Archive for Uncategorized

A London Real Estate Developer Just Dropped Its Land Values by 20%

Posted by: | Comments-

Landlord’s shares climb on new Covent Garden rental forecast

-

Buyer reserved or acquired 59 homes at Lillie Square Phase 2

Covent Garden

Source: Getty Images

Capital & Counties Properties Plc wrote down the value of its land holdings in west London by 20 percent, less than expected by some analysts, as higher taxes and political uncertainty weaken sentiment in the U.K. capital’s housing market.

Savills Studley Closes 78 KSF Dumbo Heights Lease

Posted by: | Comments

New York—Savills Studley announced that it has closed a 12-year, 78,000-square-foot lease at 55 Prospect St. in Dumbo Heights, Brooklyn, on behalf of education technology company 2U.

2U will occupy the last three floors of a ten-story, 255,000-square-foot building, also benefiting from rooftop access. The company will uproot headquarters from Chelsea Piers, where it occupies 20,000 square feet, around four times less space, by the end of 2017.

Blackstone Nabs $1.7B US Portfolio from Swedish Pension Fund

Posted by: | CommentsBarbra Murray, Contributing Editor

New York and London—JLL knows how to multitask. The commercial real estate services firm not only arranged the $2.1 billion sale of Stockholm-based Alecta’s 4.5 million-square-foot international commercial portfolio to two separate buyers—investment giant Blackstone and a global investment bank—but it also orchestrated acquisition financing on Blackstone’s behalf…

Blackstone Nabs $1.7B US Portfolio from Swedish Pension Fund

BTG Revival Strategy Moves to Chile With Plans to Boost Lending

Posted by: | Comments-

Brazil bank’s goal is to make ‘strategic’ loans, Aguero says

-

Rodrigo Oyarzo joins to lead the firm’s new credit business

Grupo BTG Pactual, the Brazilian lender that slashed its workforce in 2016 and sold off assets to survive a liquidity crisis, is investing in Chile with plans to start lending.

Rodrigo Oyarzo joined BTG to head the new credit business, according to Juan Guillermo Aguero, BTG’s chief executive officer for Chile. The idea is to use the Sao Paulo-based company’s banking license in Chile, obtained in 2014, to provide more “strategic” loans to clients tied to mergers and capital-markets transactions, Aguero said…

Norton Rose and Chadbourne to Combine in Latest Merger of Large Law Firms

Posted by: | CommentsTwo large law firms said on Tuesday that they would combine to form a global firm amid continuing consolidation in the legal industry.

The two firms, Norton Rose Fulbright and Chadbourne & Parke, will merge into a single entity with more than 4,000 lawyers and expected annual revenue just under $2 billion. The combined firm will be known as Norton Rose Fulbright.

The merger, which is to take effect in the year’s second quarter, is the second large-scale combination for Norton Rose, whose biggest previous merger partner was the Texas firm Fulbright & Jaworski in 2013.

CIM Group Announces Partnership to Attract Japanese Investors

Posted by: | Comments

Los Angeles and Tokyo—A strategic partnership between CIM Group LLC and Mitsui & Co. Ltd. will look to expand both organizations’ growth initiatives in real estate and infrastructure investments across North America.

“We are excited to partner with Mitsui to position CIM to be the first choice for Japanese investors interested in real estate and infrastructure investments in North America,” Avi Shemesh, CIM Group’s co-founder & principal, said in a prepared release. “This partnership will allow CIM to better meet the growing needs of our investors.”

Hedge Funds Continue to Chase the Herd With Record Momentum Bets

Posted by: | Comments-

Managers bet on past winners the most in at least seven years

-

Momentum-value correlation level also historically high

Hedge funds can’t get enough of momentum — even if it means embracing an investing strategy they hate.

Loosely defined as betting on shares that went up the fastest over the preceding nine-to-12 months, hedge funds are the most reliant on momentum strategies since at least 2010, according to an Evercore ISI analysis of 13F filings with the Securities and Exchange Commission. Meanwhile, they’ve reduced their bearish bet on value stocks, which are priced at deep discounts to earnings and assets, for the first time in nine quarters, the study shows.

With Snap’s I.P.O., Los Angeles Prepares to Embrace New Tech Millionaires

Posted by: | Comments The Venice sign spans the intersection of Windward and Pacific Avenues in the Los Angeles neighborhood. It is a replica of the original sign from 1905, which was hung by the developer to lure buyers. The neighborhood is undergoing change now as tech money flows in.CreditMelissa Lyttle for The New York Times

The Venice sign spans the intersection of Windward and Pacific Avenues in the Los Angeles neighborhood. It is a replica of the original sign from 1905, which was hung by the developer to lure buyers. The neighborhood is undergoing change now as tech money flows in.CreditMelissa Lyttle for The New York Times

LOS ANGELES — Blaine Lourd has long helped the movie stars, professional athletes and heiresses in Los Angeles manage their wealth. Over the past few years, he has also noticed millionaires who made their money in technology begin to dot the west side of the city.

Delos, Glumac Create Building Wellness Bond

Posted by: | CommentsNew York—Delos’s role in the well-building movement continues to grow, as the wellness real estate and technology firm forms a strategic alliance with Glumac, a full-service consulting and engineering company. Together, the partners will work to further the evolution of indoor environments into spaces that foster health and wellness…

Africa’s ‘Youngest Billionaire’ Loses Asset Ruling in Divorce

Posted by: | Comments-

Judge rules Ashish Thakkar, not family, owns disputed assets

-

London judge says that Thakkar’s claims are a ‘blatant lie’

Ashish Thakkar, who co-founded Africa banking conglomerate Atlas Mara Ltd. with ex-Barclays Plc head Bob Diamond, lost a ruling over the ownership of family assets in a London divorce case, with a judge questioning Thakkar’s truthfulness.

Judge Philip Moor ruled that Thakkar, and not his mother and sister, was the owner of disputed assets in the divorce. He found that the 35-year-old owned 100 percent of Mara Group Holdings Ltd. and other corporate entities…

Parkway to Sell Interest in Houston Portfolio for $512M

Posted by: | CommentsHouston—It’s a Texas-sized deal. Parkway Inc. has arranged to sell a 49 percent interest in its Greenway office portfolio in Houston for $512.1 million, or an implied $210 per square foot, the company announced last Friday. The portfolio comprises an 11-building office campus totaling about 5 million square feet, in Houston’s Greenway submarket…

Hedge Funds Can’t Sue Over Investments in Fannie and Freddie

Posted by: | Comments-

Appeals court upholds bulk of ruling dismissing challenge

-

Institutions might qualify for inclusion in contract claim

Hedge funds largely failed in their legal challenge to the U.S. government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac after their bailout, sending shares of the mortgage guarantors plunging.

Perry Capital LLC, the Fairholme Funds and other big investors lost a bid to overturn a judge’s ruling that said they can’t sue the government over the dividend change. The change known as the “net-worth sweep” forced the companies to send almost all their profits to the U.S. Treasury, leaving shareholders with nothing. The companies have been under government control since being bailed out during the 2008 financial crisis…

HFF Secures $65M Loan for West Houston Office Asset

Posted by: | Comments

Houston—HFF announced it has arranged financing for The Plaza at Enclave, a 344,296-square-foot office building located in Houston’s Energy Corridor. According to Yardi Matrix data, the borrower is Azrieli Group of Tel Aviv, Israel and the loan amount equals $64.8 million. HFF worked on behalf of the borrower to secure a 15-year, fixed-rate loan through Allianz Real Estate of America.

Singapore’s Home Curbs May Stay for Some Time, Minister Says

Posted by: | Comments-

Measures ‘have helped to achieve a soft landing’ Wong Says

-

Home prices fell 3 percent in 2016, the 3rd annual decline

Singapore’s residential property curbs are expected to stay for some time as the city-state’s economy remains stable and demand is still “very resilient,” National Development Minister Lawrence Wong said.

Singapore home prices fell 3 percent in 2016, with prices declining for the 13th straight quarter in the last three months of the year for the longest streak since data was first published in 1975. Still, Singapore house sales last year topped 2015’s tally as a third straight year of price declines stoked pent-up demand from homebuyers…

Fed’s Williams Says Historically Low Interest Rates Will Persist

Posted by: | CommentsHistorically low interest rates are here to stay, making it much harder for central banks in wealthy countries to prevent and limit recessions in the future, according San Francisco Federal Reserve Bank President John Williams.

Writing in the bank’s latest economic letter, Williams argued that a decline in the long-run economic growth rate of the U.S. and other rich nations has depressed business investment, and with it, interest rates.

A low-rate world is “likely to be very persistent,” as an aging population and lagging productivity hold down growth, he said…

Fed’s Williams Says Historically Low Interest Rates Will Persist

Thor Equities Acquires $40M SoMa Office Asset

Posted by: | Comments

San Francisco—Thor Equities recently announced that it has closed the acquisition of 634 Second St., a 46,750-square-foot office building situated in the SoMa neighborhood of San Francisco. The property was bought for $40 million from MCM Real Estate Services, a subsidiary of Manchester Capital Management LLC.

The seller was represented by Kyle Kovac, Michael Taquino and Daniel Cressman, executive managing directors of NGKF Capital Markets, and by Newmark Cornish & Carey’s Executive Managing Directors Michael Brown and Bill Benton, who also represented MCM in the lease-up of the property. As part of the transaction, Thor Equities engaged NGKF to both secure the acquisition financing and handle property management of the asset moving forward…

Sydney Morning Herald Owner Plans Property Listings Spinoff

Posted by: | Comments-

Separate listing for Domain would be completed by end of 2017

-

Fairfax would own between 60% and 70% of standalone entity

Sydney Morning Herald-publisher Fairfax Media Ltd. is considering hiving off its property-listings business, turning the group’s main earnings engine into a new Fairfax-controlled entity as media income shrinks.

Fairfax shares soared the most in three years after it said Domain Group could be listed in Australia by the end of 2017. Fairfax will retain between 60 percent and 70 percent of the new entity and shareholders will receive stock in Domain, it said in a statement Wednesday.

Vice Said to Hire Banks to Raise Fund for Scripted Programs

Posted by: | Comments-

Fundraising process for programs said to be in early stages

-

Previous investment by Disney valued Vice at $4 billion

Shane Smith

Photographer: Brian Ach/Getty Images for TechCrunch

Vice Media Inc., the New York-based company known for provocative news coverage, has hired Morgan Stanley and Raine Group to help raise money for a fund to develop and produce scripted programming for TV, mobile devices and movie theaters, according to a person familiar with the matter.

Paul Singer No Longer One Of President Trump’s Many Enemies

Posted by: | Comments

Getty Images

The President of the United States held a press conference today. Perhaps you have heard about. It was certainly quite a show. Ostensibly, it was held to introduce his new pick for labor secretary, Alex Acosta, since his first pick didn’t pan out so well. And sure enough, President Trump spent exactly 100 words on the subject to open things up. Then he spent an hour-and-a-half rambling about how his mess of an administration is a “fine-tuned machine,” whining about how mean people are to him and dismissing the growing reports of contacts between his campaign and Russia as “fake news.” In between, however, he took a moment to talk about Paul Singer, who had just paid him a courtesy call. The same Paul Singer who called a Trump presidency “close to a guarantee of a global depression” before gingerly getting on board the Trump train after the election…

Cushman & Wakefield Closes Record Industrial Sale in Orlando

Posted by: | CommentsOrlando, Fla.—Cushman & Wakefield has negotiated the sale of four Class A warehouse and distribution buildings in Orlando’s Southwest Industrial Corridor, making it the largest multi-tenant industrial portfolio transaction in Orlando history, in terms of square footage.

The Capital markets team of Executive Managing Director Mike Davis, Senior Director Michael Lerner and Senior Director Rick Brugger represented a state pension fund advised by L&B Realty Advisors in the disposition. Colony North Star acquired the assets for $67.1 million through its industrial fund, Colony Industrial…

Natixis Finds Refi Answers for Silicon Valley Trio

Posted by: | CommentsSilicon Valley, Calif.—Through its Los Angeles office, Natixis has originated three loans totaling $75 million to refinance a portfolio of office buildings in Silicon Valley, the company announced late last week. The loans, which were uncrossed, were provided to Pollock Realty Corp. through Natixis’ CMBS and portfolio lending programs.

The first property, 3495 Deer Creek Road, is an 81,000-square-foot office building in Stanford Research Park in Palo Alto. It is fully leased to EMC Corp., which will be vacating in the near future as part of a strategic decision by EMC’s new parent company, Dell…

Britain Seeks to Cancel Sale of R.B.S. Branch Network

Posted by: | Comments A branch of the Royal Bank of Scotland in Edinburgh in 2014. The lender is required by European regulators to divest a branch network as a condition of the government bailout of 45 billion pounds, or $56 billion, that it received during the financial crisis. CreditAndy Buchanan/Agence France-Presse — Getty Images

A branch of the Royal Bank of Scotland in Edinburgh in 2014. The lender is required by European regulators to divest a branch network as a condition of the government bailout of 45 billion pounds, or $56 billion, that it received during the financial crisis. CreditAndy Buchanan/Agence France-Presse — Getty Images

LONDON — The British government said on Friday that it would ask the European Commission not to require Royal Bank of Scotland to sell its Williams & Glyn branch network by the end of this year.

MCA Realty Expands Las Vegas Portfolio

Posted by: | Comments

Las Vegas—MCA Realty has acquired two assets in the Las Vegas market for a combined $18.3 million. The portfolio includes the Harmon Warehouse Center, a 145,491-square-foot multi-tenant industrial building in Southwest Las Vegas and the Gibson Tech Center, a 29,988-square-foot office building in Henderson.

Spotify Claims Big Spot at 4 WTC

Posted by: | CommentsNew York—Spotify USA just took a big bite out of the tenant roster at 4 World Trade Center in Lower Manhattan. The music streaming service recently signed a 387,200-square-foot office lease with Silverstein Properties Inc., owner of the 2.3 million-square-foot skyscraper, in a move that brings the building’s lease level to 100 percent.

With No Frills and No Commissions, Robinhood App Takes On Big Brokerages

Posted by: | CommentsA start-up called Robinhood Markets is taking on the big brokerage firms with its commission-free trading app, and appears to be making headway. Since its introduction in December 2014, the app has attracted a million users and executed more than $30 billion in trades, up from $2 billion in 2015.

Despite the app’s hype and surging popularity, some industry experts question if the free-trades business model can survive, or if it will wind up joining other start-ups that have crashed and burned. The company currently makes money primarily from interest on customer cash balances…

Brooklyn Waterfront Hotel Lands $80M in Financing

Posted by: | CommentsNew York—Capital One has provided an $80 million construction/mini-perm loan to a joint venture between the Starwood Capital Group and Toll Brothers, for the soon-to-be-completed 1 Hotel Brooklyn Bridge, a 194-key property on the Brooklyn waterfront.

Capital One previously provided a $160 million loan to finance the project’s initial construction, which also included a 107-unit recently completed condominium building…

Federal Agency Begins Inquiry Into Auto Lenders’ Use of GPS Tracking

Posted by: | CommentsThey can figure out when you leave town and see where you parked your car. They can see how many times you went to the grocery store or the health clinic.

Auto loans to Americans with poor credit have been booming, and many finance companies, credit unions and auto dealers are using technologies to track the location of borrowers’ vehicles in case they need to repossess them.

Such surveillance, lenders say, allows them to extend loans to more low- income Americans, knowing that they can easily locate the car. Lenders are also installing devices that enable them to remotely disable a car’s ignition after a borrower misses a payment…

Buchanan Street Provides $25M Refi for SoCal Retail Center

Posted by: | CommentsStater Bros. Plaza, a 73,641-square-foot grocery-anchored shopping center in Chino Valley, Calif., was 96 percent leased at the time of the financing.

Chino, Calif.—Buchanan Street Partners has provided a $25 million loan to Euclid Plaza LLC, for Stater Bros. Plaza. CBRE’s California office represented the borrower in the refinancing, while Buchanan Street represented itself. The transaction represents Buchanan Street’s largest bridge loan in the past years.

The property is located on Schaefer Avenue, at the intersection of Euclid and Fern Avenues. Built in 2008, the 73,641-square-foot Inland Empire retail center includes tenants such as Sprint, Subway and Teriyaki Madness. Stater Bros. Plaza is two miles from the 60 Freeway and the Chino Airport, the largest non-commercial airport within a 20-mile radius. The Los Angeles/Ontario International Airport is seven miles northeast…

Kenya Said to Be Near $800 Million Loan With Citibank, StanChart

Posted by: | CommentsKenya is close to signing an $800 million syndicated loan with four banks to help fund infrastructure projects and support the shilling, according to a person familiar with the matter.

East Africa’s biggest economy is expected to sign the three-year facility with Citigroup Inc., Standard Bank Group Ltd., Standard Chartered Plc and Rand Merchant Bank by tomorrow, the person said, declining to be identified because he isn’t authorized to speak on the matter. Kamau Thugge, the Treasury’s principal secretary, didn’t answer calls and text messages seeking comment…

Kenya Said to Be Near $800 Million Loan With Citibank, StanChart

Signs of a Step Back in Financial Regulatory Enforcement

Posted by: | CommentsWhen you drive down the highway and see a police cruiser off to the side, the immediate response is to take your foot off the gas and check to see how much over the speed limit you were driving. There is that momentary anguish that the officer might stop you, and a sigh of relief when you check the mirror and see the officer hasn’t moved.

Enforcement often relies on the presence of people with the authority to issue punishments, so cutting back is not so much a matter of changing the law as having fewer cops on the beat.

MBA Special Report: Cautious Optimism in 2017

Posted by: | CommentsThe real estate finance association discussed opportunities to stay competitive in 2017 and beyond.

San Diego—The Mortgage Bankers Association’s CREF/Multifamily Housing Convention & Expo 2017 is in full swing at the Manchester Grand Hyatt in San Diego. At the conference, professionals from all aspects of real estate finance have converged to discuss how the industry will respond to impending regulatory changes, demographic shifts, global movements and opportunities to diversify the commercial real estate workforce.

Yellen Can’t Halt Trump Gold Rally That Funds Bet Against

Posted by: | Comments-

Net-long position drops before bullion posts weekly rally

-

Standard Chartered recommends buying gold on price dips

Gold bulls are acting as if they can’t believe a good thing when they see it.

They should’ve had more faith. Hedge funds reduced their wagers on a bullion rally for the first time in three weeks, just before prices neared a two-month high and capped a third straight week of gains.

Yes, Mr. President, Banks Are Lending

Posted by: | Comments President Trump ordered a review of financial regulations. CreditPool photo by Aude Guerrucci

President Trump ordered a review of financial regulations. CreditPool photo by Aude Guerrucci

This is the party line: Banks aren’t lending nowadays because the regulatory burden they face is too onerous. And that is hurting the economy and job creation.

Articulating this view, President Trump has vowed to slash financial regulations to fix the problem.

“Frankly, I have so many people, friends of mine, that have nice businesses and they can’t borrow money,” he said in early February. “They just can’t get any money because the banks just won’t let them borrow because of the rules and regulations in Dodd-Frank,” the Wall Street reform law of 2010…

WTC Opens on the Rock

Posted by: | Comments

Gibraltar—The World Trade Center Association (WTCA) has opened its newest addition to its global network in 91 countries. The 254,000-square-foot Grade A office building in Gibraltar was inaugurated by Chief Minister Fabian Picardo and developer Gregory Butcher. The total investment amounted to more than €100 million (around $107 million) over several years.

Picardo emphasized that the new building is a sign of continued collaboration with international partners despite Brexit-induced fears of isolationism. With 90 percent of Gibraltar’s business and services in the EU single market being conducted with the UK, investors remain optimistic…

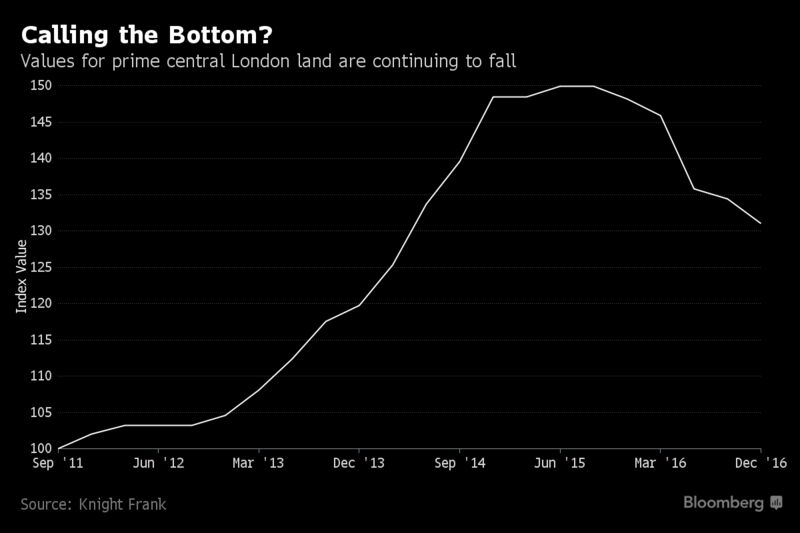

London Luxury-Home Land Values Fall Most in Five Years: Chart

Posted by: | Comments Residential land values in London’s best districts fell 11.5 percent in 2016, the most in at least five years, on Brexit and tax increases, Knight Frank said in a report on Friday. The tax hikes caused home values in the priciest districts to drop by an average of 6.7 percent in the 12 months through January. There are signs that London land may be repeating conditions last seen in 2010, when “savvy investors returned to the market and bought in expectation that pricing was reaching the bottom,” Ian Marris, joint head of residential development at the broker, said in the report…

Residential land values in London’s best districts fell 11.5 percent in 2016, the most in at least five years, on Brexit and tax increases, Knight Frank said in a report on Friday. The tax hikes caused home values in the priciest districts to drop by an average of 6.7 percent in the 12 months through January. There are signs that London land may be repeating conditions last seen in 2010, when “savvy investors returned to the market and bought in expectation that pricing was reaching the bottom,” Ian Marris, joint head of residential development at the broker, said in the report…

The Rise and Decline of the Hedge Fund Billionaire

Posted by: | Comments Clockwise from top left: William A. Ackman of Pershing Square Capital Management; David Einhorn of Greenlight Capital; Marc Lasry of Avenue Capital Group and owner of the Milwaukee Bucks; and Nelson Peltz, of Trian Fund Management.CreditClockwise from top left: Drew Angerer for The New York Times; Mike Segar/Reuters; David A. Grogan/NBCU Photo Bank via Getty Images; Jonathan Alcorn/Bloomberg

Clockwise from top left: William A. Ackman of Pershing Square Capital Management; David Einhorn of Greenlight Capital; Marc Lasry of Avenue Capital Group and owner of the Milwaukee Bucks; and Nelson Peltz, of Trian Fund Management.CreditClockwise from top left: Drew Angerer for The New York Times; Mike Segar/Reuters; David A. Grogan/NBCU Photo Bank via Getty Images; Jonathan Alcorn/Bloomberg

In the annals of the immensely wealthy, the hedge fund manager is a relatively new entry. It has been only about a decade since significant numbers of hedge fund managers, including Kenneth C. Griffin of Citadel, Paul Tudor Jones of Tudor Investment Corporation and Steven A. Cohen of Point72 Asset Management, began appearing on billionaire rankings.

CBRE Closes Sale of 550 KSF Mall near Orlando

Posted by: | CommentsOrlando—CBRE has arranged the sale of Oviedo Mall, a 554,973-square-foot retail property in the Orlando area, the company announced recently. The shopping center was sold to an affiliate of Ilbak Investments, and according to public records as reported by the Orlando Sentinel, the asset traded for $15.3 million. CBRE’s executive vice presidents Dennis Carson and Casey Rosen represented the seller, Oviedo Fund LLC.

Yellen Can’t Halt Trump Gold Rally That Hedge Funds Bet Against

Posted by: | Comments-

Net-long position drops before bullion posts weekly rally

-

Standard Chartered recommends buying gold on price dips

Gold bulls are acting as if they can’t believe a good thing when they see it.

They should’ve had more faith. Hedge funds reduced their wagers on a bullion rally for the first time in three weeks, just before prices neared a two-month high and capped a third straight week of gains.

JW Marriott to Make Sweet Music in Nashville

Posted by: | CommentsNashville—The City of Nashville will soon get its first JW Marriott-branded hotel, and Turnberry Associates is making it happen. The real estate developer recently released additional details about its plans for the development of JW Marriott Nashville, which will bring 533 luxury guestrooms to the city’s downtown area. The project carries a development price tag of nearly $220 million, according to research from Dodge Data & Analytics…

Repositioned Sky Harbor Towers Set for Debut in Phoenix

Posted by: | CommentsPhoenix—The Muller Co. and Harbert Management Corp. are nearing completion of the first phase of their $20 million redevelopment of Sky Harbor Towers, a 13.6-acre, two-building office campus in the Sky Harbor submarket of Greater Phoenix.

Hedge Funds Are in Trouble, and Billions Is On It

Posted by: | CommentsIn its second season, the Showtime drama that glorified hedge funds gives them a second look.

When the first episode of Showtime’s Billions premiered in January of 2016, a Democrat was in the White House, #OscarsSoWhite was trending on Twitter, and the top 10 performing hedge funds with assets of more than $1 billion had averaged a 28.6 return over the previous 12 months.

What a difference a year makes.

By the time the second season of Billions premieres this Sunday, Feb. 19, many hedge funds will have suffered through the worst four quarters in their history. Others, including Blackstone’s Senfina fund, have folded entirely. The show, built on celebrating—and castigating—hedge fund managers’ stupendous fortunes, is beginning to show cracks…

Quantum Capital Lines Up Refi for LA Mixed-Use Development

Posted by: | CommentsLos Angeles—The Runyon Group has received a 10-year, non-recourse $47 million mortgage to refinance Platform, a 75,000-square-foot, transit oriented, mixed-use project in the Hayden Tract district of Culver City, Calif.

Quantum Capital Partners arranged the financing with Wells Fargo. Runyon Group will use the proceeds from the financing to retire construction debt and equity on the project, which was completed in late 2016…

European Bond Investors Seek Havens as Political Risks Increase

Posted by: | Comments-

French, Italian bonds fall as political uncertainty weighs

-

German 10-year yield approaches lowest level in a month

European bond investors gravitated toward the safest assets on Friday as political and economic developments pointed to a muddier outlook for the continent.

German bunds led gains among core euro-region securities after French Socialist Party presidential candidate Benoit Hamon said he’s in talks with far-left candidate Jean-Luc Melenchon about a potential single candidacy. That boosts the chance that the anti-euro Marine Le Pen may not face a centrist candidate in the final round of voting in May. Austrian and Dutch securities also advanced…

Here’s a Jaw-Dropping Penthouse in NYC’s Tallest Residential Building

Posted by: | CommentsIt’s hard to upstage the view from 1,224 feet, so when the interior designer Kelly Behunwas contacted to design a 92nd-floor penthouse at 432 Park Avenue, she didn’t try. “It was about not even beginning to try to compete with those views,” she said. “They’re mesmerizing, like watching the most beautiful movie of New York you’ve ever seen.”

Here’s a Jaw-Dropping Penthouse in NYC’s Tallest Residential Building

NJ Office Campus Changes Hands in $26M Deal

Posted by: | CommentsRed Bank, N.J.—Cushman & Wakefield’s Metropolitan Area Capital Markets Group has arranged the off-market sale of a three-building office campus in Red Bank. Mack-Cali Realty Corp. bought the property from Alfieri Co. Inc. for a price tag of $26 million.

The transaction was led by Cushman & Wakefield’s Andrew Merin, David Bernhaut, Gary Gabriel, Brian Whitmer and Andrew MacDonald…

IMF to Help Somalia Print First Banknotes in a Quarter Century

Posted by: | Comments-

State will circulate shilling notes to bolster monetary policy

-

Creditors willing to cancel nation’s $5.3 billion debt

The International Monetary Fund is backing Somalia’s plans to replace tattered currency notes that were printed before the Horn of Africa nation plunged into civil war almost three decades ago.

The new Somali shilling notes may come into circulation this year, alongside the dollar that’s been the main means of payment, and will replace fake or old currency in circulation, said Samba Thiam, the IMF’s country head.

IMF to Loan Mongolia $440 Million as Part of Bailout Package

Posted by: | Comments-

Facility will help Mongolia repay $580 million bond due March

-

GDP growth slowed to 1% last year amid commodity price drops

Mongolia reached an initial agreement with the International Monetary Fund for a three-year program that includes a $440 million loan package as part of a $5.5 billion bailout to help the north Asian country with looming debt repayments.

Risky Business for C.E.O.s: An Invitation From Trump

Posted by: | Comments From left, Virginia Rometty, chief of IBM; Indra Nooyi, chief of PepsiCo; Stephen A. Schwarzman, chief of the Blackstone Group; President Donald J. Trump; Mary Barra, chief of General Motors; Gary Cohn, chief economic adviser to President Trump; and Doug McMillon, chief of Walmart, during a meeting of the president’s forum of business leaders this month. CreditAl Drago/The New York Times

From left, Virginia Rometty, chief of IBM; Indra Nooyi, chief of PepsiCo; Stephen A. Schwarzman, chief of the Blackstone Group; President Donald J. Trump; Mary Barra, chief of General Motors; Gary Cohn, chief economic adviser to President Trump; and Doug McMillon, chief of Walmart, during a meeting of the president’s forum of business leaders this month. CreditAl Drago/The New York Times

For the nation’s top executives, a summons to the White House has long been a much-coveted honor.

Now, less than a month into President Trump’s administration, it’s become something to be ducked, at least for some.

JLL to Lease Office Campus in Houston’s Energy Center

Posted by: | CommentsDeveloped by Skanska, West Memorial Place includes two sustainable Class A towers totaling more than 700,000 square feet.

Houston—Skanska has retained JLL as the exclusive leasing agency for its West Memorial Place development, a premier 12-acre office campus situated along Terry Hershey Park in Houston’s Energy Corridor.

The campus includes two sustainable Class A office towers—West Memorial Place I, measuring 331,000 square feet, and West Memorial Place II, measuring 385,000 square feet…

ANZ Bank First-Quarter Cash Earnings Rise to A$2 Billion

Posted by: | Comments-

Lending profitability declines on increased funding costs

-

Bad-debt provisions outlook ‘more positive’ than expected

Australia & New Zealand Banking Group Ltd. first-quarter cash earnings rose on a stronger performance from the lender’s domestic businesses, while the outlook for bad debts has improved.

Unaudited cash profit, which excludes one-time items, rose to A$2 billion ($1.54 billion) in the three months ended Dec. 31, the Melbourne-based lender said in a statement to the stock exchange Friday. That’s up 8 percent from the A$1.85 billion recorded a year earlier. Statutory net profit was unchanged at A$1.6 billion…

Consumer Agency Can Demand Answers About Foreclosed Homes, Judge Rules

Posted by: | Comments A home in Akron, Ohio. A federal judge has upheld a consumer agency’s authority to issue a subpoena in a housing finance inquiry. CreditMichael F. McElroy for The New York Times

A home in Akron, Ohio. A federal judge has upheld a consumer agency’s authority to issue a subpoena in a housing finance inquiry. CreditMichael F. McElroy for The New York Times

At a time when many Republicans are urging President Trump to weaken the Consumer Financial Protection Bureau, a federal judge has now upheld its authority to issue a subpoena in a housing finance investigation.

Judge Nancy G. Edmunds of Federal District Court in Detroit has ruled that one of the nation’s largest providers of seller-financed homes must comply with a demand for documents and other information from the consumer agency…

Blackstone Sells Creative Office Building in LA

Posted by: | Comments

Los Angeles—A five-story, Class A creative office building in the Universal City submarket of Los Angeles near many of the city’s major studios has been sold by Blackstone to 4M Investment Corp. with the help of NGKF Capital Markets.

The 103,154-square-foot building at 3330 Cahuenga Blvd. West was sold for $36 million, according to the San Fernando Valley Business Journal.

Japan Is Quietly Reflating, Buying Time for Reckoning With Debt

Posted by: | Comments-

Nominal GDP under Abe has finally surpassed the 1990s record

-

Abenomics has for moment defeated demographics, with job gains

Pedestrians are reflected in an electronic stock board outside a securities firm in Tokyo, Japan.

Photographer: Tomohiro Ohsumi/Bloomberg

Hidden beneath the headlines about Japan’s continual failure to reach its inflation target is a quiet reflation of its economy.

It took almost two decades, but Japan finally notched a record for the size of its economy in 2016, one of the most significant signs yet that Prime Minister Shinzo Abe’s reflation policies have had an impact on underlying fundamentals…

Asian Conglomerates, Flush With Cash, Scour for U.S. Fund Deals

Posted by: | Comments HNA Group bought a stake in SkyBridge from Anthony Scaramucci as he needed to divest quickly, he said.CreditSam Hodgson for The New York Times

HNA Group bought a stake in SkyBridge from Anthony Scaramucci as he needed to divest quickly, he said.CreditSam Hodgson for The New York Times

In the investment management world these days, the deals are not coming from American or British banks but from big Asian conglomerates flush with cash.

SoftBank, the Japanese technology and telecommunications conglomerate, scooped up a New York-listed private equity firm this week. HNA Group, the Chinese aviation and shipping conglomerate, took a piece of a New York hedge fund company last month, a week after buying a New Zealand investment company. And HNA has tossed its hat into the ring to acquire a British insurer and its asset management unit…

Spain’s Littered With Unsold Homes. This U.S. Firm Wants to Build More

Posted by: | Comments-

Almost half of Spain’s homebuilders have gone bust since 2008

-

Private equity has edge in market as bank lending dries up

Ignore those million-plus empty new homes scattered across Spain. A developer owned by Lone Star Funds says there’s never been a better time to build more.

Neinor Homes, bought in 2014 by the Dallas-based investor, aims to become one of Spain’s biggest homebuilders by increasing construction in big cities where the housing stock is running low, according to Chief Executive Officer Juan Velayos. Competition is thin after the 2008 real estate collapse wiped out about half the company’s competitors and made banks reluctant to finance development…

U.S. Households Ramp Up Borrowing Led by Mortgages, Credit Cards

Posted by: | Comments-

Mortgage origination volumes rise to highest since Q3 2007

-

Student loan and auto loan debt balances hit new record highs

U.S. households increased their borrowing in the final three months of 2016 at the fastest pace in three years, according to the Federal Reserve Bank of New York.

Consumer debt rose by $226 billion, or 1.8 percent, in the fourth quarter, led by a $130 billion increase in mortgage loan balances and a $32 billion increase in credit-card borrowings, the New York Fed said Thursday. The rise brought total consumer debt to $12.58 trillion, just shy of the $12.68 trillion peak in the third quarter of 2008.

Ford Announces $200M Wind Tunnel Complex in Allen Park

Posted by: | Comments

Dearborn, Mich.—Ford Motor Co. announced it will invest $200 million in a new wind tunnel complex that is actually an environmental simulation facility. The structure will be built on a 13-acre lot, next to Ford’s current driveability test facility in Allen Park, Mich., and construction will start this year.

Freddie Mac to Pay U.S. $4.5 Billion After Reporting Profit

Posted by: | Comments-

Mortgage company posts fourth quarter income of $4.8 billion

-

Freddie capital buffer to hit zero in 2018 under bailout terms

Freddie Mac will send $4.5 billion to the U.S. Treasury in March as the mortgage-finance giant continues to prepare for the possibility of having zero capital by next year.

The company earned $4.8 billion in the fourth quarter, compared with $2.2 billion in the same period a year earlier, according to a regulatory filing posted Thursday. Net interest income, which includes the fees Freddie charges to guarantee mortgages, was $3.9 billion compared with $3.6 billion, the company said…

Snap Set to Pitch $3.2 Billion Share Sale to Voteless Investors

Posted by: | Comments-

Company will have $18.5 billion market value at top of range

-

Execs set to host potential investors at Mandarin Oriental

Snap Inc. is pitching a stock to investors that’s more expensive and comes with less shareholder control than any social media company before it.

The result? The company has had to temper its expectations for how it thinks public markets will value the company after its initial public offering.

Snap, which set the terms for its IPO Thursday, will offer 200 million shares for $14 to $16 apiece, according to a filing. That would give the disappearing-photo application maker a market value of $16.2 billion to $18.5 billion, based on the total shares outstanding after the offering…

Savills Studley Adds to Firepower at NYC Office

Posted by: | Comments

New York—Savills Studley has both acquired advisory and investment firm RP Capital, headed by Michael Rotchford and David Heller, and has also brought on board Paul Leibowitz and David Krantz, formerly of CBRE, to form a new capital markets group in its New York headquarters office with current Executive Managing Director Woody Heller (no relation), the company announced Tuesday.