Archive for Uncategorized

Seller-Financed Deals Are Putting Poor People in Lead-Tainted Homes

Posted by: | Comments Kendra Harrell’s home, second from left, in West Baltimore. Many houses in Baltimore were built when lead paint was common during the first half of the 20th century. CreditAl Drago/The New York Times

Kendra Harrell’s home, second from left, in West Baltimore. Many houses in Baltimore were built when lead paint was common during the first half of the 20th century. CreditAl Drago/The New York Times

BALTIMORE — A year after Tiffany Bennett moved into a two-story red brick house at 524 Loudon Avenue here, she received alarming news.

Two children, both younger than 6, for whom Ms. Bennett was guardian, were found to have dangerous levels of lead in their blood. Lead paint throughout the nearly 100-year-old home had poisoned them…

Seller-Financed Deals Are Putting Poor People in Lead-Tainted Homes

Fund Manager Riding 55% Posco Gain Sees Steel Prices Staying Hot

Posted by: | Comments-

Baring’s Choi bought Korean steelmaker stock near 12-year low

-

Choi says steel prices may rise for another quarter or two

The rally in steel that helped propel Posco shares 55 percent higher this year may continue for another six months, according to a money manager who bought the stock when it was near a 12-year low.

Baring Asset Management Korea Ltd.’s head of equities, Hyun Choi, said he started buying Posco shares in late 2015, after Korea’s biggest steelmaker posted its biggest loss in at least five years. That was around the time when Chinese authorities spoke of the need to overhaul state-run companies and address a glut in supply…

Justice Department Sues Barclays Over Mortgage-Backed Securities

Posted by: | Comments The Justice Department said Barclays’ actions in the packaging and sale of what are known as residential mortgage-backed securities in the years leading to the financial crisis injured tens of thousands of investors when the housing market collapsed. CreditKevin Coombs/Reuters

The Justice Department said Barclays’ actions in the packaging and sale of what are known as residential mortgage-backed securities in the years leading to the financial crisis injured tens of thousands of investors when the housing market collapsed. CreditKevin Coombs/Reuters

LONDON — United States authorities have accused the British bank Barclays and two former executives of fraudulently misleading the public in the sale of tens of billions of dollars in securities backed by home mortgages.

The Justice Department filed a lawsuit Thursday in Federal District Court in Brooklyn after the two sides failed to reach a settlement despite months of talks…

Belgium Has Credit Rating Cut by Fitch as Deficit Seen Rising

Posted by: | Comments-

Downgrade reflects struggle to return to a balanced budget

-

Rating lowered to AA- from AA, with a stable outlook

Fitch Ratings cut Belgium’s credit rating for the first time in almost five years as the government struggles to reach its goal of returning to a balanced budget.

In a statement Friday, Fitch announced a one-step reduction to AA- from AA. That’s equivalent to Belgium’s credit score of Aa3 at Moody’s and one step below the AA rating assigned by Standard & Poor’s. The outlook on the rating is stable, Fitch said.

Deutsche Bank to Settle Mortgage Inquiry for $7.2 Billion

Posted by: | Comments John Cryan, chief executive of Deutsche Bank, at a conference in Berlin in June.CreditJohn Macdougall/Agence France-Presse — Getty Images

John Cryan, chief executive of Deutsche Bank, at a conference in Berlin in June.CreditJohn Macdougall/Agence France-Presse — Getty Images

Deutsche Bank announced late on Thursday that it had reached a tentative $7.2 billion deal to resolve a federal investigation into its sale of toxic mortgage securities, capping months of negotiations that weighed heavily on the bank’s stock price and reputation.

The civil settlement requires the bank, Germany’s largest, to pay a $3.1 billion penalty and provide relief to American consumers valued at $4.1 billion, the bank said in a statement that came ahead of a formal announcement in the case. The consumer portion of the settlement, the bank said, is expected to be “primarily in the form of loan modifications and other assistance to homeowners.”…

Make Banks Great Again? G.O.P. Push to Ax Key Agency Poses Risks

Posted by: | Comments-

Republicans face disagreement over how far changes should go

-

Banks may resist CFPB overhaul after costly compliance efforts

Richard Cordray.

Photographer: Alex Wong/Getty Images

Donald Trump and Republican lawmakers have made no secret of their desire to remove shackles put on banks by the Dodd-Frank Act, and taking an ax to the Consumer Financial Protection Bureau is one of their top priorities.

But transforming stump speeches that vilified Elizabeth Warren’s favorite regulator into actual change is easier said than done for a variety of reasons. They include disagreements among Republicans about how far to go and opposition to blowing up the CFPB from an unlikely source: bankers…

Deutsche Bank the Winner in Late Flurry of Mortgage Settlements

Posted by: | CommentsEuropean lenders’ end-of-year fines for troubled mortgage securities have confounded market expectations and left a clear winner: Deutsche Bank.

Although Barclays failed to achieve similar closure, settlements with the United States Justice Department by Deutsche, Germany’s largest lender by assets, and its peer Credit Suisse remove major question marks for both banks…

Deutsche Bank the Winner in Late Flurry of Mortgage Settlements

Prat-Gay Fired as Argentine Finance Minister After One Year

Posted by: | Comments-

Finance Ministry to split into two: Finance and Economy

-

Caputo will become Finance Minister, Dujovne Economy Minister

Alfonso Prat Gay

Photographer: Louis Lanzano/Bloomberg

Alfonso Prat-Gay was fired as Argentina’s Finance Minister Monday after just one year in the post as a long-heralded recovery in the economy fails to materialize.

The ministry he headed will now be split into two, with Luis Caputo, who was finance secretary, heading the new Finance Ministry and Nicolas Dujovne overseeing the Economy Ministry, Cabinet Chief Marcos Pena told a press conference in Buenos Aires. Prat-Gay’s spokeswoman Yael Bialostozky didn’t reply to calls seeking response…

Flurry of Settlements Over Toxic Mortgages May Save Banks Billions

Posted by: | Comments Deutsche Bank on Wall Street. Investors were relieved this week when the bank reached a $7.2 billion settlement with the Justice Department to end an investigation into the sale of toxic mortgage securities.CreditMark Kauzlarich/Bloomberg

Deutsche Bank on Wall Street. Investors were relieved this week when the bank reached a $7.2 billion settlement with the Justice Department to end an investigation into the sale of toxic mortgage securities.CreditMark Kauzlarich/Bloomberg

European banks have rushed to cut deals with prosecutors over longstanding claims that they pushed toxic mortgage securities in the years before the financial crisis.

The payouts are steep: Deutsche Bank and Credit Suisse said that they would disgorge nearly $13 billion combined to settle with the United States Justice Department.

Sales of New U.S. Homes Rise to Second-Fastest Pace Since 2008

Posted by: | CommentsPurchases of new U.S. homes increased in November to the second-fastest pace in almost nine years as the beginning of a spike in mortgage rates persuaded buyers to quickly sign contracts.

Sales rose 5.2 percent to a four-month high of a 592,000 annualized pace, Commerce Department data showed Friday. The median forecast in a Bloomberg survey was for a 2.1 percent gain to 575,000. The advance included the largest gain in the Midwest market since October 2012 and the fastest pace of demand in the West in almost nine years…

Sales of New U.S. Homes Rise to Second-Fastest Pace Since 2008

Credit Suisse to Pay $5.3 Billion to Resolve Mortgage Inquiry

Posted by: | Comments A Credit Suisse building in Milan. The bank said the settlement related to business primarily conducted from 2005 to 2007. CreditStefano Rellandini/Reuters

A Credit Suisse building in Milan. The bank said the settlement related to business primarily conducted from 2005 to 2007. CreditStefano Rellandini/Reuters

LONDON — Credit Suisse said on Friday that it had agreed to pay $5.3 billion to settle an investigation by the United States authorities into the packaging and sale of mortgages ahead of the global financial crisis eight years ago.

The announcement came a day after the Justice Department sued Barclays over the sale of toxic mortgage securities and Deutsche Bank separately said it had reached a tentative $7.2 billion deal to resolve an investigation into its sale of securities backed by residential mortgages…

Executive of the Year Spotlight: Stephen Furnary

Posted by: | Comments Stephen Furnary (pictured) received Honorable Mention for the 2016 Office Property Executive of the Year award.

Stephen Furnary (pictured) received Honorable Mention for the 2016 Office Property Executive of the Year award.

This article is one in a series of short articles profiling recipients of CPE’s Executives of the Year awards. Celebrating its 20th year, the program recognizes the contributions of commercial real estate’s top executives across all major business sectors and asset types.

First-place winners and honorable mention awardees are chosen by a confidential vote of the CPE 100, an invited group of industry leaders.

A Sudden Burst of Activity on Mortgage Litigation

Posted by: | CommentsIn the span of just 12 hours, three U.S. enforcement matters left over from the financial crisis made significant progress: Deutsche Bank AG and Credit Suisse Group AG separately announced that they would pay a combined $12.5 billion to resolve U.S. investigations into their sales of toxic mortgage debt, whereas Barclays Plc chose to roll the dice and let the Justice Department file a fraud lawsuit over its debt sales. Before these latest two deals, the U.S. investigations had already yielded more than $46 billion from six U.S. financial institutions…

Where Does the Mortgage Settlement Money Go?

Posted by: | Comments In 2014, Attorney General Eric H. Holder Jr. led a news conference about Bank of America’s $16 billion settlement. It was attended by such a large group of investigators that there was masking tape on the stage to show them where to stand.CREDITLAUREN VICTORIA BURKE/ASSOCIATED PRESS

In 2014, Attorney General Eric H. Holder Jr. led a news conference about Bank of America’s $16 billion settlement. It was attended by such a large group of investigators that there was masking tape on the stage to show them where to stand.CREDITLAUREN VICTORIA BURKE/ASSOCIATED PRESS

Since the 2008 housing crisis, federal regulators have touted billion-dollar settlements, which, by giving certainty to investors, are often accompanied by a jump in the bank’s stock price.

Financial companies have paid at least $164 billion in more than 100 mortgage-related settlements since 2009, according to an analysis by Keefe, Bruyette & Woods. Below, we examine the eight banks that have paid the most and explain how the largest payments were divided up…

McDonald’s HQ Project Receives $209M in Financing

Posted by: | Comments Tim Joyce, HFF

Tim Joyce, HFF

Chicago—A joint venture between Sterling Bay and institutional investors advised by J.P. Morgan Asset Management has received a $209 million construction loan for the development of 110 North Carpenter, the future 567,000-square-foot global headquarters of McDonald’s Corp. in Chicago’s Fulton Market District.

HFF arranged the financing on behalf of the development partnership, placing the construction loan with Bank of America and Wintrust Financial.

Energy Firms Forbes, Memorial Plan to Start 2017 With Bankruptcy

Posted by: | Comments-

Bonanza joins Forbes and Memorial on Friday to outline plans

-

About 24 listed companies have filed for bankruptcy in 2016

In the dying breaths of the year, the commodity price plunge claimed its latest victims as three energy companies outlined bankruptcy filing plans.

Forbes Energy Services Ltd., Bonanza Creek Energy Inc. and Memorial Production Partners LP will use the U.S. courts to restructure their borrowings, each said Friday in regulatory filings. Bonanza and Memorial will give current shareholders some recovery of their investments, while Forbes said it plans to allocate them nothing and cede control to senior bondholders…

In American Towns, Private Profits From Public Works

Posted by: | CommentsDesperate towns have turned to private equity firms to manage their waterworks. The deals bring much-needed upgrades, but can carry hefty price tags.

BAYONNE, N.J. — Nicole Adamczyk’s drinking water used to slosh through a snarl of pipes dating from the Coolidge administration — a rusty, rickety symbol of the nation’s failing infrastructure.

So, in 2012, this blue-collar port city cut a deal with a Wall Street investment firm to manage its municipal waterworks.

Four years later, many of those crusty brown pipes have been replaced by shiny cobalt-blue ones, reflecting a broader infrastructure overhaul in Bayonne. But Ms. Adamczyk’s water and sewer bill has jumped so much that she is thinking about moving out of town…

New York REIT Lands $760M Financing, Prepares to Sell Assets

Posted by: | Comments Worldwide Plaza, New York

Worldwide Plaza, New York

New York—New York REIT Inc., an office and retail REIT that is planning to liquidate, has closed on $760 million in financing from Credit Suisse secured by 12 assets that will be used to repay debt, buy the remaining equity interest in Worldwide Plaza and fund the company’s dissolution.

Canada Pension Board Sells NYC Building Stake for $1.03 Billion

Posted by: | CommentsCanada Pension Plan Investment Board sold its 45 percent stake in the former McGraw-Hill Building, part of the Rockefeller Center complex in midtown Manhattan, for $1.03 billion.

The buyer was a global institutional investor that wasn’t named. Rockefeller Group will keep the remaining 55 percent of 1221 Avenue of the Americas, and will continue to manage the 50-story, 2.6 million-square-foot (241,500-square-meter) tower, the pension fund said in a statement Friday. The transaction values the building at $2.29 billion…

Canada Pension Board Sells NYC Building Stake for $1.03 Billion

HFF Seals Largest Portland Office Deal in 2016

Posted by: | Comments Pacwest Center

Pacwest Center

Portland, Ore.—HFF recently closed the $170 million sale of Pacwest Center, a 545,000-square-foot office building in Portland’s central business district.

The company marketed the asset on behalf of the seller, The Ashforth Co. and an institutional investor. HFF also procured the buyer, LPC Realty Advisors I LP, on behalf of a pension fund client. The investment sales team was led my senior managing directors Nick Kucha and Michael Leggett, co-heads of HFF’s West Coast team…

Porsche Holding Wins Hedge Fund Lawsuit at German Top Court

Posted by: | Comments-

Plaintiffs sought damages over alleged market manipulation

-

Porsche Holding legal chief says pending cases to confirm view

Porsche Automobil Holding SE won a key legal victory in its effort to end years of litigation stemming from a failed attempt to take full control of Volkswagen AG in 2008.

Germany’s highest civil court dismissed an appeal by 19 hedge funds including Viking Global Equities LP, Glenhill Capital LP and David Einhorn’s Greenlight Capital Inc., Porsche Holding said Friday in a statement. The investors were seeking around 1.2 billion euros ($1.25 billion) in damages from alleged market manipulation triggered by short-selling transactions, swaps and options related to VW voting stock…

Islamic Development Bank Sets 2017 Budget at $5.2 Billion: SPA

Posted by: | CommentsThe bank also agreed to fund development projects in some member countries with total of $863 million, state-run Saudi Press Agency reports, citing a bank statement.

*The bank set the budget for its 2017 to 2019 work plan at $16 billion…

Islamic Development Bank Sets 2017 Budget at $5.2 Billion: SPA

JV Acquires 2 Properties in SF Financial District

Posted by: | CommentsCaesars Reorganization Back on Track After Lenders Reach Accord

Posted by: | CommentsCreditors of Caesars Entertainment Operating Co. resolved a standoff that had threatened to scuttle a plan to bring the casino giant out of bankruptcy.

Senior lenders to the insolvent company dropped their objection to the terms of the plan after Caesars filed revisions on Friday in Chicago federal court.

The lenders had been demanding changes to documents governing $2 billion in new debt that Las Vegas-based Caesars would issue to the group as part of its reorganization. Senior bondholders had opposed those changes, people familiar with the dispute said…

Caesars Reorganization Back on Track After Lenders Reach Accord

Greek Short-Term Debt Measures Can Go Ahead, Dijsselbloem Says

Posted by: | CommentsEurope’s stability fund can go ahead with short-term debt relief measures for Greece that will ease the nation’s payment obligations.

“I’m happy to conclude that we have cleared the way for the European Stability Mechanism to go ahead with the decision-making procedures for the short-term debt measures, which will be conducted in January,” Eurogroup Chairman Jeroen Dijsselbloem said in an e-mailed statement on Saturday, after he received a letter from Greek Finance Minister Euclid Tsakalotos…

Greek Short-Term Debt Measures Can Go Ahead, Dijsselbloem Says

Danny Queenan Moves Up the Ladder at CBRE

Posted by: | Comments Danny Queenan

Danny Queenan

Los Angeles—CBRE Global Investors has recently promoted Danny Queenan to the role of president of CBRE Global Investors. In this expansion of his role, Queenan will have executive responsibility for CBRE Global Investors’ regional businesses with the leaders of the Americas, EMEA, and Asia Pacific reporting directly to him.

437 Madison Ave. Welcomes 2 New Tenants

Posted by: | Comments 437 Madison Avenue

437 Madison Avenue

New York—Montgomery McCracken Walker & Rhoads LLP and Prelude Capital have signed two separate leases totaling 47,821 square feet of office space at the William Kaufman Org.’s (WKO) 437 Madison Ave.

Montgomery McCracken, a full-service law firm, inked a 10-year, 28,297-square-foot lease, consisting in a part of the 23rd floor and the entire 24th floor of the four-story tower. The law firm has been a subtenant at 437 Madison since 2011. The new direct lease will start in the first quarter of 2018. Michael Lenchner, vice president & director of leasing at Sage Realty Corp., the leasing and management division of WKO, represented the tenant in the long-term transaction…

U.S. Mortgage Rates Jump to More Than 2-Year High After Fed Hike

Posted by: | CommentsU.S. mortgage rates rose, with the 30-year reaching the highest level since April 2014, after the Federal Reserve increased its benchmark lending rate.

The average rate for a 30-year fixed mortgage was 4.3 percent, up from 4.16 percent last week, Freddie Mac said in a statement Thursday. The average 15-year rate climbed to 3.52 percent, the highest since January 2014, from 3.37 percent, the McLean, Virginia-based mortgage-finance company said…

U.S. Mortgage Rates Jump to More Than 2-Year High After Fed Hike

Calpers Cuts Investment Targets, Increasing Strain on Municipalities

Posted by: | Comments Officials with the California Public Employees’ Retirement System, Calpers, at a meeting on Monday. The pension system’s board voted Wednesday to cut projections for future investment returns.CreditJonathan J. Cooper/Associated Press

Officials with the California Public Employees’ Retirement System, Calpers, at a meeting on Monday. The pension system’s board voted Wednesday to cut projections for future investment returns.CreditJonathan J. Cooper/Associated Press

The board of California’s state public pension system, Calpers, voted Wednesday to lower expectations for future investment returns, a step that will increase pressure on the budgets of towns and cities across the state.

Private Lenders Step in to Fill the CMBS Gap

Posted by: | CommentsTurbulence in the CMBS market early in 2016 created refinancing opportunities for other commercial real estate lenders, which filled the void even as concerns over increasing federal regulations, rising interest rates and falling cap rates loomed.

“That volatility resulted in a number of opportunities for our company where we were able to step in and close short-term bridge financing on a number of deals that had been slated for short-term CMBS,” said Brendan Miller, principal, partner & chief investment officer at Thorofare Capital in Los Angeles, a middle-market loan origination and servicing company. “We were able to capture a large number of short-term opportunities where we were able to help borrowers that had a purchasing opportunity or a maturity.”…

The U.S. Government Is Collecting Student Loans It Promised to Forgive

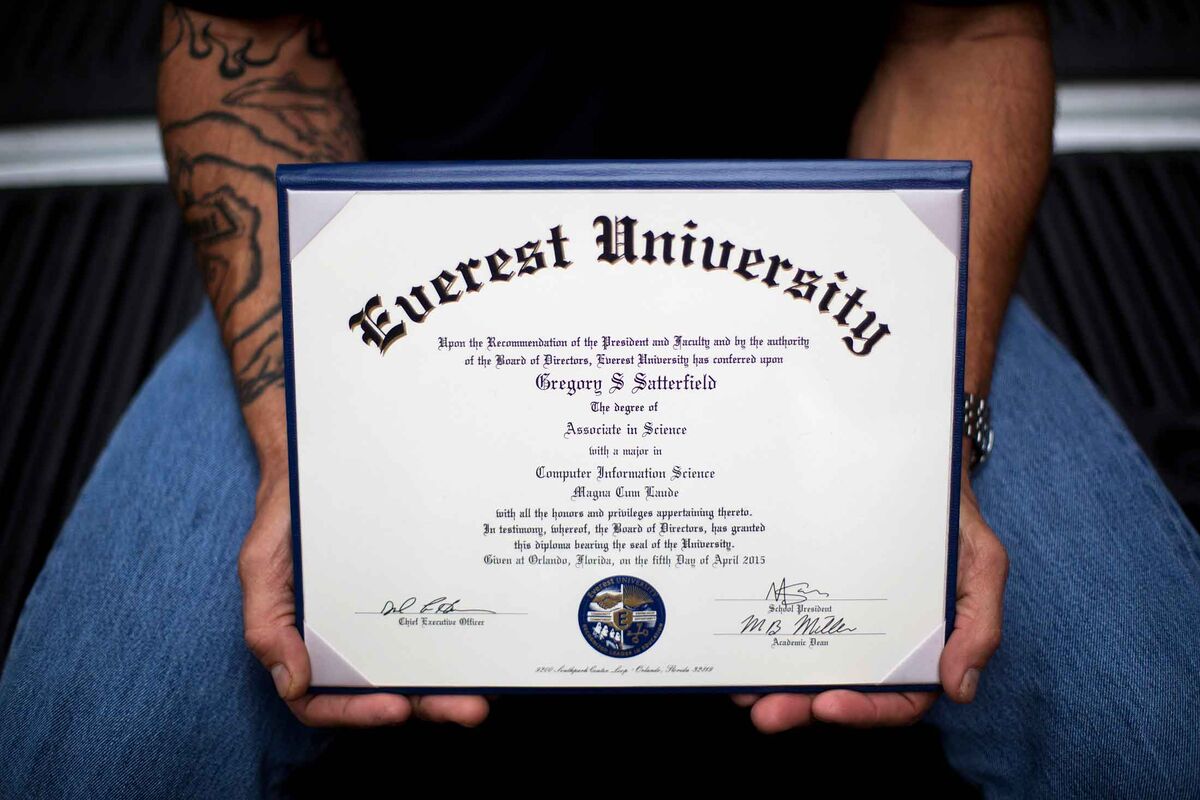

Posted by: | Comments Shane Satterfield, a roofer who owes more than $30,000 in debt for an associate’s degree in computer science from Corinthian Colleges holds his diploma in Atlanta. “I graduated in April at the top of my class, with honors,” says Satterfield, “And I can’t get a job paying over $8.50 an hour.”

Shane Satterfield, a roofer who owes more than $30,000 in debt for an associate’s degree in computer science from Corinthian Colleges holds his diploma in Atlanta. “I graduated in April at the top of my class, with honors,” says Satterfield, “And I can’t get a job paying over $8.50 an hour.”

The Obama administration has been actively seeking loan payments from thousands of former students eligible for a debt-forgiveness program.

The U.S. Department of Education has two quite different roles in the lives of indebted former students. The same bureaucracy that must safeguard taxpayer dollars by collecting $1.1 trillion in loans also oversees the nation’s largest-ever effort to forgive student debt.

After the Crisis, This Wall Street Lawyer Turned Fanboy Toy Maker

Posted by: | Comments Jordan Schwartz, a former finance lawyer, left Wall Street to start a company that makes collectibles for pop culture enthusiasts. CreditGeorge Etheredge for The New York Times

Jordan Schwartz, a former finance lawyer, left Wall Street to start a company that makes collectibles for pop culture enthusiasts. CreditGeorge Etheredge for The New York Times

The financial crisis of 2008 shook the nation and forced many on Wall Street to take stock of their careers. For Jordan Schwartz, a lawyer at the 224-year-old law firm Cadwalader, Wickersham & Taft, the turmoil led him to embrace his inner nerd.

Vornado Scores Big at Vintage Manhattan Building

Posted by: | Comments 85 Tenth Ave. in Manhattan

85 Tenth Ave. in Manhattan

New York—As part of a $625 million refinancing of 85 Tenth Ave. in Manhattan, Vornado Realty Trust has received $192 million and a 49.9 percent interest in the 11-story, 168,000-square-foot building.

Vornado received the $192 million from the refinancing proceeds in repayment of multiple loans to Related. In 2007, Vornado made $50 million in 11 percent payment-in-kind mezzanine loans, and in 2013 and 2014 the REIT funded an additional $23 million.

Hedge Fund Math: Heads We Win, Tails You Lose

Posted by: | Comments Thanks to William A. Ackman’s early successes, his longtime investors have fared much better than the more recent ones. CreditDrew Angerer for The New York Times

Thanks to William A. Ackman’s early successes, his longtime investors have fared much better than the more recent ones. CreditDrew Angerer for The New York Times

When do 1.5 and 16 add up to 72?

That’s the riddle confronting investors in Pershing Square Holdings Ltd., the closed-end fund run by the prominent activist investor Bill Ackman.

In a letter to investors this month, Mr. Ackman disclosed that through the end of November, the fund had declined 13.5 percent this year after accounting for fees. (Pershing Square Holdings shouldn’t be confused with Pershing Square L.P., Mr. Ackman’s hedge fund, although the two vehicles have the same investment strategy.)…

SF Office Building Changes Hands for $350M

Posted by: | Comments Foundry Square III in San Francisco

Foundry Square III in San Francisco

San Francisco—American Realty Advisors has acquired Foundry Square III, a Class A trophy office asset located in the heart of San Francisco’s Transbay District, from a development joint venture between Tishman Speyer and institutional investors advised by J.P. Morgan Asset Management, for $350 million.

The building is currently 100 percent leased to an impressive roster of tenants, including IBM, NASDAQ, Perkins Coie, Neustar and Silicon Valley Bank.

A Look at Four Multimillion-Dollar Estates With Helipads

Posted by: | CommentsTaking a helicopter to your vacation home is probably the most hassle-free way to commute, and it’s definitely the most expensive. (It’s also a surefire way to annoy your neighbors and ruin your foliage.) If you decide to make this your regular mode of transit, though, you’ll want a landing pad—and these properties each come armed with one ready for your personal Sikorsky. They’re spread around the world and vary dramatically in price, but each provides a small window into the culture of helicopter users in different corners of the globe…

Enhanced Resource Center to Lease Call Center in Minnesota

Posted by: | Comments ERC Headquarter,Jacksonville, Fla.

ERC Headquarter,Jacksonville, Fla.

Willmar, Minn.—Enhanced Resource Centers recently announced its plan to lease the former Kandiyohi Power Cooperative building at 1311 N. Highway 71 in Willmar, Minn. The company will use the property as a call center.

The company, which specializes in customer management, said it will create up to 238 new positions at the facility and invest $2 million in building improvements over the next three years. The Minnesota Department of Employment and Economic Development (DEED) is supporting the project with a $563,183 grant from the Job Creation Fund. The company will receive the funding once it meets investment and hiring commitments…

Paschi Drops Private Fund-Raising, Paving Way for State Rescue

Posted by: | Comments-

The world’s oldest bank failed to lure sufficient demand

-

The Italian cabinet may meet as early as Thursday evening

Banca Monte dei Paschi di Siena SpA, the world’s oldest lender, abandoned plans to raise 5 billion euros ($5.2 billion) from the market, making a state rescue likely.

Monte Paschi failed to lure sufficient demand from investors in a share sale that ended Thursday, the Siena-based bank said in a statement after the market closed. The bank said it was scrapping the entire capital plan, including the sale of bad loans and the debt-for-equity swap, without elaborating on what it will do next…

Barclays to Face Off Against U.S. Over ‘Craptacular’ Loans

Posted by: | Comments-

U.S. sues over defaults on billions in securitized mortgages

-

Investors were deceived about risk of securities, DOJ says

The U.S. Justice Department sued Barclays Plc for fraud over its sale of mortgage bonds after the bank balked at paying the amount the government sought in settlement negotiations.

The lawsuit announced on Thursday is rare for big banks, which typically negotiate a settlement with the government rather than risk drawn-out litigation and a possible trial. The breakdown in talks suggests that the bank is willing to take its chances with incoming enforcement officials in the Trump administration. The bank has lined up a law firm whose top lawyer is known for his aggressive defense of clients, including Lt. Col. Oliver North…

LePage Expects Vancouver Housing Correction in 2017

Posted by: | Comments-

Realtor says plummeting transactions herald correction

-

Single-family houses likely to face biggest declines

Vancouver’s long-awaited housing correction may be around the corner: prices are headed for a double-digit decline in 2017 as buyers drop out of the market, according to the head of Canada’s largest real estate services company.

“Home prices had gotten so out of whack with the growth in underlying wages and salaries that there had to be a correction,” said Phil Soper, chief executive officer of Royal LePage, a unit of Brookfield Real Estate Services Inc. “And it’ll happen in 2017.”

Spain’s Households Toast Mortgage Win While Italy’s See Bond Hit

Posted by: | Comments-

Borrowers may claim back thousands in overcharged interest

-

Court ruling puts more pressure on Spain’s struggling banks

Ivan Muniz is starting to think how he would spend the 6,000 euros ($6,300) he estimates he could win back from his bank for charging him too much for his Spanish mortgage.

“I would like to go traveling — to New York or maybe also London,” said Muniz, a steelworks quality-control inspector from Gijon in northern Spain. “It was time that someone put their fist down and said that what banks were charging wasn’t right.”

Platinum Partners Executives Become Most Predictable Arrests Ever

Posted by: | Comments![Rob Lavinsky, iRocks.com – CC-BY-SA-3.0 [CC BY-SA 3.0], via Wikimedia Commons](https://dealbreaker.com/uploads/2016/06/Platinum-54286.jpg) All that glitters… Rob Lavinsky, iRocks.com – CC-BY-SA-3.0 [CC BY-SA 3.0], via Wikimedia Commons

All that glitters… Rob Lavinsky, iRocks.com – CC-BY-SA-3.0 [CC BY-SA 3.0], via Wikimedia Commons

It seemed that Platinum Partners had the perfect, if somewhat morally dubious, strategy: Invest in the scandal-plagued and the Biblically usurious and the dying (the latter without their knowledge), and sextuple your clients’ money. It was, one delightfully understated Reuters source said, rather “aggressive,” perhaps not for the faint of heart, but all quite “within the limits of the law.”

It turns out, however, that such returns are not built only on legitimate scumminess, nor even mere kickbacks for union pension money. No, accomplishing Platinum Partners’ achievements allegedly required some more extra-legal means. Specifically, making up returns:

Credit Suisse Gives $5 Billion Justice Department Settlement A Hard Pass

Posted by: | Comments (Getty Images)

(Getty Images)

Let’s say you’re a major European bank still facing a multibillion-dollar fine over subprime-era mortgage misdeeds. At this juncture, you have two options. First, you can settle with the Obama Department of Justice, whose approach has favored big, eye-popping settlements in lieu of individual charges, with the possibility of not having to admit guilt.

Alternatively, you can hold out a month longer and see what happens under a Trump administration, which is essentially a giant question mark. The free-market conservative tilt of Trump’s cabinet appointments could signal a DOJ ready to retract its claws. But it’s equally conceivable that the Trump DOJ cranks up the populist-nationalist dial to 11…

J. Crew’s Debt Looms as Retailer Seeks to Regain First-Lady Glow

Posted by: | Comments-

Chain focusing on preppy heritage, Madewell brand, discounting

-

Some of company’s $2 billion in debt becomes current in 2018

J. Crew Group Inc. is heading into 2017 on a mission that gets more critical with each passing day: turn around a two-year sales slump or slam head-on into a wall of debt.

Some of the company’s $2 billion in debt becomes current in 2018, and J. Crew needs to revive its flagging business to stave off rising odds of default. To do that, the retailer is focusing on its preppy heritage, expanding its discount business and fueling the growth of its small but successful Madewell brand geared toward millennials. For some analysts, it may already be too late…

Lloyds to Buy Bank of America’s British Credit Card Business

Posted by: | Comments A branch of Lloyds Bank in London. The deal culminates years of upheaval and reorganization at the bank.CreditKirsty Wigglesworth/Associated Press

A branch of Lloyds Bank in London. The deal culminates years of upheaval and reorganization at the bank.CreditKirsty Wigglesworth/Associated Press

LONDON — Lloyds Banking Group will buy Bank of America’s British credit card business for about $2.4 billion, signaling a major turning point for Lloyds eight years after a government bailout.

The deal for the business, called MBNA Limited, will bolster Lloyds’s consumer finance business in Britain by adding about 7 billion pounds, or $8.7 billion, in assets. Lloyds also said its market share in the British credit card market would rise to more than a quarter from 15 percent, a level that would bring it closer to Barclays, the largest provider of credit cards in Britain with a share of nearly 30 percent…

Spanish Banks Lose EU Case on Mortgage Interest Repayments

Posted by: | Comments-

EU court ruling concerns ‘mortgage floors’ on Spanish loans

-

Threat of retroactive repayments weighed on banking industry

Spanish banks, including Banco Popular Espanol SA and Banco Bilbao Vizcaya Argentaria SA, may have to give back billions of euros to mortgage customers after a final ruling by the European Union’s top court. Bank shares tumbled by as much as 10 percent.

Borrowers who paid too much interest on home loans pre-dating a May 2013 Spanish ruling on so-called mortgage floors are entitled to a refund from their banks, judges at the EU Court of Justice ruled in Luxembourg Wednesday…

Investors Worry as Financial Picture of Italy’s Oldest Bank Deteriorates

Posted by: | Comments A customer in a Monte dei Paschi di Siena bank branch in Siena, Italy, last week. The bank’s shares plunged on Wednesday. CreditAlessia Pierdomenico/Bloomberg

A customer in a Monte dei Paschi di Siena bank branch in Siena, Italy, last week. The bank’s shares plunged on Wednesday. CreditAlessia Pierdomenico/Bloomberg

LONDON — Investors are increasingly sounding the alarms over Monte dei Paschi di Siena, the beleaguered Italian lender, as concerns mounted on Wednesday about its ability to raise new capital and avoid a government bailout.

The troubled Italian banking system, stuffed with dubious loans, has broadly put global policy makers and investors on alert for signs of a potential shock. And Monte dei Paschi, the country’s oldest bank, is in the weakest spot…

Lend Millennials Cash for Houses, Ontario Realtor Chief Says

Posted by: | Comments

Tim Hudak

Photographer: Galit Rodan/Bloomberg

The head of a realtor group in Canada’s largest province said he’d support a program that would lend first-time buyers cash to buy houses and get them out of their parent’s basement.

Tim Hudak, chief executive officer of the Ontario Real Estate Association, said Wednesday he liked the newest housing announcement from British Columbia Premier Christy Clark, who announced last week her province would match down-payments of as much as C$37,500 ($27,980), or 5 percent of the purchase price, for new buyers…

Lend Millennials Cash for Houses, Ontario Realtor Chief Says

World’s Biggest Wealth Fund Excludes 15 More Coal Companies

Posted by: | Comments-

New exclusions include Alliant, Tenaga, Emera and Westar

-

Fund places 11 companies on exclusion observation list

Norway’s $870 billion sovereign wealth fund expanded the list of miners and power producers excluded from its portfolio as it continues to cull its investments of coal-related businesses.

After an initial exclusion of 44 companies, 15 more have now been banned, including U.S.-based Alliant Energy Corp. and Westar Energy Inc., Malaysia’s Tenaga Nasional Bhd and Canada’s Emera Inc., according to a statement from Norges Bank Investment Management. The exclusions are based on new criteria introduced by the government in February, impacting companies that rely on coal for at least 30 percent of their activities or revenues…

Spanish Banks Ordered to Repay Customers Over Unfair Mortgages

Posted by: | Comments BBVA, one of Spain’s largest banks, said it expected a European Court of Justice ruling on Wednesday to reduce its profit by about 404 million euros. CreditAntonio Heredia/Bloomberg

BBVA, one of Spain’s largest banks, said it expected a European Court of Justice ruling on Wednesday to reduce its profit by about 404 million euros. CreditAntonio Heredia/Bloomberg

MADRID — Europe’s highest court ruled on Wednesday that customers of banks in Spain can reclaim billions of euros because lenders did not pass on savings from interest rate cuts on variable-rate mortgages, sending shares in several of the country’s top lenders crashing.

The ruling centered on the use of a “floor clause” in Spanish mortgage contracts during the aftermath of the global financial crisis. Such agreements meant that the interest rate on an adjustable-rate mortgage was always held above a predetermined level, regardless of how low central bank rates fell…

Big Banks Are Stocking Up on Blockchain Patents

Posted by: | Comments-

Established firms seek exclusive rights in threat to startups

-

Beyond techno-utopian roots, blockchain seen reshaping finance

In the headlong rush to revolutionize modern finance, blockchain enthusiasts are overlooking one potentially costly problem: their applications, built on open-source code, may actually belong to someone else.

Recently, some of the biggest names in business, from Goldman Sachs to Bank of America and Mastercard, have quietly patented some of the most promising blockchain technologies for themselves. Through mid-November, the number of patents that companies have obtained or said they’ve applied for has roughly doubled since the start of the year, according to law firm Reed Smith…

Blackstone Closes Senfina Hedge Fund After Losing 24% in 2016

Posted by: | Comments-

Parag Pande said to be leaving along with other fund managers

-

Fund wasn’t able to bounce back from a 17% loss in February

Blackstone Group LP, the largest manager of alternative assets, is closing its two-year-old Senfina Advisors after it lost 24 percent in 2016.

The $1.8 billion Senfina, which allocated money among a group of 11 portfolio managers, lost 6 percent last month alone, Bloomberg reported in December. It was a short-lived experiment for Blackstone, which started Senfina in 2014 as its first in-house, multi-manager fund…

Blackstone Closes Senfina Hedge Fund After Losing 24% in 2016

To Problems With China’s Financial System, Add the Bond Market

Posted by: | Comments A brokerage house in Shanghai in November. China’s stock market crashed last year, and its $9 trillion bond market is showing signs of distress. CreditAly Song/Reuters

A brokerage house in Shanghai in November. China’s stock market crashed last year, and its $9 trillion bond market is showing signs of distress. CreditAly Song/Reuters

SHANGHAI — Chinese officials cheered on the country’s stock market when it reached heady new highs, offering hope that it could become a new source of money to fix China’s economic problems. Then, last year, the market crashed.

Now another fast-growing part of China’s vast and increasingly complicated financial market is showing signs of distress: its $9 trillion bond market.

IguanaFix, an Argentine Start-Up, Raises $16 Million

Posted by: | CommentsRIO DE JANEIRO — IguanaFix, a home-services start-up based in Buenos Aires, has raised $16 million from Temasek Holdings, an investment company in Singapore, and Qualcomm Ventures.

The new financing round, which closed on Monday, will fuel the company’s expansion beyond its base, in particular in Brazil and Mexico, said Matias Recchia, the co-founder and chief executive of IguanaFix.

The company, founded in 2013, is an on-demand home improvement marketplace and service provider. It connects professionals like plumbers and electricians with consumers and retail stores. The company bears similarities to the Indian start-up Housejoy, which Qualcomm Ventures also backs…

Runaway Australian Property Market Shows First Signs of Cooling

Posted by: | Comments-

Sydney gains slowest since 2012, Melbourne weakest in a year

-

Population growth, wealth continue to underpin market

Offshore hedge fund managers and priced-out young Australians have long argued the pace of house price growth in the nation’s biggest cities is unsustainable. They may finally be right.

After two years of double-digit growth, the Sydney house price index gained just 3.2 percent in the year to September, the weakest increase since 2012, according to the latest government data. Melbourne’s rise of 6.9 percent was the slowest in more than a year…

Small Banks Also Charge Substantial Overdraft Fees, Report Says

Posted by: | CommentsSmall banks are not much better than big banks when it comes to the fees they charge customers who spend more than they have in their accounts.

That is the finding of a new report published on Tuesday by the Pew Charitable Trusts, which used “secret shoppers” to request information from 45 smaller banks from across the country, to examine their overdraft practices and penalty fees.

The findings are not surprising, said Lauren Saunders, associate director of the National Consumer Law Center. “Some smaller banks are far more addicted to overdraft fees than bigger banks,” she said…

No Respite in Sight for London’s Luxury-Homes Market in 2017

Posted by: | Comments-

Prime central homes sales dropped about 24% last year

-

Sellers had to accept price cuts of 10% to secure deals

Photographer: Luke MacGregor/Bloomberg

Photographer: Luke MacGregor/Bloomberg

If 2016 was a tough year for London’s luxury property market, 2017 may not provide any respite…

No Respite in Sight for London’s Luxury-Homes Market in 2017

Billionaire Steinmetz Under House Arrest on Bribe Suspicion

Posted by: | Comments-

Steinmetz has been barred from leaving Israel for 180 days

-

Israeli Steinmetz’s BSGR has always rejected bribery claims

Beny Steinmetz, the billionaire entangled in a long-running dispute over rights to one of the world’s most valuable mining assets, has been put under house arrest in Israel after being detained on suspicion of bribing Guinean government officials.

The 60-year-old, who made his fortune in the diamond trade, was detained on suspicion of bribery and money laundering, Israeli police said. Steinmetz was released to house arrest for two weeks on bail of 100 million shekels ($26 million), court documents show. His Israeli and French passports were confiscated and he was barred from leaving Israel for 180 days. Steinmetz didn’t appear in court…

Limited Stores Is Said to Plan for Bankruptcy and Possible Liquidation

Posted by: | Comments

A Limited store is shown in Brooklyn, New York.

Photographer: JB Reed/Bloomberg

Limited Stores is planning to file for bankruptcy within weeks and most likely liquidate its business, according to people with knowledge of the matter.

The struggling retailer has retained Kirkland & Ellis as its legal adviser, said the people, who asked not to be named because the hire is private. Guggenheim Securities and RAS Management Advisors have been hired to help with a debt restructuring and any asset sale, the people said.

Ringgit Dips to Weakest Level Since 1998 Asia Financial Crisis

Posted by: | Comments-

Current situation ‘is a turbulence, not a crisis’: Minister

-

Ringgit set to weaken further to 4.52, according to analysts

Malaysia’s ringgit touched its lowest level since the Asian financial crisis in 1998, as investors continue to sell down emerging-market assets and after a crackdown on currency speculators last month exacerbated outflows.

The ringgit declined as much as 0.1 percent to 4.4805 per dollar, a level unseen since January 1998, according to prices from local banks compiled by Bloomberg, before trading at 4.4802 at 1:47 p.m. in Kuala Lumpur. The current situation “is a turbulence, not a crisis,” and the Malaysian currency will eventually recover back to its fair value, Second Finance Minister Johari Abdul Ghani told reporters…