operations in town.

When completed in 2018, the project will be among the largest processing facilities in the company’s global package network…

HFF Secures $39M Loan for Premier Plaza Complex

Posted by: | CommentsThe 10-story One Premier Plaza and the seven-story Two Premier Plaza are 81.4 percent leased to a mix of tenants.

Atlanta—HFF recently announced that it has secured $38.8 million in financing for One and Two Premier Plaza, a 316,734-square-foot, two-building, Class A office complex in Atlanta. HFF worked on behalf of the borrower, Zeller Realty Group, to arrange the floating-rate loan.

Shrinking Bonuses Slow the Revolving Door of Wall Street Brokers

Posted by: | CommentsAfter months of secretive planning, seven teams of financial advisers had new business cards and client lists in hand, poised to dump their employers and join Morgan Stanley with more than $500 million of assets in tow.

But the wealth managers woke on Oct. 28 to find the ground beneath them had shifted. Morgan Stanley had pulled the advisers’ lucrative recruitment packages overnight after U.S. regulators clarified new rules to reduce conflicts of interest in the industry, according to people with knowledge of the situation. The teams were thrown into limbo…

Shrinking Bonuses Slow the Revolving Door of Wall Street Brokers

Prologis, CBRE Global Investors Team Up for Big UK Effort

Posted by: | CommentsSan Francisco—Prologis and CBRE Global Investment Partners, a division of CBRE Global Investors, have formed a new development venture in the United Kingdom, one worth at least $1.2 billion, the two companies announced Friday.

Dubbed Prologis UK Logistics Venture, the entity will pursue a develop-to-own strategy focusing on prime markets in the East and West Midlands, London and the South East. It will acquire land, develop buildings, and operate and hold logistics real estate and will be seeded with a 7.6 million-square-foot portfolio of stabilized properties, developments in progress and land, with an initial closing of about 3.9 million square feet…

Divaris Closes Virginia Beach Tech Firm Lease

Posted by: | CommentsMythics’ corporate headquarters will occupy 39,000 square feet of office space at the 4525 Main St. tower.

Richmond, Va.—Divaris Real Estate Inc. has closed on a 39,000-square-foot lease at the 4525 Main St. office tower within Virginia Beach’s Town Center development. The IT company will occupy the top floor of the property, as well as the majority of the eighth floor.

Vivian Turok, senior vice president with Divaris, assisted Mythics in finding the location, while President Michael Divaris and Vice President Krista Costa represented the landlord…

Next Big Tax Fight Could Pit Wall Street Against Private Equity

Posted by: | Comments-

Ryan’s tax plan calls for ending interest deductions on loans

-

Banks, insurers and leasing companies promised special relief

Debate over a border-adjustment tax is consuming Washington, but another, less-discussed proposal in House Speaker Paul Ryan’s tax plan stands a better chance of being included in a GOP overhaul bill.

The measure would force companies to include the interest they pay on loans in their taxable income. That could pit financial services firms such as banks and insurers that have been promised relief from the proposal against private equity firms, which rely on leverage and wouldn’t get special treatment…

Peak Market?

Posted by: | CommentsLike any good private-equity investor, Carlyle has demonstrated a knack for buying when others are selling, and vice versa. It is instructive then that Carlyle, led by David Rubenstein, is embarking on its biggest quest for distressed assets at a time when tax-cut hopes are fanning Wall Street euphoria. The $2.5 billion fund is a good reminder that lofty valuations, an aging recovery and a chaotic new administration can produce bad outcomes.

$550M Loan Earmarked for Brookfield NYC Asset

Posted by: | CommentsNew York—Brookfield Property Partners has received a $550 million senior loan to refinance 200 Liberty St., a 1.7 million-square-foot, Class A office building located in New York City.

Civitas Capital Group arranged the financing through Kiwoom Milestone US Debt Professional Private Real Estate Trust 2, which comprises 11 institutional investors from South Korea, led by NongHyup Property & Casualty Insurance and Kiwoom Asset Management…

Nordic Tech ‘Miracle’ Delivers 30% Returns for $1 Billion Fund

Posted by: | Comments-

Robur Ny Teknik fund in large part targets medical technology

-

Has recently bought Boule Diagnostics, RaySearch Laboratories

Ignoring its global mandate to invest in Apple Inc. and Facebook Inc. is delivering top returns for this technology fund.

The Swedbank Robur Ny Teknik fund just focuses on small, “innovative” companies in Scandinavia with a heavy concentration in medical technology.

“There’s a Nordic IT miracle,” Carl Armfelt, the fund’s manager who also helps oversee the small-cap team at Swedbank Robur in Stockholm, said in a phone interview on Thursday. “The Nordics is the best region globally to make good investments in these sectors.”…

Little Credit History? Lenders Are Taking a New Look at You

Posted by: | CommentsAbout 45 million Americans lack traditional credit files, and the federal government is looking into whether alternative credit scoring models could bring more of these consumers into the financial mainstream.

The Consumer Financial Protection Bureau opened an inquiry this month into the pros and cons of using “alternative” data, like rent and cellphone payments, to formulate credit scores. It is seeking feedback from the public and the credit industry.

StepStone Closes Fund III, Plans $1B+ in Investments

Posted by: | CommentsThe company will target office, industrial, senior housing, student housing, hotels and multifamily projects in the U.S. and Europe.

New York—StepStone Real Estate has closed StepStone Real Estate Partners III with $700 million in commitments that together with co-investment capital will give the fund more than $1.1 billion to invest in the U.S. and Europe.

Founded by partners Jeff Giller, Josh Cleveland and Brendan MacDonald, StepStone Real Estate is part of StepStone Group, a leading private markets firm that oversees about $100 billion of private capital allocations, including $28 billion of assets under management…

Deutsche Bank Cuts 2016 Bonus Pool by Almost 80%, FAS Reports

Posted by: | CommentsDeutsche Bank AG cut its bonus pool for 2016 by almost 80 percent, Frankfurter Allgemeine Sonntagszeitung reported, a figure unmatched in the bank’s recent history as it tries to counteract the impact of low interest rates and legal expenses.

Germany’s largest lender is reducing the payments with an eye toward shareholders and is aware it will be “frustrating” for employees, Chief Administrative Officer Karl von Rohr told the German Sunday newspaper. The measures will affect about a quarter of the 100,000 staff. Some workers in key positions — about 5,000 in all — will get a special long-term incentive tied to the bank’s performance and paid out after as long as six years, von Rohr said…

Store Here Self-Storage Acquires First Asset in St. Louis

Posted by: | Comments

St. Louis—Store Here Self Storage recently announced the acquisition of a multi-story indoor self-storage facility located at 8319 Jennings Station Road, in Jennings, Mo.

According to Yardi Matrix data, RHW Capital Management Group bought the property for roughly $51 million in January.

The property is situated on the corner of Jennings Station Road and West Florissant Avenue. The building was formerly a Schnuck’s grocery store before being converted into a self storage facility in 2016…

Apple to Open $5B Silicon Valley Campus in Spring

Posted by: | CommentsCupertino, Calif.—The doors of Apple Park, Apple Inc.’s $5 billion campus project in Cupertino, Calif., will swing open to the tech giant’s employees for the first time in April. Envisioned by late CEO Steve Jobs, the 2.8 million-square-foot development will ultimately be home to 12,000 workers.

Buffett Stings Hedge Funds Anew Over Their `Misbegotten’ Rewards

Posted by: | Comments-

Billionaire encourages investment in low-cost index funds

-

Letter reiterates optimism about U.S., praises immigrants

Warren Buffett’s sweeping endorsement of index investing is sure to sting the hedge-fund industry and encourage the stampede into assets that passively track the market.

In his well-read annual letter to Berkshire Hathaway Inc. shareholders on Saturday, he estimated that investors wasted more than $100 billion on high-fee Wall Street money managers over the past 10 years. He declared an early victory in his decade-long bet that a basket of hedge funds would fail to keep pace with an an S&P 500 Index fund. And he called Jack Bogle, the Vanguard Group founder who pioneered low-cost market trackers, a “hero.”

Economy Watch: Tourism Growth to Boost Luxury Retail Worldwide

Posted by: | Comments London topped the global ranking for new luxury retail store openings in 2016, according to the Savills Global Luxury Retail report, which was released this week. Tied for No. 3, New York was also high in the rankings—the highest in the United States, in fact. The British capital saw a total of 41 new luxury openings during the year, of which 15 were the respective brands’ first-ever stores in London, compared to 36 openings in Paris and 31 in both New York and Dubai.

London topped the global ranking for new luxury retail store openings in 2016, according to the Savills Global Luxury Retail report, which was released this week. Tied for No. 3, New York was also high in the rankings—the highest in the United States, in fact. The British capital saw a total of 41 new luxury openings during the year, of which 15 were the respective brands’ first-ever stores in London, compared to 36 openings in Paris and 31 in both New York and Dubai.

Hong Kong Existing Home Prices Rise to Record, Defying Curbs

Posted by: | Comments-

Low borrowing costs, pent-up domestic demand also drive market

-

Prices have rebounded 16% since bottoming out 11 months ago

Hong Kong’s existing home prices have climbed to a record, fueled by a surge in demand from local buyers and investors despite taxes and mortgage curbs designed to rein in prices.

The Centaline Property Centa-City Leading Index, which tracks sales in the secondary market, rose to 147.74 for the week ended Feb. 19, surpassing the previous high of 146.92 reached in September 2015. The index has rebounded 16 percent since home prices bottomed at the end of March…

Junk Bond Manager Beating 98% of Peers Bets on Stressed Debt

Posted by: | Comments-

Value Partners high-yield China fund returned 4.9% this year

-

Premium on global junk notes has fallen to a three-year low

One of the world’s best-performing junk bond funds is dealing with the surging costs of debt globally by digging deeper in the bargain bin.

As the world’s riskiest notes soar to their most expensive levels in three years, Hong Kong-based Value Partners Group Ltd. is looking for value in securities others have avoided. Gordon Ip, who manages the $2.4 billion Value Partners Greater China High-Yield Income Fund, has overseen returns of 4.9 percent this year, beating 98 percent of peers targeting junk debt globally…

Structured Development Announces 100KSF Office Sale

Posted by: | Comments

Chicago—Structured Development’s founding principal, Michael Drew, announced the $27.8 million sale of 1333 N. Kingsbury, a 100,000-square-foot office building in Chicago’s Clybourn Corridor. Credit Suisse Group, a Zurich-based company bought the asset for $278 per square foot. Cody Hundertmark and Blake Johnson of CBRE represented the seller, Everbury Partners, a limited partnership managed by Drew.

Toronto Housing Market May Need Vancouver-Style Cooling, RBC Says

Posted by: | Comments-

‘Concerning mix of drivers’ pushing up prices, CEO McKay says

-

Average Toronto home prices up more than 20% for five months

Toronto may require measures to cool its red-hot housing market similar to moves taken in Vancouver if interest rates don’t increase, said Royal Bank of Canada Chief Executive Officer David McKay.

The head of Canada’s largest lender said Toronto housing is “running hot” and is fueled by a “concerning mix of drivers” that include lack of supply, continued low rates, rising foreign money and speculative activity. Similar circumstances in Vancouver prompted British Columbia’s government last year to impose a 15 percent tax on foreign buyers…

Samsung’s Hedge Fund Does Better When Samsung Shares Falter

Posted by: | Comments-

Samsung Electronics’ success can hurt hedge fund returns

-

Samsung hedge fund says group name is also double-edged sword

For Samsung’s $1 billion hedge fund, the looming presence of Samsung Electronics Co. — and even the Korean conglomerate’s name — can be part of the challenge.

Samsung Hedge Asset Management Co. rose 3.4 percent last year for its worst annual return since its inception in 2011, in part because Samsung Electronics’ shares became so popular that investors pulled cash from the smaller stocks that the money manager often favors. The hedge fund is predicting that trend will reverse this year and a rally at Korea’s largest companies will fade, Samsung Hedge Chief Executive Officer Yoonho Heo says…

Banking Industry Addresses Diversity, Adding Women to Boards

Posted by: | CommentsBanking and capital markets, often viewed as dominated by men, achieved high scores in a newly released survey measuring the diversity in their director ranks.

In 2016, women made up 26 percent of the boards in the banking and capital markets industry, which tied with the retail industry, according to a survey conducted by PricewaterhouseCoopers. The average rate of women on boards of companies in the Standard & Poor’s 500-stock index was 21 percent.

In addition, the 21 companies that the survey defined as its banking and capital markets sector have shored up their position by adding more women to their boards. About 13 percent of new directors in 2016 were women…

Kidder Mathews Expands in SoCal

Posted by: | Comments

Irvine, Calif.—Kidder Mathews, the largest independently owned commercial real estate firm on the West Coast, is continuing its Southern California expansion, acquiring Alden Management Group and preparing to finalize a merger with Heger Industrial.

Alden is a commercial property management firm with a large portfolio of office, industrial and retail properties in Southern California. It will be rebranded to Kidder Mathews within the next several weeks and the Alden staff will relocate to the Kidder Mathews’ Irvine office bringing the firm’s property management division to 178 people and over 45 million square feet of managed properties…

Tristar Capital Lands $232M in Financing for Sunnyvale Campus

Posted by: | CommentsSunnyvale, Calif.—Natixis has provided an approximately $232.5 million five-year, fixed-rate loan to Tristar Capital for the acquisition of Crossroads III, an office property in Sunnyvale, Calif.

The financing was arranged by Richard Horowitz of Cooper-Horowitz in New York.

According to a Tristar Capital press release, the properties were acquired from Rockwood Capital for a price tag of $290.7 million…

Tristar Capital Lands $232M in Financing for Sunnyvale Campus

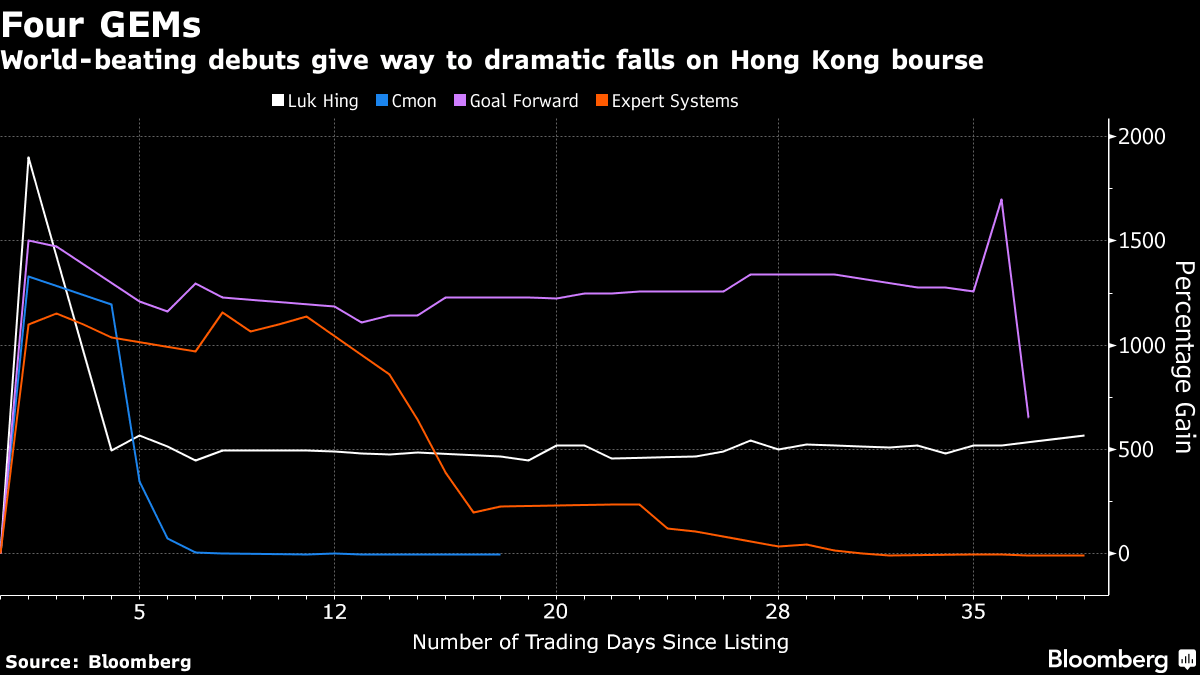

Hong Kong Halts Stock’s 543% Debut in Volatile Equity Market

Posted by: | Comments-

More than 20 million shares changed hands in morning session

-

City’s second exchange under scrutiny over manipulation fears

Hong Kong traders are used to seeing strange things on the city’s small-cap exchange, home to some of the world’s biggest price swings. But the initial public offering of GME Group Holdings Ltd. on Wednesday had even hardened market watchers scratching their heads.

Hong Kong traders are used to seeing strange things on the city’s small-cap exchange, home to some of the world’s biggest price swings. But the initial public offering of GME Group Holdings Ltd. on Wednesday had even hardened market watchers scratching their heads.

Shares of the tunnel excavating subcontractor rose 543 percent before they were suspended from 1 p.m. local time by the Securities and Futures Commission. The stock was trading for the first time on the city’s Growth Enterprise Market…

Washington Prime Group Unveils Scottsdale Quarter Expansion

Posted by: | Comments

Scottsdale, Ariz.—Washington Prime Group Inc. has announced a new redevelopment project, consisting of a significant expansion of Scottsdale Quarter, an open-air shopping mall located in Scottsdale, Ariz. Construction on the project is expected to commence later this year, with tenants starting to open in 2018.

Hong Kong Property Stock Rally Gathers Pace on Earnings Outlook

Posted by: | Comments-

Shares to keep climbing if earnings remain stable: analyst

-

New home sales soared 48 percent in January over December

A rally by Hong Kong property developers showed little sign of faltering amid optimism rising home sales will boost earnings.

Landlords Are Taking Over the U.S. Housing Market

Posted by: | CommentsAs rising home prices, slow new home construction, and demographic shifts push homeownership rates to 50-year lows, the U.S. is increasingly a country of renters—and landlords.

Last year, 37 percent of homes sold were acquired by buyers who didn’t live in them, according to tax-assessment data compiled in a new report published by Attom Data Solutions and ClearCapital.com Inc…

Nativo Relocates HQ to 100 Pacific Corporate Towers in LA

Posted by: | CommentsThe new location will include 25,051 square feet of office space.

Los Angeles—JLL recently announced that it has represented Nativo Inc., a technology firm specializing in native advertising, in a new 25,051-square-foot lease at 100 Pacific Corporate Towers (PCT). JLL’s Jason Fine represented Nativo in the lease. The landlord, GM Pension Fund / Blackrock, was represented by CBRE.

PCT is a three building, 1.5 million-square-foot office complex located at 100, 200 and 222 N. Sepulveda Blvd. in El Segundo, Calif. The property will serve as the company’s new headquarters. The firm will be relocating from its current 9,000 square feet at 200 Pacific Corporate Towers to the 100 PCT…

Olympic Housing Boom Fades Before Tokyo Games Even Begin

Posted by: | Comments-

Apartment prices set to fall more than 20%, Deutsche Bank says

-

Chinese demand slumps amid slowing economy, capital controls

Photographer: Akio Kon/Bloomberg

Evidence is mounting that Tokyo’s housing boom is nearing an end.

In the Kachidoki area facing Tokyo Bay, home to the city’s hottest market given its proximity to venues for the 2020 Olympic Games, real-estate broker Hayato Jo has a wall full of notices of apartments for sale, with a 20 percent increase in the number of people looking to sell in the area in the past year. Prices in the neighborhood, which surged 25 percent since Tokyo won the Games in 2013, have started to fall from their peak…

Omnia Media Joins Culver City Office Campus

Posted by: | Comments

Los Angeles—Private investor, operator and developer of commercial real estate Olive Hill Group has announced that the company has leased half of the fifth floor of its office campus in Culver City, Calif. Omnia Media, a subsidiary of Blue Ant Media Inc., a Canadian media company, has inked the lease for 9,762 square feet, bringing the asset to 95 percent occupancy.

HHGregg Said to Prepare for Bankruptcy as Soon as Next Month

Posted by: | Comments-

Move would follow two years of losses, difficult Christmas

-

Company recently hired advisers to mull strategic alternatives

HHGregg Inc., the 61-year-old seller of appliances and electronics, is preparing to file for bankruptcy as it grapples with slumping sales, according to people familiar with the matter.

The filing may come as soon as next month, said the people, who asked not to be identified because the matter isn’t public. The Indianapolis-based company announced last week that it was pursuing a range of strategic and financial options. HHGregg is still seeking an out-of-court solution that would allow it to stave off Chapter 11, one of the people said…

RBA’s Lowe Sees `Period of Stability’ in Rates Amid Record Debt

Posted by: | Comments-

Governor testifies before parliamentary committee in Sydney

-

Market pricing for rates on hold in 2017 ‘seems reasonable’

Photographer: Dallas Kilponen/Bloomberg

Australian central bank Governor Philip Lowe said he expects “a period of stability” in interest rates and suggested further cuts could push already high household debt to “dangerous” levels.

“The issue we’re discussing, internally, is how much extra fragility would that mean in the economy with household debt already at a record high,” Lowe said in testimony to a parliamentary panel Friday in Sydney. “Is it really in the national interest to get a little bit more employment growth in the short run at the expense of creating vulnerabilities which would become quite dangerous in the medium term?”…

Prudential Mortgage Capital Becomes PGIM Real Estate Finance

Posted by: | CommentsNewark, N.J.—Prudential Mortgage Capital Co. enters the New Year with a new name. The commercial, multifamily and agricultural mortgage lender is now PGIM Real Estate Finance, a moniker that will, for one, clearly distinguish each of the company’s 22 global offices as part of a singular entity.

The change is about more than name identity. “Our new name reflects our full investor base and global lending activities, and highlights our connection to PGIM, the trillion-dollar global investment manager of Prudential Financial,” David Durning, CEO of PGIM Real Estate Finance, told Commercial Property Executive…

Wall Street Dissenters Emerge Calling for May Fed Rate Increase

Posted by: | Comments-

BNP Paribas, JPMorgan join Mizuho in calling for May hike

-

Most banks are set on June as timing for first 2017 move

Pedestrians walk past JPMorgan Chase & Co.

Photographer: Ron Antonelli/Bloomberg

At least four of Wall Street’s biggest banks are breaking with their bulge-bracket brethren, telling clients that the Federal Reserve will probably raise interest rates before June.

Top China Stock Fund Says Hong Kong Best Place to Make Money

Posted by: | Comments-

Harvest’s fund doubled its assets in 2017 on Hong Kong appeal

-

PBOC’s tightening may actually boost stocks: fund manager

Zhang Jintao is sticking with the bet that’s made his stock fund China’s top performer: Hong Kong equities.

Harvest Fund Management Co.’s fund has returned 13.4 percent this year after putting 70 percent of its stock holdings in the former British colony, where the local benchmark has jumped 9.3 percent. With the market now near a 1 1/2-year high, Zhang says the rally can continue as earnings improve and China’s economy stabilizes…

Morning Agenda: Snap, Financial Regulation, Kraft Heinz and Unilever

Posted by: | Comments The intersection of Windward and Pacific Avenues in Venice, Los Angeles. The neighborhood is undergoing change as technology money flows in. CreditMelissa Lyttle for The New York Times

The intersection of Windward and Pacific Avenues in Venice, Los Angeles. The neighborhood is undergoing change as technology money flows in. CreditMelissa Lyttle for The New York Times

Real-estate agents, money managers and luxury goods retailers in Los Angeles are rubbing their hands together in anticipation of their city’s “Google moment.”

When Google debuted on the stock market in 2004, it produced a horde of new millionaires in Silicon Valley.

Now, many in Los Angeles hope Snap’s initial public offering will do the same in their city…

Morning Agenda: Snap, Financial Regulation, Kraft Heinz and Unilever

Midtown Manhattan Office Asset Changes Hands in $83M Deal

Posted by: | CommentsThe new owner plans a complete creative office remake in order to attract tenants from Manhattan’s fast-growing technology, advertising, media and information sector.

New York—NGKF recently announced that it has closed the sale of 250 W. 54th St., a 145,170-square-foot loft office building in Midtown Manhattan. Zar Property NY LLC acquired the asset from Ascot Properties LP for $83.1 million. According to Yardi Matrix data, the sale was subject to a five-year loan in the amount of $58 million, held by Signature Bank.

The seller was represented by Paul Davidson and Roy Lapidus, senior managing directors of NGKF, along with NGKF Capital Markets Managing Director Chip Porter…

China Home Prices Rise in Fewest Cities in a Year Amid Curbs

Posted by: | Comments-

Prices gained in 45 cities in January, versus 46 in December

-

Lenders in some cities said to raise first-home mortgage rates

China home prices increased last month in the fewest cities in a year, signaling property curbs to deflate a potential housing bubble are taking effect.

New-home prices, excluding government-subsidized housing, gained last month in 45 of the 70 cities tracked by the government, down from 46 in December, the National Bureau of Statistics said Wednesday. Prices fell in 20 cities and were unchanged in five.

Some Fed Officials Support Moving Faster to Raise Interest Rate

Posted by: | Comments Patrick T. Harker, president of the Federal Reserve Bank of Philadelphia and one of the Fed officials who vote on monetary policy. CreditCharles Mostoller/Bloomberg

Patrick T. Harker, president of the Federal Reserve Bank of Philadelphia and one of the Fed officials who vote on monetary policy. CreditCharles Mostoller/Bloomberg

WASHINGTON — The American economy appears to be avoiding the kind of winter swoon that has become an annual event in recent years, a turn for the better that could encourage the Federal Reserve to start raising its benchmark interest rate sooner.

At the Fed’s most recent meeting, on Jan. 31 and Feb. 1, “many participants” wanted to increase the benchmark rate “fairly soon” if the economy continued to grow, according to minutes published Wednesday.

NoVa Assets Trade for $53M

Posted by: | CommentsThe 183,731-square-foot office property last traded in 2010, when COPT shelled out $43 million.

3120 Fairview Drive, Falls Church, Va.

3120 Fairview Drive, Falls Church, Va.

Falls Church, Va.—Corporate Office Properties Trust has recently sold 3120 Fairview Park Drive, a 183,731-square-foot office asset located in the Merrifield submarket of Falls Church for $39 million, as well as a 5.3-acre parcel for $14 million.

Chinese State Fund’s Broker Says It’s Buying Hong Kong Stocks

Posted by: | Comments-

Guotai Junan has been trading on the fund’s behalf, Yim says

-

Hong Kong’s benchmark gauge has rallied to 1 1/2 year high

China’s $278 billion social security fund has started investing in Hong Kong equities to achieve higher returns, according to one of the nation’s top brokers.

Guotai Junan Securities Co. and its Hong Kong unit have been providing the social security fund with investment advice and trading services for mainland and Hong Kong stocks, Yim Fung, chairman and chief executive officer at Guotai Junan International Holdings Ltd., said in an interview on Wednesday…

Silicon Valley Tried to Upend Banks. Now It Works With Them.

Posted by: | Comments Brett King once hoped his company, Moven, would become “the Facebook of banking.” Today, he is selling his software to the banks he once scorned. CreditAn Rong Xu for The New York Times

Brett King once hoped his company, Moven, would become “the Facebook of banking.” Today, he is selling his software to the banks he once scorned. CreditAn Rong Xu for The New York Times

SAN FRANCISCO — In 2011, Brett King was promoting his book, “Breaking Banks,” and creating a start-up that he hoped would do to the banks what Amazon did to the retail industry and Facebook did to media.

“We had grand ideas of being the Facebook of banking, and being a new form of bank account,” Mr. King said recently.

Partners Capital JV Launches Private Bridge Lender Platform

Posted by: | CommentsLos Angeles—Archway Fund, a private bridge lender that will provide financing for Western U.S. opportunistic and value-add commercial real estate transactions in the $2 million to $15 million range, has been launched as a joint venture between Partners Capital and an investment management firm.

Partners Capital, a Los Angeles-based private commercial real estate fund, did not identify the joint venture partner by name but noted it has worked with the firm in the past and described it as a $700 million investment management firm based in the Western United States…

This $942 Billion Fund Just Removed the Fed From List of Risks

Posted by: | Comments-

Northern Trust’s Jim McDonald sees two rate hikes from Fed

-

Fed not going to raise rates too rapidly, McDonald says

For all the worry and deliberation over U.S. monetary policy, there’s one big asset manager who thinks it’s all smoke and mirrors.

Northern Trust Corp. removed the Federal Reserve from its list of investment risks this month, says Jim McDonald, the firm’s chief investment strategist. Up until as recently as January, the Chicago-based asset manager which controls $942 billion counted U.S. monetary policy as a key risk when deciding where and when to buy and sell securities.

HFF Arranges Financing for Orlando Industrial Portfolio

Posted by: | Comments

Orlando, Fla.—HFF has arranged $12.9 million in acquisition financing for Cypress Industrial Park, a five-building light industrial portfolio totaling 256,838 square feet, located in southern Orlando, the company announced recently. The asset traded in January for approximately $19 million.

HFF worked on behalf of the borrower, Denholtz Associates to place the 10-year, fixed-rate loan with Principal Global Investors. Senior managing directors Jon Mikula and Michael Weinberg and Managing Director Michael Klein led the debt placement team representing the borrower…

Plans Unveiled for $250M Tech Hub in Manhattan’s Union Square

Posted by: | CommentsNew York—AppNexus unveiled its latest designs and details for the new Union Square Tech Hub, a 258,000-square-foot project that will provide space for tech worker training, education, startups and convening.

The $250 million project is being developed by RAL Development Services and designed by Davis Brody Bond. The development will also include traditional and flexible office spaces that will provide tech companies with direct access to a steady pipeline of potential future employees…