Archive for Uncategorized

Hines REIT Wraps Up $1.2B Office Sale to Blackstone

Posted by: | Comments Howard Hughes Center, Los Angeles

Howard Hughes Center, Los Angeles

Los Angeles—Hines REIT takes a big step forward in its dissolution and liquidation plan with the closing of the sale of a 3 million-square-foot office portfolio to an affiliate of Blackstone, just months after announcing the deal. The group of seven West Coast properties fetched nearly $1.2 billion.

In a prepared statement, Sherri Schugart, president & CEO of Hines REIT, said the sale “was a significant and positive transaction and a result of our focus on maximizing the assets’ appeal to the institutional market.”…

Hedge-Fund Love Affair Is Ending for U.S. Pensions, Endowments

Posted by: | Comments-

State retirement plans for workers fed up with fees, returns

-

University endowments also redeeming, negotiating better terms

About five years ago, Kentucky started investing some of its public-employee pension money with hedge funds. Sure, fees were high but the funds came with the lure of high returns and could serve as a buffer if the market tanked.

By early November, Kentucky officials had had enough. They voted to start yanking $800 million from hedge funds including Pine River Capital Management and Knighthead Capital Management…

Hedge-Fund Love Affair Is Ending for U.S. Pensions, Endowments

U.S. Foreign Investor Program Funding More Luxury Projects

Posted by: | Comments The Waldorf Astoria hotel in Beverly Hills, Calif., was built under a program meant to encourage wealthy foreigners to invest in depressed areas of the United States, CreditTanveer Badal for The New York Times

The Waldorf Astoria hotel in Beverly Hills, Calif., was built under a program meant to encourage wealthy foreigners to invest in depressed areas of the United States, CreditTanveer Badal for The New York Times

A federal program meant to encourage investment in the United States from wealthy foreigners is increasingly supporting large luxury real estate projects, not the development in the rural and downtrodden districts that some say were the original targets of the program.

With billions of dollars flowing in, mostly from wealthy Chinese, the program faces an uncertain future. In September, Congress reset the expiration date on parts of the so-called EB-5 program to Dec. 9…

Canada’s Goeasy Beats Banks Tapping Borrowers They Turn Away

Posted by: | Comments-

CEO Ingram says firm undervalued relative to performance

-

Firm weighing cards, auto loans or secured credit to expand

Goeasy Ltd. shares have surged 21 percent this year, beating almost every bank and alternative lender in Canada. That’s not good enough for the head of the company that offers loans with rates as high as 47 percent and rents out sofas and TVs.

“I am disappointed, I truly am,” Chief Executive Officer David Ingram, 50, said in an interview in Bloomberg’s Toronto office last week. “I would argue that we’re actually undervalued against what we’ve demonstrated for 16 years and the commitment that we’ve given to targets that we’ve executed and performed to.”…

Wall Street’s Decade-Long Firing Spree Is Seen Winding Down

Posted by: | Comments-

U.S. firms are cutting jobs in 2016 at slowest pace in decade

-

John Challenger sees bank dismissals stabilizing in future

It’s the beginning of the end for major job cuts at U.S. banks, according to Challenger, Gray & Christmas Inc., a firm that advises many of them on workplace reductions.

Dismissals across the financial industry dropped to about 1,940 per month this year through October — the slowest pace in more than a decade — as banks and other firms finished reshaping themselves in the wake of the financial crisis, said John Challenger, head of the Chicago-based consulting firm…

HOK Chooses 717 Harwood for Dallas HQ

Posted by: | Comments 717 N. Harwood St., Dallas

717 N. Harwood St., DallasSpike in Mortgage Rates Throws a Wrench Into U.S. Housing Market

Posted by: | Comments-

Higher borrowing costs limit some buyers, could slow building

-

Price gains may weaken as people seek smaller, cheaper homes

The spike in borrowing costs in response to President-elect Donald Trump’s pro-growth agenda is causing some heartburn in America’s housing industry.

San Diego mortgage broker Shanne Sleder said a third of his clients, many of whom were already stretching budgets to buy homes in pricey southern California, are having to reconsider what they can afford as rates soar…

Spike in Mortgage Rates Throws a Wrench Into U.S. Housing Market

ECHO Realty Expands NC Portfolio

Posted by: | Comments Regency Village Shopping Center in Huntersville, N.C.

Regency Village Shopping Center in Huntersville, N.C.

Charlotte, N.C.—ECHO Realty recently announced the purchase of two properties located in Charlotte, N.C. The two Harris Teeter-anchored shopping centers are Regency Village, a 70,000-square-foot center in the Lake Norman community of Huntersville, and Coddle Creek, an 80,000-square-foot center in Concord. The price of the two acquisitions was not disclosed.

NYC’s Trump Place Apartments to Drop Name Amid Tenant Outcry

Posted by: | Comments-

Almost 600 residents signed petition to ‘Dump the Trump Name’

-

Presidential race was marked by offensive comments by Trump

The Trump Place apartment complex stands on the Upper West Side of Manhattan in New York.

Photographer: Jin Lee/Bloomberg

The Trump Place apartment complex on Manhattan’s Upper West Side is about to drop the president-elect’s name after an outcry by residents.

Another Financial Warning Sign Is Flashing in China

Posted by: | Comments-

Broad loan-to-deposit ratio at 80% for top 50 China banks: S&P

-

China’s credit reliance could worsen NPL problem, Fitch says

Add another credit indicator to the financial warning signs flashing in China.

The adjusted loan-to-deposit ratio, which includes a range of off-balance sheet items and is an indicator of the banking system’s ability to weather stress, climbed to 80 percent as of June 30, according to S&P Global Ratings. For some smaller lenders, the ratio has already topped 100 percent, S&P estimates.

Erie Insurance Plans New $135M Office Building

Posted by: | Comments Erie Indemnity Co.’s new 6th Street building, Erie, Pa., rendering

Erie Indemnity Co.’s new 6th Street building, Erie, Pa., rendering

Erie, Pa.—Albert Kahn Associates and construction manager PJ Dick are developing a $135 million, 346,000-square-foot office building on the Erie Insurance Home Office campus in downtown Erie for Erie Indemnity Co.

“The building itself is located physically between two structures we recently finished—one being our Heritage Center and the other our technical learning center—and it fits right into our campus and fills in a gap in our organization,” Jeff Brinling, Erie Insurance’s senior vice president, corporate services, told Commercial Property Executive. “It’s connected to the Heritage Center, which was the first owned office of our company, from 1938 until 1956. There’s a clear connection to our past.”…

Goldman Says Buy China Stocks With Foreign Assets as Yuan Slumps

Posted by: | Comments-

Gains for exporters may be harder now that Trump has won: Bank

-

Goldman predicts currency will drop further 6% by end of 2017

Chinese companies with overseas businesses and foreign-currency assets will benefit as the yuan’s depreciation accelerates after Donald Trump’s victory, according to Goldman Sachs Group Inc.

The technology industry could profit the most from a weaker yuan because more than 35 percent of company revenues come from abroad, said Kinger Lau, Hong Kong-based chief China equity strategist at Goldman Sachs. Energy and industrial businesses will benefit as well with non-yuan sales accounting for more than 15 percent of their overall income last year. Exporters could advance, although it may be harder for them to excel now that Trump will be U.S. president, said Lau, adding that the yuan will weaken a further 6 percent by end-2017…

Asia’s Hedge Funds Suffer Highest Withdrawals in Four Years

Posted by: | Comments-

Investors redeemed $2.1 billion, 1.3% of assets in the region

-

Hedge funds globally face investor backlash over low returns

Asia’s hedge funds had the highest investor withdrawals last month in more than four years as the industry is struggling with lackluster returns.

Hedge funds investing in Asia excluding Japan suffered net outflows of $2.1 billion, or 1.3 percent of total assets, according to data provider Eurekahedge Pte. That compares with withdrawals of $3.6 billion in Europe, representing 0.7 percent of assets, and $2.5 billion in North America, or 0.2 percent, the data show…

Charles Dunn Closes Beverly Hills Retail Sale

Posted by: | Comments 315-319 North Beverly Drive

315-319 North Beverly Drive

Los Angeles—Charles Dunn Co., one of the largest full-service regional real estate companies in the western U.S., recently completed the $23.5 million sale of a Beverly Hills retail asset. Florida-based Sterling Org. acquired the building for $5,000 per square foot, through its Sterling Value Add Partners II institutional fund.

Situated at 315-319 N. Beverly Drive, the 4,700-square-foot property was built in 1940 and is 70 percent leased to Peter Lik Gallery. The asset is conveniently located in Beverly Hills’ Golden Triangle shopping district, just one block east of the iconic Rodeo Drive, and is expected to be vacant in the first quarter of 2017…

ADP to Create 1,500 Jobs in Arizona

Posted by: | Comments 100 W. Rio Salado Parkway, Tempe, Ariz.

100 W. Rio Salado Parkway, Tempe, Ariz.

Tempe, Ariz.— ADP, a comprehensive global provider of cloud-based Human Capital Management solutions, has announced the opening of a new operation center in Tempe, Ariz. As reported by state officials, the company plans to create roughly 1,500 jobs and invest more than $33.8 million in remodeling the building.

The Next Generation of Hedge Fund Stars: Data-Crunching Computers

Posted by: | Comments Christina Chung

Christina Chung

Every five minutes a satellite captures images of China’s biggest cities from space. Thousands of miles away in California, a computer looks at the shadows of the buildings in the images and draws a conclusion: China’s real estate boom is slowing.

Traders at BlackRock, the money management giant, then use the data to help choose whether to buy or sell the stocks of Chinese developers. “The machine is able to deal with some of the very complex decisions,” said Jeff Shen, co-chief investment officer at Scientific Active Equity, BlackRock’s quantitative trading, or quant, arm in San Francisco…

American Apparel Seeks Bankruptcy Protection a Second Time

Posted by: | Comments-

They ‘crashed it into the wall,’ ousted founder Charney says

-

Canadian T-shirt maker Gildan agrees to buy brand, not stores

American Apparel Inc., the clothing brand built on racy advertising and made-in-the-U.S.A. marketing, is back in bankruptcy after nine months and may emerge as a Canadian concern.

The Los-Angeles based company filed for Chapter 11 protection Monday, with plans to sell itself at auction with a lead bid of $66 million from Canadian T-shirt and underwear maker Gildan Activewear Inc. Montreal-based Gildan said in a statement that it wants to buy the brand and inventory supply, but not any stores…

Selloff in Bonds, Emerging-Market Assets Deepens as Dollar Gains

Posted by: | Comments-

Record $1.2 trillion was wiped off world debt values last week

-

Japanese index futures rise as other Asian contracts retreat

Routs in bonds and emerging-market assets intensified, while the dollar continued to strengthen as investors positioned for the wave of U.S. fiscal stimulus that President-elect Donald Trump has pledged to unleash.

Yields on 30-year Treasuries rose to the highest level since January, with last week’s record debt selloff bleeding into Monday amid losses from Asia to Europe. The Bloomberg Dollar Spot Index climbed to a nine-month high, with the greenback gaining against most major peers. U.S. stocks took a breather as a gauge of shares in developing nations sank to a four-month low. Copper climbed with nickel, while crude oil fell with gold…

Ahead of Trump Presidency, Global Investors Sell Bonds and Grab Stocks

Posted by: | Comments Pedestrians walking past an electronic ticker board for the Bombay Stock Exchange in Mumbai, India.CreditDhiraj Singh/Bloomberg

Pedestrians walking past an electronic ticker board for the Bombay Stock Exchange in Mumbai, India.CreditDhiraj Singh/Bloomberg

Global investors have rendered their verdict on Donald J. Trump as president: Sell government bonds and pile into stocks that will benefit the most from a resurgent United States economy.

From Indonesia to the United States, government bonds are undergoing a sharp sell-off as investors — large sovereign wealth funds and hedge funds, as well as the accounts of American retirees — restructure investment portfolios to try to capture the fruits of what they expect will be a free-spending Trump presidency…

Era of Falling U.K. Mortgage Costs May Be at an End

Posted by: | CommentsMuted wage growth means muted house-price inflation

The era of falling mortgage costs may be over.

Swap rates, which banks use to price their home loans, have been rising since September and are now at levels last seen before Britons voted to leave the European Union on June 23.

That’s in spite of the Bank of England cutting its benchmark interest rate to a record-low 0.25 percent on Aug. 4 in attempt to shore up the economy from any fallout from the Brexit vote…

Hedge Funds Added Tech Stocks Ahead of Trump Victory Sell-Off

Posted by: | Comments Photographer: Eric Thayer/Bloomberg

Photographer: Eric Thayer/Bloomberg

-

Tiger Global, Coatue, Appaloosa also piled into tech

-

Tudor bet on financial institutions that have since surged

Marquee money managers including Moore Capital Management and Point72 Asset Management boosted their holdings of technology firms in the third quarter, before the U.S. presidential election spurred a selloff in the industry.

Modi Raises Cash Limits as Banks Get $44 Billion in Deposits

Posted by: | Comments-

Limits on daily withdrawals from bank ATMs increased

-

About $7.4 billion have been disbursed, old bills exchanged

India raised the limits on withdrawals and exchange of old banknotes after the government’s surprise move to ban high-denomination bills on Nov. 8 resulted in customers across the country queuing for hours to deposit the old bills.

Banks have received 3 trillion rupees ($44.4 billion) in deposits in the first four days, the finance ministry said in a statement late on Sunday. About 500 billion rupees have been disbursed either from withdrawals or exchange of old banknotes, it said. The daily limit on withdrawals from cash dispensing machines has been raised to 2,500 rupees, while weekly cap has been increased to 24,000 rupees…

Phoenix Great American Tower Sells for $49M

Posted by: | Comments Great American Tower

Great American Tower

Phoenix—EverWest Real Estate Partners and American Realty Advisors have announced the sale of the Great American Tower, a landmark high-rise office building in midtown Phoenix. The property traded for $49 million and was acquired by Colorado-based DPC Cos., a privately held commercial real estate firm specializing in the acquisition and development of commercial real estate in the West.

Hedge Fund Gold Buyers Caught Out by Trump Vote as Prices Plunge

Posted by: | Comments

U.S. President-elect Donald Trump

-

Bullish bets undercut by prospect of more spending, tax cuts

-

Citigroup sees stronger dollar extending metal risk into 2017

Add hedge funds to the list of investors caught on the wrong end of Donald Trump’s surprise election as U.S. president.

Before the Trump victory on Nov. 8, which defied most poll-based forecasts, speculators increased bets on a bullion rally for a third straight week, data released Monday show. Since then, prices posted their biggest weekly decline in three years, touching a five-month low, and holdings in exchange-traded funds backed by gold have seen their biggest two-day outflow in three years…

China’s Economy Holds Ground Amid Curbs to Cool Housing Market

Posted by: | Comments-

Industrial production, fixed-asset investment remain resilient

-

Retail sales growth slows as real estate curbs cap spending

China’s economy held ground last month following new measures to cool property markets in almost two dozen big cities.

- Industrial production rose 6.1 percent from a year earlier in October, compared with median estimate of 6.2 percent in a Bloomberg survey and 6.1 percent in September

- Retail sales growth slowed to 10 percent, missing estimates for 10.7 percent

- Fixed-asset investment rose 8.3 percent in first ten months of the year

Culver City Office Complex Lands New Tenant

Posted by: | Comments Culver City Corporate Point campus

Culver City Corporate Point campusThe Los Angeles-based company recently announced it has signed a 7.5-year lease for 11,000 square feet of space—or half of the fifth floor—at 200-300 Corporate Pointe campus to Ipsos Insight, a subsidiary of European-based market research firm Ipsos…

The Chinese Home-Buying Frenzy’s Coming to a City Near You

Posted by: | Comments-

Chinese homebuyers defy capital controls as local prices surge

-

New offshore targets include Texas, Thailand and Malaysia

If they were anywhere else in Beijing, the five young women in cowboy hats and matching red, white, and blue costumes would look wildly out of place.

But here at the city’s biggest international property fair — a frenetic gathering of brokers, developers and other real estate professionals all jockeying for the attention of Chinese buyers — the quintet of wannabe Texans fits right in. As they promote Houston townhouses (“Yours for as little as $350,000!”), a Portugal contingent touts its Golden Visa program and the Australian delegation lures passersby with stuffed kangaroos…

Trump Victory Seen Spurring Foreign Demand for London Property

Posted by: | Comments-

Investors seeking safe assets expected to target London homes

-

Falling pound helping as home prices post only modest decline

Donald Trump may be good for the London housing market.

That’s according to property website operator Rightmove, which says Trump’s shock election victory could spur the return of international investors seeking a safe haven.

While asking prices in the capital fell for a fifth month, the 0.3 percent drop was much smaller than the 1.5 percent average seen in November over the past six years, it said in a report published Monday. The pound’s slide is helping to fuel demand…

In Murky Russia, One Investor Finds Value in Thinking Small

Posted by: | Comments Aleksei A. Kozlov, a Russian private equity investor, in Moscow last month. CreditJames Hill for The New York Times

Aleksei A. Kozlov, a Russian private equity investor, in Moscow last month. CreditJames Hill for The New York Times

MOSCOW — There’s no doubt Russia is a country with grandeur in its scale, sweeping across 11 time zones and home to gargantuan oil, gas and mining companies.

The country’s wealthy also have a reputation for living large and taking risky bets. But in the economic swoon today, getting by as an investor, says one wealthy Russian in the capital, means thinking small.

Phoenix’s Renaissance Square Wins 2016 TOBY Award

Posted by: | Comments Renaissance Square, Phoenix

Renaissance Square, Phoenix

Phoenix—International real estate investment, development and management firm Hines was the biggest winner of this year’s BOMA Greater Phoenix’s The Outstanding Building of the Year (TOBY) awards, which were presented Nov. 4 at the Arizona Biltmore.

This $15 Million Montana Lodge Is Selling for Half-Price

Posted by: | CommentsSki-in, ski-out in Big Sky Country.

Twelve years ago, Martin Belz, a Memphis-based real estate developer and CEO of Peabody Hotel Group, went on a vacation in Big Sky, Montana, with his son. They stayed in what Belz described as a “small cabin,” and fell in love with the area’s rural charm. The next year, Belz said, he brought his wife and their two daughters, who were also enchanted.

“It’s rustic and just so gorgeous,” he said on a phone call. “We kept going out every winter, and finally I started to look for a property for us.”…

Parallel Capital Nabs $20M Scottsdale Office Asset

Posted by: | Comments Kierland Corporate Center

Kierland Corporate Center

Phoenix—San Diego-based Parallel Capital Partners has announced the purchase of Kierland Corporate Center in Scottsdale, Ariz. The Class A office complex traded for $20 million, being sold by Bataa/Kierland II LLC.

“The center is situated in an ideal Scottsdale location in the 730-acre Kierland master planned community – considered one of the best addresses in metro Phoenix – with outstanding tenant demand as well as close proximity to a wealth of housing, dining, retail, resorts and entertainment options. We are thrilled to expand our presence in the Phoenix area – one of the fastest growing cities in the nation and home to six Fortune 500 companies,” said Matt Root, CEO with Parallel Capital Partners, in a prepared statement…

It’s Not Just Deutsche Bank; German Banking Gloom in Four Charts

Posted by: | Comments-

Europe’s most fragmented banking market squeezes earnings

-

Wealth of deposits a burden in negative-rate environment

Deutsche Bank AG Chief Executive Officer John Cryan’s troubles range from the company’s mounting legal costs to stricter regulation that’s eroding returns. And there’s at least one challenge he shares with his German rivals: Europe’s most competitive market.

“Deutsche Bank still has a lot to deal with, but the German market as a whole is pretty rotten,” said Martin Wilhelm, founder of IfK GmbH, which manages more than 600 million euros ($650 million) of fixed-income securities in Kiel, Germany. “It’s really hard for banks to make money here.”…

Epic Piping Opens $45M Fabrication Plant in Louisiana

Posted by: | Comments Rendering of the new pipe fabrication facility in Livingston Parish, La.

Rendering of the new pipe fabrication facility in Livingston Parish, La.

Baton Rouge—Epic Piping, one of the largest turnkey industrial pipe fabrication organizations in the world, has announced the opening of a $45.3 million advanced pipe fabrication facility in Livingston Parish, La. The complex features advanced robotic equipment that will optimize pipe fabrication for various industries across the U.S.

Transwestern to Market NIH Office Building in Bethesda

Posted by: | Comments Two Rockledge Centre, Bethesda, Md., courtesy of Transwestern

Two Rockledge Centre, Bethesda, Md., courtesy of Transwestern

Bethesda, Md.—Transwestern has just added a new assignment to its plate. The real estate firm was recently tapped by Eagle Canyon Corp. to secure a buyer for Two Rockledge Centre, a 247,400-square-foot office building leased by the National Institutes of Health in Bethesda, Md., just outside Washington, D.C.

Why Greek Debt Could Be Good Buy as Trump Win Shakes Bond Market

Posted by: | CommentsCommerzbank bullish on the debt while others advise caution.

Global government bonds slid this week on speculation the next U.S. president will boost inflation, but one country has so far stayed out of the rout: Greece.

Greek 10-year bond yields fell to a five-month low on Friday, and are down more than 60 basis points this week, a sign risk associated with the asset is decreasing. That may continue as market turmoil since Donald Trump was elected improves the odds for substantial debt relief for the country, according to David Schnautz, a fixed income analyst at Commerzbank AG…

JLL Completes $36M Sale of PDX Logistics Center II

Posted by: | Comments PDX Logistics Center

PDX Logistics Center

Portland—Capstone Partners LLC and PCCP LLC, aided by JLL Capital Markets, announced the sale of PDX Logistics Center II, a brand new, Class A, 355,200-square-foot industrialasset in Portland. Clarion Partners purchased the fully leased property for $36.2 million.

“PDX Logistics Center II is a superior asset that benefits from being fully leased by two institutional credit tenants, (…) this presented investors with an opportunity to take advantage of a secure cash flow in a newly constructed building,” Mark Detmer, managing director at JLL, said in a prepared statement.

Asian Emerging Market Shares Drop, While Financial Stocks Rally

Posted by: | Comments-

Exporters drop on concern Trump will renegotiate trade deals

-

Shanghai Composite enters bull market as metal producers surge

Asian shares fell, with emerging-market stocks leading declines on bets the Federal Reserve will raise interest rates faster than anticipated. The Shanghai Composite Index entered a bull market and financial firms in Tokyo and Sydney rallied.

The MSCI Asia Pacific Index lost 0.8 percent to 135.54 as of 4:01 p.m. in Hong Kong, erasing earlier gains of as much as 0.4 percent. The gauge is down 0.9 percent for the week. Indexes in Indonesia, the Philippines and Taiwan led declines. Japanese shares capped their best week since September and Chinese equities rallied as metals companies surged and property curbs boosted the lure of stocks…

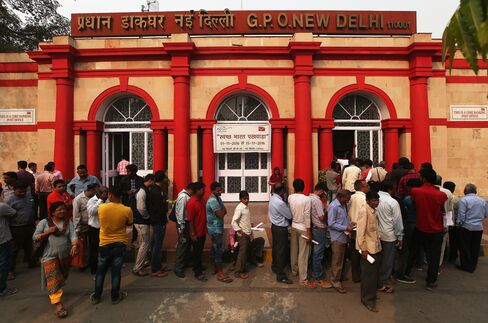

Banks Lure $30 Billion Deposits as Indians Struggle to Find Cash

Posted by: | Comments

People stand in line to exchange now-defunct notes.

-

Modi on Nov. 8 made surprise move to phase out some banknotes

-

Will take more steps to fight against tax evasion: Modi

Indian government’s surprise move to ban high-denomination banknotes on Nov. 8 has seen lenders lure 2 trillion rupees ($29.8 billion), as customers across the nation queue for hours to deposit the old bills.

Selery Fulfillment Relocates Dallas Corporate HQ

Posted by: | CommentsDallas—Selery Fulfillment, a global logistics and fulfillment company, announced the relocation of its corporate headquarters to a new, state-of-the-art facility. Located at 13592 N. Stemmons Freeway in Dallas, the building offers 32,000 square feet of space with a 5,000-square-foot climate-controlled warehouse and office space.

Selery will be able to leverage DFW Airport, the International Inland Port of Dallas and other rail, air and trucking hubs through its new location, a key trucking and shipping route that connects manufacturing and distribution centers in Mexico with markets in the U.S. and Canada…

London’s Housing Slowdown Holds Back U.K. Property-Price Gains

Posted by: | Comments-

Prices grow 0.4 percent, as demand bounces back from Brexit

-

Homes in capital’s exclusive boroughs lose 8.6 percent on year

London’s priciest neighborhoods are weighing down house-price growth in the U.K., according to Acadata and LSL Property Services Plc.

The average value of a British home rose 3 percent in the year to October, the groups said in a report published on Saturday. Excluding London and the southeast, average prices rose 3.6 percent. From a month earlier, national prices gained 0.4 percent in October to 294,351 pounds ($366,000)…

London’s Housing Slowdown Holds Back U.K. Property-Price Gains

Japan’s Big Banks Struggle to Make Money From Lending

Posted by: | Comments-

Negative interest rates exacerbating drop in lending income

-

Megabanks still seen on track to achieve annual profit goals

Making money from lending remains a tough task for Japan’s biggest banks.

Profit at Mitsubishi UFJ Financial Group Inc. and Mizuho Financial Group Inc. probably fell about 20 percent last quarter as negative interest rates pressured loan income at home and the stronger yen dented earnings abroad, according to analysts surveyed before results due Monday. Sumitomo Mitsui Financial Group Inc.’s net income is estimated to have risen 31 percent after it booked a writedown on its stake in an Indonesian lender a year earlier…

Select Comfort Relocates HQ to Downtown Minneapolis

Posted by: | Comments Select Comfort’s new headquarters

Select Comfort’s new headquarters

Minneapolis—Select Comfort, a company which manufactures and sells Sleep Number beds, plans to relocate its headquarters from suburban Plymouth, Minn., to downtown Minneapolis in October 2017. Transwestern announced it has completed a 211,000-square-foot lease for the company at 1001 Third Ave. S., a five-story, 476,000-square-foot office building.

“This property occupies a full city block and, with the exception of a data center, has sat mostly vacant since 2014, (…) our lease with Select Comfort – the city’s largest incoming office user in many years – will further enhance the up-and-coming southeast corner of downtown and make it a popular destination for employers looking to recruit and retain top talent,” Reed Christianson, principal at Transwestern, said in a statement. He also represented the building owner, DCI Technology Holdings, in the 15-year lease…

Trump Expected to Seek Deep Cuts in Business Regulations

Posted by: | CommentsThe unwinding of Dodd-Frank. The firing up of shuttered coal plants. The rollback of rules that increase overtime pay for low-wage workers.

Hours after Donald J. Trump won the race for the White House, scores of regulations that have reshaped corporate America in the last eight years suddenly seemed vulnerable.

While many questions remain about how Mr. Trump will govern, a consensus emerged Wednesday in many circles in Washington and on Wall Street about at least one aspect of his impending presidency: Mr. Trump is likely to seek vast cuts in regulations across the banking, health care and energy industries…

Hogan Lovells Joins 390 Madison Tenant Roster

Posted by: | Comments 390 Madison Ave.

390 Madison Ave.

New York—Hogan Lovells has signed a 206,720-square-foot lease at 390 Madison Ave., a Midtown office tower currently undergoing redevelopment in New York’s Grand Central area, with the building’s owner, L&L Holding Co.

The global law firm is the first tenant to sign a lease at the 850,000-square-foot, 32-story tower, which is being redeveloped by L&L Holding in conjunction with Clarion Partners LLC acting on behalf of the New York State Common Retirement Fund, and world renowned architects Kohn Pederson Fox Associates…

Icahn Left Trump Victory Party to Bet $1 Billion on Stocks

Posted by: | Comments-

Billionaire investor has endorsed Trump since September 2015

-

President Trump will be ‘positive not negative,’ Icahn says

As Donald Trump celebrated his surprise election win over Hillary Clinton and equity futures swooned in response, billionaire investor and Trump supporter Carl Icahn headed home to start trading.

Icahn, 80, left President-elect Trump’s victory party in the early hours of the morning to bet about $1 billion on U.S. equities, he said Wednesday in a telephone interview on Bloomberg TV…

For Hedge Fund Investors, Calm Uncertainty Over Trump’s Direction

Posted by: | Comments Wilbur Ross, a billionaire who helped raise money from Wall Street executives for Donald J. Trump’s presidential campaign, before an interview in London in 2012. CreditSimon Dawson/Bloomberg News, via Getty Images

Wilbur Ross, a billionaire who helped raise money from Wall Street executives for Donald J. Trump’s presidential campaign, before an interview in London in 2012. CreditSimon Dawson/Bloomberg News, via Getty Images

Wilbur Ross, the contrarian billionaire investor, stood in a sea of red caps early Wednesday morning at the New York Hilton Midtown hotel in Manhattan as Donald J. Trump took the stage.

Mr. Ross, who played a role in raising money from Wall Street executives for Mr. Trump’s presidential campaign, was celebrating the New York billionaire’s surprising election victory over Hillary Clinton.

Blackstone to Pay Hefty Price for OfficeFirst Immobilien

Posted by: | Comments Dietmar Binkowska

Dietmar Binkowska

London and Frankfurt—After scuttling an initial public offering and a previous offer by private equity giant Blackstone this fall, Germany’s IVG Immobilien AG has agreed to sell OfficeFirst to Blackstone in a move that will expand the firm’s German holdings in the country’s biggest cities.

OfficeFirst was formed earlier this year by IVG to hold mostly office properties. The company’s portfolio comprises roughly 15.1 million square feet of assets in six cities—Frankfurt, Berlin, Hamburg, Stuttgart, Dusseldorf and Munich. Blackstone already owns about 4.3 million square feet of high-quality assets in all of those cities except Stuttgart…

SunLink Health Systems to Sell Georgia Property

Posted by: | Comments 1362 S Main Street, Ellijay, Ga.

1362 S Main Street, Ellijay, Ga.

Atlanta—Atlanta-based SunLink Health Systems Inc., the parent company of subsidiaries that own and operate healthcare facilities in the Southeast, has announced that one of its subsidiaries has reached an agreement to sell a medical office building complex consisting of land and three buildings in Ellijay, Ga. The property traded for roughly $4.9 million and was acquired by an undisclosed buyer.

U.K. Adds Housing as It Continues Overhaul of Inflation Measures

Posted by: | Comments-

Statistics office says CPIH to be key price measure from March

-

Move brings closer potential switch of BOE target to new gauge

The U.K.’s chief statistician said a measure of inflation including housing will become the favored gauge of consumer prices from March.

CPIH — the consumer prices index including owner-occupiers’ housing costs — will be the “preferred measure” of inflation for the Office for National Statistics. Switching to the new index will address several flaws and limitations in alternative price measures and simplify the current plethora of different gauges, John Pullinger said in a statement on Thursday…

Blackstone, KKR Said to Ready Financing for Valeant’s INova

Posted by: | CommentsBlackstone Group LP, Carlyle Group LP and KKR & Co. are among buyout firms in talks with banks for financing to back their bids for Valeant Pharmaceutical International Inc.’s Australian drug unit, people with knowledge of the matter said.

Indicative bids for Valeant’s iNova Pharmaceuticals business were submitted this month, according to the people, who asked not to be identified because they aren’t authorized to speak publicly. The sale may fetch about A$1 billion ($773 million), the people said…

Broe Real Estate Group Sells $14M Tempe Office Asset

Posted by: | Comments Tempe 10/60 Corporate Center

Tempe 10/60 Corporate Center

Tempe, Ariz.—Broe Real Estate Group, a leading investment manager of commercial real estate assets affiliated with The Broe Group, alongside Greenlaw Partners, a California-based real estate operating company, have closed the sale of the Tempe 10/60 Corporate Center in Tempe, Ariz., for $14.3 million.

“We originally purchased the property directly from a major special servicer in April 2014 for $3.5 million, and immediately began a $4 million renovation and property reposition, which created significant competitive advantages, and helped to drive robust, near-term leasing success,” Doug Wells, CEO of Broe Real Estate Group, said in a statement…

Manhattan Renters Score Record Incentives in Apartment Glut

Posted by: | Comments Photographer: Michael Nagle/Bloomberg

Photographer: Michael Nagle/Bloomberg

-

Signing sweeteners offered on 24% of new leases in October

-

Share is biggest in six years of data, up from 10% a year ago

Manhattan landlords are giving renters more financial incentives than ever in a bid to keep apartments from going empty while the market gets flooded with new supply.

London’s Property Market Is ‘Tanking,’ Green’s Vernon Says

Posted by: | Comments-

Vernon’s firm is waiting for the chance to buy at lower values

-

London property values have been hurt by June’s Brexit vote

London’s real estate market, hurt by the Brexit vote, is “tanking by the day,” Green Property Chairman Stephen Vernon said.

The firm, which has closed its London office, is waiting for an opportunity to buy into the market at lower values, the 66-year-old said at a conference in Dublin. Vernon would consider buying a real estate company, raising a fund or buying a portfolio of assets in London, he said…

Insight Global Inks Lease at Phoenix’s 24th at Camelback

Posted by: | Comments 24th at Camelback II

24th at Camelback II

Phoenix—Hines has announced that Insight Global, an Atlanta-based national staffing services company, has signed a long-term, 12,460-square-foot lease at 24th at Camelback II in Phoenix. The company will occupy the entire eighth floor of the office building, which offers superior glass exposure, as of early 2017. Insight is relocating to the property from Scottsdale.

“24th at Camelback II’s strong visibility on Camelback Road, central location, size and design, along with the close proximity to the many businesses in the high-profile area, helped attract Insight Global,” Michelle Brown, general property manager with Hines, said in prepared remarks…

Wall Street Bonus Rules Seen as Urgent Ahead of Trump Takeover

Posted by: | Comments-

Regulators rushing to finish compensation limits by January

-

Incentive pay rule targets excessive risk taking at banks

U.S. regulators are rushing to issue sweeping limits on Wall Street pay by January, said people familiar with the effort, before President-elect Donald Trump begins replacing officials installed by Barack Obama.

The rule on finance industry bonuses is the last major unfinished piece of the Dodd-Frank Act, which was created to strengthen regulations and prevent a repeat of the 2008 economic crisis. The government agencies are making last-minute adjustments to the measure to complete it within the next two months, according to two people who asked not to be named because the process isn’t public…

China’s Sky-High Home Prices Sustainable, Harvard Scholars Say

Posted by: | Comments

Residential buildings stand in Shenzhen, China.

-

The stock of empty houses is about 20 billion square feet

-

Price stability to hit urbanization, productivity, employment

China’s stratospheric housing prices can be maintained because of robust demand, provided the government radically curtails new supply, according to four Harvard University scholars. The economic downside of such price stability: huge hits to urbanization, productivity and employment.

Vancouver Wields C$10,000-a-Day Fine in Crackdown on Empty Homes

Posted by: | Comments-

Canada’s priciest property market plans new tax by Jan. 1

-

City plans to tax empty properties 1% of their assessed value

Want to keep your million-dollar luxury pad in Vancouver empty? Get ready to pay C$10,000 ($7,450) annually in extra taxes. Lie about it? That’ll be C$10,000 a day in fines.

Canada’s most-expensive property market, suffering from a near-zero supply of rental homes, announced the details of a new tax aimed at prodding absentee landlords into making their properties available for lease. The empty-home tax will take effect by Jan. 1 and will be calculated at 1 percent of the property’s assessed value, Vancouver Mayor Gregor Robertson told reporters at City Hall…

Morning Agenda: Trump Triumphs and Global Markets Plummet

Posted by: | Comments A foreign exchange brokerage in Tokyo on Wednesday. Japanese economic officials convened an emergency meeting in response to the swings in financial markets. CreditFranck Robichon/European Pressphoto Agency

A foreign exchange brokerage in Tokyo on Wednesday. Japanese economic officials convened an emergency meeting in response to the swings in financial markets. CreditFranck Robichon/European Pressphoto Agency

Donald John Trump has been elected the 45th president of the United States.

His campaign railed against the establishment, as did his voters. In the end, they delivered a huge upset and a repudiation of Hillary Clinton.

The response was immediate: Mr. Trump’s victory roiled global financial markets.

Saywitz Negotiates 90 KSF Lease Renewal in LA area

Posted by: | Comments 751 East Artesia Blvd., Carson, Calif.

751 East Artesia Blvd., Carson, Calif.

Los Angeles—The Saywitz Co. recently negotiated a 7-year office lease renewal and extension on behalf of international manufacturer Gordon Laboratories, for two facilities totaling 90,000 square feet of space in Carson, Calif. The value of the two leases equates to approximately $5 million.

Located at 751 East Artesia Blvd. and 840 East Walnut St., the assets are divided into R&D, quality assurance labs, manufacturing, production and warehousing facilities. Additionally, they house the Gordon Laboratories’ North American headquarters. For the first property, the company’s President Barry Saywitz represented the personal care firm, while landlord Stanton Moore Trust was represented by Jason Hines at Overton Moore Partners. The Saywitz Co. also handled negotiations with the Allen Shor Trust for the second building…