Archive for Uncategorized

Doubts Arise as Investors Flock to Crowdfunded Start-Ups

Posted by: | Comments Ryan Feit set up one of the first websites that list companies trying to raise money from small investors. “Investing in start-ups is really risky, and it’s very different than buying a used couch,’’ he said. “We definitely do not think you should treat it like Craigslist.” CreditSasha Maslov for The New York Times

Ryan Feit set up one of the first websites that list companies trying to raise money from small investors. “Investing in start-ups is really risky, and it’s very different than buying a used couch,’’ he said. “We definitely do not think you should treat it like Craigslist.” CreditSasha Maslov for The New York Times

SAN FRANCISCO — Ryan Feit left behind his lucrative career at a private equity firm to chase the dream of crowdfunding.

Salesforce Hub Debuts in Hot Downtown Bellevue

Posted by: | Comments Nine Two Nine Office Tower in downtown Bellevue, Wash. (Image courtesy of Salesforce)

Nine Two Nine Office Tower in downtown Bellevue, Wash. (Image courtesy of Salesforce)

Bellevue, Wash.—Salesforce has opened its latest office, one of its largest engineering and innovation hubs, in the Nine Two Nine Office Tower in Bellevue, Wash. The customer relationship management company says it will be doubling its workforce in Bellevue to nearly 500 in the coming months.

LaSalle Buys West Loop Tower

Posted by: | CommentsLocated at 123 N. Wacker Drive, the Class A office building reportedly fetched $147 million.

123 N. Wacker Drive, recently acquired by LaSalle Investment Management

123 N. Wacker Drive, recently acquired by LaSalle Investment Management

LaSalle Investment Management has acquired 123 North Wacker Drive, a 30-story Class A office tower located in Chicago’s West Loop, on behalf of the company’s closed-end, U.S. value-add fund, LaSalle Income & Growth Fund VII, from LNR Partners. The price was reported as $147 million, according to published reports.

JLL Capital Markets provided brokerage services on behalf of the seller, a special servicer that in May took control of the tower, which had been in foreclosure…

Milestone Investors Push Back on $1.3 Billion Starwood Deal

Posted by: | Comments-

Manulife, AGF portfolio managers unhappy with bid for landlord

-

Agreement needs two-thirds shareholder approval to go through

Shareholders representing at least 5.6 percent of Milestone Apartments Real Estate Investment Trust said a $1.3 billion takeover deal by Starwood Capital Group is too low.

Starwood agreed to pay $16.15 a share for the owner of U.S. rental properties, Milestone announced Jan. 19. The investment firm, controlled by Barry Sternlicht, needs to raise that bid by at least 11 percent to $18 a share, said Steve Belisle, senior portfolio manager at Manulife Asset Management. Portfolio manager Peter Imhof at AGF Management Ltd. wants to either hold onto the stock or see Starwood increase its bid by at least 5 percent…

How Deutsche Bank Made a $462 Million Loss Disappear

Posted by: | CommentsA dubious trade leads to a criminal trial for Europe’s most important bank.

On Dec. 1, 2008, most of the world’s banks were still panicking through the financial crisis. Lehman Brothers had collapsed. Merrill Lynch had been sold. Citigroup and others had required multibillion-dollar bailouts to survive. But not every institution appeared to be in free fall. That afternoon, at the London outpost of Deutsche Bank, the stolid-seeming, €2 trillion German powerhouse, a group of financiers met to consider a proposal from a team led by a trim, 40-year-old banker named Michele Faissola…

BTIG Outlook: REITs in the Woods?

Posted by: | Comments James Sullivan

James SullivanRemember ABX? Wall Street Said to Test New Mortgage Index

Posted by: | Comments-

Unlike subprime era, underlying mortgages are high-quality

-

An index could help GSE reform by enlarging market for bonds

A bond-market startup is a step closer to reviving crisis-era derivatives that let investors bet on U.S. homeowner defaults.

JPMorgan Chase & Co., Bank of America Corp. and Credit Suisse Group AG have given price data to the startup, New York-based Vista Capital Advisors, which rolled out the latest version of its pilot initiative this month, according to a person with knowledge of the matter. Vista has been working on the project for the past few years with Intercontinental Exchange Inc. The firm plans to use that data to create indexes of mortgage securities, which in turn would become the basis for the derivatives, said the person, who asked not to be identified because the matter is private…

CIMB in Talks to Sell $200 Million Stake in Brokerage Arm

Posted by: | Comments-

Malaysian lender discusses deal terms with Galaxy Securities

-

Chinese brokerage could reach agreement by end of March

CIMB Group Holdings Bhd., Malaysia’s second-biggest lender, is in talks to sell a stake in its brokerage business to China Galaxy Securities Co. for about $200 million, people with knowledge of the matter said.

CIMB is in negotiations to sell a minority stake in its Malaysian securities unit and as much as 50 percent of its overseas brokerage business to Galaxy Securities, according to the people. The Kuala Lumpur-based bank aims to reach a deal by the end of March, the people said, asking not to be identified as the information is private…

Toronto’s Home-Price Gains Are Rippling Toward Niagara Falls

Posted by: | CommentsToronto’s housing boom is fueling price gains in markets as far away as the Niagara region, better known for its waterfall and wine.

Towns including St. Catharines, more than 100 kilometers (62 miles) south of Toronto, and Barrie, about 100 kilometers north, are showing a “stronger price growth relationship” to the country’s largest city, Canada Mortgage & Housing Corp. said Tuesday. The agency used high, medium and low correlation labels in analyzing the effect of Toronto’s boom on surrounding markets…

Toronto’s Home-Price Gains Are Rippling Toward Niagara Falls

China Raises Mid-Term Lending Rates in New Signal of Tightening

Posted by: | Comments-

Central bank boosted rates on 1-year, 6-month loan facilities

-

Shift comes amid recovering prices and bid to rein in risk

China increased interest rates on the medium-term loans it uses to manage liquidity, the strongest signal yet of tightening as it shifts focus to curbing risk in the financial system.

The People’s Bank of China raised the one-year Medium-term Lending Facility rate to 3.1 percent from 3 percent and the six-month rate to 2.95 percent from 2.85 percent, it said Tuesday in a statement on its Weibo social media account. The rates are becoming one of the main policy tools as the central bank moves away from old benchmarks…

A $90 Billion Debt Wave Shows Cracks in U.S. Property Boom

Posted by: | Comments-

Commercial mortgages from 2007 are set to mature this year

-

Borrowers face higher interest rates, refinancing challenges

A $90 billion wave of maturing commercial mortgages, leftover debt from the 2007 lending boom, is laying bare the weak links in the U.S. real estate market.

It’s getting harder for landlords who rely on borrowed cash to find new loans to pay off the old ones, leading to forecasts for higher delinquencies. Lenders have gotten choosier about which buildings they’ll fund, concerned about overheated prices for properties from hotels to shopping malls, and record values for office buildings in cities such as New York. Rising interest rates and regulatory constraints for banks also are increasing the odds that borrowers will come up short when it’s time to refinance…

Singapore Wealth Fund Buys Wall Street Tower

Posted by: | CommentsGIC Pte, Singapore’s sovereign wealth fund, bought a 95 percent stake in 60 Wall St., a 47-story tower in lower Manhattan that serves as the U.S. headquarters of Deutsche Bank AG.

The deal values the 1.6 million-square-foot (148,600-square-meter) skyscraper at $1.04 billion, or about $640 a square foot, GIC and seller Paramount Group Inc. said in a joint statement. Paramount, a New York-based real estate investment trust, will retain a 5 percent stake and continue to manage the property. In connection with the deal, the joint venture completed a $575 million financing of the tower…

A $7 Billion Bet on the U.S. Could Lift Taiwan’s Foxconn

Posted by: | Comments Terry Gou, the founder of Foxconn, on a screen at a conference last year. On Sunday, he detailed plans to build a $7 billion display-making plant in the United States. CreditAly Song/Reuters

Terry Gou, the founder of Foxconn, on a screen at a conference last year. On Sunday, he detailed plans to build a $7 billion display-making plant in the United States. CreditAly Song/Reuters

Foxconn’s $7 billion bet on the United States goes beyond politics. Building a huge TV screen factory in America would fit neatly with President Trump’s push to create domestic jobs. Grabbing a share of the American market could also help the Taiwanese iPhone maker revive Sharp, its recently acquired subsidiary.

SF Office Towers Land $975M Refi

Posted by: | CommentsThe buildings are part of One Market Plaza, a 1.6 million-square-foot Class A office-and-retail development in the South Financial District.

One Market Plaza, San Francisco

One Market Plaza, San Francisco

San Francisco—Paramount Group, Inc., has completed a $975 million refinancing of One Market Plaza, a 1.6-million-square-foot Class A office and retail development, located in the South Financial District of San Francisco.

Eastdil Secured LLC arranged the financing for the property, with a loan provided by Goldman Sachs Mortgage Co., Morgan Stanley Bank N.A., Deutsche Bank AG, New York Branch and Barclays Bank PLC. The new seven-year interest-only loan matures in January 2024 and has a fixed rate of 4.03 percent…

Hedge Funds Risk Treasuries Wipeout After Bearish Bets Soar

Posted by: | Comments-

Leveraged funds boosted short positions to record this month

-

JPMorgan says ‘real money’ should buy after backup in yields

There’s a big showdown looming in the U.S. Treasury market.

The “fast money,” made up of hedge funds and other speculators, upped its bearish bets like never before this month, based on futures data for five-year notes. At the same time, “real-money” accounts, composed of institutional buyers like mutual funds and insurers, did the opposite and built up their bullish positions in much the same way…

Judge Blocks Aetna’s $37 Billion Deal for Humana

Posted by: | Comments A federal judge ruled on Monday that a $37 billion merger between the health insurance giants Aetna and Humana should not be allowed to go through on antitrust grounds, siding with the Justice Department, which had been seeking to block the deal.

A federal judge ruled on Monday that a $37 billion merger between the health insurance giants Aetna and Humana should not be allowed to go through on antitrust grounds, siding with the Justice Department, which had been seeking to block the deal.

The deal is one of two mega-mergers proposed by the nation’s largest health insurers; both were challenged by the Obama administration. Another federal judge is expected to rule soon on the case involving Anthem and Cigna, the larger of the two deals, at $48 billion…

Construction Kicks Off on Billion-Dollar Boston M-U

Posted by: | Comments Bulfinch Crossing, Office High-Rise

Bulfinch Crossing, Office High-Rise

Boston—Construction has gotten underway on Bulfinch Crossing, a 2.9 million-square-foot mixed-use project in Boston. Developers National Real Estate Advisors LLC and The HYM Investment Group LLC have joined local leaders to celebrate the commencement of the $1.5 billion undertaking, which will be credited with ushering in a new era in Beantown.

Forest City Sells Bronx Retail Center for $32M

Posted by: | Comments The Shops at Bruckner Boulevard in New York

The Shops at Bruckner Boulevard in New York

New York—Forest City Realty Trust Inc. recently announced that is has sold the Shops at Bruckner Boulevard, also known as Bruckner Plaza, a 116,000-square-foot specialty retail center in the Bronx. Urban Edge Properties acquired the property for $32 million and the transaction is expected to generate net proceeds to Forest City of $9.2 million. Forest City owned the property in a 51/49 percent joint venture with Madison International Realty LLC.

RioCan CEO Plots 2017 Toronto Projects as Home Demand Spikes

Posted by: | Comments-

CEO Sonshine eyeing 50+ sites across Canada for redevelopment

-

Each project expected to cost at least C$150 million

The head of Canada’s largest real estate investment trust is adding more projects to his redevelopment pipeline amid unprecedented heat in Toronto’s housing market.

Ed Sonshine, the 70-year-old chief executive officer of RioCan REIT, is in the planning stages for several large sites this year that may push the company beyond an original goal of building 10,000 residential units in the next decade. The Toronto-based company has a portfolio of about 300 malls across the country, and is seeking to redevelop stores and add housing to at least 50 of them…

China Gives ‘Hedge Fund Brother No.1’ 5 1/2 Years in Prison

Posted by: | Comments-

Xu Xiang was arrested after 2015’s stock market crash

-

Xu colluded with top executives at 13 listed companies: court

China sentenced former hedge fund manager Xu Xiang to five-and-a-half years imprisonment for market manipulation, in one of the most high-profile cases following the 2015 market rout, a court in the eastern city of Qingdao said in its official Weibo account.

Xu, known as “hedge fund brother No. 1” for his winning record in the stock market, was charged with colluding to manipulate share prices in an operation from 2010 to 2015, the court said in a statement Monday. Wang Wei, another defendant that Xu collaborated with, was sentenced to three years in jail while Zhu Yong, a third, was given two years with a three-year reprieve on the same charges…

Special Report: The 411 on NYC

Posted by: | Comments What are the takeaways from 2016 for the nation’s largest commercial real estate market—and what’s in store this year?

What are the takeaways from 2016 for the nation’s largest commercial real estate market—and what’s in store this year?

The final numbers for New York City are coming in, and CPE looks at the highlights in the first of two parts.

Office: Amid Mixed Signals, a Strong Showing

“I think what we’re seeing is pricing compression among submarkets, asset classes, even buildings within certain submarkets.” So said Richard Bernstein, executive vice chairman of office brokerage at Cushman & Wakefield, during a panel discussion held by the firm in Midtown Manhattan last week…

Wells Fargo Levied Fees on Mortgages It Delayed, ProPublica Says

Posted by: | Comments-

Practice broke bank’s policies, ex-employees tell publication

-

‘We are reviewing these questions,’ company says in statement

Wells Fargo & Co. charged some homebuyers fees to extend promised interest rates when the bank failed to process their mortgage applications on time, ProPublica reported, citing four former employees from the Los Angeles area.

The practice, apparently limited to that region, broke with the company’s policy of eating the fees when it was at fault for delays, the publication said. They typically amount to about $1,000 to $1,500 if deadlines are missed and interest rates have increased, it said…

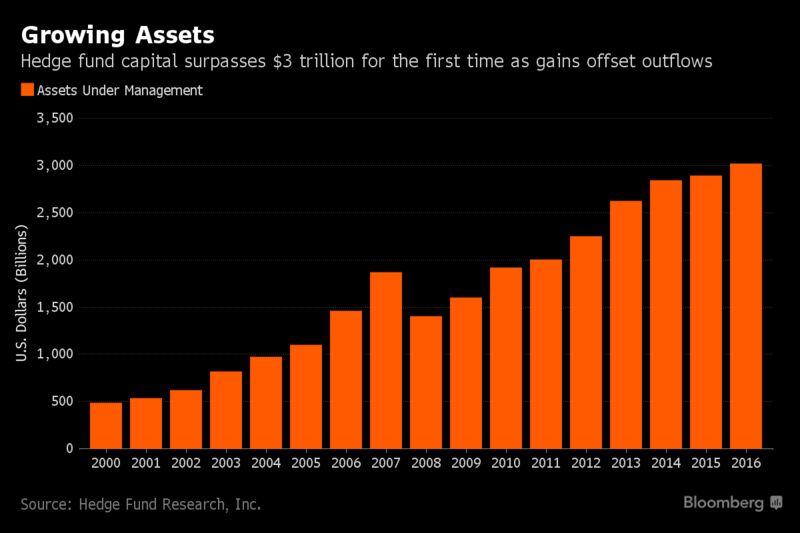

Hedge Fund Assets Pass $3 Trillion in 2016 for First Time: Chart

Posted by: | Comments The hedge fund industry ended 2016 with $3.02 trillion in global assets under management, surpassing the $3 trillion mark for the first time as performance gains offset net withdrawals, according to data released by Hedge Fund Research Inc. on Friday. The industry, which saw about $70 billion in outflows last year, had about $2.9 trillion in assets in 2015…

The hedge fund industry ended 2016 with $3.02 trillion in global assets under management, surpassing the $3 trillion mark for the first time as performance gains offset net withdrawals, according to data released by Hedge Fund Research Inc. on Friday. The industry, which saw about $70 billion in outflows last year, had about $2.9 trillion in assets in 2015…

Hedge Fund Assets Pass $3 Trillion in 2016 for First Time: Chart

Iconic Pruneyard Center Slated for Renovation

Posted by: | Comments The Pruneyard Place in Campbell, Calif.

The Pruneyard Place in Campbell, Calif.SEC Reviews Bond Trades by Hedge Funds, Devaney’s Firm

Posted by: | Comments-

Devaney says unaware of any such review, firm follows all laws

-

Investigators said to look at pricing in trades of securities

U.S. securities regulators are reviewing a series of trades involving hedge funds and a Florida mortgage-bond dealer to see if they may have inflated prices for illiquid securities, according to people with knowledge of the matter.

Jump of 930% Baffles Danish Property Firm With Near-Zero Equity

Posted by: | Comments-

Victoria Properties, a Danish penny stock, top gainer of 2017

-

Management sends statement reminding market it has no equity

A small Danish property company started 2017 as the biggest winner on the Copenhagen stock market, surging as much as 930 percent since the end of last year. But there’s a problem: Management has no idea why and is trying to talk sense to investors.

Victoria Properties A/S, which had focused on German real estate, on Monday had to remind the market that its equity is gone, responding to a jump in its share price as big as 195 percent in early trading…

Time Is Not on Your Side When It Comes to Credit Debt

Posted by: | CommentsTHE decorations have been put away, and mailboxes are now filling with credit card bills instead of holiday cards.

If you binged on gifts and entertainment in December and your card balances are higher than you were expecting, it’s important to make a plan to pay down the debt as quickly as possible, credit experts say.

“Don’t put those bills aside, thinking they’ll look better if you come back to them later,” said Bruce McClary, spokesman for the National Foundation for Credit Counseling. When it comes to paying down high-interest card debt, he said, “time is not your friend.”…

Quicken Loans, the New Mortgage Machine

Posted by: | Comments

CreditAndrew Spear for The New York Times

DETROIT — A low buzz fills the air as an army of mortgage bankers, perched below floating canopies in a kaleidoscope of vivid pinks, blues, purples and greens, works the phones, promising borrowers easy financing and low rates for home loans.

By the elevators, nobody blinks when an employee wearing a pink tutu bustles past. On any given day, a company mascot, Simon, a bespectacled mouse, goes on the hunt for “gouda,” or good ideas, from the work force…

Hines Enters Denmark with $126M Deal

Posted by: | Comments Synoptic location in Copenhagen, building part of the portfolio transaction

Synoptic location in Copenhagen, building part of the portfolio transaction

Copenhagen, Denmark—Hines and Universal-Investment have acquired five prime high-street retail assets with associated office and residential components in central Copenhagen for $126 million from Avignon Capital, on behalf of its Bayerische Versorgungskammer fund.

The transaction marks Hines’ first entry into Denmark. This deal is the seventh transaction by Hines for the $1.4 billion investment BVK mandate, which is targeting prime high-street retail assets across Europe…

London Home Presales Slump to Four-Year Low as Supply Jumps

Posted by: | Comments-

Number of unsold units under construction hits record high

-

Sales fell 22 percent in 2016 on sales tax, Brexit vote

Sales of London homes under construction last year dropped to the lowest level since 2012, leaving developers with a record number of unsold properties.

Purchases of homes currently being built fell 22 percent to 20,695 from a year earlier, according to a report by Molior London seen by Bloomberg. The number of unsold properties that are under construction surged 14 percent to 25,139 units in the period, the highest since the researcher began collating data in 2009, the report shows. A spokesman for Molior declined to comment…

News Corp., 21st Century Fox Renew NYC Leases

Posted by: | Comments 1211 Ave. of the Americas

1211 Ave. of the Americas

New York—Ivanhoe Cambridge and its partner, Callahan Capital Properties, announced 21st Century Fox and News Corp. have both renewed leases at 1211 Ave. of the Americas in Midtown Manhattan. Totaling more than 1.2 million square feet, 21st Century Fox’s 777,000-square-foot transaction of its corporate headquarters will be extended an extra 649,000 square feet effective December 2020, while a 128,000-square-foot expansion into three upper floors of the building goes into effect January 2017. News Corp.’s 440,000-square-foot transaction will be effective in December 2020.

Tier REIT Buys a Little, Sells a Little

Posted by: | Comments Domain 7 in Austin, Texas

Domain 7 in Austin, Texas

Dallas—With the execution of three transactions valued at an aggregate $217.7 million, Tier REIT Inc. continues to move forward with its strategic plan. The Dallas-based company just acquired its partner’s interest in two Austin office properties, and completed two office dispositions in Philadelphia and Burbank, Calif., effectively increasing its presence in one of its core markets and backing away from two locations that didn’t make its target list.

U.K. Retail-Sales Slump Hints at Cracks in Brexit Boom

Posted by: | Comments-

Sales drop 1.9% from November, far more than forecast

-

Accelerating inflation may damp consumer spending this year

A crowd of pedestrians and shoppers walk on Oxford Street, in London, U.K., on Friday, Nov. 25, 2016

Photographer: Luke MacGregor

U.K. Chancellor of the Exchequer Philip Hammond told a Davos gathering on Friday that an inflation pickup will put a damper on consumers this year. The first signs may already be appearing.

Less than an hour before Hammond spoke, data showed retail sales fell at the fastest pace in almost five years in December, recording a 1.9 percent drop that far exceeded even the most pessimistic forecasts in a Bloomberg survey…

Breathing New Life Into Californian East Hills Mall

Posted by: | Comments Preliminary site plan of the East Hills Mall in Bakersfield, Calif.

Preliminary site plan of the East Hills Mall in Bakersfield, Calif.

Bakersfield, Calif.—The new owners of East Hills Mall, C & C Properties Inc. and MarkChris Investments, recently unveiled their plans to revitalize the Bakersfield shopping center. Their concept includes transforming the enclosed property into a 350,000-square-foot open-air destination that offers a plethora of dining, shopping and entertainment options. The redevelopment project is expected to break ground in the late second quarter or early third quarter of this year and be completed in the autumn of 2018.

Rockwood Closes $1.1B Fund, Nabs Watergate Building

Posted by: | Comments Watergate Office Building in Washington, D.C.

Watergate Office Building in Washington, D.C.

New York–Rockwood Capital LLC, a private real estate investment firm, closed its latest fund with $1.1 billion in capital commitments and reportedly acquired the famous 12-story Watergate office building in Washington, D.C., as one of the fund’s first nine purchases.

Rockwood Capital Real Estate Partners Fund X LP is a value-added fund that will target office, residential, retail and hotel assets in growing and evolving urban and “suburban-core” mixed-use neighborhoods in the United States…

Angolan Banks Appeal for Bailout as Oil Slump Crimps Liquidity

Posted by: | Comments-

Banks’ body calls on government to protect account holders

-

Dollars dry up as foreign-exchange earnings from crude plunge

Angolan banks are appealing to the government to help put together a bailout package to protect account holders as lenders reel from low oil prices that make up almost all of the nation’s foreign-exchange earnings.

Financial assistance could come from the administration of President Jose Eduardo dos Santos or be shared by all of the southwest African country’s 28 operational lenders, Amilcar Silva, chairman of the Association of Angolan Banks, said in an interview in the capital, Luanda. He didn’t specify whether lenders were calling for a liquidity boost for the industry or cash injections aimed at struggling companies…

Starwood Capital Snaps Up Canadian Apartment REIT for $2.9B

Posted by: | Comments Greenwich, Conn.—Starwood Capital Group agreed to buy Canada’s Milestone Apartments Real Estate Investment Trust in a deal valued at about US $2.85 billion. Under the terms of the deal, all of Milestone’s subsidiaries and assets will be absorbed by Starwood, while Milestone unit holders will receive $16.15 per trust unit in cash.

Greenwich, Conn.—Starwood Capital Group agreed to buy Canada’s Milestone Apartments Real Estate Investment Trust in a deal valued at about US $2.85 billion. Under the terms of the deal, all of Milestone’s subsidiaries and assets will be absorbed by Starwood, while Milestone unit holders will receive $16.15 per trust unit in cash.

Milestone, formed in 2013, is an unincorporated, open-ended REIT based in Toronto. Based on current exchange rates, the offer is a premium of 9.2 percent to the price per unit at the close of the markets on Wednesday…

Mnuchin Defends Banking Past, Advocates Strong U.S. Dollar

Posted by: | Comments-

Treasury secretary nominee says IRS must run more efficiently

-

He backs Volcker Rule, existing sanctions, cutting tax fraud

Treasury Secretary nominee Steven Mnuchin said a strong dollar is important over the long term, noting that it’s currently “very, very strong,” and that avoiding U.S. default on the debt would be a top priority if he’s confirmed.

Mnuchin also defended his personal record as a founder of OneWest Bank amid the housing crisis, and pushed for tax reform as a key way to lift economic growth as promised by President-elect Donald Trump. Mnuchin’s comments at his Senate confirmation hearing on Thursday in Washington come after Trump rattled currency markets by saying the dollar was “too strong” in an interview with the Wall Street Journal…

Hong Kong Tops Survey of World’s Least Affordable Home Market

Posted by: | Comments-

Home in Hong Kong costs 18.1 times median pretax income

-

Prices hovering 2.6 percent below September 2015 record

Hong Kong retained its rank as the most expensive housing market among 406 major metropolitan regions in the annual Demographia International Housing Affordability Survey for the seventh year in a row.

The median price of a home in Hong Kong last year was 18.1 times the median annual pretax household income, the survey showed. That’s a modest improvement in affordability compared with last year’s 19 times, which was the highest multiple in the 12 years Demographia has been conducting its research…

Younan Properties Continues to Expand in Arizona

Posted by: | Comments Warner Crossing

Warner Crossing

Tempe, Ariz.—Younan Properties, an international commercial real estate investment and asset management company, recently announced the acquisition of Warner Crossing in Tempe.

The 140,000-square-foot property consists of two adjacent, single-story office buildings situated on a 15.5-acre site located at 8260 and 8312 S. Hardy Drive. It provides easy access to a variety of amenities, including restaurants, recreation and shopping, as well as Phoenix’s light rail system, Sky Harbor International Airport and numerous employees such as Honeywell Aerospace, State Farm, American Airlines and Humana…

Secretive Hedge Fund Renaissance Picks Winner in Hot Japanese Tech Stock

Posted by: | Comments-

V Tech shares surged 185% last year after successful deal

-

Company eyes revenue-doubling partnership in OLED displays

V Technology Co., a small Japanese supplier to display makers, added a surprising new shareholder last June: Renaissance Technologies.

For the secretive U.S. hedge fund started by Jim Simons, it turned out to be an especially savvy bet. Shares of V Tech, as it’s known, surged almost threefold in 2016, with much of the gain coming after Renaissance first reported a stake. V Tech, whose market value has jumped to $616 million, posted the second-best stock performance in a broad index of Tokyo-listed companies last year…

Steven Mnuchin, Treasury Nominee, Failed to Disclose $100 Million in Assets

Posted by: | CommentsWASHINGTON — Steven T. Mnuchin, President-elect Donald J. Trump’s pick to be Treasury secretary, failed to disclose nearly $100 million of his assets on Senate Finance Committee disclosure documents and forgot to mention his role as a director of an investment fund located in a tax haven, an omission that Democrats said made him unfit to serve in one of the government’s most important positions.

The revelation came hours before Mr. Mnuchin, a former Goldman Sachs banker, began testifying on Thursday before the Senate Finance Committee, which has historically been bipartisan in its demands for transparency from nominees. Mr. Mnuchin was ready to outline his vision for the economy and defend himself against claims that he headed a bank that ran a “foreclosure machine” during the financial crisis…

REIT Nabs Grocery-Anchored Greenville Center

Posted by: | Comments 11 Galleria, Greenville, N.C.

11 Galleria, Greenville, N.C.

Greenville, N.C.—Slate Retail REIT, an owner and operator of U.S. grocery-anchored real estate, recently announced its intention to buy 11 Galleria in Greenville, N.C., for $14 million, or $129 per square foot. Closing is expected to be completed in the first quarter of 2017 and remains subject to customary closing conditions. Slate Asset Management LP is the REIT’s manager.

Starwood to Buy Milestone Apartments for About $1.3 Billion

Posted by: | Comments-

Landlord has 78 properties in U.S. Southeast and Southwest

-

Offer for $16.15 a share an 8.6% premium to Wednesday’s close

Starwood Capital Group, the investment firm controlled by Barry Sternlicht, agreed to buy U.S. landlord Milestone Apartments Real Estate Investment Trust for about $1.3 billion in cash.

Starwood will pay $16.15 a share for Dallas-based Milestone, which trades on the Toronto Stock Exchange but mostly owns properties in the U.S. Southeast and Southwest. The offer is about 8.6 percent more than Wednesday’s closing share price of C$19.66 ($14.87). The deal has an enterprise value of $2.85 billion, including debt, according to a statement Thursday…

Student Loan Suit Is Bold Gambit on Eve of Trump Presidency

Posted by: | CommentsBallooning student debt has been increasingly compared to subprime mortgages. That helps explain why the Consumer Financial Protection Bureau just ripped a page out of the crisis playbook and accused the loan servicer Navient of cheating borrowers on their loans for college. Suing just 48 hours before Donald J. Trump is sworn in as the 45th American president is nevertheless a bold gambit by the same agency that nailed Wells Fargo for opening fake accounts…

Mack-Cali Sells DC-Area Office Asset

Posted by: | Comments 4200 Parliament Place, Lanham, Md.

4200 Parliament Place, Lanham, Md.

Lanham, Md.—Chesapeake Real Estate Group and Thompson Creek Window Co. recently announced the acquisition of a Class A office building in Lanham, Md., and an adjoining land parcel suitable for the development of an additional commercial building. The 122,000-square-foot asset was sold by Mack-Cali for $6.3 million. The partnership intends to design and obtain permits for the development of an additional Class A, 120,000-square-foot commercial building on the adjacent land parcel.

Mnuchin Sees an Asset in Banking Background Reviled by Democrats

Posted by: | Comments-

Treasury Secretary pick says strong dollar good over long term

-

Tax reform, IRS modernization, managing debt high on agenda

Photographer: Andrew Harrer/Bloomberg

Treasury Secretary nominee Steven Mnuchin echoed President-elect Donald Trump’s ideas for cutting taxes and seeking fairer trade in an occasionally combative Senate confirmation hearing over his banking record during the financial crisis.

Women’s March Draws ‘Duty-Bound’ From Wall Street

Posted by: | Comments Hillary Ripley, a longtime investor-relations professional, hosted a gathering on Tuesday for those planning to attend the women’s march in Washington this weekend. CreditSasha Maslov for The New York Times

Hillary Ripley, a longtime investor-relations professional, hosted a gathering on Tuesday for those planning to attend the women’s march in Washington this weekend. CreditSasha Maslov for The New York Times

Hillary Ripley was on a stair climber at her Brooklyn gym when her 16-year-old daughter texted.

A women’s march was being organized in Washington, the teenager wrote, to protest the incoming administration of President-elect Donald J. Trump and to speak up for gender equality. Ms. Ripley hopped off the machine and began searching for a bus-charter company…

Northville Five Buys Former Site of Scott Correctional Facility

Posted by: | Comments Project Plan for Village at Northville

Project Plan for Village at Northville

Northville, Mich.—Northville Five LLC bought 53 acres of land at the northwest intersection of Five Mile and Beck Roads from the Charter Township of Northville, Mich. for $8.5 million. The former site of the Scott Correctional Facility will be redeveloped into a mixed-use project to include single-family homes, loft-style residential units, retail and dining.

JPMorgan Boosts CEO Dimon’s Annual Pay 3.7% to $28 Million

Posted by: | Comments-

Bank awards $19 million compensation packages to four deputies

-

Stock surged 31% last year, mostly after presidential election

Jamie Dimon

Photographer: Laura McDermott/Bloomberg

JPMorgan Chase & Co. gave Chief Executive Officer Jamie Dimon a $1 million raise after the bank’s stock climbed 31 percent last year.

Dimon, who’s also chairman, got a $28 million compensation package for 2016, or 3.7 percent more than a year earlier, according to a regulatory filing Thursday. It includes $21.5 million in performance shares tied to future goals, a $5 million cash bonus and $1.5 million in salary…

Trump Aide Scaramucci Sells Investment Business to Chinese Consortium

Posted by: | Comments Anthony Scaramucci, a member of the Trump transition team, confirmed on Tuesday that he will join the administration as public liaison and intergovernmental affairs adviser. CreditSam Hodgson for The New York Times

Anthony Scaramucci, a member of the Trump transition team, confirmed on Tuesday that he will join the administration as public liaison and intergovernmental affairs adviser. CreditSam Hodgson for The New York Times

Donald J. Trump has made no secret that he is willing to pick fights with China. Yet a financier with close ties to the president-elect said on Tuesday that he was selling his investment firm to a group led by a fast-growing Chinese conglomerate.

The investor, Anthony Scaramucci, announced that he was selling his firm, SkyBridge Capital, to a consortium led by RON Transatlantic and HNA Capital of China. The deal paves the way for Mr. Scaramucci to join the Trump administration as a public liaison and adviser…

NY Life Lends $146M on Jersey City Tower

Posted by: | Comments 3 Second Street, Jersey City, N.J.

3 Second Street, Jersey City, N.J.

Jersey City, N.J.—New York Life Real Estate Investors has extended, on behalf of institutional investors, $146.6 million in financing secured by 3 Second Street, a Class A office tower in Jersey City, N.J. The borrower/owner was Dividend Capital Diversified Property Fund Inc. (DPF), of Denver, a public reporting daily NAV REIT.

“Three Second Street is one of the best and most conveniently located office properties along the Hudson Waterfront,” David Li, senior director at New York Life Real Estate Investors, said in a prepared statement…

SF Disney Store Building Changes Hands

Posted by: | Comments 39 Stockton St., San Francisco

39 Stockton St., San Francisco

San Francisco—Mesa West Capital recently announced that, together with one of its U.S. pension fund partners, has provided a $16 million first mortgage debt to Vanbarton Group for the acquisition of a retail property in San Francisco. The building is fully leased to The Walt Disney Co.

The five-year floating-rate loan was originated out of the firm’s Mesa West Real Estate Income Fund IV LLC. The West Coast origination team was led by Ronnie Gul, the company’s principal. The financing was arranged by John Churchward, HFF’s San Francisco president…

Housing Starts in U.S. Rose More Than Forecast in December

Posted by: | CommentsBuilders broke ground on more U.S. homes than forecast in December as a jump in apartment construction helped cap the seventh straight yearly increase, a report from the Commerce Department showed Thursday.

Key Points

- Starts rose 11.3 percent to a 1.23 million annualized rate (forecast was 1.19 million) from a revised 1.10 million pace

- Permits, a proxy for future construction, decreased 0.2 percent to a 1.21 million annualized rate (forecast was 1.23 million)

- Single-family starts declined 4 percent to 795,000 rate, while multifamily construction jumped 57.3 percent to 431,000…

Bankers in Davos See Trump Making Wall Street Great Again

Posted by: | CommentsWall Street’s high-flyers in Davos, basking in their firms’ strong fourth-quarter earnings, said they’re confident Donald Trump’s incoming administration will loosen regulatory constraints on financiers — even if it leaves Barack Obama’s signature Dodd-Frank Actlargely intact.

Bank executives, speaking on condition of anonymity at events around the Swiss ski resort, said they’re not counting on Trump to overturn Dodd-Frank. Instead, they expect the federal agencies that enforce the rules to ease up on them and support bankers’ efforts to limit how much capital and liquidity their companies need to pay bills or absorb losses in a crisis…

Increases in Interest Rates on Savings Accounts Remain Slow to Materialize

Posted by: | CommentsSavers hoping for higher interest rates on deposit accounts are probably going to have to wait awhile longer for yields on their savings to move upward.

While the Federal Reserve decided in December to increase short-term interest rates, that hasn’t yet translated into significant increases in deposit rates paid out by banks on safe, federally insured deposits — the kind of accounts consumers might want to use for an emergency fund or for parking cash they expect to use in the next month or two…

Increases in Interest Rates on Savings Accounts Remain Slow to Materialize

Whole Foods Relocates in New England

Posted by: | CommentsThe retailer has signed a 50,000-square-foot lease in Marlborough and will make a significant investment in the property.

200 Forest St. in Marlborough, Mass.

200 Forest St. in Marlborough, Mass.

Boston—Whole Foods Market Inc. has signed a 50,000-square-foot lease at 200 Forest St. in Marlborough, Mass., with building owner Atlantic Management. CBRE/New England executed the deal on behalf of the owner.

Credit Suisse Resolves U.S. Mortgage Probe for $5.3 Billion

Posted by: | Comments-

Bank to pay $2.5 billion fine, $2.8 billion in consumer relief

-

Pact leaves handful of open mortgage probes as Obama exits

Credit Suisse Group AG and the Justice Department completed a $5.3 billion agreement to settle a U.S. investigation into the bank’s sales of toxic mortgage debt before the financial crisis.

Credit Suisse will pay a $2.5 billion civil penalty and $2.8 billion in consumer relief, to be paid over five years after the settlement, the Justice Department said on Wednesday, in line with the bank’s Dec. 23 announcement of a preliminary resolution.

JPMorgan to Pay $55 Million to Settle Mortgage Discrimination Complaint

Posted by: | CommentsJPMorgan Chase has agreed to pay $55 million to settle an investigation into whether it charged thousands of African-American and Hispanic borrowers higher interest rates on mortgages than white customers.

The proposed settlement, which was announced Wednesday, would conclude a federal inquiry that began nearly seven years ago into possible discriminatory mortgage practices by JPMorgan, the nation’s largest bank.

The discriminatory loans were originated from at least 2006 to late 2009, according to a complaint filed this month by Preet Bharara, the United States attorney for the Southern District of New York. Black and Hispanic borrowers were charged, on average, $1,000 more than comparable mortgages given to whites, the complaint said…

U.S. Homebuilder Confidence Retreats From Highest in 11 Years

Posted by: | CommentsConfidence among U.S. homebuilders retreated in January from an 11-year high, suggesting optimism has plateaued following Donald Trump’s election victory, a report from the National Association of Home Builders/Wells Fargo showed Wednesday.

Key Points

- Builder sentiment gauge fell to 67 (forecast was 69) from a revised 69 in Dec.; readings below 50 indicate respondents report poor market conditions

- Gauge of current sales dropped to 72 from 75

- Index of prospective buyer traffic at 51 after 52

- Measure of six-month sales outlook fell to 76 from 78…

U.S. Homebuilder Confidence Retreats From Highest in 11 Years