Archive for Uncategorized

The Debt Ceiling Is Coming Back and Some Treasury Bills Are About to Get Squeezed

Posted by: | Comments-

Rallying point of deficit hawks set to become Trump’s problem

-

U.S. must cut cash holdings to less than one day’s outlays

One of the first tests of the Trump administration will be what to do about the statutory limit on the nation’s debt, a favorite cudgel of anti-deficit Republicans, including Budget Director nominee Mick Mulvaney. Money market rates are already signaling disruptions going into the March 15 deadline…

The Debt Ceiling Is Coming Back and Some Treasury Bills Are About to Get Squeezed

Major Boston-Area Mixed-Use Project Receives Green Light

Posted by: | Comments Arsenal Yards in Watertown, Mass., rendering

Arsenal Yards in Watertown, Mass., rendering

Watertown, Mass.—Construction on Arsenal Yards, a mixed-use development to be built at the site of a former Boston-area mall, is set to begin within six to eight months now that the Watertown Planning Board has given its approval to the 1 million-square-foot project.

Manhattan’s Luxury Hudson Yards Tower Is 25% Sold

Posted by: | Comments-

Sales range from $2 million to $10 million for apartments

-

Building had most sales at under-construction tower last year

A condo tower rising in what’s billed as Manhattan’s newest neighborhood reported that more than a quarter of its 285 units have sold since marketing began in September, a sign that local buyers are willing to commit to the borough’s far west side.

Signed contracts at Fifteen Hudson Yards range from about $2 million for a one-bedroom apartment to about $10 million for a three-bedroom unit, said Sherry Tobak, senior vice president of sales at Related Cos., which is developing the $25 billion Hudson Yards commercial and residential project with Oxford Properties Group. One buyer acquired two individual three-bedroom units for a combined $16 million, she said…

Singapore Wealth Fund Hits Snag on Vietnam Deal Approval

Posted by: | Comments-

Local authorities withhold approval on Vietcombank investment

-

GIC agreed in August to purchase 7.7% of biggest listed bank

Singapore sovereign fund GIC Pte has hit a snag as it seeks government approval for its planned investment in Bank for Foreign Trade of Vietnam JSC, the nation’s biggest lender by market value, people with knowledge of the matter said.

The deal, originally expected to be completed by the end of 2016, hasn’t yet been approved by Vietnamese authorities, according to the people. The government has withheld approval in part because GIC proposed to buy stock in Vietcombank at less than the market price, the people said, asking not to be identified because the information is private…

From Argentina to St. Louis: AgIdea Plans New HQ

Posted by: | Comments Helix Center Biotech Incubator, St. Louis

Helix Center Biotech Incubator, St. Louis

St. Louis—AgIdea, a contract research and development company based in Argentina is expanding its footprint in St. Louis. The company selected Helix Center Biotech Incubator to serve as their new headquarters in North America.

AgIdea provides scientific support to R&D and regulatory projects in biotechnology, seed and crop protection industries. They assist companies with project design, management, trials, data analysis and product deregulation…

Hong Kong Property Tax May Help End Singapore’s Housing Slump

Posted by: | Comments-

Foreigners may turn to Singapore after Hong Kong raises taxes

-

Retail rents in both cities pressured by sluggish spending

Singapore’s three-year housing slump could see relief from an unexpected quarter in 2017: Hong Kong.

So says Cushman & Wakefield Inc., which expects the slide in the city-state’s home prices to end this year as foreign investors turned off by Hong Kong’s move to increase the stamp duty for overseas buyers look to Singapore instead. Desmond Sim, head of research for Singapore and Southeast Asia at CBRE Ltd., said Singapore house prices are approaching their trough, with a forecast price move of flat to minus 2 percent…

A Scandal at Korea’s Retirement Giant

Posted by: | CommentsWas the National Pension Service pressured to support a merger?

With 546 trillion won ($456.5 billion) in assets, South Korea’s public National Pension Service is the world’s third-largest pension fund, behind Japan’s and Norway’s. It’s also become a part of the widening scandal surrounding impeached President Park Geun-hye.

Berkadia Relocates Boston Office

Posted by: | Comments 10 Milk St./294 Washington St., Boston

10 Milk St./294 Washington St., Boston

Boston—Berkadia announced the relocation of its Boston office in order to accommodate for the company’s growth. Taking over suite 720 of the Old South Building, a co-addressed property at 10 Milk St./294 Washington St., the expanded location offers increased production activity on both the regional and local levels.

The 11-story, 230,206-square-foot building is located in the heart of Boston’s central business district. Built in 1903, the transit-oriented property is situated within a quarter mile of four subway stations, was last renovated in 1989 and offers 20,000 square feet of ground-level retail space, according to Yardi Matrix…

Goldman, Citi Beat Estimates as Trading Buoys Wall Street

Posted by: | Comments-

Banks follow JPMorgan, BofA, Morgan Stanley in bond rebound

-

Blankfein, Corbat continue push to reduce firmwide expenses

Goldman Sachs Group Inc. and Citigroup Inc. both reported fourth-quarter profit that surpassed analysts’ estimates as a bond-trading revival spurred by Donald Trump’s surprise victory lifted earnings across Wall Street.

The two firms were the last of the major U.S. banks to report results, with JPMorgan Chase & Co., Morgan Stanley and Bank of America Corp. all posting gains as investors placed bets on the direction of interest rates and the economy after the November U.S. election. Citigroup’s profit rose 7.1 percent on a 36 percent jump in fixed-income revenue, while earnings at New York-based Goldman Sachs more than tripled, with bond trading up 78 percent…

This Is What a $250 Million House Looks Like

Posted by: | Comments The house’s exterior, with a non-working helicopter on the roof.

The house’s exterior, with a non-working helicopter on the roof.

Source: Bruce Makowsky/BAM Luxury Development

The new mansion that developer Bruce Makowsky is selling for $250 million comes with 150 pieces of original artwork, $30 million worth of classic cars (his estimate), a dozen high-performance motorcycles, and a deactivated helicopter.

Understatement clearly isn’t on the agenda. But in a saturated spec-home market that gives the super-rich some super-sized options, even the appearance of getting bang for one’s many bucks is a selling point…

Navy Federal Credit Union to Invest $100M in Virginia

Posted by: | Comments Cutler Dawson, Navy Federal president & CEO

Cutler Dawson, Navy Federal president & CEO“This Virginia-headquartered company’s growth and investment over nearly 40 years is an incredible testament to our unparalleled business environment, infrastructure and top-notch workforce,” Governor Terry McAuliffe said in a prepared release. “An expansion of this magnitude is transformational for Frederick County and for the Commonwealth, as Navy Federal is a critical partner providing good-paying job opportunities for thousands of hard-working Virginians.”

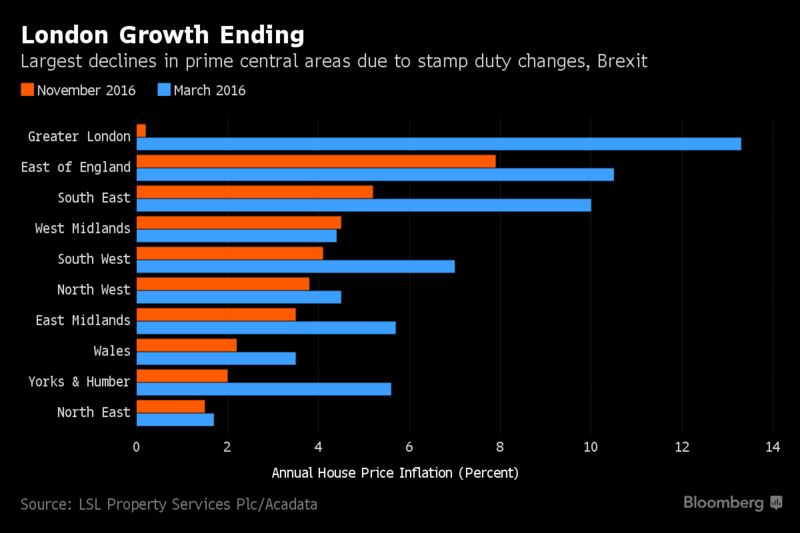

London Slumps From Best to Worst for Home-Price Growth: Chart

Posted by: | Comments London house prices have gone from the fastest growing in the U.K. to the slowest within eight months. Average annual house-price inflation was 0.2 percent in November, the latest available figures, compared with 13.3 percent in March, according to data from LSL Property Services Plc and Acadata. Large price declines in central areas are contributing to the slowdown as uncertainty over Brexit and higher stamp-duty rates weigh on transactions…

London house prices have gone from the fastest growing in the U.K. to the slowest within eight months. Average annual house-price inflation was 0.2 percent in November, the latest available figures, compared with 13.3 percent in March, according to data from LSL Property Services Plc and Acadata. Large price declines in central areas are contributing to the slowdown as uncertainty over Brexit and higher stamp-duty rates weigh on transactions…

London Slumps From Best to Worst for Home-Price Growth: Chart

Runaway Aussie Property Market Prompts Fund to Reduce Debt

Posted by: | Comments-

Perpetual fund cuts real estate debt to 2.9% from 14.8% peak

-

Risks are rising for Aussie real estate: Perpetual’s Prabhu

Australia’s overheated property market has spurred one of the nation’s top-performing fixed income money managers to cut some of its real estate debt investments to the lowest level since the 2007 financial crisis.

Vivek Prabhu, the Sydney-based head of fixed income at Perpetual Ltd., is making the move as he braces for potential blow-ups in the nation’s A$7.6 trillion property market. He has whittled down the debt holdings of Australian real estate investment trusts within the A$926.4 million ($692.7 million) Perpetual Wholesale Diversified Income Fund to 2.9 percent from a peak of 14.8 percent in 2014…

Atlanta-Area Office Campus Changes Hands for $57M

Posted by: | Comments Milton Park, Alpharetta, Ga.

Milton Park, Alpharetta, Ga.

Alpharetta, Ga.—Avison Young recently announced that it has represented Adventus Realty Trust in the acquisition of Milton Park, a two-building Class A office campus in Alpharetta.

According to Yardi Matrix data, the property was sold by Talcott Realty Investors for a price tag of $57 million and the sale was subject to a $39.9 million loan held by JPMorgan Chase.

Canada’s Housing Agency Boosts Mortgage Premiums Again

Posted by: | Comments-

Changes will ‘preserve competition’ in mortgage loan industry

-

Agency is moving to limit taxpayer exposure to housing

A home for sale, in East Vancouver, British Columbia.

Photographer: Darryl Dyck/Bloomberg

Canada’s government-owned housing agency is raising premiums for the riskiest homebuyers as it seeks to limit taxpayer exposure to the housing market .

On average, the charges will add about C$5 a month to the average Canadian’s mortgage payments, Canada Mortgage & Housing Corp. said in a statement Tuesday. The increase ranges from 40 basis points for those with 95 percent loan-to-value ratio to 115 basis points for those with 80 percent…

Trump Takes Aim at King Dollar and It Threatens U.S. Equities

Posted by: | CommentsThe S&P 500 has a friend and a foe in King Dollar.

The greenback is the only major currency whose current strength has coincided with rallies in its domestic equity market, according to Goldman Sachs Group Inc., underscoring the risk for stocks if the dollar’s poor start to the year gathers more steam.

“Recently, the dollar is alone as a major risk-on currency, gauged by looking at the rolling correlation of S&P 500 and USD,” writes a team led by Ian Wright…

Trump Takes Aim at King Dollar and It Threatens U.S. Equities

RSM to Occupy 95 KSF at Iconic 4 Times Square

Posted by: | Comments 4 Times Square, New York

4 Times Square, New York

New York—Savills Studley announced that audit, tax and consulting firm RSM US LLP has signed a 15-year, 95,000-square-foot lease at The Durst Org.’s iconic 4 Times Square. The firm will occupy the 10th and 11th floors, as well as parts of the 12th. RSM will be downsizing, moving from 1185 Sixth Ave., where it currently occupies roughly 165,000 square feet, according to The Real Deal.

China Home Prices Rose in Fewest Cities in 11 Months Amid Curbs

Posted by: | Comments-

Prices gained in 46 cities in December, versus 55 in November

-

Some smaller cities expanded home-buying curbs last month

China home prices increased last month in the fewest cities since January last year, signaling property curbs to deflate a potential housing bubble are taking effect.

New-home prices, excluding government-subsidized housing, gained last month in 46 of the 70 cities tracked by the government, compared with 55 in November, the National Bureau of Statistics said Wednesday. Prices dropped in four cities, in line with a month earlier. They were unchanged in 20 cities…

Brooklyn Real Estate Outpaces Manhattan as City Tallies Values

Posted by: | Comments-

Brooklyn jumps 14 percent, while Manhattan up 8.2 percent

-

Property taxes make up about 41 percent of NYC’s revenue

New York City set a value of $1.16 trillion for its more than one million properties for the fiscal year beginning July 1, 2018, an increase of 8.74 percent over the previous period, according to city finance department data.

Residential and commercial property values in Brooklyn rose 14 percent, the most of New York’s five boroughs, to $301 billion. Manhattan property rose 8.24 percent. The values are later used to help set tax assessments, which are established separately…

FD Stonewater Acquires $30M Chicago Office Asset

Posted by: | Comments 1007 Church St.

1007 Church St.

Chicago—FD Stonewater has acquired 1007 Church St. in Evanston, Ill., from Farbman Group. Renamed Evanston MetroCenter, the Class A, 164,845-square-foot, multi-tenant office building sold for $30 million, according to Yardi Matrix. Built in 1984, the eight-story property was designed by renowned architect Helmut Jahn.

There are plans to enhance the tenant experience through physical building improvements, expanded tenant services and cosmetic upgrades. The acquisition includes on-site expansion potential. Located one block from the Davis Street Metro Station and 13 miles from Chicago’s central business district, the property was 79 percent leased at the time of acquisition and includes tenants in education, technology and health care…

HSBC CEO Says Bankers Generating 20% of London Revenue May Move

Posted by: | Comments

Stuart Gulliver.

Photographer: Simon Dawson/Bloomberg

HSBC Holdings Plc Chief Executive Officer Stuart Gulliver said trading operations that generate about 20 percent of revenue for the lender’s investment bank in London may move to Paris, quantifying some of the aftershocks for the U.K. after Brexit.

“Activities specifically covered by EU legislation will move, and looking at our own numbers, that’s about 20 percent of revenue,” Gulliver said in a Bloomberg Television interview at the World Economic Forum in Davos, Switzerland, with John Micklethwait. The bank confirmed that he was referring to the lender’s global banking and markets operations in the U.K. capital…

DOJ: Deutsche Bank Agrees to Pay $7.2 Billion for Misleading Investors

Posted by: | Comments-

Bank said Dec. 23 that it had reached a deal in principle

-

Mortgage probe was among the bank’s biggest litigation risks

Deutsche Bank AG reached a final settlement with the U.S. Justice Department over its handling of mortgage-backed securities before 2008, resolving one of its biggest litigation risks.

The bank agreed to pay $7.2 billion and admitted to misleading investors, the Justice Department said on Tuesday. The penalty was in line with the bank’s Dec. 23 announcement that it had reached an agreement in principle in the matter. It will pay a $3.1 billion civil penalty and provide $4.1 billion in relief to homeowners…

Menashe Properties Acquires $35M CO Office Campus

Posted by: | Comments Aurora Marketplace

Aurora Marketplace

Denver—Menashe Properties announced its acquisition of Aurora Marketplace, a 600,000-square-foot, eight-building corporate office campus in the Denver suburb of Aurora, Colo., for $35.5 million. The 25-acre property located on South Parker Road is 88 percent leased to a mix of tenants including Comcast, Raytheon, American Financing, Space Age Credit Union, High Noon Productions and NelNet.

“This asset was management intensive, with 67 tenants,” Jordan Menashe, principal of Menashe Properties, told Commercial Property Executive. “But we’re a very hands on company so this was a good match for us. We are a believer in Denver and this property. Broadreach was a clean operation, the bones are in phenomenal shape, so now we want to make the place more fun.”…

Morgan Stanley Sees Better Trading Environment in 2017

Posted by: | Comments-

Gains fueled by post-election rates and currencies trading

-

Fourth-quarter profit, trading revenue surpass estimates

Morgan Stanley said momentum from a strong fourth quarter, including bond-trading revenue that more than doubled, continued into the first weeks of this year.

“Going into 2017, the market sentiment is clearly more optimistic than we were going into 2016,” Chief Financial Officer Jonathan Pruzan said Tuesday in an interview. “The tone is better, all the markets are open and constructive, which is not where we were last year. So from a sales and trading perspective, we continue to see good levels of activity.”…

Commerce Pick Wilbur Ross Discloses Assets Topping $336 Million

Posted by: | Comments-

Disclosure comes less than a day before Senate hearing

-

Ethics agency signs off on agreement, Ross to divest assets

Billionaire investor Wilbur Ross, commerce secretary nominee for president-elect Donald Trump, arrives in the lobby at Trump Tower in New York, on Dec. 13, 2016.

Photographer: John Taggart/Bloomberg

Private equity investor Wilbur Ross, President-elect Donald Trump’s choice for Commerce Secretary, disclosed assets worth more than $336 million in a federal financial disclosure statement that doesn’t capture his net worth.

Moody’s Reaches $864 Million Subprime Ratings Settlement

Posted by: | Comments-

Agreement is victory for U.S. in probes of ratings industry

-

Pact helps resolve a long-standing overhang for Moody’s

Moody’s Corp. agreed to pay almost $864 million to resolve a multiyear U.S. investigation into credit ratings on subprime mortgage securities, helping to clear the way for the firm to move beyond its crisis-era litigation.

Cathay Pacific to Revamp Fuel Hedges, Workforce; Shares Rise

Posted by: | Comments-

Carrier ‘won’t hedge as far forward,’ COO Rupert Hogg says

-

Hogg also says Cathay Pacific will ‘rethink’ its workforce

Cathay Pacific Airways Ltd., Asia’s biggest international airline, plans to shorten its fuel-hedging program and revamp its workforce as part of a new business strategy to halt a slide in earnings. The shares jumped the most in nine months.

The carrier “won’t hedge as far forward as we have in the past” and will “rethink its workforce,” Chief Operating Officer Rupert Hogg told the South China Morning Post in comments confirmed by Cathay Pacific Monday. The Hong Kong-based airline plans to reassign employees from some outdated roles to new jobs that are better aligned with a “digital focus” while “never saying never” to redundancies, Hogg said…

Rolls-Royce to Pay $817 Million to Resolve Bribery and Graft Inquiries

Posted by: | Comments A Rolls-Royce engine being mounted on an Airbus aircraft in France. Rolls-Royce’s products include engines for civilian and military aircraft, as well as turbines for the electrical power and energy industries.CreditGuillaume Horcajuelo/European Pressphoto Agency

A Rolls-Royce engine being mounted on an Airbus aircraft in France. Rolls-Royce’s products include engines for civilian and military aircraft, as well as turbines for the electrical power and energy industries.CreditGuillaume Horcajuelo/European Pressphoto Agency

LONDON — Rolls-Royce, the maker of jet engines and other power systems, said on Monday that it had agreed to pay $817 million to resolve several long-running bribery and corruption inquiries.

The company said that it had reached so-called deferred prosecution agreements with the Serious Fraud Office of Britain, as well as the United States Department of Justice. It also reached a leniency agreement with the Ministério Público Federal of Brazil.

Virtua Recapitalizes Dallas Property

Posted by: | Comments Midtown Atrium

Midtown Atrium

Dallas—Virtua Partners has announced the $18 million recapitalization of Midtown Atrium at 5525 Lyndon B. Johnson Freeway in Dallas. The 113,359-square-foot office complex offers six floors, common area Wi-Fi and 426 parking spaces. Originally built in 1979, the property underwent renovations in 1994, according to Yardi Matrix. The building faced trouble when its sole tenant, Republic Insurance, notified the owners they would not be renewing their lease when it expires in February 2017.

Noble Buys Clayton for $2.7 Billion to Expand in Permian

Posted by: | Comments-

Will have second-largest position in Southern Delaware Basin

-

Deal provides 4,200 drilling locations on about 120,000 acres

Noble Energy Inc. agreed to buy Clayton Williams Energy for $2.7 billion in stock and cash to expand in America’s hottest shale play.

The combination will create the second-largest acreage position in the Southern Delaware Basin of the Permian shale formation, Houston-based Noble said in a statement Monday. The deal provides more than 4,200 drilling locations on about 120,000 net acres, with resources of more than 2 billion barrels of oil equivalent, Noble said…

Moody’s to Pay $864 Million to Settle Inquiry Into Inflated Ratings

Posted by: | CommentsMoody’s Corp. has agreed to pay nearly $864 million to settle federal and state claims it gave inflated ratings to risky mortgage investments in the years leading up to the financial crisis.

The deal announced on Friday was struck among the New York-based rating agency, the Justice Department and the attorneys general for 21 states and the District of Columbia.

It calls for $437.5 million to go to the Justice Department and $426.3 million to be divided among the states and the District of Columbia…

Moody’s to Pay $864 Million to Settle Inquiry Into Inflated Ratings

Crackdown Improved Australian Banks’ Mortgage Lending Standards, Regulator Says

Posted by: | Comments-

Regulator holds banks’ counter-cyclical capital buffer at zero

-

APRA has taken steps in recent years to curb property loans

Australian banks have “appreciably improved” their mortgage-lending standards, the nation’s regulator said, as it left the amount of additional capital banks are required to hold as a buffer against the build-up of credit risk at zero.

The pace of lending to property investors is currently at around half of the regulator’s recommended levels, and higher-risk mortgages — such as those with loan-to-value ratios of over 90 percent — had fallen, the Australian Prudential and Regulatory Authority said in its annual report on the operation of the counter-cyclical capital buffer…

This Hedge Fund Says China’s Next Big Short Is Stocks

Posted by: | Comments-

Crescat cuts bearish bets on currency, adds to equity shorts

-

Stocks fell suddenly Monday in latest sign of investor fear

When Kevin Smith realized late last year that China was getting serious about defending its currency, his first move was to dial back bearish bets on the yuan. His second move: double down on wagers against Chinese stocks.

Smith, whose global macro hedge fund has returned about 350 percent over the past decade, says China’s attempts to prop up its currency are tightening domestic monetary conditions and making a credit crisis increasingly likely. To him, that means shares of banks and other “zombie” companies may be the first dominoes to fall as China faces a reckoning after years of debt-fueled growth…

Singapore Home Sales Top 8,000 Units in 2016, Beating 2015 Tally

Posted by: | Comments-

Prices fell 3% in 2016 for third straight yearly decline

-

Home values have fallen 11% from 2013 peak amid curbs

Singapore house sales last year topped 2015’s tally as a third straight year of price declines stoked pent-up demand from homebuyers.

Developers sold 367 units last month, taking the yearly total to 8,136, compared to the 7,440 sold in 2015, according to data released Monday by the Urban Redevelopment Authority…

Singapore Home Sales Top 8,000 Units in 2016, Beating 2015 Tally

Expect Hedge-Fund Returns to Be More Honda Than Rolls Royce, Point72 Says

Posted by: | Comments-

Industry faces backlash after years of lackluster performance

-

Firms may combine human skills and computer power to gain edge

Hedge funds will have to adapt to a more challenging market as investors respond to disappointing returns by demanding their fees back or pulling out altogether, according to Matthew Granade, chief market intelligence officer of Point72 Asset Management.

No matter how you “slice-and-dice the data,” hedge funds are struggling to meet their promise to clients to consistently produce high returns with low correlation to markets, Granade said at the London School of Economics’ alternative-investment conference on Monday…

Self-Storage Facility Breaks Ground near Upscale Orlando Mall

Posted by: | CommentsThe multi-story facility will be climate controlled and feature more than 90,000 square feet of space.

My Neighborhood Storage Center Groundbreaking

My Neighborhood Storage Center Groundbreaking

Orlando—Liberty Investment Properties recently broke ground on a new self-storage facility located near The Mall at Millenia in Orlando. The facility will be the company’s ninth Florida location.

The asset will operate under the My Neighborhood Storage Center brand, a prominent manager and operator of self-storage facilities with locations throughout central Florida. The multi-story, Class A self-storage facility will be climate controlled, offering more than 90,000 square feet of space. It will be open 24 hours a day, seven days a week, providing easy accessibility and a well-lit environment…

Canada Home Prices End 2016 With Slowest Gain in Two Years

Posted by: | Comments

Residential housing stands in the downtown area of Whitehorse, Yukon.

Photographer: Ben Nelms/Bloomberg

Canadian home prices rose in December at the slowest pace in two years, adding to evidence the nation’s housing market is cooling.

Prices rose 0.1 percent from the prior month, the Canadian Real Estate Association said Monday, citing its benchmark home indexes. That’s the slowest pace since November 2014.

With Toronto and Victoria the only pockets of strength, the data suggest recent steps by policy makers to curb demand are working…

Meritex Buys Phoenix Industrial Asset for $26M

Posted by: | Comments Park Ladera at Spectrum Ridge

Park Ladera at Spectrum Ridge

Phoenix—Meritex, a private real estate investment and management company that acquires, develops, owns and operates commercial real estate, has announced the purchase of Park Ladera at Spectrum Ridge, an industrial project in Phoenix. According to Yardi Matrix, Trammel Crow Co. sold the asset for $26.4 million.

“This acquisition is in keeping with our strategy of investing in markets that provide opportunity for growth, expansion and diversification. We continue to seek additional investments in the market with a goal of building an industrial portfolio of 1.5 to 2.0 million square feet in Phoenix,” Dan Williams, CIO of Meritex, said in a prepared statement…

GM Plans $1 Billion U.S. Investment in Nod to Trump

Posted by: | Comments-

Carmaker outlining plans similar to Ford, Fiat Chrysler

-

Trump threatening Mexico-built cars, praising U.S. hiring

General Motors Co. will invest $1 billion in U.S. plants as part of a previously announced factory retooling for future models, a person familiar with the matter said, as President-elect Donald Trump pressures carmakers to boost spending and hiring.

The largest U.S. automaker will create or retain 1,000 jobs at several existing facilities, said the person, who asked not to be named ahead of an announcement expected Tuesday…

London Home Owners Stay Put as Brexit Damps Appetite to Sell

Posted by: | Comments-

New listings for sale dropped an annual 14% in January

-

Prices rose 1.4% from previous month versus 0.4% nationally

London home owners are showing a “marked reluctance” to put their property up for sale, deterred by uncertainty caused by the looming Brexit process and an increase in tax, according to Rightmove.

While the average asking price of a property in the capital rose 1.4 percent in January to 624,953 pounds ($759,000), fewer Londoners put their properties up for sale. New listings slid 14 percent from a year earlier, the property website operator said Monday…

S.E.C. Inertia on Paybacks Adds to Investor Harm

Posted by: | Comments In August 2015, the S.E.C. struck a settlement with Citigroup over an exotic investment strategy involving municipal bonds that the bank sold to clients from 2002 to 2008. CreditEric Risberg/Associated Press

In August 2015, the S.E.C. struck a settlement with Citigroup over an exotic investment strategy involving municipal bonds that the bank sold to clients from 2002 to 2008. CreditEric Risberg/Associated Press

When securities laws are broken and investors get hurt, the Securities and Exchange Commission often rides to the rescue, using its regulatory muscle to extract penalties that can be returned to victims.

But as a cadre of harmed Citigroup investors is learning, it is one thing to persuade a wrongdoer to pay reparations and quite another to disburse the money.

Davos to Commence as Investment Bank Earnings Are Released

Posted by: | CommentsHere’s a look at what’s coming up this week.

WORLD ECONOMIC FORUM

Davos Gathering to Convene, With Trump on the Agenda

Heads of state, business leaders and entrepreneurs will meet in the Swiss resort town of Davos on Tuesday for the world’s most elite networking event, the annual World Economic Forum. Among the most anticipated guests this year will be President Xi Jinping of China, marking the first time that a Chinese head of state has attended the gathering. Participants will discuss topics like climate change, social inclusion and responsible leadership, against a backdrop of rising populism in Europe and the United States. President-elect Donald J. Trump is likely to be a major topic of discussion in the many sessions this week. Alexandra Stevenson…

Where is Washington State’s Largest Solar Rooftop?

Posted by: | Comments Renton, Wash., IKEA store

Renton, Wash., IKEA store

Renton, Wash.—Home furnishings retailer IKEA continues its renewable energy efforts at stores in the United States, completing the largest solar rooftop array in Washington state atop its future Seattle-area store.

The 399,000-square-foot Renton, Wash., store will be opening in the spring with a 244,000-square-foot solar installation on its roof. It consists of a 1.13 MW system with 3,268 panels expected to generate about 1.26 million kWh of electricity annually for the store. The new store is being built on the parking lot of the current IKEA in Renton near State Highway 167, about 11 miles from downtown Seattle. During the construction, IKEA has been running shuttles to the retail site at busy times because of the loss of parking spaces at the 29-acre parcel…

Cracks in U.S. Mortgage Demand Grow as Banks Signal Fed’s Impact

Posted by: | Comments-

Wells Fargo, BofA say application pipelines are shrinking

-

Still, more customers may finish process before rates increase

Wells Fargo & Co. and Bank of America Corp. said they’re starting to see demand for home loans taper as the Federal Reserve raises interest rates.

Wells Fargo, the biggest U.S. mortgage lender, said Friday that its pipeline of applications for home loans dropped 40 percent to $30 billion at the end of the fourth quarter, compared with three months earlier. The decline capped a year in which mortgage revenue fell to $6.1 billion, the lowest level since 2009. Bank of America, meantime, said its pipeline shrank 43 percent in the quarter as fewer customers sought to refinance existing debts…

Howard Hughes Corp. Nabs 2 Maryland Towers

Posted by: | Comments Downtown Columbia Streetscape

Downtown Columbia StreetscapeBillionaire Li Ka-Shing Sweetens Duet Offer to $5.5 Billion

Posted by: | Comments-

Under revised bid, Duet shareholders to get A$3.03 a share

-

Deal would help Li diversify away from European risks

Li Ka-shing.

Photographer: Justin Chin/Bloomberg

Billionaire Li Ka-shing agreed to buy Duet Group in a A$7.4 billion ($5.5 billion) deal, sweetening an earlier offer, as the Hong Kong tycoon seeks to expand his infrastructure assets in Australia to diversify away from Europe.

In the revised bid, endorsed by Duet, investors will receive A$3.03 for each share in the energy company after including a newly announced special dividend of 3 cents a share, according to statements from the companies. That’s 9 percent higher than Friday’s closing price for Duet, which on Monday climbed to as high as A$2.93 in Sydney trading…

Stone Mountain Properties Buys $20M Office Building in Houston

Posted by: | CommentsOntario Is Becoming Last Bastion of Canada’s Hot Housing Market

Posted by: | Comments-

Toronto real estate prices rose 20% in 2016, Hamilton up 17%

-

Prices in Vancouver suffer biggest 3-month drop since 2012

Toronto and some of its neighboring towns seem to be the last refuge of Canada’s real estate boom.

Based on the latest bits of 2016 housing data this week, Canada’s housing market ended the year on two separate tracks — hot in Ontario but cool or cooling in most other cities including Vancouver, the country’s most expensive market…

Ontario Is Becoming Last Bastion of Canada’s Hot Housing Market

Goldman Sachs Defies Mexican Peso Bears, Forecasts 13% Rally

Posted by: | Comments-

Risk of U.S. protectionism priced to ‘significant’ extent: GS

-

Peso is the worst performer among 16 major currencies in 2017

Against the most “Trumpian” of odds, Goldman Sachs Group Inc. is defying bearish bets and predicting Mexico’s peso will make a comeback this year.

The worst performer among the world’s 16 major currencies so far in 2017 will rally 13 percent to 19 per dollar over the next 12 months on the view that the protectionist impact of the new U.S. administration will be less severe than the rhetoric of President-elect Donald Trump. The currency touched a record low of 22.04 per dollar this week after he reiterated during a press conference that Mexico would be paying for a border wall and that companies that relocate operations there would have to pay a border tax…

Clarion Partners Grabs Boston-Area Shopping Center

Posted by: | Comments Brookside Shops in Acton, Mass.

Brookside Shops in Acton, Mass.

Boston—New York-based Clarion Partners recently announced the acquisition of Brookside Shops, a 75,781-square-foot shopping center in Acton, Mass. The transaction was conducted on behalf of a separately managed account client advised by the firm. According to Middlesex County records, TIAA Realty disposed of the property at the end of December for a price tag of $33.5 million. The shopping center last changed hands in 2006 for roughly $27.9 million.

Wet Seal Said to Consider Sale or Bankruptcy as Business Falters

Posted by: | Comments-

A bankruptcy would be the second in two years for teen chain

-

Investment firm Versa Capital acquired the brand in 2015

Wet Seal, the mall retailer owned by Versa Capital Management, is considering a sale or bankruptcy after struggling to turn around the business, according to people with knowledge of the situation.

A decision could come as soon as next week, said the people, who asked not to be identified because the matter isn’t public. The company would prefer an out-of-court deal, according to the people…

Wet Seal Said to Consider Sale or Bankruptcy as Business Falters

Cohen’s Fund Returned a Measly 1% Last Year

Posted by: | Comments-

Englander’s Millennium gained 3.3% last year, people said

-

Folger Hill loses 17%, Blackstone’s Senfina shuts down

Steven Cohen

Photographer: Scott Eells/Bloomberg

Steve Cohen’s Point72 Asset Management returned about 1 percent in 2016, the second-worst annual performance ever for the billionaire investor, according to people familiar with the returns.

The family office, which runs Cohen’s personal fortune and invests across equity teams, suffered along with other multi-manager firms, which struggled to make money in stocks. The high correlation among equities for most of last year, caused in part by the billions of dollars that flowed into index and exchange-traded funds, hurt managers making significant wagers on falling shares…

Russell Reynolds Signs 15K Lease at 609 Main at Texas

Posted by: | CommentsHouston—Russell Reynolds Associates recently signed a 10-year lease for 15,000 square feet in a new 48-story downtown office tower developed by Hines in Houston. The company will occupy the space on the 35th floor of 609 Main at Texas.

Located at the corner of Main and Texas streets, the 1,050,000-square-foot office tower is scheduled for completion this month. With this lease, 609 Main at Texas stands at over 50 percent leased and other notable tenants include Kirkland & Ellis LLP, Orrick, Hogan Lovells and United Airlines. The project constructed for LEED Platinum standards was designed by architectural firm Pickard Chilton. According to Yardi Matrix data, the property will offer 1,500 parking spaces and will include 12,000 square feet of retail space…

A $45 Million Manhattan Penthouse Carved in Two Has Found a Buyer

Posted by: | Comments-

Duplex sells for $25 million; $10 million unit still on market

-

Buyers feel ‘there’s nothing to wait on anymore,’ broker says

A Manhattan penthouse listed for $27.5 million — a fragment of a larger condo that was carved in two amid a luxury-sales slowdown — has found a buyer as the borough’s high-end market experiences a sudden revival.

The 5,500-square-foot (511-square-meter) duplex spanning the top floors of 10 Sullivan St., a Soho development completed last year, sold this week for $25 million. The two-story penthouse was sliced from a larger 8,400-square-foot triplex that was seeking $45 million, after co-developers Property Markets Group and Madison Equities concluded they wouldn’t find a buyer for such a large unit and at such a high price…

The Bond Market Isn’t Dead Yet for This JPMorgan Fund

Posted by: | Comments-

Fund returned 8.1% in past year, almost double its benchmark

-

Emerging markets offer opportunities, fund manager says

Don’t count your nails yet for the bond market’s coffin.

That’s the message from a JPMorgan Asset Management fund that’s outperformed in the past year by keeping to shorter-maturity securities. The $2.4 billion Global Bond Opportunities Fund has reduced its average duration in U.S. securities to three years from more than five in July, and has jumped into the domestic debt of Brazil and Russia, two higher-yielding emerging markets that have avoided the recent exchange-rate depreciation afflicting Turkey and Mexico…

U.K. Banks Weaken Push to Keep EU ‘Passporting’ Post-Brexit

Posted by: | Comments-

Lobby group calls for U.K., EU deal guaranteeing market access

-

TheCityUK wants interim deal as early as March to retain jobs

U.K. finance firms diluted their bid to retain unfettered access to the European Union after Brexit, accepting that Prime Minister Theresa May’s government is unwilling to fight their corner against EU resistance.

In a two-page summary of industry priorities for the upcoming negotiations released on Thursday, TheCityUK lobby group made no mention of its once key demand to safeguard so-called passporting, which allows banks with bases in London to service customers throughout the EU. The banks are now pushing for “mutual access” and additional time to adapt to the new regime…

A Financial Mystery Emerges. Its Name? Steven T. Mnuchin Inc.

Posted by: | Comments Steven T. Mnuchin is Donald J. Trump’s nominee to be Treasury secretary. CreditEvan Vucci/Associated Press

Steven T. Mnuchin is Donald J. Trump’s nominee to be Treasury secretary. CreditEvan Vucci/Associated Press

Steven T. Mnuchin plans to divest himself of his financial interests in 43 companies, hedge funds and investment funds and resign from numerous board positions as he tries to disentangle himself from potential conflicts of interest before his confirmation as the next Treasury secretary.

But Mr. Mnuchin, a former hedge fund manager and Goldman Sachs executive, intends to retain control of one of his oldest companies — one named after himself…

A Financial Mystery Emerges. Its Name? Steven T. Mnuchin Inc.

HMC Adds New Hotel to Management Portfolio

Posted by: | Comments Holiday Inn Express® Irving DFW Airport North

Holiday Inn Express® Irving DFW Airport North

Dallas—Hospitality Management Corp. (HMC) has added Holiday Inn Express® Irving DFW Airport North in Irving, Texas, to their portfolio.

“The Holiday Inn Express Irving DFW North is an ideal property for guests traveling to the area, not only because it offers a convenient location to key attractions and amenities, but will also provide guests with outstanding service by a professional and well-established staff. We’re happy to announce the addition of this property to the expanding hotels managed by Hospitality Management Corporation,” Gerald Morris, vice president of Operations for HMC, said in a prepared statement…

Carson Says 30-Year Mortgage May Not Need Government Backing

Posted by: | Comments-

HUD nominee says private market could take much of the burden

-

Democrats question neurosurgeon’s fitness for the housing role

Ben Carson, President-elect Donald Trump’s nominee for the top U.S. housing-policy job, told lawmakers that he questions the need for a government backstop of the market for 30-year mortgages, saying the private market could take on much of the responsibility.

Carson commented in response to a question Thursday at a Senate confirmation hearing where some Democrats questioned his qualifications to lead the Department of Housing and Urban Development, which has responsibilities ranging from insuring low-down-payment mortgages to administering rental assistance for low-income home owners. The housing industry has defended the federal backing as essential in keeping down mortgage costs…

Eyeing Emergency Exits From Mergers in Anxious Times

Posted by: | CommentsThe merger escape hatch may be about to open.

President-elect Donald J. Trump’s unnerving tweets and fickle policy ideas add to the angst already undermining transactions like Abbott Laboratories’ $5.8 billion acquisition of Alere, a medical test maker. Buyers seek solace in material adverse change, or MAC, clauses, which offer the potential to wriggle out of a deal between signing and closing, but the provisions are almost never enforced in court. That may be about to change.