Archive for Uncategorized

U.S. Housing Starts Exceed Estimates After a Stronger December

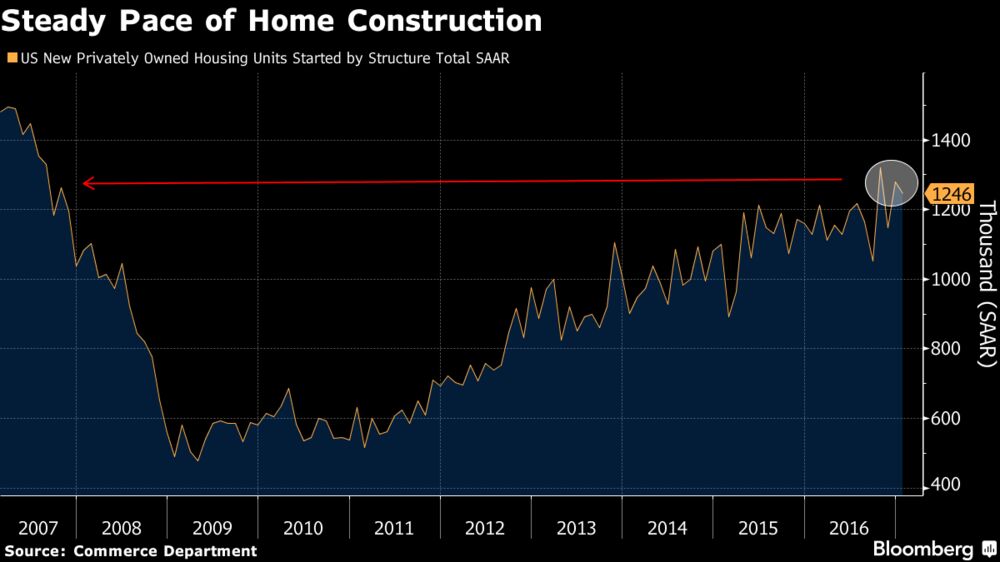

Posted by: | Comments Builders started work on more U.S. homes than forecast in January after an upward revision to starts in the prior month, a sign construction was on a steady path entering 2017.

Builders started work on more U.S. homes than forecast in January after an upward revision to starts in the prior month, a sign construction was on a steady path entering 2017.

Residential starts totaled an annualized 1.25 million, easing from a 1.28 million pace in the prior month, a Commerce Department report showed Thursday. The median forecast of economists surveyed by Bloomberg was 1.23 million. Permits, a proxy for future construction, increased at the fastest pace since November 2015 on a pickup in applications for apartment building…

U.S. Housing Starts Exceed Estimates After a Stronger December

BlackRock Backs Gold to Hedge Market Risk

Posted by: | Comments-

Traders are underpricing political risks, Koesterich says

-

Gold has surged 8 percent in 2017 on an uptick in haven demand

Investors should probably be a little more nervous, according to one BlackRock Inc. money manager.

Stocks have rallied to records amid signs of stabilization in China’s economy and bets that President Donald Trump will boost U.S. infrastructure spending, roll back regulations and cut taxes. While the stock surge and below-average volatility show investors are more optimistic, markets are underpricing global political risks, said Russ Koesterich, who helps manage the $41 billion BlackRock Global Allocation Fund. He recommends gold as insurance…

Morning Agenda: SoftBank and Fortress, Trump Bump and Misguided Critiques

Posted by: | Comments Masayoshi Son, the founder of the Japanese conglomerate SoftBank, which is buying Fortress Investment Group, an American private equity giant. CreditToru Hanai/Reuters

Masayoshi Son, the founder of the Japanese conglomerate SoftBank, which is buying Fortress Investment Group, an American private equity giant. CreditToru Hanai/Reuters

The founder of the Japanese conglomerate SoftBank, Masayoshi Son, is known for making ambitious, sometimes head-scratching moves.

But this could be his most unusual move yet: SoftBank is buying the private equity giant Fortress Investment Group for $3.3 billion.

Fortress oversees about $70 billion in assets, but how will that help SoftBank’s $100 billion technology investment fund?

It will have to operate at an arms length from the SoftBank Vision Fund because it is a regulated entity, but it is expected that there will be opportunities to share intelligence…

U.S. Homebuilders’ Sentiment Slips as Buyers Hunker Down

Posted by: | Comments-

Builders stay fairly confident, while struggling to cut costs

-

Confidence declined most in Northeast, held steady in West

Confidence among U.S. homebuilders dropped in February as rising interest rates damped the market’s optimism, according to data Wednesday from the National Association of Home Builders/Wells Fargo…

A Victory for Trump Is a Victory for Big-Name Traders

Posted by: | Comments Carl Icahn, the billionaire investor, waiting for Donald J. Trump, to speak at a campaign event in April in New York. CreditVictor J. Blue/Bloomberg

Carl Icahn, the billionaire investor, waiting for Donald J. Trump, to speak at a campaign event in April in New York. CreditVictor J. Blue/Bloomberg

Carl C. Icahn is one of several billionaire investors who have bet big on a Donald J. Trump presidency.

So bullish was Mr. Icahn that he said he made $1 billion worth of bets in the stock market the morning after Mr. Trump won the election.

Moinian Launches New Lending Arm

Posted by: | CommentsNew York—With its finger on the pulse of the commercial real estate market, The Moinian Group has formed a new lending platform, Moinian Capital Partners, for borrowers seeking a minimum of $25 million. Moinian Capital will offer financing in the form of a variety of debt products for large institutional assets across an array of property sectors.

Toronto Home Sellers Vanish as BMO Warns of Housing Bubble

Posted by: | Comments-

Sales to new listings in Toronto rise to record 94% in January

-

BMO economist Porter says Toronto housing market in bubble

Conventional wisdom suggests that when prices soar for something, so does its supply — except when you are talking about Toronto’s housing market.

Real estate in Canada’s biggest city has become so expensive that potential home sellers are pulling out of the market altogether, possibly since they have nowhere cheaper to move to as the housing boom expands into Toronto’s suburbs and neighboring towns…

Janet Yellen and House Republicans Clash Over Fed’s Performance

Posted by: | Comments Janet Yellen, the Federal Reserve chairwoman, arriving to testify on Wednesday before a House committee.CreditYuri Gripas/Reuters

Janet Yellen, the Federal Reserve chairwoman, arriving to testify on Wednesday before a House committee.CreditYuri Gripas/Reuters

WASHINGTON — Janet Yellen, the Federal Reserve chairwoman, sparred with House Republicans on Wednesday about the value of financial regulation and the effectiveness of monetary policy in a testy session that showed the gulf between the central bank and the conservatives who control Capitol Hill.

During a hearing before the House Financial Services Committee, Ms. Yellen was relentlessly pressed by Republicans to concede that the American economy was broken, that the Fed had failed to fix the underlying problems and that excessive regulation was making things worse…

CBRE Acquires Capstone Financial Solutions

Posted by: | CommentsThe firm, which has been rebranded, is led by Jon Faulkenberg and Shawn Givens.

Brian Stoffers, CBRE

Brian Stoffers, CBRE

Los Angeles—CBRE Group Inc. is enhancing its debt and structured finance service offerings and boosting its Midwest presence with the acquisition of Capstone Financial Services LLC, a national boutique commercial real estate finance and consulting firm based outside of St. Louis. Terms of the deal were not disclosed.

Toll Brothers to Pay Taxes on Manhattan Condos to Lure in Buyers

Posted by: | Comments-

Luxury developer offers to pay transfer and mansion taxes

-

Manhattan builders are contending with overcrowded market

Luxury developer Toll Brothers Inc. has a deal for those shopping for a condo in Manhattan: buy something soon, and we’ll pay the taxes on your purchase.

The publicly traded homebuilder is offering to pay the city transfer tax and the New York state “mansion tax” — an effective discount totaling almost 2.5 percent — on deals made at three of its developments by Feb. 20, the company said in a statement Wednesday. The closing incentives apply to any apartment bought at Toll’s under-construction projects at 100 Barrow St., in the West Village, and 55 West 17th St., in Chelsea. The deal is also being offered at the Sutton, a development in the East 50s, where sales began in early 2015…

Sunstone Sells Orange County Hotel for $125M

Posted by: | Comments

Newport Beach, Calif.—Sunstone Hotel Investors Inc. announced the sale of the Fairmont Newport Beach hotel to Marriott for $125 million. Eastdil Secured acted as exclusive advisor to Sunstone on the sale.

Renamed The Duke Hotel Newport Beach, the 444-key asset comprises 10 floors, 411 rooms and 33 suites. Amenities include 17 meeting rooms at 23,498 square feet, a fitness center, tennis court, outdoor pool, spa, a business center, two ballrooms, two restaurants, an airport shuttle and the Bamboo Garden, a 10,000-square-foot outdoor function space that is adjacent to the ballrooms and includes a water feature, fireplace and fire pit. The property is 1.2 miles from John Wayne Airport and 4.2 miles from the Fashion Island shopping center…

Singapore Property Curbs to Stay in 2017, CapitaLand Says

Posted by: | Comments-

Residential market close to bottom, price declines have slowed

-

China-U.S. relationship important for business environment

Singapore’s residential property curbs are set to stay in place for at least another year amid signs the city’s housing market is stabilizing, the chief executive officer of Southeast Asia’s biggest developer said.

“We see volume picking up and the price declines have slowed,” Lim Ming Yan, the president and CEO of CapitaLand Ltd., said in a Bloomberg Television interview with Haslinda Amin on Wednesday. “We see this trend continuing for 2017. There is no compelling reason for the government at this point to make major changes,” to property curbs, he said…

Wall Street Rule Changes Will Be Slow in Senate, Crapo Says

Posted by: | Comments-

Banking panel chairman says bill may take 12-24 months to pass

-

Idaho Republican cites confirmation battles in ‘toxic climate’

A key Republican Senator is casting doubt on hopes for quick action to dismantle the Dodd-Frank Act or overhaul the U.S. mortgage-finance system, citing the need for bipartisan support in a Congress that seems to be far from providing it.

The need to confirm President Donald Trump’s nominees, congressional rules on the time lawmakers have to debate legislation and bitter political battles will make it difficult to move any measure, Senate Banking Committee Chairman Mike Crapo said Wednesday. Crapo believes it might take at least 12 to 24 months to advance housing reform legislation, in particular, his spokeswoman said…

JBG Smith Expands, Appoints New CFO

Posted by: | CommentsStephen Theriot has more than 30 years of finance and accounting experience and brings extensive industry knowledge to the company.

Washington—The JBG Cos. announced that Stephen Theriot has been appointed as chief financial officer of JBG Smith Properties.

Theriot has more than 30 years of finance and accounting experience. He served as CFO of Vornado Realty Trust since 2013, and Vornado’s lead outside auditor while working for Deloitte & Touche LLP. Theriot held various positions at Deloitte since 1986, most recently serving as managing partner of their Northeast real estate practice.

Renting $2 Million Hamptons Homes Just Got Easier

Posted by: | Comments-

Long Island rentals will be available through onefinestay

-

Unit is expanding into Southern California, French Riviera

The ‘Meadow Lane Estate’ from Accor’s onefinestay.

Source: onefinestay

Accor SA, Europe’s biggest hotel operator, is expanding its luxury vacation-rental offering with listings in the Hamptons, Wall Street’s summer playground.

The Long Island rentals cost as much as $2 million for the season and are the first launches in the Collections portfolio of Accor’s onefinestay unit, according to a company statement. More sites will be added over the next year as onefinestay expands beyond a handful of global cities into locations including Southern California and the French Riviera…

Agnico to Invest $1.2 Billion in Gold Projects in Canada’s North

Posted by: | Comments-

Miner moving ahead with Meliadine and expansion of Meadowbank

-

Projects would boost Agnico annual output to 2 million ounces

Agnico Eagle Mines Ltd. plans to invest more than $1.2 billion in Canada’s subarctic in the next three years as it builds one new mine and expands another.

North America’s fourth-largest gold miner by market value is moving ahead with plans to develop its Meliadine project and a deposit near its Meadowbank mine in Nunavut, the company said Wednesday in its fourth-quarter earnings statement. The decision will boost Agnico’s gold production to 2 million ounces a year by 2020, about 20 percent more than last year’s output of 1.66 million ounces.

Spanish Court Orders Criminal Inquiry Into Oversight of Bankia I.P.O.

Posted by: | Comments A Bankia location in Madrid. The collapse of the bank a year after its initial public offering prompted Spain’s banking bailout. CreditAndrea Comas/Reuters

A Bankia location in Madrid. The collapse of the bank a year after its initial public offering prompted Spain’s banking bailout. CreditAndrea Comas/Reuters

MADRID — Spain’s national court on Monday ordered a criminal inquiry into whether a former governor of the country’s central bank and seven other regulatory officials knowingly ignored financial problems at Bankia, the giant savings bank whose near collapse prompted Spain’s banking bailout in 2012.

The court said in a statement that there was sufficient evidence to indict the officials in connection with Bankia’s initial public offering in 2011, a year before the bank’s forced nationalization…

Hyatt to Double Centric-Brand Portfolio

Posted by: | Comments

Chicago—Hyatt Hotels Corp. is really putting its heart into Hyatt Centric, one of its newest brands. The hotel giant just announced that it will expand the millennial-focused portfolio to nearly twice its current 14-property size by the close of 2019.

Goldman Stock Hits Record on Bets Trump Will Unleash Wall Street

Posted by: | Comments-

Stock has jumped 37% since election, leading Dow Index higher

-

Trump blasted bank in campaign, then named alumni to top posts

Goldman Sachs Group Inc. climbed to a record high on optimism President Donald Trump’s administration will spur trading and dealmaking, slash corporate taxes and roll back costly regulations after installing the firm’s executives in top government posts.

The shares rose 1.3 percent to $249.46 at 4 p.m. in New York, passing a record close set in late 2007, just before the industry plunged into a crisis that almost brought down the global financial system. Goldman’s stock recovered much of its loss in the years after that turmoil, and since Trump’s election has soared 37 percent, leading the Dow Jones Industrial Average higher…

SoftBank of Japan Will Buy U.S. Private Equity Giant Fortress

Posted by: | Comments Masayoshi Son, the founder of the Japanese conglomerate SoftBank. CreditToru Hanai/Reuters

Masayoshi Son, the founder of the Japanese conglomerate SoftBank. CreditToru Hanai/Reuters

Over its three-decade existence, the Japanese conglomerate SoftBank and its founder, Masayoshi Son, have been known for ambitious and sometimes head-scratching moves.

Now, SoftBank is nearing its most unusual move yet: It is buying Fortress Investment Group, an American private equity giant that oversees around $70 billion in assets.

That business is a radical departure from the technology and telecommunications holdings for which the Japanese company is known. But the acquisition is intended to energize SoftBank’s other enormous new endeavor: a $100 billion technology investment fund that threatens to roil the private equity world…

Indian Manufacturer Plans US Debut

Posted by: | Comments

Ridgeville, S.C.—India-based Sundaram-Clayton Ltd. (SCL), a manufacturer and supplier of aluminum cast products to global automotive original equipment manufacturers, recently announced its plans to invest $50 million in its first U.S. plant in Ridgeville, S.C. The company intends to create 130 new jobs during the next five years.

Credit Suisse Sees Alternatives to Swiss IPO on Capital Beat

Posted by: | Comments-

Thiam says bank continues to prepare for IPO in late 2017

-

Swiss bank plans to cut as many as 6,500 jobs this year

Credit Suisse Group AG signaled it is weighing alternatives to a public offering of its Swiss unit after its $5.3 billion settlement over toxic mortgage securities hurt capital buffers less than estimated. Investors cheered the change in tune.

The settlement was a “game-changer for us,” Chief Executive Officer Tidjane Thiam said in an interview with Bloomberg Television. “What it does is that it leaves us in a more comfortable position to look today at our capital planning.”…

A Venture Capitalist’s Misguided Critique of a Trump Adviser

Posted by: | Comments Harry Campbell

Harry Campbell

When a man worth more than $3 billion attacks another billionaire as greedy and as a character out of “Goodfellas,” you know something unusual is happening. In this case, it may be a sign that all is not well in the world of private funds.

The man with the $3 billion in this case is Michael Moritz, a storied partner at the venture capital firm Sequoia Capital. In an Op-Ed article in The New York Times last week, Mr. Moritz denounced the actions of Stephen A. Schwarzman, the co-founder and chief executive of the private equity firm the Blackstone Group and the chairman of President Trump’s advisory business council…

Publix-Anchored Retail Center Trades near Orlando

Posted by: | Comments

Orlando—HFF has closed the sale of Publix at St. Cloud, a 78,779-square-foot community shopping center anchored by Publix, the company announced recently. The asset is located in St. Cloud, Fla., in the Orlando metropolitan area.

HFF marketed the property on behalf of the seller, Kite Realty Group Trust. The retail center was purchased free and clear of financing. The team representing the seller was led by Senior Managing Director and Co-head of HFF’s retail practice Daniel Finkle, senior managing directors Brad Peterson and Jim Hamilton and Director Eric Williams…

Goldman Sachs Denies Bonuses for 100 Investment Bankers

Posted by: | Comments-

Number of dealmakers passed over for rewards is said to grow

-

On Wall Street, getting ‘blanked’ is often a signal to quit

Goldman Sachs Group Inc. didn’t pay 2016 bonuses to about 100 bankers who advise on takeovers and underwrite securities offerings, signaling to a bigger crowd of underperformers that they’re probably better off elsewhere, according to people with knowledge of the matter.

The move is more draconian than in past years when many dealmakers who failed to impress their bosses still got something, said the people, who asked not to be identified discussing the firm’s compensation practices. The number of employees denied a bonus in recent weeks is higher than a year ago — eliminating what’s typically a major component of their pay…

A Billionaire’s Party Is a Lens on Wealth in the Trump Era

Posted by: | Comments Fireworks exploded over Palm Beach, Fla., on Saturday as part of a birthday party for Stephen A. Schwarzman, co-founder of the Blackstone Group and chairman of President Trump’s strategic policy forum. CreditAmanda L. Gordon/Bloomberg

Fireworks exploded over Palm Beach, Fla., on Saturday as part of a birthday party for Stephen A. Schwarzman, co-founder of the Blackstone Group and chairman of President Trump’s strategic policy forum. CreditAmanda L. Gordon/Bloomberg

So, Stephen A. Schwarzman had another birthday party.

The celebration for his 70th birthday at his Palm Beach, Fla., home over the weekend included live camels, trapeze artists and a performance by Gwen Stefani. Some reports speculated the party cost as much as $20 million, a price tag that insiders say is ridiculously inflated, but clearly the event fell in the category of over-the-top expensive.

JLL Wraps Up Lease Renewal at Two Urban Centre in Tampa

Posted by: | CommentsCurrently 90 percent leased, the property is one of Tampa’s most sought-after office buildings.

Tampa, Fla.—JLL has announced that the firm has completed a 33,005-square-foot lease renewal with Mortgage Contracting Services, a national mortgage services company headquartered in Texas, with operations across the U.S. MCS’ Tampa office will remain at Two Urban Centre, a 270,000-square-foot office building located at 4890 West Kennedy Ave., in Tampa’s Westshore neighborhood.

JLL Senior Vice President John Heald and JLL Associate Jordan Fogler represented MCS in the lease renewal. JLL SVP Jim Moler and JLL VP Deana Beer represented TIAA, the ownership entity of Two Urban Centre…

This $6.9 Million Villa Comes With Its Own Private Island

Posted by: | CommentsOn Florida’s Melody Key, a three-bedroom villa is powered by solar panels and gets its water from the sea.

Sometime in 2014, French-born, Dubai-based, real estate developer Blaise Carroz decided to buy his own island. “Since I was a kid, I dreamed of owning an island,” he said. “And it was the perfect spot for family vacations.”

Melody Key

New Hotel Coming to Downtown Phoenix

Posted by: | Comments

Phoenix—Mortenson is developing and building a Hampton Inn & Suites by Hilton, a 210-key hotel in downtown Phoenix.

This is the second Hampton Inn & Suites that Mortenson has developed in the past three years, but the first in the Phoenix area.

HASI Invests $144M in Land for Solar Projects

Posted by: | Comments

Annapolis, Md.—Hannon Armstrong Sustainable Infrastructure Capital Inc. has acquired, for $144 million, more than 4,000 acres of land that’s leased under long-term contracts to more than 20 individual solar projects with investment grade off-takers (customers that have contracted to buy power).

The projects have an aggregate capacity exceeding 690 megawatts of direct current.

Including this transaction, HASI has invested about $375 million in real estate and owns more than 20,000 acres of land leased under long-term agreements to over 45 renewable-energy projects and has the rights to payments from land leases for more than 50 additional projects. The projects are located in over 15 states…

SoftBank to Buy Fortress Investment Group for $3.3 Billion

Posted by: | Comments-

Fortress will operate alongside SoftBank Vision Fund

-

Masayoshi Son aims to be world’s biggest technology investor

SoftBank Group Corp. is buying alternative-asset manager Fortress Investment Group LLC for $3.3 billion to operate alongside the Japanese company’s soon-to-be-established technology investment fund.

Japan’s SoftBank will pay $8.08 a share for New York-based Fortress, a 39 percent premium to the company’s Feb. 13 closing price, according to a statement Tuesday. Fortress co-founders Pete Briger, Wes Edens and Randy Nardone have agreed to continue leading the business, which will remain based in New York and operate independently within SoftBank, according to the statement…

Goldman Sachs’ Hedge Fund Is Doing A Super Hard Brexit

Posted by: | CommentsRunning a post-Dodd-Frank hedge fund has been something of a pain in the old ass for Goldman Sachs, especially a fund that keep getting crushed on value investing plays that aren’t working out very well.

But Lloyd Blankfein and his new(ish) leadership team are apparently drawing the line at running any operations for said fund out of a post-European London…

CBRE Promotes Grant Mueller to Managing Director

Posted by: | CommentsAustin, Texas—CBRE has announced the promotion of Grant Mueller, MAI, to managing director of its valuation and advisory services for the Central Texas region. Mueller takes over from David Thibodeaux, who assumed an investment properties role with CBRE Capital Markets in 2016.

Mueller’s primary business is in Austin, where he leads a team of 10 appraisers. He has 12 years of experience in Austin, having appraised various commercial properties, including office towers, mixed-use, residential, and industrial developments…

Loeb’s Third Point Bet on Banks Amid Trump Election Share Rally

Posted by: | CommentsThird Point, the sometimes-activist hedge fund run by Dan Loeb, took new stakes in a handful of banks including JPMorgan Chase & Co. in the fourth quarter, amid a rally in financial stocks after President Donald Trump’s election victory.

Loeb disclosed a $453 million stake in the New York-based bank — his fifth-biggest position — along with new holdings in Bank of America Corp., Goldman Sachs Group Inc. and PrivateBancorp Inc., according to a regulatory filing Friday…

Loeb’s Third Point Bet on Banks Amid Trump Election Share Rally

Morgan Stanley Cougars Cruising For Young Bucks

Posted by: | Comments ames Gorman (Getty Images)

ames Gorman (Getty Images)

Morgan Stanley used to be a hot commodity amongst young college grads looking to score quick on Wall Street. But times have changed. Investment banking just isn’t sexy as it once was, and now everyone is drooling over Facebook and Snapchat. But old Morgan Stanley’s still got a few tricks up the old sleeve – namely, handing out promotions to kids who are still getting used to the taste of beer. As eFinancialCareers reports, some special 21 year-olds are making associate in as few as four months:

Jeffrey Moeller to Lead Transwestern’s SF Office

Posted by: | CommentsMoeller has 20 years of experience in Northern California commercial real estate.

San Francisco—Transwestern has announced the promotion of Jeffrey Moeller from senior vice president to senior managing director of the firm’s San Francisco office. In addition to overseeing operations and personnel, and executing the company’s growth plans, he will continue to pursue his brokerage role.

Moeller brings 20 years of experience in Northern California commercial real estate with executed transactions of more than $1.2 billion, totaling in excess of 1.8 million square feet…

U.K. House Prices Climb to Record as Shortage of Homes Worsens

Posted by: | Comments-

Average value now 300,000 pounds, says Acadata/LSL report

-

London one of the worst performers among 10 regions in 2016

The average price of a U.K. home hit a new record in January, continuing an upward trend that’s in part being driven by a supply-demand imbalance.

The 0.3 percent increase in values lifted the average to 300,169 pounds ($374,000), Acadata and LSL said in a report on Monday. Annual growth was 3.1 percent, and prices are now double what they were in 2002…

U.K. House Prices Climb to Record as Shortage of Homes Worsens

Earlier this week, Andrew Ross Sorkin offered us a peek at what Baupost Group chief Seth Klarman is thinking these days. In short, he’s thinking that President Trump is going to be a disaster, that his fellow investors are burying their heads in the sand about this, and that passive investing is just the latest thing to prove efficient markets theory will never be borne out by inefficient realities.

Oh, but there’s more. So much more. Nineteen long, dense pages of it, in which Seth Explains It All. Without further ado, a taste:

PLR Debuts First Building in Dallas Logistics Complex

Posted by: | CommentsDallas—Port Logistic Realty, in a joint venture with Diamond Realty Investments, has announced the completed construction of its first building at the company’s 531-acre Southport Logistics Park, located within the inland port area of southern Dallas County in Wilmer, Texas, approximately 10 miles south of downtown Dallas…

Six Canadian Lenders Hit Record Highs Ahead of Earnings Season

Posted by: | Comments-

Big lenders expected to lift quarterly profit 7%, Cormark says

-

Barclays says bank valuations may be nearing infection point

Six Canadian lenders including Royal Bank of Canada and Toronto-Dominion Bankreached record highs Monday, extending a North American bank rally as analysts predict higher profits.

Bank of Nova Scotia, Canadian Imperial Bank of Commerce, National Bank of Canada and Laurentian Bank of Canada also reached peaks, helping extend the eight-company S&P/TSX Commercial Banks Index’s streak of record highs for the fourth straight day. Bank of Montreal rose, though remained 8 cents short of its all-time high…

Ford to Invest $1 Billion in Artificial Intelligence Start-Up

Posted by: | Comments An employee at a Ford plant in Louisville, Ky. Ford sees “mobility services” as potentially more profitable than its traditional business of making and selling cars. CreditLuke Sharrett/Bloomberg

An employee at a Ford plant in Louisville, Ky. Ford sees “mobility services” as potentially more profitable than its traditional business of making and selling cars. CreditLuke Sharrett/Bloomberg

SAN FRANCISCO — One of the oldest automakers in the United States is making a billion-dollar bet that one day, owning a car may not be a necessity of American life.

Ford Motor announced on Friday its plans to invest $1 billion over the next five years in Argo AI, an artificial intelligence start-up formed in December that is focused on developing autonomous vehicle technology.

World’s First Triple-Flagged Hilton Lands Financing

Posted by: | CommentsChicago—HFF has arranged $78 million in construction financing for a 466-key triple-flagged Hilton hotel now beginning development across the street from Chicago’s McCormick Place convention center.

HFF worked on behalf of the developer, Michigan Cermak Indiana LLC and First Hospitality Group, to place the construction loan with The PrivateBank…

How a Jazz Pianist Took a Top Post at Wall Street Hedge Fund

Posted by: | Comments-

Larry Richards sold options algos to Wall Street hedge fund

-

Richards became Gammon Capital’s chief technology officer

Larry Richards.

Source: Larry Richards

Larry Richards, a trained jazz pianist and former phone-company executive, is an unlikely entrepreneur in the esoteric world of stock options.

Just three years after taking an online course on equity derivatives, Richards set up his own company in 2013 to develop trading software for individual investors and small funds. At the end of 2016, the 53-year-old sold the firm to Wall Street hedge fund Gammon Capital, becoming that company’s chief technology officer…

Banks Look to Cellphones to Replace A.T.M. Cards

Posted by: | Comments Minh Uong/The New York Times

Minh Uong/The New York Times

Wallets can be lost, stolen or forgotten, but most people today wouldn’t be caught dead without their phones.

Banks understand, and are grabbing on to that trend. Customers who don’t want to fumble around in their wallet for their A.T.M. card — or who have misplaced it for the umpteenth time — will soon be able to unlock cash dispensers’ coffers by using their phone…

Billionaire Wiese Faces Hurdles in Attempt to Combine Assets

Posted by: | Comments-

Negotiations underway to create Africa’s biggest retailer

-

Deal may face opposition from minority investors, regulators

Christo Wiese, South Africa’s fourth-richest person with a fortune of about $5.7 billion, is at the center of plans to create the continent’s largest retailer by combining the African operations of Shoprite Holdings Ltd. and Steinhoff International Holdings N.V.Here’s why a transaction makes sense for the 75-year-old billionaire and why a deal may face opposition from minority shareholders and antitrust authorities…

Billionaire Wiese Faces Hurdles in Attempt to Combine Assets

World’s Biggest Debt Market Faces Huge Test From Trump

Posted by: | Commentsresident Donald Trump is a man obsessed by imports, and untroubled by exports.

Since he first hit the campaign trail, Trump has been squarely focused on boosting domestic production by limiting cheap imports from places like China and Mexico and replacing them with homegrown offerings. Much more rarely has he talked about selling those homegrown offerings — be they Ford Explorers or Boeing 747s — to the rest of the world.

It’s a curious state of affairs, like encouraging people to cook by banning restaurants. Disconcertingly, Trump’s brand of import substitution is now playing out in the world’s biggest debt market…

Is Your Financial Adviser Acting in Your Best Interest?

Posted by: | Comments Gary Ribe, left, chief investment officer, and Mark Cortazzo, senior partner, in the Parsippany, N.J., office of the Macro Consulting Group, a wealth management firm. Both advise investors to keep a close eye on fees.CreditJake Naughton for The New York Times

Gary Ribe, left, chief investment officer, and Mark Cortazzo, senior partner, in the Parsippany, N.J., office of the Macro Consulting Group, a wealth management firm. Both advise investors to keep a close eye on fees.CreditJake Naughton for The New York Times

This is a tale of two mutual funds with abysmal performance — but very different reactions from their investors to their returns.

The Ivy Asset Strategy — which is known as a total return fund, because it tries to maximize gains through a variety of investment strategies — ranked in the 99th percentile in 2016, according to Morningstar, meaning that investors could scarcely do worse.

Binswanger Named Exclusive Agent for SC Facility

Posted by: | Comments

Clio, S.C.—Baldor Electric Co. has named Binswanger the exclusive agent for the sale of its single-story industrial property that spans approximately 40 acres in Clio, S.C. The 162,800-square-foot plant will be marketed to manufacturers of plastics, rubber, steel, fabricated metal, machinery, electrical equipment/appliance/component, motor vehicle parts, aerospace products and furniture. The facility could also be used as a warehouse or storage space.

Billionaire Wiese Faces Antitrust Hurdles in Bid to Merge Assets

Posted by: | Comments-

Negotiations underway to create Africa’s biggest retailer

-

Deal may face opposition from minority investors, regulators

Christo Wiese, South Africa’s fourth-richest person with a fortune of about $5.7 billion, is at the center of plans to create the continent’s largest retailer by combining the African operations of Shoprite Holdings Ltd. and Steinhoff International Holdings N.V.Here’s why a transaction makes sense for the 75-year-old billionaire and why a deal may face opposition from minority shareholders and antitrust authorities…

Billionaire Wiese Faces Antitrust Hurdles in Bid to Merge Assets

Why Falling Home Prices Could Be a Good Thing

Posted by: | Comments Minh Uong/The New York Times

Minh Uong/The New York Times

Suppose there were a way to pump up the economy, reduce inequality and put an end to destructive housing bubbles like the one that contributed to the Great Recession. The idea would be simple, but not easy, requiring a wholesale reframing of the United States economy and housing market.

The solution: Americans, together and all at once, would have to stop thinking about their homes as an investment.

Transwestern Brokers Sale of 156 KSF Flex Portfolio

Posted by: | Comments

Largo, Md.—Transwestern recently announced that it represented Atapco Properties in the disposition of Inglewood Business Center, two flex properties totaling 156,393 square feet in Largo, Md. Transwestern brokered the sale after increasing occupancy by 76 percent. Caraway Court Owner LLC, an investment group led by Rosenthal Properties, purchased the portfolio for $16.5 million.

Gucci’s Record Sales Propel French Luxury House Kering

Posted by: | Comments-

Label’s sales rose 21% in fourth quarter, trouncing rivals

-

Designer Alessandro Michele reignites interest in key brand

Gucci’s $2,000 Sylvie leather shoulder bags and $1,190 studded leather pumps are flying off the shelves, propelling parent company Kering SA to its fastest sales growth in four years and further lifting spirits in the hard-hit luxury-goods industry.

The Italian fashion brand’s revenue advanced 21 percent in the fourth quarter, almost twice as fast as analysts expected, Kering said Friday. Full-year sales at the business, Kering’s largest, exceeded 4 billion euros ($4.3 billion) for the first time as creative director Alessandro Michele reignited interest in the label. The shares rose 2.6 percent to 230.15 euros at 10:48 a.m. in Paris…

Retirement Advice in the Trump Era

Posted by: | CommentsA federal judge in Texas did President Trump a favor last week. It came in a decision in a case filed by the financial industry against the Labor Department to overturn an Obama-era regulation called the “fiduciary rule,” which requires financial advisers to put their clients’ interests first when giving advice and selling investments for retirement accounts.

The judge, Barbara Lynn, called the plaintiffs’ objections “without merit,” “unpersuasive” and “at odds with market realities.”..

HFF Closes Sale of Memphis-Area Retail Center

Posted by: | CommentsSouthaven, Miss.— HFF closed the sale of Stateline Square, a fully-leased retail center located at 550 Stateline Road and 570 W. Main St. in the Memphis-area suburb of Southaven, Miss.

HFF marketed the asset on behalf of the seller, Conn’s HomePlus. The investment sales team representing the seller was led by HFF’s Senior Managing Director Ryan West…

Aussie Banks Hit Back at Apple Over Mobile Payment Dispute

Posted by: | Comments-

Banks abandon attempt to negotiate as bloc over Apple Pay fees

-

Retailers support banks’ bid to gain access to key technology

A consortium of Australia’s biggest banks has abandoned its attempt to negotiate as a bloc with Apple Inc. over the cost of using its mobile payment system, narrowing its claim to focus solely on access to a key piece of iPhone technology.

In their final submission to the competition regulator, the banks hit back at earlier claims by Apple that the dispute was fundamentally an attempt to “delay or even block” the expansion of Apple Pay into Australia. Apple’s “conspiracy theories” are “fantasy,” the banks said in an accompanying e-mailed statement Monday…

Blackstone to Acquire Aon Unit for Up to $4.8 Billion

Posted by: | CommentsLONDON — The Blackstone Group said on Friday that funds affiliated with the private equity giant had agreed to pay up to $4.8 billion to acquire Aon’s human resources outsourcing business.

The business is the largest benefits administration platform in the United States and a provider for cloud-based human resources management systems, Blackstone said. It serves about 15 percent of the United States’ working population at more than 1,400 companies…

Jersey Office Portfolio Commands $87M

Posted by: | Comments

Cranford, N.J.—Signature Acquisitions has acquired a 822,730-square-foot commerce office portfolio encompassing eight buildings located in Cranford and Clark, N.J. from Mack-Cali Realty Corp. The total cost was $87 million.

The portfolio includes a wide range of building sizes and space configurations to accommodate various tenant and use requirements, with an average tenant size of 7,000 square feet.

“The appeal was the diversity of space sizes and buildings. Some is pure office and some is flex,” Jeffrey Dunne, CBRE’s vice chairman, told Commercial Property Executive. “Further, there is good upside to grow NOI through increases in occupancy from its current 75 percent level.”…

Singapore’s Big Banks’ Bad-Loan Woes May Be Getting Worse

Posted by: | Comments-

DBS, rivals to report fourth-quarter results this week

-

Lenders may set aside more provisions for energy loans: RHB

The woes of Singaporean energy-services provider Ezra Holdings Ltd. are a stark reminder to the city’s biggest banks of the threat souring oil and gas loans pose to their earnings.

A writedown flagged by Ezra recently has refocused attention on the debt-repayment problems marine-services firms are facing, fueling concerns that lenders may have to set aside more money to cover loan losses. Fourth-quarter results due this week from DBS Group Holdings Ltd. and its two biggest rivals may include a 44 percent surge in combined provisions for the period from a year earlier, according to RHB Capital Bhd…

Griffin Capital REIT Acquires Denver Office Complex

Posted by: | CommentsDenver—Griffin Capital Corp., on behalf of Griffin Capital Essential Asset REIT II Inc., announced the first acquisition by the REIT—a Class A office complex in the Greater Denver metropolitan area. The REIT purchased the property from Farmers New World Life Insurance Co., which was represented by CBRE.

Located in Lone Tree, Colo., the three-story building comprises 70,273 square feet, solely leased to Allstate Insurance Co. for 10 years. Developed in 2000, the building underwent interior renovations in 2015 after being previously occupied by Sprint/Nextel…

Lantian Files Plan for $650M Suburban DC Project

Posted by: | CommentsShady Grove Neighborhood Center will feature 200,000 square feet of office space, 100,000 square feet of retail, a hotel and as many as 1,600 residential units.

Shady Grove Neighborhood Center in Rockville, Md.

Shady Grove Neighborhood Center in Rockville, Md.

Washington—Lantian Development LLC’s vision for a 31-acre site in Rockville, Md., near Washington, just moved closer toward realization. Lantian and partner 1788 Holdings LLC recently filed a project plan with the City of Rockville, outlining a mixed-use destination tentatively called Shady Grove Neighborhood Center and bearing an estimated development price tag of $650 million.