Archive for Uncategorized

Thor Equities Sells Jordan Flagship Location in Chicago

Posted by: | CommentsThe two-level athletic store traded for $44.2 million.

28-32 S. State St.

28-32 S. State St.

Chicago—Thor Equities has recently closed on the $44.2 million sale of 26-34 S. State St., in the Chicago Loop. The property currently houses the first dedicated Jordan Brand store, which first opened its doors to clients in October 2015.

Thor leased roughly 12,000 square feet of retail space to 32 South State: The Jordan Brand Retail Experience back in 2014. The two-story building offers sneakers, apparel and other merchandise featuring the trademarked Michael Jordan “Jumpman” silhouette, as well as a basketball gym and consumer lounge. Footaction also operates a 12,000-square-foot, two-level store adjacent to the Jordan Brand store…

NBCUniversal Makes Another $200 Million Investment in BuzzFeed

Posted by: | Comments Photographer: Andrew Harrer/Bloomberg

Photographer: Andrew Harrer/Bloomberg

-

Deal will help companies expand in online video, advertising

-

Latest funding said to value BuzzFeed at about $1.7 billion

Comcast Corp.’s NBCUniversal made its second $200 million investment in BuzzFeed Inc., deepening ties between the two companies in online video and advertising.

The latest funding will let NBC and BuzzFeed work more closely together on ad sales, like producing more short-form digital video for advertisers and sharing it across social media. It will also help BuzzFeed expand its digital video production, such as its popular food media network, Tasty, according to a statement from the two companies Monday…

Small Banks Cheer Trump. So, After a Pause, Do Big Ones.

Posted by: | Comments Rusty Cloutier, president of MidSouth Bank in Louisiana. While many on Wall Street supported Hillary Clinton, community bankers see hope for their businesses and communities in Donald J. Trump’s presidency.CreditWilliam Widmer for The New York Times

Rusty Cloutier, president of MidSouth Bank in Louisiana. While many on Wall Street supported Hillary Clinton, community bankers see hope for their businesses and communities in Donald J. Trump’s presidency.CreditWilliam Widmer for The New York Times

Washington lobbyists, financial and policy analysts and Wall Street insiders are all trying to figure out what the Trump administration will mean for the banking industry.

But Rusty Cloutier never doubted that Mr. Trump would be good for the small bank he runs in Lafayette, La.

Two-Tower Office Building in Silicon Valley Changes Hands

Posted by: | Comments Steve Golubchik

Steve Golubchik

San Jose, Calif.—Ridge Capital Investors LLC has acquired One Eleven Market Square, a 320,559-square-foot, two-tower office property in downtown San Jose, from Swift Real Estate Partners.

NGKF Capital Markets represented the seller in the transaction.

“The greatest appeal of One Eleven Market Square is its incredible Main and Main corner location in the heart of downtown San Jose’s multifamily and retail core,” Steve Golubchik, co-head of NGKF Capital Markets Northern California, told Commercial Property Executive. “The downtown San Jose real estate market has built meaningful momentum this past year with several high profile tenants moving into the urban center.”…

Hedge Funds Hold Back Amid Dollar’s Biggest Rally Since 2008

Posted by: | Comments-

Speculators barely raise net-long wagers on the greenback

-

Yen strengthens after reports of earthquake, tsunami warning

As the dollar charged toward its best gain since the global financial crisis, hedge funds held back.

Wagers among large speculators for the U.S. currency to rise against eight major peers climbed by only 15 contracts to a net 221,204 in the week through Nov. 15, according to data from the Commodity Futures Trading Commission. Bloomberg’s dollar index climbed the most since 2008 in the two weeks just past amid speculation U.S. President-elect Donald Trump’s reflationary economic policies will trigger higher interest rates.

Divaris Lands 4 Leases in the Carolinas

Posted by: | Comments Gerald Divaris, Chairman & CEO of Divaris

Gerald Divaris, Chairman & CEO of Divaris

Charlotte—Divaris Real Estate Inc. (DRE) has announced the signing of four leases totaling 20,377 square feet of new and renewed commercial space in North Carolina and South Carolina. Agents of the company’s Charlotte office handled lease negotiations.

Safari Nation leased 16,294 square feet of retail space in South Park Shopping Center. The property is located at 3191 Peters Creek Parkway in Winston-Salem, N.C. DRE’s Jessica Peadon represented the tenant in the lease negotiations with the landlord, South Park Shopping Center LLC…

Morgan Stanley Takes More Space in Baltimore

Posted by: | Comments Bank of America Center, Baltimore

Bank of America Center, Baltimore

Baltimore—Morgan Stanley & Co. is in need of more elbowroom in Baltimore, and the company just found it. With plans for creating as many as 800 jobs in the city over the next four years, the global financial services firm recently signed a lease with Carlyle Development Group for space at the Bank of America Center, the 500,000-square-foot office property at 100 S. Charles St. in downtown Baltimore.

World’s Best-Funded Pension Market Has a $650 Billion Warning

Posted by: | Comments-

Danish regulator warns of new fundamental risk after reforms

-

FSA in Copenhagen has called for talks to address the issue

No country on the planet is better prepared to pay for its aging population than Denmark. But a nation whose pension industry has been ahead of the curve for decades is now bracing for a fundamental shift that most people probably aren’t prepared for, according to the financial regulator.

Campanelli Sells Heritage Properties in Massachusetts

Posted by: | Comments Heritage One, located at 1 Heritage Dr. Quincy, Mass.

Heritage One, located at 1 Heritage Dr. Quincy, Mass.

Boston—Campanelli in partnership with TriGate Capital announced the two separate transaction sales of Heritage One and Heritage Two located in Quincy, Mass. Foxrock Properties purchased Heritage One, while Heritage Two was purchased by Grander Capital Partners.

Heritage One is a five-story, 172,536-square-foot office building that is currently more than 50 percent occupied by State Street Corp. Heritage Two is a nine-story, 185,262-square-foot office building with 2,400 square feet of retail space. The property is 93 percent occupied by the Massachusetts Teachers Association, Healthcare Financial, G-Force Shipping, Pharmalogics Recruiting and Stran promotional Services…

How India’s Cash Chaos Is Shaking Everyone From Families to Banks

Posted by: | Comments

Customers line up outside a Bank of India branch in Mumbai.

Serpentine queues spilling from banks. Parents worried that they can’t provide for their families. Prime Minister Narendra Modi appealing to Indians to bear the pain for just a little while longer.

These pictures continue to dominate media coverage in Asia’s third-largest economy, even two weeks after the government’s shock clampdown on cash. While supporters of the move say it will help root out tax evasion and graft in the years ahead, critics question the administration’s planning and execution…

The Weather Co. Relocates HQ to Atlanta

Posted by: | CommentsAtlanta—The Weather Co., purchased by IBM in January, is relocating its headquarters from Cobb to Atlanta. The move to 1001 Summit Blvd. will create 400 new jobs including positions in software and product development, engineering, technology and marketing, among others…

U.S. Apartment Construction Hovers Near a Four-Decade High: Chart

Posted by: | Comments It’s no wonder why a multitude of tower cranes are springing up across skylines of major U.S. cities: Apartment building represented about 57 percent of all homes under construction in October, close to a four-decade high, Commerce Department data show. Rental vacancy rates near their lowest since 1985 signal robust demand, and builders are responding. Apartment living has become the option for many Americans unable to qualify for a home loan because of rising prices or those who don’t have enough for a down payment…

It’s no wonder why a multitude of tower cranes are springing up across skylines of major U.S. cities: Apartment building represented about 57 percent of all homes under construction in October, close to a four-decade high, Commerce Department data show. Rental vacancy rates near their lowest since 1985 signal robust demand, and builders are responding. Apartment living has become the option for many Americans unable to qualify for a home loan because of rising prices or those who don’t have enough for a down payment…

U.S. Apartment Construction Hovers Near a Four-Decade High: Chart

These Asian Cities Offer the Best Property Bargains of 2017

Posted by: | CommentsBPO, IT industries drive demand for Indian office space

Not only is India the world’s fastest-growing major economy, it may also offer Asia’s best real-estate investments next year.

A survey has ranked Bangalore and Mumbai as the region’s top picks, vaulting both cities to lead a table of 22 Asian markets.

Commercial property is key. The survey, compiled by the Urban Land Institute with input from PricewaterhouseCoopers LLP, cited a boom in business process outsourcing, or BPO, and IT firms that are driving demand for new office space…

Two Moody National REITs Become One

Posted by: | Comments Moody National REIT I’s Homewood Suites Austin-South

Moody National REIT I’s Homewood Suites Austin-South

Houston—Less than two months after announcing plans to become a single entity, two investment trusts affiliated with Moody National Cos. signed a definitive merger agreement.

According to the terms of the merger agreement, Moody National REIT II has agreed to acquire Moody National REIT I and is set to pay gross consideration of $11.00 per share of REIT I common stock before the payment of various fees and costs—but at a net per share price no less than $10.25, in which case the exchange ratio will be 0.41 shares of REIT II common stock for each share of REIT I common stock…

Should Trump Undo Investor Protections? Meet the Brokers of Madison County

Posted by: | Comments Two brokerage firms, Clayton, Lowell & Conger and Ridgeway & Conger, in New Woodstock, N.Y., are no longer in operation. The building is for sale. CreditHeather Ainsworth for The New York Times

Two brokerage firms, Clayton, Lowell & Conger and Ridgeway & Conger, in New Woodstock, N.Y., are no longer in operation. The building is for sale. CreditHeather Ainsworth for The New York Times

NEW WOODSTOCK, N.Y. — No, not that Woodstock, the one of peace, love and extremely good vibes.

On the manure-scented main strip of this Woodstock, in Madison County’s horse country about 25 miles southeast of Syracuse, lies the answer to a question that has bedeviled me for months: How did this rural county become the place with the highest percentage of stockbrokers in the entire United States with at least one black mark on their disciplinary records?

Almac Group Expands in Montgomery County

Posted by: | CommentsFed Makes It Tougher for Former Officials to Work On Wall Street

Posted by: | Comments-

Regulator increases number of examiners under one-year ban

-

Policy also limits former officials from dealings with Fed

The Federal Reserve is slamming a wedge into the revolving door between government and Wall Street, by placing several restrictions on former officials who go to work for financial services firms.

An existing rule was revised to expand the number of Fed employees who are subject to a one-year ban on working for a company they’ve been overseeing, the agency said in a statement Friday. New measures will also prohibit examiners from representing any financial firm before the regulator for one year as well as restrict current Fed employees from talking about official matters with people who’ve left the agency within the last 12 months…

Trump Adviser Takes Stake in China Ride-Sharing Company

Posted by: | Comments A woman in Shanghai placed an order at a station for the ride-sharing company Didi Chuxing.CreditImaginechina/AP Images

A woman in Shanghai placed an order at a station for the ride-sharing company Didi Chuxing.CreditImaginechina/AP Images

A hedge fund billionaire who was an economic adviser to President-elect Donald J. Trump during the campaign has taken a position in a fast-growing Chinese ride-sharing company that recently signed a deal to acquire Uber Technologies’ operations in China.

John Paulson, who made $15 billion betting against the housing market before the financial crisis, told his investors on Wednesday that at least one of his portfolios had taken an investment stake in Didi Chuxing, a privately owned Chinese company, said people briefed on the matter who were not authorized to speak publicly…

HFF Does Double Duty on Portland Office Campus Deal

Posted by: | Comments Park Square Campus (courtesy of Red Studio Inc.)

Park Square Campus (courtesy of Red Studio Inc.)

Portland—Park Square Campus, a 295,767-square-foot, two-building creative office campus in Portland’s CBD, got a new owner with a double dose of help from HFF. The firm closed the $94.4 million sale of and arranged $42.4 million in financing for a CBRE Global Investors client.

HFF marketed the 1.75-acre property on behalf of Clarion Partners LLC, a New York-based investment advisor and real estate investment manager that was acting as advisor to a separate account client. The purchaser was a European separate account client advised by Los Angeles-based CBRE Global Investors…

Financial Conditions Are Rigged Against Donald Trump

Posted by: | CommentsThe reaction in financial markets to President-elect Donald Trump’s election victory — much like the win itself — has defied conventional wisdom, with U.S. equities surging following a sharp drop as the results came in. But if you’re an occasional real estate developer — a self-professed “low interest rate guy” who wants to fix America’s trade deficit while bringing factories back from overseas — it might seem as though markets have been rigged against you.

Italy’s Banks Are in a Slow-Motion Crisis. And Europe May Pay.

Posted by: | Comments Victor Massiah, chief executive of UBI Banca, in his office in Milan. CreditCalogero Russo for The New York Times

Victor Massiah, chief executive of UBI Banca, in his office in Milan. CreditCalogero Russo for The New York Times

MILAN — Victor Massiah has grown weary of talk that the Italian banking system is so threadbare and stuffed with terrible loans that it threatens Europe with another financial crisis.

The mansion that serves as local headquarters for the bank he runs, UBI Banca, one of Italy’s largest lenders, does not feel like a place on the verge of running out of money. An inlaid marble fireplace sits in a conference room beneath wooden beams worthy of a castle. A statue of the Greek goddess Athena stands triumphantly over a staircase…

San Francisco’s 115 Sansome Office Tower Sells—Again

Posted by: | Comments 115 Sansome St., San Francisco, courtesy of TA Realty

115 Sansome St., San Francisco, courtesy of TA Realty

San Francisco—It’s the kind of game of hot potato most investors would want to play. TA Realty LLC has sold the office building at 115 Sansome St. in San Francisco to Vanbarton Group for $83 million. The transaction marks the third trade of the 128,000-square-foot property in five years, with each seller having pocketed substantially more money than the previous.

Aussie Mortgage Bonds Sell at Slowest Pace in Four Years

Posted by: | Comments-

RMBS issuance Down Under 36% less than at same stage last year

-

Decline comes as fundraising in unsecured market has increased

Home-loan providers in Australia are selling mortgage bonds at the slowest pace in four years, flocking instead to cheaper debt that doesn’t require collateral.

Just A$14.8 billion ($11 billion) of new residential mortgage-backed securities have been issued so far in 2016 by banks and other housing lenders, 36 percent less than at this stage last year, data compiled by Bloomberg show. At the same time, unsecuritized borrowing by Australia’s four biggest banks is running at the fastest pace since 2009…

New CFO Takes the Helm at The Gap

Posted by: | Comments Teri List-Stoll

Teri List-Stoll

San Francisco—Gap Inc. will start the new year with a new executive vice president & CFO at the helm. Teri List-Stoll will take on the role in January 2017, and will report to Gap Inc. CEO Art Peck. List-Stoll will be replacing Sabrina Simmons, whose departure from the company was announced earlier this month, and will oversee the company’s global finance operations, as well as the loss prevention and corporate administration divisions.

Boral Buys Headwaters For $1.8 Billion in Infrastructure Bet

Posted by: | Comments-

Acquisition will more than double Boral’s U.S. business

-

Boral plans A$2.05 billion share sale to help fund deal

Australia’s Boral Ltd. agreed to buy U.S. building materials company Headwaters Inc. for $1.8 billion in cash as it seeks to benefit from increased infrastructure spending promised by President-elect Donald Trump.

Boral will pay $24.25 per share, according to a statement Monday — 21 percent more than Headwater’s closing price on Friday. It plans to sell A$2.05 billion ($1.5 billion) of shares at A$4.80 each, a 22 percent discount to the last closing price, to help fund the deal, with the balance coming from existing cash and debt…

HFF Arranges $72M Refi for DC-Area Retail Center

Posted by: | Comments Plaza at Landmark, Alexandria, Va.

Plaza at Landmark, Alexandria, Va.

Washington—HFF recently announced the closing of a $72 million refinancing for Plaza at Landmark, a 437,299-square-foot, grocery-anchored power center in Alexandria, Va.

“We are extremely pleased that through the efforts of the HFF team we were able to work with the first-class, professional real estate lending group at AIG and close this very beneficial long-term, fixed-rate financing. The recently renovated Plaza at Landmark is now well positioned for outstanding long-term growth and success for our tenants and the community we serve,” said Marshall Ruben, principal of owner Landmark HHH LLC, in prepared remarks…

JPMorgan Sees $50 Billion Wave From Insurers Flooding Into ETFs

Posted by: | Comments-

In blow to hedge funds, insurers seek cheaper growth options

-

ETFs could replace some cash and stock holdings, JPMorgan says

The booming demand for hot exchange-traded funds has finally caught up with the staid, sleepy insurance industry.

U.S. insurers are the latest group of investors to start buying ETFs en masse, with one of the fastest adoption rates among institutions. And they’re not done yet, according to JPMorgan Chase & Co.’s Mark Snyder, who helps oversee funds for the industry. Insurance companies are holding an estimated $200 billion in cash and another $80 billion in equities that could be reallocated, he said, and by shifting some of their portfolios about $25 billion to $50 billion could flow into ETFs…

Hedge Funds Embrace Copper’s Wild Ride

Posted by: | Comments-

Money managers boost bets on rally to largest on record

-

Goldman says recent rally for metal was too far, too fast

The biggest copper rally in almost six years is leaving hedge funds squaring off with Goldman Sachs Group Inc.

Futures in New York jumped 18 percent in just a month. The gains were propelled by a drop in London Metal Exchange-monitored inventories and speculation that Donald Trump’s pledges on infrastructure building will increase metals demand. The president-elect seems to have convinced money managers, who boosted their wagers on further price gains to the largest ever…

Canadian REIT Pure Industrial Grows US Footprint

Posted by: | Comments 3755 Atlanta Industrial Parkway

3755 Atlanta Industrial Parkway

Vancouver, B.C.—Canadian-based Pure Industrial Real Estate Trust (PIRET) is expanding its footprint in two major Southeast U.S. markets—Atlanta and Charlotte, N.C.—with the purchase of a six-property portfolio of industrial assets from STAG Industrial Inc. for $81 million.

The United States acquisitions comprise roughly 1.6 million square feet and consist of four assets in the Atlanta metro area and two in Charlotte. They increase PIRET’s investment in the U.S. to 19 properties totaling 4.6 million square feet and its Southeast U.S. holdings to 10 properties with a total of 3 million square feet of gross leasing area…

Mnuchin’s Bank Accused of Redlining Black, Latino Home Buyers

Posted by: | Comments-

Two groups file claim against OneWest, which he built and sold

-

He has been a leading contender to run Treasury under Trump

OneWest Bank, the lender Steven Mnuchin built and then sold last year, broke federal laws by keeping branches out of minority neighborhoods and making few mortgages to black and Latino borrowers, two housing advocacy groups alleged to U.S. regulators.

Their redlining complaint doesn’t name the financier, but it may complicate his potential appointment to Treasury secretary under Donald Trump. As recently as Monday, the president-elect’s transition team viewed him as its top candidate, people familiar with the process said at the time…

Minneapolis Fed Chief Proposes Eliminating ‘Too Big to Fail’ Banks

Posted by: | CommentsWall Street banks are still too big to fail, and the hundreds of thousands of pages of regulations created in the eight years since the crisis are not adequate protection against another financial shock, says Neel Kashkari of the Federal Reserve Bank of Minneapolis.

Mr. Kashkari, a Republican who has run the Minneapolis Fed for about a year, delivered an unusually blunt and sweeping indictment of financial regulation in a speech before the Economic Club of New York on Wednesday…

Minneapolis Fed Chief Proposes Eliminating ‘Too Big to Fail’ Banks

Iconic Atlanta Building Gets Major Revamp

Posted by: | Comments 101 Marietta Street

101 Marietta Street

Atlanta—The Dilweg Cos., a real estate investment firm focused on key economic markets in the Southeast, has announced that it is completing a major revamp of 101 Marietta Street, an office building formerly known as Centennial Tower. Renovations have already begun and are slated for completion by Thanksgiving.

“There has always been a landmark office building on this property since the early 1900s, and it has been known as 101 Marietta Street for most of its history. Our repositioning efforts connect the historical roots of Downtown to the evolving workplace needs of today,” said Anthony Dilweg, CEO of The Dilweg Cos., in a prepared statement…

William Ackman’s 2016 Fortune: Down, but Far From Out

Posted by: | Comments William Ackman, chief executive of Pershing Square Capital Management. “I have an enormous stomach for volatility,” Mr. Ackman said last week. CreditMisha Friedman for The New York Times

William Ackman, chief executive of Pershing Square Capital Management. “I have an enormous stomach for volatility,” Mr. Ackman said last week. CreditMisha Friedman for The New York Times

William A. Ackman is a big-moneyed, swaggering hedge fund manager with a long list of accomplishments.

He played tennis against Andre Agassi and John McEnroe. He bought one of the most expensive apartments in Manhattan because he thought it would “be fun.” And three years ago, his hedge fund beat the competition to the pulp.

Housing Starts in U.S. Surged to a Nine-Year High in October

Posted by: | CommentsU.S. new-home construction jumped to a nine-year high in October as an outsized advance in the number of apartment projects accompanied a strong pickup for single-family housing.

Residential starts surged 25.5 percent to a 1.32 million annualized rate, the fastest since August 2007 and exceeding the highest projection in a Bloomberg survey, a Commerce Department report showed Thursday. The increase from September was the biggest since July 1982. Multifamily-home building was up a whopping 68.8 percent…

Housing Starts in U.S. Surged to a Nine-Year High in October

Celebration Pointe Partners with ArcisCap on Gainesville Project

Posted by: | Comments Celebration Pointe, Gainesville, Fla. rendering

Celebration Pointe, Gainesville, Fla. rendering

Gainesville, Fla.—Gainesville-based Celebration Pointe Holdings, the sponsor and owner of the Celebration Pointe mixed-use project in Gainesville, Fla., has partnered with New York-based investment firm Arcis Capital Partners to secure a $70 million revolving facility for the development of the project.

“We are very excited to team up with ArcisCap, who have tremendous global capital markets experience, which has enabled us to secure this significant portion of our overall capital stack for the project,” said Ralph Conti, a partner with Celebration Pointe Development Partners & the development manager of the project, in prepared remarks…

Mortgage Rates Soar to 10-Month High After Trump Bond Rout

Posted by: | Comments-

Average 30-year fixed rate jumps to 3.94%, Freddie Mac Says

-

Federal Reserve seen boosting borrowing costs in December

U.S. mortgage rates skyrocketed to a 10-month high as investors reacted to Donald Trump’s presidential election win by pulling money out of the bond market, driving up yields that guide home loans.

The average rate for a 30-year fixed mortgage was 3.94 percent, up from 3.57 percent last week and the highest since January, Freddie Mac said in a statement Thursday. The average 15-year rate rose to 3.14 percent from 2.88 percent, the McLean, Virginia-based mortgage-finance company said…

Hedge Funds That Backed Trump Enter Washington, Demands in Hand

Posted by: | Comments-

From Mnuchin to Mercer, industry figures gather clout in DC

-

‘The screed of hatred’ is over, fund manager Scaramucci says

Donald Trump, the candidate, was blunt: “Hedge fund guys are getting away with murder.”

But Donald Trump, the President-elect, is going a bit easier on the hedge funders — to huzzahs from the industry.

In Trump, hedge-fund types are finally getting their day in Washington. One of their own, Steven Mnuchin, is even a contender for Treasury secretary…

Hedge Funds That Backed Trump Enter Washington, Demands in Hand

National Interstate’s Third Ohio Office Building Breaks Ground

Posted by: | Comments Groundbreaking ceremony at National Interstate’s campus in Richfield, Ohio

Groundbreaking ceremony at National Interstate’s campus in Richfield, Ohio

Richfield, Ohio—National Interstate Insurance Corp. broke ground on its third Richfield campus building. The five-story, 117,000-square-foot structure will connect the two existing buildings through walkways. The new $25 million development will host approximately 200 employees the company plans to hire in the next few years.

The new hires will benefit from a larger company cafeteria, additional wellness facilities and several outdoor decks and patios. Campus amenities will encourage customer interaction, as the new spaces will be able to host more visitors…

Homebuilding Is Hot Again. And Not Nearly Hot Enough

Posted by: | CommentsU.S. housing starts surged in October, but new units are still being added at the slowest rate in half a century.

New residential construction rose to a nine-year high in October, according to census data published today. Builders started new homes at an annualized rate of 1.32 million, the most since August 2007 and the largest month-over-month increase since July 1982. That’s good news for a housing market struggling with low inventory in recent years, driving up prices and forcing prospective buyers to delay purchases, even as the vaunted millennials age into their prime homebuying years.

The less-good new is that there’s still a long way to go…

What $25 Million Beach Houses Look Like on Three Global Islands

Posted by: | CommentsCredit One Bank to Develop Sin City HQ

Posted by: | Comments Credit One Bank’s new headquarters in Las Vegas.

Credit One Bank’s new headquarters in Las Vegas.

Las Vegas—Credit One Bank, one of the largest credit card issuers in the U.S., recently broke ground on its new headquarters in Las Vegas. The new facility will create up to 500 new jobs and is slated for completion by the end of 2017.

The 152,000-square-foot building will be located on 26 acres just south of I-215 between Durango Drive and Buffalo Drive, 7 miles from Credit One Bank’s existing location. The new campus will provide additional capacity for technical, analytical and marketing positions to support Credit One Bank’s growing business. The development will embody the latest architectural advancements…

Chinese Pile Into Bargain London Property on Post-Brexit Pound

Posted by: | Comments-

Record-breaking year for investment not slowed by EU vote

-

Chinese banks back new financial district near City Airport

With Britain trying to hammer out the terms of its exit from the European Union and banks considering their options on the continent, is this the best time to start building a new financial district in London?

China thinks so.

Four of the country’s biggest banks this month agreed to finance the first stage

of a 1.7 billion-pound ($2.12 billion) transformation of an old East End dock into a hub for Asian businesses. To the west of the site near London City Airport, the towers of Canary Wharf stand as a reminder of how ambitious projects in the U.K. capital can remain white elephants for years before turning into cash cows…

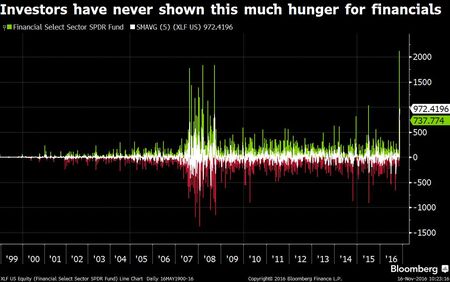

Investors Just Flooded Into Financials at the Fastest Weekly Pace Ever

Posted by: | CommentsNearly $5 billion in inflows to the most popular financial ETF.

In the week following the election, the Financial Select Sector SPDR exchange-traded fund amassed $4.9 billion of inflows — a record, and more than it accumulated in the past three years.

Source: Bloomberg

Source: Bloomberg

This ETF has stakes in major U.S. financial institutions, including banking behemoths like JPMorgan Chase & Co. and Citigroup Inc…

Investors Just Flooded Into Financials at the Fastest Weekly Pace Ever

Parsons Brinckerhoff Joins Skanska’s $399M Bridge Contract

Posted by: | Comments

Rendering of the new Pensacola Bay Bridge

Pensacola, Fla.—WSP | Parsons Brinckerhoff was recently selected by of the Florida Department of Transportation to design the new $399 million bridge in Pensacola as part of a design-build contract with Skanska. The project includes design and construction plans to completely rebuild the existing 3-mile-long bridge known as the Three-Mile Bridge that links Pensacola and Gulf Breeze.

John Weinberg, Ex-Goldman Executive, Takes a Top Post at Evercore

Posted by: | CommentsUntil last year, John S. Weinberg was a top corporate adviser at Goldman Sachs, a high-powered executive at the firm where his family built a banking dynasty.

Now, he is moving to a newer Wall Street firm, taking one of its most senior posts.

The investment bank Evercore Partners said on Wednesday that it had hired Mr. Weinberg as its executive chairman and chairman of its board. Roger C. Altman, a co-founder of the firm and its current executive chairman, will take the new role of senior chairman, while Ralph L. Schlosstein will remain chief executive…

One Kendall Square in Cambridge Trades for $725M

Posted by: | Comments One Kendall Square, Cambridge, Mass.

One Kendall Square, Cambridge, Mass.

Cambridge, Mass.—The East Cambridge life science submarket continues to be one of the hottest in the United States as Alexandria Real Estate Equities closes on One Kendall Square for $725 million, making it the biggest real estate deal in the Boston area so far this year.

Private Funding for FinTech Firms Has Taken a Tumble

Posted by: | CommentsTrouble brewing for private companies?

The hottest new things in financial technology are proving to be lukewarm this year.

Funding for startups in the financial technology space — which includes robo advisors, marketplace lenders and blockchain technology firms — fell 17 percent to $2.9 billion in the third quarter, according to a new report from KPMG International and CB Insights. North America in particular saw a big hit, with funding for venture capital-backed fintech companies in the region falling 68 percent compared to the same quarter last year — a period which saw massive rounds of $100 million or more from Social Finance Inc., Avant Inc. and Kabbage Inc…

House Foe of Dodd-Frank Says Overhaul Will Face Test in Senate

Posted by: | Comments Representative Jeb Hensarling, left, Republican of Texas and chairman of the House Financial Services Committee, at a hearing in March. CreditDrew Angerer for The New York Times

Representative Jeb Hensarling, left, Republican of Texas and chairman of the House Financial Services Committee, at a hearing in March. CreditDrew Angerer for The New York Times

WASHINGTON — A prominent Republican lawmaker on Wednesday laid out his agenda for restructuring the financial system in the next Congress, including his plan to roll back major portions of the Dodd-Frank Act.

Representative Jeb Hensarling, Republican of Texas and chairman of the House Financial Services Committee, has long been a vocal opponent of the 2010 financial reform law. But he now has an ally in President-elect Donald J. Trump, who has repeatedly called for taking apart Dodd-Frank, and he has Republican majorities in both chambers of Congress…

Regency Centers to Upsize with Equity One Merger

Posted by: | Comments Equity One’s largest asset – Serramonte Center, Daly City, Calif.

Equity One’s largest asset – Serramonte Center, Daly City, Calif.

Jacksonville, Fla. & New York—Move over, Kimco. Step aside, Federal Realty Investment Trust. Regency Centers Corp. will soon move to the top of the list of the largest U.S. shopping center REITs by equity value, now that the company has committed to a merger with Equity One Inc. The transaction, which values Equity One at $4.6 billion, will give the new Regency a total market capitalization of $15.6 billion.

Hedge Fund With $2 Billion Sets Bets on ‘Crazy’ in a Trump World

Posted by: | Comments-

Sector now betting on U.S. banks, boosting energy stocks

-

Avoiding stocks in consumer staples and discretionary

Buying the losers of the past decade could pay off in a world where Donald Trump is in charge of the world’s biggest economy.

Norwegian hedge fund firm Sector Asset Management, which manages about $1.7 billion, is turning its portfolios around to bet on bank, energy and materials stocks that may thrive as fiscal stimulus is about to be unleashed after years of global austerity.

A Preview of Risk Retention Effects

Posted by: | Comments Lauren Cerda, Senior Director at Fitch Ratings

Lauren Cerda, Senior Director at Fitch RatingsCPE: What are some of the short-term ramifications of the new risk retention rules on CMBS lenders?

Lowe’s Declines After Forecast Renews Housing-Market Fears

Posted by: | Comments-

Sales missed company’s goals due to August, September slowdown

-

Results follow troubling signs from larger rival Home Depot

Lowe’s Cos. suffered its worst stock decline in three months after the retailer posted disappointing third-quarter profit and cut its full-year forecast, renewing concerns that Americans are curtailing spending on their homes.

Earnings rose to 88 cents a share in the quarter, the Mooresville, North Carolina-based company said on Wednesday. Analysts estimated 96 cents on average…

Warren Assails Trump for ‘Wall Street Elites’ on Transition Team

Posted by: | Comments-

Senator says advisers contradict pledges Trump made to voters

-

President-elect has said he would ‘drain the swamp’ in D.C.

Elizabeth Warren says President-elect Donald Trump is already violating promises he made to voters by filling his transition team with “Wall Street elites” and corporate lobbyists.

“The American people are watching to see if you were sincere in your campaign promises to look out for the interests of working families, rather than the interests of the rich and powerful,” Warren, a Democratic senator from Massachusetts, wrote in a Tuesday letter to Trump. “Unfortunately, you already appear to be failing.”…

Executive Q&A: How Trump Win May Impact CRE Investment

Posted by: | Comments David Rifkind, Principal & Managing Director of George Smith Partners

David Rifkind, Principal & Managing Director of George Smith Partners

Los Angeles—The 2016 presidential election generated shock waves around the world with the surprise victory of Donald Trump. When election results started pouring in on Nov. 8, investor uncertainty led global stock markets to drop, with Dow futures down as much as 900 points on Tuesday night. But once the initial surprise wore off, with Dow futures down about 300 points by early Wednesday morning and bouncing back into positive territory, it seemed the markets largely went back to normal as investors began adjusting to the news. Investors are still concerned about the unknown surrounding the new administration, but currently strong fundamentals seem hard to nudge. Ultimately, it’s too early to tell how the capital markets will respond.

Confidence Among Homebuilders in U.S. Remains Near 2016 High

Posted by: | CommentsConfidence among U.S. homebuilders in November remained near the highest level this year, a sign of strength in the residential real estate market, according to data Wednesday from the National Association of Home Builders/Wells Fargo.

Key Points

- Builder sentiment gauge held at 63 (forecast was 63); readings below 50 mean more respondents report poor market conditions

- Index of prospective buyer traffic rose to 47 from 46

- Measure of six-month sales outlook decreased to 69 from 71

- Gauge of current sales was unchanged at 69…

Confidence Among Homebuilders in U.S. Remains Near 2016 High

World’s Biggest Real Estate Frenzy Is Coming to a City Near You

Posted by: | Comments-

Chinese homebuyers defy capital controls as local prices surge

-

New offshore targets include Texas, Thailand and Malaysia

If they were anywhere else in Beijing, the five young women in cowboy hats and matching red, white, and blue costumes would look wildly out of place.

But here at the city’s biggest international property fair — a frenetic gathering of brokers, developers and other real estate professionals all jockeying for the attention of Chinese buyers — the quintet of wannabe Texans fits right in. As they promote Houston townhouses (“Yours for as little as $350,000!”), a Portugal contingent touts its Golden Visa program and the Australian delegation lures passersby with stuffed kangaroos…

Santa Monica Office Campus Changes Hands in $400M Deal

Posted by: | Comments Lantana Media Campus, Santa Monica, Calif.

Lantana Media Campus, Santa Monica, Calif.

Los Angeles—A joint venture between Brightstone Capital Partners and Artisan Realty Advisors has acquired Lantana Media Campus, a 478,713-square-foot office complex comprised of four buildings in Santa Monica, Calif., for $400 million from Jamestown.

“Santa Monica’s strategic location and amenity-rich environment make the area one of the top submarkets in Southern California,” Dennis Irvin, Brightstone Capital Partners’ managing director, said in a prepared release. “It is one of the most supply constrained markets in the country, making the acquisition of Lantana Media Campus an extraordinary opportunity for Brightstone and one that is consistent with our model of acquiring unique, high quality assets in advance of offering interests to our investors.”…

U.S. Mortgage Applications Gauge Slumps to Lowest Since January

Posted by: | CommentsMortgage applications in the U.S. slumped last week after the sharpest increase in borrowing costs since mid-2013, signaling tougher sledding for the housing market.

The Mortgage Bankers Association’s index of purchase and refinancing applications dropped 9.2 percent in the period ended Nov. 11 to 436.3, the lowest level since January. The average rate on a 30-year fixed loan soared 18 basis points, the most since June 2013, to 3.95 percent…

U.S. Mortgage Applications Gauge Slumps to Lowest Since January

Online Lending Platform Taps Veteran Originator

Posted by: | Comments Ken Gaitan recently joined Money360 to lead the firm’s Western lending platform.

Ken Gaitan recently joined Money360 to lead the firm’s Western lending platform.

Online money lending platform Money360 has hired veteran originator Ken Gaitan to run the firm’s Western lending platform.

The Ladera Ranch, Calif.-based firm is expanding as part of an effort to increase its share of the small-balance commercial mortgage market at the expense of small and regional commercial banks that have been coping with growing scrutiny from regulators…

Fannie and Freddie’s Status Continues to Provoke Criticisms

Posted by: | Comments A limited partnership property in Akron, Ohio. CreditMichael F. McElroy for The New York Times

A limited partnership property in Akron, Ohio. CreditMichael F. McElroy for The New York Times

The presidential campaign that just ended was notable for a lack of debate about housing — in particular the uneven state of the United States mortgage market nine years since the start of the financial crisis.

Neither President-elect Donald J. Trump nor Hillary Clinton spent much time discussing housing policy, even though the financial crisis in the United States began with the collapse of home prices nationally. And neither candidate laid out a plan for dealing with the two biggest engines in the mortgage market — Fannie Mae and Freddie Mac — which remain under a controversial federal government conservatorship…