Archive for Uncategorized

Capital One Leads Half-Billion Loan for Starwood’s MOB Deal

Posted by: | CommentsGreenwich, Conn.—Starwood Property Trust Inc. grabbed a big piece of the medical office building pie—a 1.9 million-square-foot piece—and Capital One helped the REIT seal the deal. Capital One acted as lead arranger and bookrunner for a $534.9 million loan to fund Starwood’s acquisition of a 34-property MOB portfolio spanning a dozen states.

“The Capital One team delivered timely financing on this complex transaction—closing in a little more than 60 days from signing of the term sheet,” Erik Tellefson, managing director of Capital One Healthcare, said in a prepared statement. It was a big deal, but Capital One was working with solid sponsorship, as well a highly desirable group of assets…

Deutsche Bank to Cut Equities and Fixed Income Trading Staff

Posted by: | Comments-

Cuts said to affect up to 6% of FI staff and 17% of equities

-

Company aims to eliminate 9,000 jobs to raise profitability

Deutsche Bank AG is about to eliminate staff at its trading business, according to a person familiar with the matter, a day after reporting results for the unit that missed analysts’ expectations.

The bank will cut as much as 17 percent of staff globally in its equities unit and reduce fixed-income headcount by as much as 6 percent, with notices to be served to employees soon, the person said…

Nestlé USA Brings Headquarters to VA

Posted by: | CommentsThe company will occupy 206,000 square feet at the new address starting September 2017.

Arlington, Va.—Virginia Governor Terry McAuliffe announced that Nestlé USA, a subsidiary of Nestlé S.A., will invest $39.8 million to relocate its corporate headquarters from Glendale, Calif., to Arlington, Va., creating 748 jobs in the process.

The company will occupy 206,000 square feet at 1812 N. Moore in the Rosslyn neighborhood starting September 2017. The high-rise has been vacant since construction was completed in 2013. The building offers views of the D.C. skyline, accessibility to major transportation venues, an onsite resource center and technology tools…

Hedge Fund Investor Letters Show Managers Are Stumped by Trump

Posted by: | Comments-

Some are ominous, most are obvious in weighing new president

-

Dalio is very ‘concerned,’ Loeb predicts winners and losers

The masters of the universe are sharpening their pencils to write about Donald Trump. The problem? Many of them aren’t sure what to say.

In commentaries such as quarterly letters to clients, money managers tackling the potential impact of the new president are sometimes bullish — and almost always hedged. They’re going to do great, they say, but it’ll be a tough time for hedge funds generally.

Here are some excerpts from the commentary we’ve read…

RBC Renews Lease for 400KSF at Brookfield Place in Manhattan

Posted by: | CommentsRBC Capital Markets will continue to occupy floors eight through 14 and a portion of six and 25 until 2032.

New York—Cushman & Wakefield and Brookfield Properties announced that Royal Bank of Canada has signed a 15-plus year lease renewal at Brookfield Place New York in Manhattan.

Located at 200 Vesey St., Brookfield Place is an eight million-square-foot complex that includes five office towers and is anchored by Brookfield Place Winter Garden. In 2015, the asset received a $300 million renovation, which included the redesign of 375,000 square feet of retail space, office lobbies and public spaces.

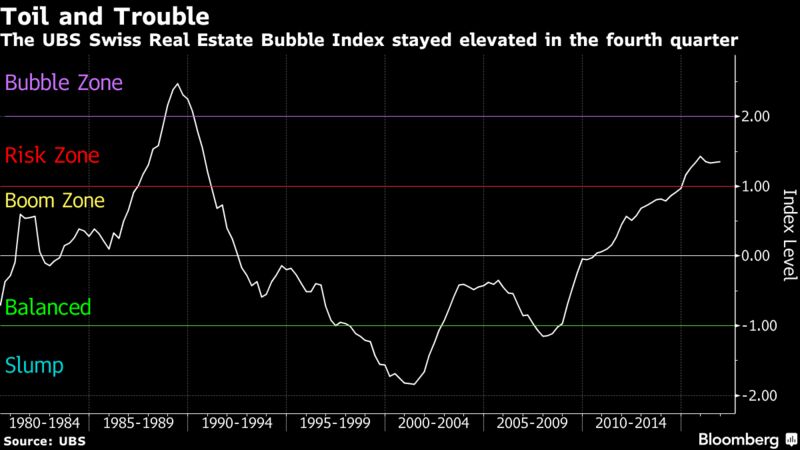

UBS Says Swiss Property Market Remains at Risk of Bubble: Chart

Posted by: | Comments Risks to the Swiss property market remained elevated in the three months through December, according to UBS Group AG’s quarterly index. “The further increase in the ratio of purchase prices to rents and income reflects increasing interest rate risks,” it said, adding that the stabilization of index “in the last few quarters is due to the sharp slowdown in household debt growth.”…

Risks to the Swiss property market remained elevated in the three months through December, according to UBS Group AG’s quarterly index. “The further increase in the ratio of purchase prices to rents and income reflects increasing interest rate risks,” it said, adding that the stabilization of index “in the last few quarters is due to the sharp slowdown in household debt growth.”…

UBS Says Swiss Property Market Remains at Risk of Bubble: Chart

Dubai Will Get a $3 Billion Loan to Fund Airport Expansion

Posted by: | Comments-

Seven-year facility to pay interest of 200 basis points

-

Lenders had been seeking higher pricing on the loan last year

Dubai agreed a $3 billion loan with banks to fund the expansion of Dubai World Central airport and logistics hub as it prepares to host the World Expo in 2020, people familiar with the matter said.

The emirate will pay interest of 200 basis points, or 2 percentage points, above the London Interbank Offered Rate on the seven-year facility, said the people, asking not to be identified because the talks are private. It will also pay a one-time fee of 85 basis on the loan value, they said. HSBC Holdings Plc is advising the government on the talks and an agreement is expected to be signed within weeks, the people said…

Paramount Strikes Record Deal to Sell NoVa Trophy Building

Posted by: | CommentsArlington, Va.—A new owner has emerged for Waterview, a 647,000-square-foot office building located in the Rosslyn section of Arlington, Northern Virginia.

New York City-based Paramount Group has sold the Class A office tower to Morgan Stanley Real Estate for a staggering $460 million. The deal represents the largest single office sale in the area since 2007, when Paramount acquired the same property. According to Real Estate Alert, Eastdill Secured negotiated the transaction on behalf of the seller.

Toronto Home Prices Jump 22% as Buyers Contend With Tight Supply

Posted by: | CommentsToronto home prices rose more than 20 percent for the fifth straight month as buyers contended with a shrinking supply of properties on the market.

The average home price in Canada’s biggest city jumped 22 percent to C$770,745 ($591,697) in January from a year earlier, according to the city’s real estate board, and sales climbed 12 percent to 5,188 deals. The number of active listings was half the year-earlier figure, and the average days on the market fell to 19 from 29…

Toronto Home Prices Jump 22% as Buyers Contend With Tight Supply

Australia’s Housing Dilemma Will Keep RBA From Changing Rates

Posted by: | Comments-

RBA widely expected to leave cash rate at 1.5% on Tuesday

-

Aussie dollar strength is renewed headwind for economy

The Reserve Bank of Australia is setting one policy for two very different economies.

In the east, Sydney and Melbourne are seeing booming property prices and spiraling household debt; on the western side of the continent, housing and rental costs in Perth are falling as mining companies retrench. The upshot: interest rates aren’t likely to be going anywhere soon.

Iconic Chicago High-Rise Slated for $500M Revamp

Posted by: | CommentsChicago—Blackstone and Equity Office will transform Willis Tower in downtown Chicago thanks to a $500 million investment, reinforcing the iconic tower as a civic destination and a premier workplace in the area.

“Willis Tower will be transformed into an enviable workplace with unprecedented office amenities, and unique retail and entertainment experiences,” Paul Kurzawa, Equity Office’s managing director-development, who is overseeing the redevelopment, told Commercial Property Executive. “We are delivering over 150,000-square-feet of new office tenant amenities, bringing them closer to the office tenants and their guests.”

Trump Cites Friends to Say Banks Aren’t Making Loans. They Are.

Posted by: | Comments-

Lending has increased 6% a year since 2013 to $9.1 trillion

-

Cohn claims on lending ‘simply false,’ Stanford’s Admati says

U.S. President Donald Trump, center, holds up a signed Executive Order related to the review of the Dodd-Frank Act in the Oval Office of the White House, in Washington, D.C. on Feb. 3.

U.S. President Donald Trump, center, holds up a signed Executive Order related to the review of the Dodd-Frank Act in the Oval Office of the White House, in Washington, D.C. on Feb. 3.

As he prepared to sign orders designed to roll back bank regulations enacted to stop the next financial crisis, President Donald Trump said that the rules are stifling lending.

Deutsche Bank Purchases Ads to Apologize for ‘Serious Errors’

Posted by: | Comments-

CEO Cryan signs ad, expressing ‘our deep regret’ for conduct

-

Ad in German newspapers blamed ‘misconduct of a few’ workers

Deutsche Bank AG bought full-page ads in all major German newspapers over the weekend to apologize for “serious errors” after two years of losses that cost the lender billions of euros.

Legal cases that date back many years cost the Frankfurt-based company “reputation and trust” in addition to about 5 billion euros ($5.4 billion) since John Cryan took over as chief executive officer in 2015, the ad said, blaming the “misconduct of a few” employees…

Dodd-Frank’s Bankruptcy Provision Could Be a Trump Target

Posted by: | CommentsThis week, President Trump, in signing another in a seemingly endless parade of executive orders, vowed to “do a big number” on Dodd-Frank, the 2010 law enacted in response to the financial crisis.

While doing so will require more than a presidential signature on a piece of paper, and we have yet to see what sort of working relationship the president will have with Congress, I take him at his word. So far, he seems quite determined to do exactly what he said he was going to do during the election campaign.

Triton Stone Group Brand Sells for $40M

Posted by: | Comments

New Orleans—Distributor of granite and natural stone products Triton Stone Group of New Orleans has announced the purchase of the Triton Stone brand for $40 million. The deal also includes the company’s relocation to Triton Stone Group’s existing headquarters in New Orleans.

Design Team in Place for Phase 2 of DC’s M-U Wharf

Posted by: | CommentsWashington, D.C.—As the initial segment of The Wharf, a 3.2 million-square-foot mixed-use project that will grace Washington, D.C.’s Southwest Waterfront, nears completion, Hoffman-Madison Waterfront puts the spotlight on the next stage. The developer of the $2 billion live-work-play community just announced the design team for Phase 2, and it’s a stellar list of new participants and repeat offenders…

Deutsche Bank Chief Apologizes for Lender’s Past Misconduct

Posted by: | Comments From left: Deutsche Bank’s chief financial officer, Marcus Schenck; chief regulatory officer, Sylvie Matherat; chief executive, John Cryan; and Christian Sewing, head of private, wealth and commercial clients, at the news conference on Thursday in Frankfurt. CreditTorsten Silz/European Pressphoto Agency

From left: Deutsche Bank’s chief financial officer, Marcus Schenck; chief regulatory officer, Sylvie Matherat; chief executive, John Cryan; and Christian Sewing, head of private, wealth and commercial clients, at the news conference on Thursday in Frankfurt. CreditTorsten Silz/European Pressphoto Agency

FRANKFURT — The chief executive of Deutsche Bank apologized in especially contrite terms on Thursday for the long list of misdeeds that tarnished the German lender’s reputation and cost it billions of euros in fines and settlements, adding that bonuses of top managers would be cut.

Downtown Washington Office Asset Changes Hands for $75M

Posted by: | Comments

Washington, D.C.—The Meridian Group recently announced that it has acquired an eight-story, 132,372-square-foot office building in the central business district of Washington. 1901 L Street NW was bought off market from New York Life for $75 million.

Meridian plans major renovations, including three new floors, a new lobby, a new façade, new HVAC and elevator systems as well as an exclusive tenant-only indoor-outdoor penthouse space, fitness center and a conference center. Fox Architects will lead the revamp, and upon completion, the size of the asset will increase to 206,000 square feet…

Yellen Eyes Commercial Real-Estate Froth as Fed Weighs ’17 Risks

Posted by: | Comments-

Property prices have doubled, leading to repeated Fed warnings

-

The boom creates anxiety even as supervision is main defense

A decade after the U.S. housing market collapsed, Federal Reserve officials are watching rising apartment towers as the next potential asset-price bubble, which could add to the debate about the pace of interest-rate hikes this year.

Fed Chair Janet Yellen cited commercial real estate prices as “high” in a speech at Stanford University on Jan. 19. That message has been echoed by Governor Jerome Powell, who warned “low rates may lead to a reach for yield,” as well as Boston Fed President Eric Rosengren, who cited luxury housing in his city…

Trump Looks to Another Finance Veteran for Senior Role

Posted by: | CommentsThe founder of Cerberus Capital Management, an investment firm that owns companies like the gun maker Remington Outdoor and the supermarket chain Albertsons, is in discussions to join the Trump administration, the firm disclosed on Thursday.

Stephen A. Feinberg, the founder, has held discussions with President Trump’s transition team about “a senior role,” according to a letter to Cerberus investors on Thursday that was reviewed by DealBook. The firm said that were he to take such a position, he would have to publicly disclose significant amounts of information about his finances…

Atypon Opens New Office in Rochester, NY

Posted by: | Comments

New York—Atypon has announced the opening of a new office at 60 Browns Race in Rochester, N.Y., to keep up with its active hiring of software engineers; solution architects; front-end developers and project managers, tripling its staff over the past three years. The newly renovated office in the historic High Falls business district, is nestled among other high-tech companies including Datto, Text100 and ShoreTel.

Vancouver Home Sales Plunge 40%, Extending String of Declines

Posted by: | Comments-

Monthly sales mark seventh consecutive year-over-year decline

-

Sales-to-listings ratio at a two-year low: real estate board

This time last year, Vancouver was one of world’s hottest housing markets as buyers turned up throughout the winter for bidding wars and sales reached an all-time high.

Today, the Real Estate Board of Greater Vancouver reported transactions in Metro Vancouver plunged 40 percent in January over a year earlier as both buyers and sellers hover on the sidelines. That’s the seventh straight month of declines, according to data compiled by Bloomberg. The ratio of sales to listings — used by the industry as a harbinger of prices — is also at a two-year low, according to the board…

An Early Trump Backer Awaits His Reward

Posted by: | CommentsBefore he bet big on Donald J. Trump last spring, Duke Buchan III was a mostly anonymous figure on Wall Street.

He was financially successful and played polo, but unlike many of the large donors that flock toward presidential candidates in an election year, he was not a billionaire or a big-name financier.

Poor investment returns forced him to shutter his hedge fund in 2011, although he did sock away enough to maintain three residences — a sprawling horse farm in upstate New York, a home in Palm Beach and an apartment on Fifth Avenue in Manhattan…

Cleveland’s Key Center Sells for $268M

Posted by: | CommentsCleveland—The 1.3 million-square-foot Key Center, which includes the tallest building in Ohio, has changed hands for $267.5 million, going from ownership by Columbia Property Trust, a national office REIT, to The Millennia Cos., a Cleveland-based multifamily property development and management firm.

Top Japan Hedge Fund Says Trump Rally Will Fade

Posted by: | Comments-

Rally has 2-3 months to run before market turns, Shimoda says

-

Tokai Tokyo also seeking to profit from Trump volatility

Tsukasa Shimoda, whose UMJ Galleyla Fund beat all other Japan-focused hedge funds last year, says the Donald Trump rally will soon fade as the U.S. president’s protectionist policies start to hurt the global economy.

“The U.S. economy perhaps may improve because of him,” said Shimoda, whose $42 million UMJ fund returned 19 percent last year. “But as he makes a mess of things, that would affect the global economy negatively.”…

TCC Closes Sale of Denver Industrial Asset

Posted by: | Comments

Denver—Trammell Crow Co. recently announced the sale of a 52,566-square-foot industrial building at Crossroads Commerce Park in Denver to Sierra Pacific Industries.

“We are so pleased to welcome Sierra Pacific as a new owner at Crossroads … They are a best-in-class addition to our park. Adams County is so supportive of new businesses and was instrumental in helping us deliver the building on schedule,” Ann Sperling, senior director with TCC’s Denver office, said in a statement.

Blackstone’s Invitation Homes Raises $1.5B in IPO

Posted by: | CommentsDallas—The initial public offering by Invitation Homes Inc. was priced at $20.00 per share for the 77 million shares being offered, the company announced Tuesday, giving the offering a total value of more than $1.5 billion.

And in an auspicious sign, on Wednesday morning, the first time that INVH stock traded on the NYSE, the share price opened at $20.10, according to The Wall Street Journal.

Hedgeye Short Seller Knocks $660 Million Off Macquarie Infrastructure

Posted by: | Comments-

Kevin Kaiser of Hedgeye sent Macquarie Infrastructure down 10%

-

Analyst has previously recommended successful energy shorts

You don’t want to be on the wrong end of a short call by Kevin Kaiser of Hedgeye Risk Management.

Macquarie Infrastructure Corp. is feeling Kaiser’s wrath after he recommended shorting it, sending shares of the the energy and transportation infrastructure conglomerate plunging almost 10 percent over two days, erasing $660 million in market value. Macquarie Infrastructure’s shares, which closed at $82.84 the day before his comments, should actually be worth $40 to $50, implying downside of as much as 52 percent, according to Kaiser. He plans to release his full report and host a conference call Friday…

Famously Cocksure Local Hedge Fund Manager Gives Reticence A Shot

Posted by: | Comments Over the last couple of years, Bill Ackman has learned a few things. Done a bit of soul-searching. And in desperate need of a change in luck, he’s decided to change a few things, like the view from his window. Oh, and the part where he puts out a press release and calls CNBC every time he makes a new investment.

Over the last couple of years, Bill Ackman has learned a few things. Done a bit of soul-searching. And in desperate need of a change in luck, he’s decided to change a few things, like the view from his window. Oh, and the part where he puts out a press release and calls CNBC every time he makes a new investment.

Ackman’s $10.9 billion hedge fund Pershing Square Capital Management made two bets in recent months where the firm committed more than 10 percent of its capital, but it has not revealed the names of those investments.

City centers from Los Angeles to Miami to Seattle have all seen a massive revitalization thanks to hipster loving Millennials that enjoy good restaurants and access to nightlife versus the white picket fence McMansion propaganda brought on by the baby boomer generation. Zero lot condos and homes make up the new housing demographic where builders try to max out every square inch of their buildable land so they can pack new buyers in like sardines and you can hear your neighbor’s sleep apnea roaring at 3am. This is the modern day dream. Being able to waste your entire paycheck at Whole Foods and eating organic falafel at your new trendy restaurant. But Millennials are choosing to go their own way. For one reason, many can’t afford to buy an overpriced particle board crap shack so they ended up staying at home living with their parents deep into their late 20s and 30s. Many are also addicted to housing lust shows where reality star wannabes flip or flop on big real estate purchases. A modern day Lifestyles of the Rich and Famous. Yet most are not famous and many are certainly not rich. Ideals have simply changed and the market has transformed for Millennials…

CBL Snags 7 Sears Outposts for Redevelopment

Posted by: | Comments

Chattanooga, Tenn.—CBL & Associates Properties Inc. takes a big step forward in its redevelopment program with the acquisition of seven Sears retail locations at CBL malls in the South and Midwest. The company purchased five department stores totaling 900,000 square feet and two Sears Auto Centers from the retail giant in a sale-leaseback transaction valued at an aggregate $72.5 million.

Government Persecuting Florida Hedge Fund Fraudster Again

Posted by: | CommentsA few years ago, a young man from northeastern Pennsylvania had some ideas, specifically money-making ideas. And so at the tender age of 24, he moved to the world’s financial hub—Tampa, Fla.—to launch a little hedge fund called TASK Capital Partners, which he then marketed to the financially savvy residents of that state and of neighboring Alabama. To get their attention, Anthony J. Klatch II may have fudged a few things in the prospectus, although he did not do so with any criminal intent. Nor, presumably, did he lose 60% of investor money with any criminal intent, nor did $180,000 of their money wind up in his bank account with criminal intent. Alas, the Stormtroopers over at the FBI and U.S. Attorney’s Office for the Southern District of Alabama weren’t interested in Klatch’s totally innocent motives for defrauding investors of $2.3 million, insisting he plead guilty to a variety of things and then cruelly sending him to jail, where he witnessed the casual violation of human rights on a daily basis, which he then committed to paper in a self-published novel not-so-loosely based upon his own travails…

In the last housing mania, people drank multiple rounds of the Kool-Aid and lost all perspective. That is to be expected when we live in the land of Hollywood and living in a world of make believe is pretty much par for the course. In fact, faking it until you make it is now a legitimate way to make a living. Doctored up photos with so many filters you would think you are purifying water to drink out of the L.A. River. SoCal is the land of rental Armageddon and delusional Taco Tuesday baby boomers who run around with their ugly looking dogs in “baby” strollers and think their crap shacks are worth one million dollars. So in the last mania, areas that were legitimately tough somehow carried ridiculous price tags. The pitch was that an area was going to gentrify because “no more land is being made!” or that it was in the county. We are now seeing some outrageous prices in areas that still have legitimate struggles. Today we go back to Compton…

Seattle Office Development Commands $269M

Posted by: | CommentsSeattle—A joint venture between RFR Holding and Tristar Capital has acquired Urban Union, a newly developed 290,647-square-foot, Class A office building in Seattle from Schnitzer West for $268.9 million.

Kevin Shannon, Ken White and Michael Moll of NGKF Capital Markets represented the seller in the transaction. The sale price represented the largest price per square foot ever paid for an office property in the Seattle region.

SoFi to Acquire Zenbanx, Allowing It to Be More Like a Bank

Posted by: | Comments Mike Cagney, co-founder and chief executive of Social Finance, the online lending company known as SoFi. A new acquisition will expand the company’s line of services. CreditDavid Paul Morris/Bloomberg

Mike Cagney, co-founder and chief executive of Social Finance, the online lending company known as SoFi. A new acquisition will expand the company’s line of services. CreditDavid Paul Morris/Bloomberg

SAN FRANCISCO — The financial start-up SoFi is getting closer to its ambition of being able to replace your bank.

SoFi, or Social Finance as it is officially known, announced Tuesday that it was acquiring a company, Zenbanx, allowing SoFi to offer checking accounts, credit cards and international money transfers to its customers.

Atlanta Retail Center Welcomes Sephora

Posted by: | Comments

Atlanta—Charlotte-based real estate investment management company FCA Partners has announced the latest tenant to join The Exchange, a shopping center located in Atlanta’s Buckhead district. Sephora, a French chain of cosmetic stores, will occupy the 4,800-square-foot corner unit adjacent to YEAH! Burger. Sephora’s existing store at Lenox Square Mall will remain open and the new location is expected to open early this summer.

TH Real Estate Acquires Town Square Las Vegas

Posted by: | CommentsLas Vegas—TH Real Estate has expanded its retail holdings in Las Vegas with the acquisition of an 85 percent share in Town Square Las Vegas, a 1.1 million-square-foot lifestyle center, along with minority stakeholder Fairbourne Partners.

The price of the transaction for the 100-acre Class A retail center with 26 buildings was not disclosed.

Wells Fargo Scandal Blocks Severance Pay for Laid-Off Workers

Posted by: | Comments Wells Fargo Bank headquarters in San Francisco. Ruled intended to limit golden parachutes instead are restricting payments to fired bank employees. CreditMax Whittaker for The New York Times

Wells Fargo Bank headquarters in San Francisco. Ruled intended to limit golden parachutes instead are restricting payments to fired bank employees. CreditMax Whittaker for The New York Times

For more than 400 employees recently laid off by Wells Fargo, the aftermath of the bank’s scandal over sham accounts has had an unexpected consequence: The bank is prohibited from paying the severance it owes them.

In mid-November, Wells Fargo’s federal regulator, the Office of the Comptroller of the Currency, imposed additional restrictions on the troubled bank. The rules, part of which are intended to curb golden parachute packages, limit what payments Wells Fargo is permitted to make to terminated employees without explicit regulatory approval…

JV to Build 750 KSF Office/Warehouse Park in South Florida

Posted by: | Comments South Florida Distribution Center rendering

South Florida Distribution Center rendering

Pembroke Pines, Fla.—Core5 Industrial Partners and Helms Development have announced the acquisition of a 60-acre parcel at 20421 Sheridan St. in Pembroke Pines, Fla. This acquisition marks Core5’s entry into Florida and will be the first project for the newly-formed Helms Development. CBRE’s team of Larry Dinner, Larry Genet and Tom O’Loughlin will handle leasing.

U.K. House-Price Growth Will Slow This Year, Nationwide Says

Posted by: | Comments-

Annual rate of increase slipped back to 4.3% in January

-

Slower jobs growth, faster inflation may weigh on demand

U.K. house-price inflation cooled to the least in more than a year in January, according to Nationwide Building Society, which warned of a slowdown this year as pressure on consumers’ pockets intensifies.

The annual rate of growth eased to 4.3 percent — the weakest since November 2015 — from 4.5 percent in December. On a monthly basis, values edged up 0.2 percent to an average 205,240 pounds ($258,000)…

U.K. House-Price Growth Will Slow This Year, Nationwide Says

Healthy Payout Possible for Carlyle From Nature’s Bounty

Posted by: | CommentsNutritional supplements are having a healthy effect on Carlyle. The buyout firm may be ready to part with Nature’s Bounty. At the $6 billion price tag reported by Bloomberg, it would deliver a substantial return for what was a pivotal deal in 2010.

At the time, it was Carlyle’s biggest leveraged buyout in years. The firm, led by David Rubenstein, had been presciently cautious starting in 2007, and NBTY, as the vitamin seller was known then, was its first sizable acquisition since the financial crisis. It also was not obvious how to wring a better return out of the company, given its financial performance. Carlyle said only that it wanted to “drive continued growth.”…

Financing Still Strong for Quality Retail Projects

Posted by: | Comments Jeff Garrison, Partner & Developer at S.J. Collins Enterprises

Jeff Garrison, Partner & Developer at S.J. Collins EnterprisesNetanyahu to Build New West Bank Settlement to House Evacuees

Posted by: | Comments-

Israeli leader announces move as police clear illegal outpost

-

First brand-new settlement in 25 years; Knesset to vote Feb. 6

Israeli Prime Minister Benjamin Netanyahu, center, chairs the weekly cabinet meeting in Jerusalem on Jan. 29.

Photographer: ABIR SULTAN/AFP via Getty Images

Prime Minister Benjamin Netanyahu said he would build Israel’s first new settlement in a quarter-century, after thousands of security officers forcibly removed residents from an unauthorized West Bank outpost.

Republicans’ Paths to Unraveling the Dodd-Frank Act

Posted by: | CommentsPresident Trump took aim at financial regulations and other federal rules on Monday, signing an executive order to trim back the federal regulatory thicket and promising to do “a big number” on Obama-era Wall Street restrictions.

At the same time, congressional Republicans opened their own front against the Dodd-Frank Act, the law that overhauled financial regulation after the 2008 financial crisis. And with Mr. Trump in the White House, Republicans who previously challenged Dodd-Frank now see success in their sights after years of futility…

HFF Secures $57M for Dallas Office Building

Posted by: | Comments 3201 Dallas Parkway

3201 Dallas Parkway

Dallas—HFF has announced its arrangement of $57.3 million in financing for the development of 3201 Dallas Parkway, a Class A office building that will be located within the HALL Park in Frisco, Texas. The new property is slated to come online in December of this year.

The new property will be the 17th building to be developed on the 162-acre, award-winning HALL Park. The campus encompasses roughly 2.5 million rentable square feet and is currently 95 percent leased. Amenities include a 100,000-square-foot, on-site fitness center, state-of-the-art conference center, full-service bank, retail center and on-site child care…

Home Prices in 20 U.S. Cities Rose at Faster Pace in November

Posted by: | CommentsHome-price gains in 20 U.S. cities accelerated for a fourth month in November when compared with a year earlier, according to S&P CoreLogic Case-Shiller data released Tuesday.

Key Points

- 20-city property values index increased 5.3 percent from November 2015 (forecast was 5 percent) after climbing 5.1 percent in the year through October

- National home-price gauge rose 5.6 percent from 12 months earlier

- On a monthly basis, the seasonally adjusted 20-city measure was up 0.9 percent from October…

Home Prices in 20 U.S. Cities Rose at Faster Pace in November

Dawn Fitzpatrick to Lead Investing at George Soros’s Investment Firm

Posted by: | Comments Dawn Fitzpatrick is currently a senior executive at the asset-management arm of the Swiss banking giant UBS. CreditAndrea Mohin/The New York Times

Dawn Fitzpatrick is currently a senior executive at the asset-management arm of the Swiss banking giant UBS. CreditAndrea Mohin/The New York Times

One of Wall Street’s biggest hedge fund names, Soros Fund Management, will soon have a woman at its investing helm.

Dawn Fitzpatrick, currently a senior executive at the asset-management arm of the Swiss banking giant UBS, has accepted the job of chief investment officer at Soros. The exact timing of her arrival is not yet clear.

A spokesman for Soros Fund Management confirmed the move but declined to comment further. An assistant to Ms. Fitzpatrick declined to comment when reached by phone…

Mesa West Funds $64M in California

Posted by: | Comments Rossmoor Shopping Center in Walnut Creek, Calif.

Rossmoor Shopping Center in Walnut Creek, Calif.

Los Angeles—Mesa West Capital has originated $63.8 million in short-term first mortgage debt in two separate financings secured by assets in the California cities of Walnut Creek and San Diego, the company announced Friday. Each property was financed with a five-year, non-recourse, floating-rate loan, originated in each case by Mesa West Principal Steve Fried and Associate Seth Hall.

Central Banker Behind Israel Intervention Plan Turns Against It

Posted by: | Comments-

Barry Topf says FX purchase program should be wound down

-

Bank of Israel argues global easing means it must still act

The man who helped design the Bank of Israel’s foreign-currency intervention program with then-Governor Stanley Fischer is now turning against it.

Barry Topf, former director of market operations, says the purchases that initially helped Israel weather the global financial crisis may now be hurting the economy by distorting prices. It’s time for the central bank, which has tripled its reserves in less than a decade, to scale back the program significantly, he said…

Capital Square 1031 Lands NC Medical Building

Posted by: | Comments Louis Rogers, founder & CEO of Capital Square 1031

Louis Rogers, founder & CEO of Capital Square 1031

Raleigh, N.C.—Capital Square 1031 recently announced that it has acquired a newly built, 8,200-square-foot medical office building in the Raleigh suburb of Louisburg, N.C. At the time of purchase, the property was 100 percent leased to an affiliate of Fresenius Medical Care, a provider of dialysis products and services. The asset was purchased on an all-cash basis as part of a Delaware statutory trust program.

Childress Klein, MidCity Plan Atlanta Office Park

Posted by: | Comments One NorthPlace in Atlanta, rendering

One NorthPlace in Atlanta, rendering

Atlanta—Childress Klein and MidCity Real Estate Partners recently snapped up the NorthPlace project development site in Atlanta’s Central Perimeter submarket, paving the way for an office park featuring as much as 370,000 square feet. It’s a case of déjà vu for MidCity, which, in 2015, joined forces with Crocker Partners on the same project.

No one’s talking dollar signs pertaining to the transaction with the seller, who was, according to Fulton County records, CP NorthPlace LLC, an entity controlled by Crocker Partners…

Stock Investors Are Finally Starting to Buy Hedges Again

Posted by: | Comments-

CBOE put-call ratio spikes to highest since before election

-

VIX skew near lowest in 10 months, signaling gauge to climb

With the U.S. equity market waking from its slumber, investors are finally taking the hint to hedge their post-election gains.

The CBOE Volatility Index is coming off its biggest one-day rise since Nov. 3 and a separate measure of bearish bets relative to bullish ones has surged to the highest since President Donald Trump’s victory, according to Bloomberg data. It’s a departure from the tranquility in U.S. equities during the weeks following the election, a period in which the VIX fell to a 2 1/2-year low…

Torrance Office Asset Changes Hands in $17M Deal

Posted by: | CommentsIllinois Science & Tech Campus Commands $77M

Posted by: | Comments Illinois Science & Technology Park in Skokie, Ill.

Illinois Science & Technology Park in Skokie, Ill.

Chicago—An affiliate of American Landmark Properties has acquired the Illinois Science & Technology Park, a bioscience, pharmaceutical and nanotechnology office campus in Skokie, Ill., from Forest City Realty Trust Inc., for $77 million.

“We’re pleased to complete this sale, which continues the execution of our strategy to focus our portfolio on our major core markets,” David LaRue, Forest City’s president & CEO, said in a prepared release.

Fund That Beat 90% of Its Peers Is Now Betting on Greek Banks

Posted by: | Comments-

East Capital invested in Alpha Bank, Eurobank Ergasias

-

Says Russia is most straight-forward investment case

Betting on banks in Greece may not be your average mutual fund’s main investment idea.

But for East Capital, which in 2016 delivered a 36 percent return and beat 90 percent of its peers, increasing exposure to the euro zone’s most beaten up economy is precisely the right thing to do.

Bank of America Richmond Operation Center Sells for $38M

Posted by: | Comments Bank of America Operations Center

Bank of America Operations Center

The property was acquired by New York-based Longships Capital, part of a partnership with Homeward Angel and Prudent Richmond. The sale was completed by Eric Robinson, senior vice presient with Cushman & Wakefield | Thalhimer’s Capital Markets Group, Scott Stein, vice chairman of the company’s data center advisory of San Jose, Rick Ingwers, vice chairman of Walnut Creek’s company office, and Brad Rogers, executive director.

Why Single Women Are Buying Homes at Twice the Rate of Single Men

Posted by: | CommentsSkip the spouse, buy the house: Single women account for 17 percent of homebuyers in the U.S., vs. 7 percent of single men.

By 2007, Michelle Jackson, a 30-something writer in Denver, held a master’s degree, had traveled the world, and was enjoying her social life as a single woman. She also felt the pull to purchase her own home, a rite of passage she thought was reserved for the coupled.

Brazil Government Deal With Rio Won’t Solve Its Debt Crisis

Posted by: | Comments-

Agreement hailed as model based on inflated growth estimates

-

Finance ministry says deal was based on reasonable projections

Demonstrators hold flags during a protest in front of the Legislative Palace in Rio de Janeiro, on Dec. 12, 2016.

Photographer: Dado Galdieri/Bloomberg

Brazilian politicians inflated growth estimates to facilitate an agreement between the federal government and Rio de Janeiro to resolve the state’s financial crisis, raising doubts over the viability of the deal.

Court Orders Justice Dept. to Release Fannie Mae and Freddie Mac Documents

Posted by: | Comments The Freddie Mac headquarters in McLean, Va. In August 2012, just as Freddie Mac and Fannie Mae were turning around, the government diverted the companies’ profits to the Treasury. CreditAndrew Harrer/Bloomberg

The Freddie Mac headquarters in McLean, Va. In August 2012, just as Freddie Mac and Fannie Mae were turning around, the government diverted the companies’ profits to the Treasury. CreditAndrew Harrer/Bloomberg

Casting a ray of sunlight on a case that has been shrouded in secrecy, a federal appeals court ruled on Monday that the government must produce a raft of documents to plaintiffs suing over its decision to seize all the profits of Fannie Mae and Freddie Mac, the mortgage finance giants that were put into conservatorship in September 2008, at the depths of the financial crisis.

Deutsche Bank Fined in Plan to Help Russians Launder $10 Billion

Posted by: | Comments The Russian headquarters of Deutsche Bank. CreditSergei Karpukhin/Reuters

The Russian headquarters of Deutsche Bank. CreditSergei Karpukhin/Reuters

Deutsche Bank agreed on Monday to pay a $425 million fine to New York State’s main financial regulator to settle charges that it helped Russian investors launder as much as $10 billion through its branches in Moscow, London and New York.

The punishment represents the latest regulatory black eye for Deutsche Bank, Germany’s largest. In the last decade, it has been implicated in several financial scandals, including pushing toxic mortgages on investors and manipulating London’s main lending rate for its own financial gain…

Deutsche Bank Fined in Plan to Help Russians Launder $10 Billion