Archive for Uncategorized

Wells Fargo Ex-Managers’ Suit Puts Scandal Blame Higher Up Chain

Posted by: | Comments-

Area president may be highest-ranking alleged to direct scheme

-

Ex-branch managers claim workers taught to cheat, threatened

The lawsuits piling up against Wells Fargo & Co. over its fake accounts scandal have expanded to include three former branch managers alleging that an area president ordered employees to open bogus accounts to juice sales.

The area president, who may be the highest-ranking bank employee alleged to have directed the opening of fraudulent accounts, told employees to “do whatever it takes” to meet sales quotas and keep their jobs, according to the lawsuit…

Savills Studley Completes Leasing Transaction for Nutanix

Posted by: | Comments The Chesterfield building in Durham, N.C.

The Chesterfield building in Durham, N.C.

Durham, N.C.—Savills Studley, a commercial real estate firm specializing in tenant representation, recently completed a lease transaction for data center infrastructure solutions provider Nutanix Inc. The company will occupy 70,000 square feet of the 286,000-square-foot Chesterfield building, a redevelopment project by Wexford Science & Technology in Durham.

Jos. A. Bank’s Comeback Fuels Huge Rally for Tailored Brands

Posted by: | Comments-

Earnings top estimates after suit retailer cuts costs

-

The shares jump as much as 45 percent in wake of results

Jos. A. Bank, the suit retailer that saw sales plunge after abandoning its famous “buy-one-get-three-free” specials, is showing signs of a rebound far sooner than expected — setting off a 45 percent rally for its parent company.

Same-store sales at the chain are expected to grow by a percentage in the mid- to high-single digits during the fourth quarter, according to parent Tailored Brands Inc., which also owns Men’s Wearhouse. A brighter outlook led the retailer to boost the low end of its annual earnings forecast…

Jump in Oil Prices Makes Lending Ecuador $750 Million a Bit More Appealing

Posted by: | Comments-

B-rated credit said to sell 10-year bonds to yield 9.65%

-

New issue comes two days after Pemex raised $5.5 billion

Oil’s bounce past $50 a barrel is giving life to some beaten-up borrowers.

Ecuador, OPEC’s smallest member, sold $750 million of 10-year bonds to yield 9.65 percent, two days after Mexico’s state oil company saw more than $30 billion of bids for the $5.5 billion of notes it was selling. The demand shows investors warming up to the credits as oil recovers amid producer pledges to curb output…

Sonesta Selects Silicon Valley for First West Coast Property

Posted by: | Comments![]() Sonesta Silicon Valley, Milpitas, Calif.

Sonesta Silicon Valley, Milpitas, Calif.

Milpitas, Calif.—Sonesta International Hotels Corp., a global hospitality brand with more than 60 properties in seven countries, has chosen a 236-key, full-service hotel in California’s Silicon Valley for its first West Coast hotel in the country.

Sonesta Silicon Valley is located in Milpitas, Calif., near San Jose and Santa Clara and close to headquarters of major technology giants Cisco, Intel, Apple, Hewlett Packard and Google. It lies roughly 40 miles from downtown San Francisco and is expected to appeal to both business and leisure travelers. The hotel, the former Beverly Heritage Hotel, is approximately 5 miles from San Jose International Airport and convenient to Interstates 680 and 880 and Highway 101…

New Mexico Businessman Accused of Deceiving Low-Income Home Buyers

Posted by: | CommentsA New Mexico businessman claimed to help low-income Spanish-speaking families by finding them foreclosed homes to buy and, in some cases, financing the deals.

But the state’s attorney general on Wednesday said that Jesus Cano of Albuquerque deceived dozens of consumers by misrepresenting the conditions of the often poorly maintained homes he sold. Sometimes Mr. Cano sold houses he did not even own, the attorney general said, and at other times he tried to sell the same property to more than one family simultaneously…

New Mexico Businessman Accused of Deceiving Low-Income Home Buyers

Investors to Remain Disciplined in 2017

Posted by: | Comments John Kevill

John KevillTraders Caught Up in Wall Street Probes Switch to Shadow Banking

Posted by: | Comments-

At less regulated firms, ‘scarlet letter’ matters less

-

Fintech startups, small brokerages among beneficiaries

Some mortgage bond traders tangled up in investigations are moving into the shadow banking system, where their new employers have greater latitude to hire people with blemishes on their records.

More than 20 traders at big banks left their jobs, or were pushed out, amid a wave of U.S. government and internal bank probes into misconduct in the trading and pricing of mortgage bonds and other complex debt in recent years, according to a Bloomberg review of employment records. Many of those professionals caught in the dragnet since 2013 are finding their records tarnished even if they were never charged or left voluntarily. At least 10 have ended up at online lenders, privately held brokerages, and other less-regulated firms, interviews and documents show…

Automated Assistants Will Soon Make a Bid for Your Finances

Posted by: | Comments Ken Lin, chief executive of Credit Karma, which has been adding more financial features for customers, including free state and federal tax filings. CreditLaura Morton for The New York Times

Ken Lin, chief executive of Credit Karma, which has been adding more financial features for customers, including free state and federal tax filings. CreditLaura Morton for The New York Times

SAN FRANCISCO — In the classic science fiction series that began with “Ender’s Game,” the character Jane begins by using her artificial intelligence to prepare taxes for the hero Ender, but soon takes over management of his entire financial life.

When it comes to otherworldly science fiction personalities, Jane is a rather prosaic figure, but Ethan Bloch had her in mind when he began his start-up Digit.

Glam Renovation Planned for Scottsdale Shopping Mall

Posted by: | Comments Scottsdale Fashion Square (PRNewsFoto/Macerich)

Scottsdale Fashion Square (PRNewsFoto/Macerich)

Scottsdale, Ariz.—Macerich has big plans for its most upscale shopping center in the Greater Phoenix area.

The Santa Monica, Calif.-based retail developer and operator is set to embark on a phased project that aims to enhance the iconic Scottsdale Fashion Square, one of the top 10 most profitable shopping malls in the country.

JPMorgan Hit Hardest as EU Fines Euribor Trio $521 Million

Posted by: | Comments-

Firms shunned Euribor settlement, got formal complaint in 2014

-

Fines follow global scandal over benchmark manipulation

JPMorgan Chase & Co., HSBC Holdings Plc and Credit Agricole SA were fined a total of 485.5 million euros ($521 million) for rigging the Euribor benchmark as European Union antitrust regulators wrapped up a five-year investigation into the scandal.

The trio colluded to rig the Euribor rate and exchanged sensitive information to suit their trading positions in correlated derivatives markets, in breach of EU antitrust rules, the European Commission said on Wednesday in an e-mailed statement. JPMorgan was fined 337.2 million euros, HSBC got a 33.6 million-euro penalty and Credit Agricole must pay 114.7 million euros…

DST Global Leads $80 Million Private Investment in Nubank

Posted by: | CommentsRIO DE JANEIRO — DST Global, the investment firm started by a Russian venture capitalist, Yuri Milner, has led an $80 million private investment in a Brazilian start-up called Nubank, the company is expected to announce this week. The new financing suggests that despite Brazil’s political and economic upheaval, the financial technology sector remains a bright spot.

Peter Thiel’s Founders Fund, QED Investors, Sequoia Capital and Tiger Global Management, all prior investors in Nubank, also joined the investment round, which closed in late November, David Velez, the company’s founder and chief executive, said in an interview…

U.K. House Prices Pick Up Even as Confidence Hits Three-Year Low

Posted by: | Comments-

Values rise annual 6.6% in November to average 218,002 pounds

-

Supply of new homes is historically very low, Halifax says

Growth in U.K. home prices accelerated in November as the market overcame a stamp-duty surcharge and mortgage-approval rates picked up, though confidence slid to a three-year low.

Values rose 6.6 percent in November from a year earlier, according to data published by mortgage lender Halifax on Wednesday. Prices were up 0.2 percent on the month, the third consecutive increase, pushing the average cost of a home to 218,002 pounds ($275,000). Meanwhile, the supply of new homes remained historically “very low,” Halifax said…

If You Voted for Trump, It’s Time to Buy a House

Posted by: | CommentsIn the housing market, perception often creates its own reality. Investors will bid up values in anticipation of a rezoning effort that allows for new development. Lenders tighten credit standards in anticipation of new regulations. And voters—at least according to one new survey—get bullish when their candidate wins.

During the last week of October, when Hillary Clinton was ahead in the polls, Trulia commissioned surveys of 2,000 Americans. Respondents who identified themselves as Republicans said that 2017 would be worse than 2016 for selling a home, buying a home, getting a mortgage, or finding rental housing. Democrats thought that 2017 would be better in each of those categories. After Donald Trump’s surprise electoral college win, outlooks for Republican and Democratic respondents flipped—in every category…

Liberty Property Trust Inks Atlanta Lease with American Furniture Rental

Posted by: | Comments Breckinridge Business Center

Breckinridge Business Center

Duluth, Ga.—Liberty Property Trust, a commercial real estate company focusing on development, acquisition, ownership and management of office and industrial properties, has announced that the company has inked a 34,910-square-foot lease with American Furniture Rental at Breckinridge Business Center, owned by Liberty.

Located at 1700 Executive Drive in Duluth, Ga., the building is now 100 percent leased following the agreement. The overall warehouse and distribution property features 201,596 square feet with 334 parking stalls…

Liberty Property Trust Inks Atlanta Lease with American Furniture Rental

Emaar’s Alabbar Sees Dubai Property Market Rebalancing Next Year

Posted by: | CommentsDubai’s real-estate market will see a “rebalancing” between supply and demand into next year, according to the head of the emirate’s largest developer.

The company expects growth next year even amid the correction in the housing market, Emaar Properties PJSC Chairman Mohamed Alabbar said Wednesday at the Bloomberg Markets Most Influential summit in Abu Dhabi. He’s targeting expansion in India and said that Egypt remains a good market for Emaar…

Emaar’s Alabbar Sees Dubai Property Market Rebalancing Next Year

Angelo, Gordon Closes $850M Asia Realty Fund III

Posted by: | Comments Wilson Leung, managing director & head of Angelo, Gordon’s Asian real estate

Wilson Leung, managing director & head of Angelo, Gordon’s Asian real estate

New York—Angelo, Gordon & Co. has announced the closing of its AG Asia Realty Fund III, with total capital commitments of $850 million, exceeding the original target amount of $750 million.

“We are grateful for the strong support we received from new and existing limited partners to close our third fund,” said Wilson Leung, managing director & head of Asian real estate at Angelo, Gordon, in prepared remarks. “We continue to see highly compelling real estate investment opportunities in Japan, Korea and Greater China and believe our deep, longstanding relationships with our local operating partners positions us well to generate attractive returns.”

AAA Grades Return for Securities Backed by Riskier Mortgages

Posted by: | Comments-

More than $210 million of the home-loan bonds to be sold

-

Bonds backed by mortgages made by Lone Star unit, and others

Two ratings firms are assigning AAA grades to bonds backed by riskier, recently made home loans, one of the few times since the financial crisis that such securities have won top marks.

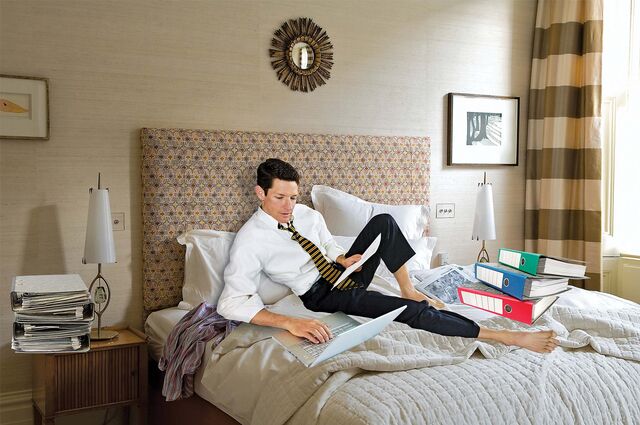

The Home Office Is Dying

Posted by: | Comments Photo illustration: 731; Photographs: Alamy (1), Getty Images (2)

Photo illustration: 731; Photographs: Alamy (1), Getty Images (2)Zac Atkinson keeps a desk in the corner of the living room of his one-bedroom apartment in Studio City, Calif. Not that he uses it much: The work-from-home television writer migrates from couch to kitchen table and back again as he churns out scenes for animated children’s programs. “The folks from the generation before me tend to have more of an office,” says Atkinson, 32. “Most people I know end up sitting on the sofa, and half the time the TV is on when they’re working.”

Wells Fargo Killing Sham Account Suits by Using Arbitration

Posted by: | Comments Jennifer Zeleny is suing Wells Fargo in federal court in Utah, along with about 80 other customers, over unauthorized accounts. CreditKim Raff for The New York Times

Jennifer Zeleny is suing Wells Fargo in federal court in Utah, along with about 80 other customers, over unauthorized accounts. CreditKim Raff for The New York Times

In congressional hearing rooms and on national television, Wells Fargo has vowed to make things right for the thousands of customers who were given sham accounts.

The bank’s new chief executive, Timothy J. Sloan, in his first week on the job, said his “immediate and highest priority is to restore trust in Wells Fargo.”

But in federal and state courtrooms across the country, Wells Fargo is taking a different tack…

Hines Acquires Flagship Retail Asset in Italy

Posted by: | Comments Hines Buys Via Torino Asset in Milan

Hines Buys Via Torino Asset in MilanThe 35,500-square-foot building is situated in the heart of the city’s historical center, in proximity to Piazza Duomo and Corso Vittorio Emanuele. The property is fully leased and its retail units front one of the busiest streets in Milan. One of the tenants, Italian shoemaker Geox, chose this location for its flagship store in Italy.

Nigeria Plans $3.2 Billion Capitalization for Farming Lender

Posted by: | Comments

This photo taken on June 20, 2016 shows young Nigeriens picking melons in a field by the River Yobe, known locally as the Komadougou, near Diffa. After the region’s governor forbid access to farmable areas, evacuated all populations of islands in Lake Chad (25,000, part of which took refuge in Diffa), suspended trade of the main local wealth and instituted a night curfew following constant attacks by Boko Haram fighters, most farmers have now turned into displaced people depending on international aid. / AFP / ISSOUF SANOGO (Photo credit should read ISSOUF SANOGO/AFP/Getty Images) Photographer: Issouf Sanogo/AFP via Getty Images

As Avianca Weighs Bids, Hedge Fund Plays Unusual Role: Diplomat

Posted by: | Comments Germán Efromovich, right, the largest investor in Avianca Holdings, watched as the airline’s stock began trading on the New York Stock Exchange in 2013. CreditRichard Drew/Associated Press

Germán Efromovich, right, the largest investor in Avianca Holdings, watched as the airline’s stock began trading on the New York Stock Exchange in 2013. CreditRichard Drew/Associated Press

Trouble was brewing this summer at Avianca Holdings, Latin America’s second-biggest airline.

Tight on cash, the airline needed to raise money. For many on the board, one option was selling part of the company.

The company’s largest investor — a swashbuckling, Bolivian-born entrepreneur, Germán Efromovich — had other ideas. The airline was the thread holding together the remnants of his once-powerful empire spanning oil and gas businesses, shipyards, hotels and airlines. He was not about to let it go without a fight…

Verizon Retailer Expands in Connecticut

Posted by: | Comments Verizon Premiun retailer, North Haven, Conn.

Verizon Premiun retailer, North Haven, Conn.

North Haven, Conn.—A Verizon Premium retailer has recently opened a new store at 100 Washington Ave. in North Haven, Conn. The new store marks Cellular Sales’ eight location in Connecticut.

The exponential growth from a single store in Knoxville, Tenn., to 570 stores nationwide has earned Cellular Sales a spot on Inc. Magazine’s Inc. 5,000 list, which recognizes the nation’s fastest-growing, privately owned retailers for eight of the past nine years. Cellular Sales currently employs 4,500 people across 30 states…

From Hot to Not, Investors Exit Gold Funds in Switch to Equities

Posted by: | Comments-

Precious-metals ETFs see fastest cash outflow since May 2013

-

After early 2016 gain for bullion, Trump election dims outlook

Donald Trump has not been good to gold.

After starting 2016 as the world’s hottest commodity, bullion’s prospects have dimmed since the election and investors are pulling money out at the fastest rate in three years.

Over the past month, exchange-traded funds backed by precious metals saw a net outflow of $6.24 billion as gold prices tumbled to a 10-month low, according to data compiled by Bloomberg. As the money exited, ETFs tied to equity markets saw an inflow of $75.81 billion, helping to send the Standard & Poor’s 500 Index to an all-time high…

Supreme Court Case Has Bankruptcy World on Edge

Posted by: | Comments Jevic Transportation trucks at the company’s Delanco, N.J., headquarters in 2008. The company filed for bankruptcy two years after a leveraged buyout by Sun Capital Partners, which former employees say heaped too much debt on its books. CreditMel Evans/Associated Press

Jevic Transportation trucks at the company’s Delanco, N.J., headquarters in 2008. The company filed for bankruptcy two years after a leveraged buyout by Sun Capital Partners, which former employees say heaped too much debt on its books. CreditMel Evans/Associated Press

The Supreme Court will hear arguments on Wednesday in a case that could upend the common practice that ranks lenders, employees and other creditors in order of priority as they try to recover their money when a company files for bankruptcy.

Long View Equity Acquires the Houston Building in Northwest Austin

Posted by: | Comments Houston Building, Austin, Texas

Houston Building, Austin, Texas

Austin, Texas—Local real estate investment firm Long View Equity is the new owner of the Houston Building in northwest Austin. Scott Herbold with CBRE Capital Markets’ Investment Properties team represented the buyer, while Todd Gold with REOC San Antonio represented the seller. The financial details of the transaction were not disclosed.

The three-story, multi-tenant office building is located at 9015 Mountain Ridge Drive and offers 34,432 square feet of space. At the time of the deal, the asset was 100 percent leased to a mix of tenants in the medical, technology and real estate fields…

Busy Bankruptcy Lawyers Put Egypt Economic Overhaul on Notice

Posted by: | Comments-

Rising costs, struggling firms create conditions for unrest

-

Government has promised stimulus plan to tackle slowdown

Salama Faris is in demand these days, and that’s bad news for the Egyptian economy.

The bankruptcy lawyer has received a flurry of phone calls since authorities abandoned currency controls and raised energy prices in an effort to ease a dollar shortage crippling the economy. Some asked about the legal consequences of defaulting on liabilities. Others were concerned that surging costs may force them to shut companies.

“Everything is becoming more expensive and many businesses are struggling,” Faris said in an interview in Cairo…

Duke Realty Expands Northeast Team with New VP

Posted by: | Comments 801 W. Linden Ave., Linden, N.J., a Duke Realty industrial property

801 W. Linden Ave., Linden, N.J., a Duke Realty industrial property

Conshohocken, Pa.—Duke Realty Corp.’s Northeast Region office has recently appointed Benjamin Rosen as vice president of leasing and development for the New Jersey area. Rosen brings more than eight years of commercial real estate experience to the table, and will oversee the company’s 2.5 million-square-foot New Jersey industrial portfolio, with the goal of expanding it through new development and investment opportunities.

Regency Breaks Ground on New Jersey Retail Project

Posted by: | Comments Chimney Rock, Whole Foods, courtesy of Regency Centers

Chimney Rock, Whole Foods, courtesy of Regency Centers

Bridgewater, N.J.—Bridgewater, N.J., will soon have a new shopping destination, courtesy of a $70 million project by Regency Centers Corp. The REIT just broke ground on Chimney Rock, a 218,000-square-foot, grocery-anchored shopping center in the greater New York City metro area.

Goldman Sachs Alum Turns to Virtual Reality to Sell $57 Million Mansion

Posted by: | CommentsStanding in the living room of an oceanside $57.5 million home in Malibu, Calif., Jack Ryan, the founder of REX, an online brokerage, took in the view.

“The only way you can sell a house like this,” he said, as the shimmer of the Pacific glinted off gleaming white lawn furniture outside, “is have them walk through it, either physically or virtually.”…

Goldman Sachs Alum Turns to Virtual Reality to Sell $57 Million Mansion

Charleston-Area Industrial Asset Changes Hands for $41M

Posted by: | Comments Charleston Gateway Distribution Center, Summerville, S.C.

Charleston Gateway Distribution Center, Summerville, S.C.

Summerville, S.C.—HFF closed the sale of a Class A, 615,650-square-foot warehouse, distribution and freezer storage complex in the Charleston-area community of Summerville for a price tag of $41 million. The property was sold by J.L. Woode Ltd. to CenterPoint Properties. HFF Senior Managing Director Chris Norvell led the investment sales team representing the seller.

MAA, Post Properties Complete Merger

Posted by: | Comments Cityscape at Market Center II in Plano, Texas, an MAA property

Cityscape at Market Center II in Plano, Texas, an MAA property

Memphis, Tenn.—MAA and Post Properties Inc. have completed their merger, creating a company that has an equity market capitalization of about $11 billion and a total market capitalization of roughly $15 billion, the companies announced late last week. The combined company, headquartered in Memphis, will retain the MAA name and will continue to trade under the symbol “MAA” on the NYSE.

NYC’s Tallest Luxury Tower Is Discounting Condos by Millions

Posted by: | Comments-

Buyers at 432 Park Ave. getting an average 10% price cut

-

Lewis Sanders purchases $60.9 million penthouse at markdown

Buyers at Manhattan’s tallest ultra-luxury condo tower are getting discounts worth millions, a sign of the times in a market that’s swamped with costly homes.

At 432 Park Ave., buyers who signed contracts and completed those purchases this year got price reductions averaging 10 percent, according to an analysis by appraiser Miller Samuel Inc. In one of the most recent big transactions to close, a penthouse on the 88th floor sold for $60.9 million, a 20 percent markdown from what developers initially sought, city property records made public Dec. 2 show…

Two Sigma Taking Crowdsourcing Approach To Trading Algorithms

Posted by: | Comments The efficient markets hypothesis has been around longer than the average hedge fund trader has been alive. As the theory goes, swarms of market participants immediately incorporate economic data and business news into asset prices, making it tough for your average trader to edge out average returns. To outperform, you have to be remarkably savvy, uncommonly well-connected, or – as successful funds like Two Sigma, Citadel and Renaissance prove – a computer.

The efficient markets hypothesis has been around longer than the average hedge fund trader has been alive. As the theory goes, swarms of market participants immediately incorporate economic data and business news into asset prices, making it tough for your average trader to edge out average returns. To outperform, you have to be remarkably savvy, uncommonly well-connected, or – as successful funds like Two Sigma, Citadel and Renaissance prove – a computer.

Bollocks to all that, says Two Sigma. Bloomberg has the story:

Two Sigma Taking Crowdsourcing Approach To Trading Algorithms

David Ortiz Has Private-Equity Plan To Save Baseball, Become Even Richer

Posted by: | Comments![By Waldo Jaquith from Charlottesville, VA, United States (Flickr) [CC BY-SA 2.0], via Wikimedia Commons](https://dealbreaker.com/uploads/2016/12/ortiz-300x200.jpg) By Waldo Jaquith from Charlottesville, VA, United States (Flickr) [CC BY-SA 2.0], via Wikimedia Commons

By Waldo Jaquith from Charlottesville, VA, United States (Flickr) [CC BY-SA 2.0], via Wikimedia Commons

As investors, baseball players are batting significantly less than .300, at least when they aren’t using performance enhancers. Jorge Posada lost a tenth of everything he madeduring his career investing in a hedge fund that he didn’t know was a hedge fund run by two guys who didn’t know how to run a hedge fund. His former teammate Alex Rodriguez’s high-profile bid to get into finance also seems to have gone nowhere, judging by how much time A-Rod had to spend trying to figure out what Pete Rose was saying on television this October.

R.B.S. Reaches Agreement to Settle Rights Issue Litigation

Posted by: | Comments Ross McEwan, chief executive of the Royal Bank of Scotland. CreditChris Ratcliffe/Bloomberg

Ross McEwan, chief executive of the Royal Bank of Scotland. CreditChris Ratcliffe/Bloomberg

LONDON — The Royal Bank of Scotland said on Monday that it had reached an agreement to settle a majority of shareholder claims over a rights issue by the lender before its near collapse in 2008.

The litigation was related to the bank’s raising of 12 billion pounds, or about $15 billion at current exchange rates, weeks before it was rescued by the British government. R.B.S., which remains 73 percent owned by the British government, received a £45 billion bailout that year…

SBE Closes Purchase of Morgans Hotel Group

Posted by: | Comments Sam Nazarian, SBE

Sam Nazarian, SBEHoy Enterprise, has completed the acquisition of Morgans Hotel Group, SBE announced late last week. The transaction more than doubles the number of hotels in SBE’s portfolio.

The expanded company, which will continue to operate under the SBE names, controls a total of 135 assets, an SBE spokesperson told Commercial Property Executive: 22 hotels and residences (residences are connected to hotels), 71 restaurants and 42 nightlife venues…

Downtown Denver Office Towers Command $154M

Posted by: | Comments Dominion Towers, Denver

Dominion Towers, Denver

Denver—Franklin Street Properties Corp. has acquired Dominion Towers, two interconnected 19- and 28-story Class A office towers in Denver, for approximately $154 million.

“We are pleased to expand our footprint further in Denver with this off-market acquisition,” Jeffrey Carter, Franklin Street president & CIO, said in a prepared release. “We believe that the acquisition of Dominion Towers will provide additional opportunities for value creation by growing our presence in downtown Denver to almost 2 million rentable square feet.”

How Big Banks Are Putting Rain Forests in Peril

Posted by: | Comments Young orphaned orangutans on a climbing expedition with their keeper at International Animal Rescue’s orangutan school in West Kalimantan, Indonesia. CreditKemal Jufri for The New York Times

Young orphaned orangutans on a climbing expedition with their keeper at International Animal Rescue’s orangutan school in West Kalimantan, Indonesia. CreditKemal Jufri for The New York Times

In early 2015, scientists monitoring satellite images at Global Forest Watch raised the alarm about the destruction of rain forests in Indonesia.

Environmental groups raced to the scene in West Kalimantan province, on the island of Borneo, to find a charred wasteland: smoldering fires, orangutans driven from their nests, and signs of an extensive release of carbon dioxide into the atmosphere.

ECB Buys Record Amount of Debt as QE Frontloaded Before Holidays

Posted by: | Comments-

Total debt purchases jump to 85.4 billion euros in November

-

ECB publishes monthly breakdown of asset-purchase program

The European Central Bank bought a record monthly amount of assets under its quantitative-easing program in November in an attempt to frontload purchases before market liquidity may dry up during the holiday season.

The ECB bought a total of 85.4 billion euros ($91.6 billion) of debt last month even as the pace of purchases of government bonds, which represent the bulk of the program, dropped to 70.1 billion euros from 73 billion euro in October, ECB data published on Monday showed. An increase in monthly buying of covered bonds, asset-backed securities and corporate debt helped to make up for the difference…

Red State Homes Are Luring Young Blue Buyers Inland

Posted by: | CommentsDayton, Ohio, gave the world the Wright Brothers and the electric cash register. As recently as 1990, manufacturing jobs there were the backbone of the local economy. But in the two decades since, the area has lost thousands of blue-collar jobs, and the local housing market still wears the scars of the foreclosure crisis.

Those attributes make the city representative of the Rust Belt malaise that carried Donald Trump to his electoral college victory. Montgomery County, composed of Dayton and its environs, opted for President Barack Obama in 2008 and 2012. This year, the county favored Republican Trump over Democratic nominee Hillary Clinton by 1.3 percentage points, or about 3,000 votes…

Silicon Valley Chiefs Notably Absent From Trump’s Cabinet of Business Advisers

Posted by: | CommentsIn President-elect Donald J. Trump’s newly named kitchen cabinet of business advisers, Wall Street is in. Silicon Valley is out.

Mr. Trump has named 16 business leaders to serve on what’s being called the President’s Strategic and Policy Forum, described as a group meant to guide his administration on economic matters.

The list is notable for leaning toward New York executives and industries — finance in particular. The list echoes Mr. Trump’s picks for a number of major economic positions, including Treasury secretary (the former Goldman Sachs partner and hedge fund manager Steven T. Mnuchin) and commerce secretary (the billionaire investor Wilbur L. Ross)…

QIA Pays $175M for The St. Regis San Francisco

Posted by: | Comments The St. Regis San Francisco

The St. Regis San Francisco

San Francisco—And the buying binge continues. Qatar Investment Authority just added another gem to its ever-growing U.S. portfolio with the purchase of The St. Regis San Francisco. The sovereign wealth fund of the State of Qatar acquired the 260-key hotel from Marriott International Inc., in a transaction valued at approximately $175 million.

According to a report released by commercial real estate services firm JLL in 2005—the same year the St. Regis opened its doors—the property cost roughly $130 million to develop.

Morgan Stanley Raises Hurdles for Brokers’ Compensation

Posted by: | Comments-

Some said to face revenue threshold about 10% higher

-

Top of the sliding scale of $5 million remains unchanged

Morgan Stanley changed its compensation plan, forcing some of its brokers to generate more revenue to avoid a pay cut next year, according to a person with knowledge of the move.

Bonus levels on the firm’s compensation grid — a sliding scale that determines the percentage of gross revenue a broker gets to keep — will increase by about 10 percent, said the person, who asked not to be identified speaking about personnel matters. In one example, a broker must produce at least $242,000 in 2017 revenue to reach a 32 percent payout, up from $220,000 this year…

Markets Weather Italy Referendum Result, but Banks Are Vulnerable

Posted by: | CommentsFinancial markets were stoic on Monday after Italian voters decisively rejected changes to their country’s Constitution intended to speed government decision-making and spur Italy’s stagnant economy.

Stocks in Europe and the United States rose, and the euro recovered from early losses — a reaction that was muted in part because opinion polls had predicted the “no” vote, giving investors time to adjust their portfolios, and also because political instability in Rome is not exactly unusual.

But analysts said the potential for market turmoil remained if the vote resulted in a long period of government paralysis and delayed plans to fix Italy’s ailing banks, whose shares fell sharply on Monday…

Nike Signs Blockbuster Lease on Fifth Avenue

Posted by: | Comments 650 Fifth Avenue

650 Fifth AvenueThe partnership signed a 15-year lease for the entire retail portion at 650 Fifth Ave. with Nike, which had been exploring new location opportunities for at least three years. The lease starts at nearly $35 million and is worth a combined $700 million over the term, The Real Deal reported. Cushman & Wakefield represented Nike in the deal.

Vancouver Tax Pushes Chinese to $1 Million Seattle Homes

Posted by: | Comments-

Toronto also a lure after 15% levy on foreign purchases

-

Buyers look for value: ‘Why pay more for the same thing?’

Just a few days after Vancouver announced a tax on foreign property investors, Seattle real estate broker Lili Shang received a WeChat message from a wealthy Chinese businessman who wanted to sell a home in Canada and buy in her area.

After a week of showings, he purchased a $1 million property in Bellevue, across Lake Washington from Seattle. He soon returned to buy two more, including a $2.2 million house in Clyde Hill paid for with a single cashier’s check…

4 Bank Challenges for Italy’s Next Prime Minister

Posted by: | CommentsCleaning up Italy’s banks is an opportunity ripe for the wasting. The failed referendum on Sunday need not cause a crisis if UniCredit completes its rights issue and fellow lender Banca Monte dei Paschi di Siena can be quickly stabilized. Political turmoil and weak growth, though, could push up bad loan levels, and the political will to fix them may be lacking.

The collapse of Prime Minister Matteo Renzi’s government comes at a bad time for Italian lenders, which are collectively creaking with about 350 billion euros (about $377 billion) of bad and doubtful loans. The outgoing prime minister’s replacement will face four challenges…

American Shale Companies’ Rush to Hedge Is Turning the Oil Market Upside Down

Posted by: | Comments-

Oil futures curve flattens as producers hedge 2017-2019 output

-

WTI options volume surged to record after OPEC announced cut

U.S. shale oil companies are using the post-OPEC rally to hedge their oil price risk for next year and 2018 above $50 a barrel, bankers, merchants and brokers said, pushing the forward oil curve upside down.

The rush to hedge — locking in future cash flows and sales prices — could translate into higher U.S. oil production next year, offsetting the first output cut by the Organization of Petroleum Exporting Countries in eight years. As such, the producer group could end up throwing a life-line to a sector it once tried to crush…

Panama Struggles to Shed Its Image as a Magnet for Shady Deals

Posted by: | Comments A police officer stood guard at the entrance of the Mossack Fonseca law firm office in Panama City in April.CreditCarlos Jasso/Reuters

A police officer stood guard at the entrance of the Mossack Fonseca law firm office in Panama City in April.CreditCarlos Jasso/Reuters

In August of last year, Panama sought to shed its image as a magnet for shady deals and narco traffickers by paying at least $2 million to host the world’s largest anticorruption conference, now taking place in Panama City.

At the time, it seemed like good idea.

RealtyShares Recruits Leader for New Debt Platform

Posted by: | Comments Bill Lanting, RealtyShares’ new VP of commercial debt origination.

Bill Lanting, RealtyShares’ new VP of commercial debt origination.

RealtyShares has hired Bill Lanting as vice president of commercial debt originations, as the real estate crowdfunding online marketplace looks to expand its presence.

Lanting will head the expansion of the platform’s commercial debt product.

“What’s interesting about RealtyShares is that No. 1, they have been very successful in the last three years establishing a huge deal volume, which surprised me,” Lanting told Commercial Property Executive. “What I am looking forward to more than anything else is establishing a solid foundation of institutional capital so that we can scale this business up considerably more than we could if we were simply relying on the crowd.”

Billionaire Li Ka-Shing Bids $5.4 Billion for Australia’s Duet

Posted by: | Comments-

Cheung Kong Infrastructure offers A$3 per share in cash

-

CKI may need local partner to secure Australia’s approval: RBC

Billionaire Li Ka-shing.

Photographer: Justin Chin/Bloomberg

Hong Kong billionaire Li Ka-shing’s Cheung Kong Infrastructure Holdings Ltd. offered A$7.3 billion ($5.4 billion) in cash for Australia’s Duet Group as it seeks to expand its power and gas pipeline assets.

CKI offered A$3 a share for the infrastructure company — 28 percent more than Friday’s close — Sydney-based Duet said Monday in a statement. The company’s board said it’s evaluating the non-binding and conditional offer that pushed its shares to the highest in eight years…

Regulation Without Borders Comes Under Fire in Washington

Posted by: | CommentsThe Financial Stability Board, an informal group of international regulators that does increasingly formal things, has concluded that three of the largest American banks should be forced to comply with higher capital requirements.

The action shows how important international regulation has become to American financial institutions. Increased capital requirements cost large banks billions of dollars and can be thought of as taxes on size and systemic importance, though the American banks say they already meet the board’s requirements…

Alexandria Wins Nod for Merck R&D Project

Posted by: | Comments Alexandria will develop an R&D facility for Merck in South San Francisco.

Alexandria will develop an R&D facility for Merck in South San Francisco.

South San Francisco – Merck Research Laboratories, the research arm of global biopharmaceutical company Merck & Co., has chosen Alexandria Real Estate Equities Inc. to develop, construct and operate its new West Coast research facility in South San Francisco, Calif.

Merck signed a long-term, full-building lease for a nine-story, 294,000-square-foot laboratory/office campus at 213 East Grand Ave. in the South San Francisco innovation cluster. The campus site is fully entitled so construction is expected to begin in early 2017 and be completed by early 2019. The cost of the development and lease terms were not released…

Boring Wall Street Analyst Notes Are Out. Bold and Funny Are In.

Posted by: | Comments-

Dylan, Notorious B.I.G. lyrics tapped to hook readers

-

Emphasis on ‘original, anticipatory ideas’: BofA’s Browning

Call it clickbait for Wall Street.

But instead of 17 Cat Vines That Will Slay You Every Time, Bank of America Merrill Lynch is putting its hard-won reputation as the world’s top-ranked researcher on the line as it seeks to redefine how to sell ideas to the financial elite.

Trump Treasury May Mean Independence for Fannie and Freddie

Posted by: | Comments The headquarters of Fannie Mae in Washington. Fannie Mae and Freddie Mac have been under federal government control for more than eight years. CreditManuel Balce Ceneta/Associated Press

The headquarters of Fannie Mae in Washington. Fannie Mae and Freddie Mac have been under federal government control for more than eight years. CreditManuel Balce Ceneta/Associated Press

Steven Mnuchin, President-elect Donald J. Trump’s nominee to run the Treasury Department, electrified Fannie Mae and Freddie Mac shareholders on Wednesday when he signaled that the mortgage finance giants would finally be allowed to get out from under Washington’s thumb.

“We got to get Fannie and Freddie out of government ownership,” he told Fox Business. “It makes no sense that these are owned by the government and have been controlled by the government for as long as they have.”…

Stein Investment Group Enters Atlanta Office Market

Posted by: | Comments Northside Tower, Atlanta

Northside Tower, Atlanta

Stein Investment Group solidified its shift in investment strategy with two metro Atlanta office acquisitions. In separate transactions with the same seller, it purchased Northside Tower and East Cobb Office for a combined $18 million from Alex Brown Realty.

“These were off-market, opportunistic properties and in line with what we do, which is focus on core real estate,” Jason Linscott, Stein Investment’s chief investment officer, told Commercial Property Executive. “We’re seeing that in the Atlanta marketplace: It’s just the right time to buy because there is so much going on.”

Fidelity’s Biggest Stock Mutual Fund Is Now an Index Fund

Posted by: | Comments-

S&P 500 index fund beats Contrafund with $106 billion

-

Once famed for stock picks, Fidelity can’t buck passive trend

The biggest stock mutual fund at Fidelity Investments, a firm that made its reputation picking stocks, is now an index fund.

The Fidelity 500 Index Fund ended November with $105.9 billion in assets, passing the previous leader, Fidelity Contrafund, which had $104.2 billion, according to data on the company’s website…

Electric Car Company to Build $700M Facility in Arizona

Posted by: | Comments Peter Rawlinson

Peter Rawlinson

Casa Grande, Ariz.—Lucid Motors, a luxury mobility company focusing on innovative engineering, design and technology to create electric vehicles, has announced the ground breaking of a car manufacturing center in Casa Grande, Ariz. The facility is expected to create more than 2,000 jobs and $700 million in capital investment by 2022. The development of the new site is slated to commence in the second quarter of 2017, as the company completes the site planning and permitting processes. Hiring is expected to begin in 2017, and the cars production toward the end of 2018.