Archive for Uncategorized

RBA Sees China Risks Diminish as Housing Market Reignites

Posted by: | CommentsAustralia’s central bank sees a better short-term outlook for key trading partner China and a commodity-price windfall for the economy, while acknowledging a renewed rise in some local property prices.

The Reserve Bank of Australia made few changes in its quarterly forecasts update: growth of 2.5-3.5 percent to June 2017, rising to 3-4 percent thereafter; with core inflation increasing to 1.5-2.5 percent by end-2018. Headline inflation was revised up due to higher tobacco prices…

Avison Young Markets NoVa Flex-Industrial Portfolio

Posted by: | Comments 14320 Sullyfield Circle, Chantilly, Va.

14320 Sullyfield Circle, Chantilly, Va.

Washington—Avison Young has been chosen to market a portfolio of three flex-industrial buildings in coveted Chantilly, Va.

Totaling 338,283 square feet, the Route 28 South Portfolio properties fall into the I-5 zoning category—Industrial General. According to Fairfax County records, the portfolio last traded in June 2008 for a price tag of $41.1 million and is owned by Scottsdale, Ariz.-based Route 28 NPS Portfolio Inc…

GE @ The Banks Sells for $107M in Cincinnati

Posted by: | Comments GE at The Banks, Cincinnati

GE at The Banks, Cincinnati

Cincinnati—London-based 90 North Real Estate Partners has snapped up a minority stake in General Electric @ The Banks, the 338,000-square-foot office tower that serves as home to General Electric’s Global Operations Center, at The Banks master-planned community in downtown Cincinnati. 90 North and Kuwait-based majority partner Kamco Investment Co. acquired the trophy property from Carter, developer of The Banks, for $107 million.

IMF Knocks on Doors in Quest for Intelligence on Chinese Banks

Posted by: | Comments-

Senior official queries property developers on contracts

-

Biggest five banks have reported subdued profit growth

As part of the International Monetary Fund’s biggest review of China’s banking system in half a decade, a top official recently did some detective work that didn’t involve an Excel spreadsheet.

On a trip to the mega-city of Chongqing in the nation’s interior, Ratna Sahay, acting director of the IMF’s Monetary and Capital Markets Department, visited a property fair. Her objective was to learn more about typical real-estate sales transactions, amid rising risks of property bubbles across the world’s No. 2 economy…

Westcore Pays $54M for Reno Industrial Portfolio

Posted by: | Comments Westcore Properties purchased approximately 1.2 million square feet of industrial space.

Westcore Properties purchased approximately 1.2 million square feet of industrial space.

Reno, Nev.—Westcore Properties, a global, entrepreneurial commercial real estate investment firm focusing on western U.S. commercial and industrial properties, has announced the purchase of an approximately 1.2 million-square-foot industrial portfolio in Reno, Nev., for roughly $54 million. The newly acquired asset marks the first purchase of the company in the area.

Toronto Home Prices Surge in October, Undaunted by New Rules

Posted by: | Comments-

Sales reach record as prices rise 21% from a year earlier

-

Trend set to continue as supply remains tight, board says

Toronto home sales rose to a record and prices surged in October, showing little effect so far from new government rules designed to bring stability to the market.

Sales in Canada’s biggest city rose 12 percent to 9,768 transactions from the same month a year earlier, while average prices jumped 21 percent to C$762,975 ($569,852), according to the Toronto Real Estate Board. The average price of a detached home was C$1,034,077, up 26 percent on the year. New listings rose 0.9 percent to 13,377 homes…

Vocal Hedge Funds Shake Up Singapore’s Staid Corporate Landscape

Posted by: | Comments-

Push is catching on with local shareholders ‘more demanding’

-

Dektos, Quarz Capital among activists pushing for change

Activist investors, having targeted companies in Japan and South Korea in recent years, have discovered a new playground in Asia.

In Singapore, where activist investing was virtually unheard of until now, two companies have found themselves in the crosshairs in the past month alone. Quarz Capital Management Ltd. urged retailer Metro Holdings Ltd. to return excess cash to investors and Dektos Investment Corp. pushed Geo Energy Resources Ltd. to change its debt structure, saying the coal-miner’s shares are undervalued by as much as 60 percent…

IREM Special Report: Leaders’ Insights on Managing Change

Posted by: | Comments Michael Lanning, left, IREM’s 2017 president, and Christopher Mellen, the organization’s 2016 leader.

Michael Lanning, left, IREM’s 2017 president, and Christopher Mellen, the organization’s 2016 leader.Norway Real Estate Sizzles as Oslo Gains Top 20% for First Time

Posted by: | CommentsNorway’s house price rally accelerated with gains topping 20 percent for the first time in the capital Oslo, lending support to central bank concerns about rising risks in the market.

Housing prices prices rose 12 percent nationwide and 21.7 percent in Oslo in October from a year earlier, according to monthly data from Real Estate Norway, Finn and Eiendomsverdi. In Norway’s oil capital, Stavanger, prices slid an annual 3.9 percent…

Norway Real Estate Sizzles as Oslo Gains Top 20% for First Time

Egypt Free Floats Pound, Raises Lending Rates to Spur Economy

Posted by: | Comments-

Government has pledged economic overhaul ahead of assistance

-

IMF board to consider $12 billion if Egypt meets conditions

Egypt took the dramatic step of allowing its currency to trade freely as it announced measures to stabilize an economy crippled by a dollar shortage that has raised concern about social unrest.

Stocks jumped the most in eight years and the pound slumped after the central bank’s decisions, which included raising its two benchmark overnight interest rates by three percentage points. They came after months of negotiations with the International Monetary Fund over a $12 billion loan that’s seen as crucial in western capitals to preventing an economic meltdown that could destabilize the most populous Arab country…

Vornado to Spin Off DC Portfolio in $8.4B Merger with JBG

Posted by: | Comments Atlantic Plumbing, a mixed-use property under construction by The JBG Cos. in Washington, D.C.

Atlantic Plumbing, a mixed-use property under construction by The JBG Cos. in Washington, D.C.

Washington—Calling it a “key milestone” in its value creation strategy, Vornado Realty Trust is spinning off its Washington, D.C.-area portfolio and merging it with The JBG Cos. in what will be a regional commercial real estate “powerhouse” worth $8.4 billion.

Colorado Cools, But Opportunity Remains

Posted by: | Comments Denver’s Union Station and the city skyline at night.

Denver’s Union Station and the city skyline at night.

While Denver has outpaced the national averages for rent growth and rental rates in recent years, the metro has finally begun to cool as significant construction begins to come on line and the rapidly accelerating economy eases.

Market players echo this theme of slower growth, but Denver continues to plenty of opportunity. For the past few years Denver has been one of the nation’s best-performing real estate markets, as job growth and an influx of Millennials has sent demand for housing, office space, and retail sky high. Home values, too, have risen dramatically, and Denver now has the highest median home price of any non-coastal market in the U.S…

Mergers Could Help European Investment Banks Compete With U.S.

Posted by: | CommentsCredit Suisse’s chief executive, Tidjane Thiam, is clearly frustrated with the investment banking operations of the institution he oversees.

And with good reason: Wall Street banks seem to have won most of the battle for supremacy over who gets most of the fees that the world’s biggest corporations and investment managers pay to bankers and traders.

At the same time, the cost of maintaining the Swiss bank’s business of financing companies, advising them on mergers and making markets in a bewildering array of stocks, bonds and other instruments remains high. And regulators keep demanding that banks put up more capital against these activities…

U.K. House Prices Stagnate for First Time in 16 Months

Posted by: | Comments Photographer: Simon Dawson/Bloomberg

Photographer: Simon Dawson/Bloomberg

U.K. house prices failed to rise in October and annual inflation slowed to the weakest since the start of the year, according to Nationwide Building Society.

The stagnation in values on the month ends 15 consecutive months of increases, Nationwide said on Wednesday. In its analysis of the market, it said measures of housing activity remain “fairly subdued,” with transactions about 10 percent down from a year earlier. Annual price growth slowed to 4.6 percent from 5.3 percent…

KLX Aerospace Solutions Selects Miami for Global HQ

Posted by: | Comments John Cuomo, VP and General Manager, KLX’s Aerospace Solutions Group

John Cuomo, VP and General Manager, KLX’s Aerospace Solutions Group

Miami—KLX Inc.’s Aerospace Solutions Group has announced its signing of a build-to-suit lease for a new global headquarters and distribution hub totaling more than 500,000 square feet in Miami. The relocation and expansion of ASG’s facilities highlights South Florida as a growing logistics, trade and air transport hub.

The building will be located at the intersection of NW 107th Street and 97th Avenue between Florida’s Turnpike and I-75. It will include two floors of office space with the ability to expand and a state-of-the-art storage and distribution area…

Vancouver Home Sales Fall 39% as New Rules Chill Market

Posted by: | Comments-

October residential transactions plunge most since 2010

-

Sales were 15% below 10-year average for the month: realtors

Vancouver home sales plunged 39 percent in October from a year earlier, the biggest drop since 2010, as new regulations chill Canada’s most expensive property market.

Sales in the Pacific coast city fell to 2,233 in the month, from 3,646 a year earlier, the Real Estate Board of Greater Vancouver said Wednesday. That was 15 percent below the 10-year average for October…

Hedge Fund Manager Odey Says U.K. Stocks Could Plummet 80%

Posted by: | Comments-

Odey says the country will face recession, higher inflation

-

Investor’s main hedge fund has slumped 43% this year

Crispin Odey, whose main hedge fund has lost about 43 percent this year, says U.K. stocks could slump 80 percent as the economy is roiled by a recession and higher inflation following the vote to leave the European Union.

Shares will come under pressure after the FTSE 100 share index climbed 30 percent over five years even as earnings fell by 80 percent, the money manager said in a letter to investors last week seen by Bloomberg News. Odey Asset Management has short positions — bets the stocks will fall — in companies including Tullow Oil Plc, Intu Properties Plc, and ITV Plc…

DC-Area Office Asset Trades for $79M

Posted by: | Comments Tysons Concourse, Vienna, Va,

Tysons Concourse, Vienna, Va,

Washington—A joint venture between Atlantic Realty Cos. and Angelo, Gordon & Co. recently bought Tysons Concourse in Vienna, Va., a two-building Class A office complex, Virginia Business reports.

The property was sold by California State Teachers’ Retirement System for $78.8 million. Eastdil Secured represented the seller. According to Yardi Matrix data, Atlantic Realty Cos. drew an undisclosed amount from a $66.6 million line of credit held by CIBC. The property last traded in June 2000, for $75.5 million…

Prefabs and Chinese Students Are U.K.’s New Homebuilding Gambit

Posted by: | Comments-

Education bond expected to raise as much as 1 billion pounds

-

InvestUK and Gaw Capital to fund homes with some of proceeds

The U.K. may have an unlikely solution to its housing crisis: wealthy overseas students and pre-fabricated homes.

InvestUK, a foreign direct investment adviser, and Hong Kong-based Gaw Capital Partners plan to raise 1 billion pounds from the sale of a bond and use some of the proceeds to finance property projects including affordable homes, the firms said in a statement. Overseas students who invest at least 2 million pounds ($2.46 million) will gain permanent residence after five years…

Hedge Fund Clients Dump Humans for Computers and Still Lose

Posted by: | Comments-

Funds using mathematical models raise $21 billion this year

-

Investors seeking out good performance in tough times

Losses at Leda Braga’s computer-driven hedge fund this year are running at about twice the level suffered by a macro fund run by billionaire Alan Howard. Yet, while Braga has raised money, investors have pulled billions of dollars from Howard’s fund.

The divergence is a sign of the sweeping changes underway in the $3 trillion global hedge fund industry, where investors are shunning flesh and blood traders and putting their faith, and hard cash, in algorithms to bet on macro economic trends…

DC Office Building Commands $142M

Posted by: | Comments 1025 Thomas Jefferson St., Washington, D.C.

1025 Thomas Jefferson St., Washington, D.C.

Washington—Alduwaliya Asset Management has acquired 1025 Thomas Jefferson St., a 317,248-square-foot, Class A office building in the Georgetown submarket of Washington, D.C., from The JBG Cos. for $141.8 million.

HFF represented both parties in the transaction.

At eight stories, the building fronts K Street between 30th and Thomas Jefferson Streets and sits directly across from the Georgetown Waterfront Park and Washington Harbor…

Can Banks Make Wall Street Sexy Again for Millennials?

Posted by: | CommentsStudent debt programs may help banks woo talent back to industry

The New York Stock Exchange.

Ask a bright 20-something graduate where he or she wants to work and chances are they will tell you Google. That’s a far cry from before the global banking meltdown when whiz kids saw a career on Wall Street as a badge of honor.

At a time when student debt is at at a record, the banking community is exploring the idea of helping you pay off those pesky college loans as a way to attract top talent again. Starting next month, the American Bankers Association will contribute $1,200 toward student loans, with a cap of $10,000. Almost a third of its 345 employees are indebted from their college days…

Transwestern, Mirae Pay Hefty Price for State Farm Campus

Posted by: | Comments CityLine State Farm, courtesy of Transwestern Investment Group

CityLine State Farm, courtesy of Transwestern Investment GroupDeutsche Bank: This Measure of Household Finances Could Spur the Next U.S. Recession

Posted by: | CommentsWhy the post-crisis rise in U.S. households’ net worth might be a bad thing.

Those sanguine about U.S. recession risk aren’t looking in the right place.

While standard measures of the real economy — from inflation to the labor market — nurture the Fed’s optimism that the U.S. economy can withstand the impact of rate hikes, Deutsche Bank AG’s chief economist Joseph LaVorgna sounds the alarm on financial excesses.

Specifically, a negative feedback loop from financial markets to the real economy could push the U.S. into recession, he says. He cites the ratio of U.S. household net worth to disposable personal income, which is now close an all-time record high, indicating net worth is growing faster than expendable earnings…

Landlords Are Slashing Rents Across the Country. Haven’t You Noticed?

Posted by: | CommentsSadly for most renters, prices are still rising to historic highs.

Have you ever bought a sweater off the sale rack and then thought,“Wait, 30 percent off what?”

That’s what it’s like shopping for an apartments in dozens of U.S. rental markets, as landlords offer discounts on asking prices—even as rents remain at historic highs. In San Francisco, where median rents have marched upward for years, landlords reduced the listing price on 21 percent of listings in the 12 months that ended Sept. 30, according to a new report published by Trulia. That’s up from 14 percent of listings that were price-chopped last year…

Gannett Abandons Effort to Buy the Newspaper Publisher Tronc

Posted by: | Comments The former Tribune Publishing Company, now known as Tronc, is the owner of The Los Angeles Times and The Chicago Tribune. CreditEmily Berl for The New York Times

The former Tribune Publishing Company, now known as Tronc, is the owner of The Los Angeles Times and The Chicago Tribune. CreditEmily Berl for The New York Times

For a deal that took six months of battling back and forth, the message of its collapse was cursory.

In a brief telephone conversation early Tuesday morning, Robert J. Dickey, the chief executive of the Gannett Company, told his counterpart at the company formerly known as Tribune Publishing that Gannett, the nation’s largest chain of newspapers, was dropping its $680 million-plus takeover bid — weeks after a price had been agreed upon…

HFF Closes Sale of 59 KSF Retail Center

Posted by: | Comments 320 Town Center Ave. in Suwanee

320 Town Center Ave. in Suwanee

Atlanta—HFF has recently announced the sale of the 58,634-square-foot retail portion of Suwanee Town Center on behalf of the seller, Madison Retail LLC. The asset was purchased free and clear of debt by a subsidiary of a real estate fund advised by Crow Holdings Capital Real Estate. The HFF team was led by senior managing directors Jim Hamilton and Richard Reid, along with associates Mike Allison and Brad Buchanan.

U.K. Bankers Confident City Will Remain Finance Hub After Brexit

Posted by: | Comments-

Survey finds 72% say London will be EU bank center in 5 years

-

About 78% of executives questioned think Brexit will hurt EU

Most U.K. bankers believe London will remain Europe’s pre-eminent financial center after Brexit, according to consulting firm Synechron Inc.

About 72 percent agreed that the City of London would retain its role as the main hub for finance in the European Union for at least five years, Synechron said, citing a survey of 80 financial-services executives working in capital markets in the district. While 78 percent said Brexit will have a negative impact on U.K. financial markets, 82 percent said the EU would also be hurt…

Standard Chartered Faces Inquiry Into Hong Kong Stock Sale

Posted by: | Comments The Standard Chartered bank headquarters in Hong Kong. CreditAnthony Wallace/Agence France-Presse — Getty Images

The Standard Chartered bank headquarters in Hong Kong. CreditAnthony Wallace/Agence France-Presse — Getty Images

LONDON — Standard Chartered, a bank that is based in London and has extensive activities in Asia, said on Tuesday that it was facing an inquiry by regulators into its underwriting of a stock sale in Hong Kong.

The lender’s disclosure — the latest in a series of regulatory issues it has faced worldwide in recent years — comes after UBS said last week that it had been notified that the Securities and Futures Commission in Hong Kong planned to take action against the bank and some of its employees over UBS’s role as a sponsor on certain initial public offerings…

Macy’s Continues Restructuring, Sells Assets to GGP

Posted by: | Comments Tysons Galleria, McLean, Va.

Tysons Galleria, McLean, Va.

Cincinnati—Macy’s Inc. is pushing on with its plan to operate fewer brick-and-mortar locations and focus on better-performing assets and a stronger digital presence with the disposition of five retail stores to General Growth Properties for $46 million.

Four of the stores were sold in the third quarter of 2016, while the Greenwood Mall property was sold earlier in the year. The portfolio comprised:

Hedge Fund Manager Odey Says U.K. Stocks Could Plummet 80%

Posted by: | Comments-

Odey says the country will face recession, higher inflation

-

Investor’s main hedge fund has slumped 43% this year

Crispin Odey, whose main hedge fund has lost about 43 percent this year, says U.K. stocks could slump 80 percent as the economy is roiled by a recession and higher inflation following the vote to leave the European Union.

Shares will come under pressure after the FTSE 100 share index climbed 30 percent over five years even as earnings fell by 80 percent, the money manager said in a letter to investors last week seen by Bloomberg News. Odey Asset Management has short positions — bets the stocks will fall — in companies including Tullow Oil Plc, Intu Properties Plc, and ITV Plc…

Wells Fargo to Pay $50 Million to Settle Home Appraisal Overcharges

Posted by: | Comments Wells Fargo headquarters in San Francisco. The bank disagreed with claims that it had overcharged hundreds of thousands of homeowners for appraisals after they had defaulted.CreditMax Whittaker for The New York Times

Wells Fargo headquarters in San Francisco. The bank disagreed with claims that it had overcharged hundreds of thousands of homeowners for appraisals after they had defaulted.CreditMax Whittaker for The New York Times

In the latest hit to the battered bank, Wells Fargo has agreed to pay $50 million to settle a class-action lawsuit that accused the bank of overcharging hundreds of thousands of homeowners for appraisals ordered after the homeowners defaulted on their mortgage loans.

The proposed settlement calls for Wells Fargo to automatically mail checks to more than 250,000 customers nationwide whose home loans were serviced by the bank between 2005 and 2010…

Bozzuto Breaks Ground on Charm City Mixed-Use Project

Posted by: | Comments Liberty Harbor East, courtesy of Hickok Cole Architects

Liberty Harbor East, courtesy of Hickok Cole Architects

Baltimore—Baltimore’s lively Inner Harbor area will soon be home to a brand new mixed-use residential development, now that ground has broken on Liberty Harbor East, according to a Baltimore Sun article. Owned by H&S Bakery/Paterakis, the project is being built by Bozzuto Construction, and will cost $170 million to complete.

Pentagon Set to Ask Congress for $6 Billion in Additional Funds

Posted by: | Comments-

Funds included to counter Islamic State drones: comptroller

-

Fiscal 2017 budget amendment to be submitted after election

The Pentagon will request about $6 billion more for the current fiscal year to pay for troop increases in Iraq, a slower draw-down of troops from Afghanistan and more intense air operations, according to Pentagon Comptroller Mike McCord.

The “budget amendment” also will respond to an urgent request from field commanders for additional systems to counter Islamic State drones, McCord said in an interview. “You start to see these in play now in the fight,” he said…

Austin Office Tower Tops Out, Lands 3 More Tenants

Posted by: | Comments 500 W. 2nd St., Austin

500 W. 2nd St., Austin

Austin, Texas—Trammell Crow Co. and joint venture partner Principal Real Estate Investors announced that 500 W. 2nd St. has topped out construction and also added three additional tenants to its roster. Professional services firm Deloitte, international law firm King & Spalding and CBRE Group Inc. have signed long-term leases at the building.

The Class AA, speculative 29-story office tower features 500,436 square feet of space, including 11,000 square feet of street-level restaurant/retail space. Currently, the property is 60 percent leased and is scheduled for completion in February 2017.

RBA Holds Cash Rate as ‘Brisk’ Housing Market Outweighs CPI

Posted by: | Comments-

Benchmark kept at 1.5% as seen by traders, most economists

-

Markets pricing in less than one-in-three chance of 2017 cut

Reserve Bank of Australia Governor Philip Lowe kept interest rates unchanged, signaling he’s prepared to tolerate weak inflation to avoid further stoking “briskly” rising property prices and household debt.

Lowe opted not to react to soft consumer prices growth last quarter and held the cash rate at a record-low 1.5 percent, as predicted by 22 of 28 economists surveyed and in line with money market bets. The new governor’s well-flagged concerns about easy money’s risks to financial stability and asset bubbles has led traders to scale back bets on a reduction next year as well…

This Investment Bank Sold All U.K. Assets Before Brexit Vote

Posted by: | Comments-

Stockholm-based investor began selling as polls narrowed

-

Sold out stocks and bonds in financial, consumer industies

Carnegie Investment Bank AB, which manages $17.2 billion for clients, sold all of its U.K. holdings as opinion polls narrowed ahead of the June vote to exit from the European Union.

“We had equities and corporate bonds in Britain before the vote,” chief strategist Henrik Drusebjerg said in a telephone interview on Monday. “We started selling off our U.K. holdings to absolute zero maybe a month before the vote,” he said. He wouldn’t give the value of the assets sold…

Converted Brooklyn Warehouses To Target TAMI Tenants

Posted by: | CommentsThe largest mixed-use development in Brooklyn’s Gowanus neighborhood will activate the area with a mix of creative workspace and retail.

Architectural rendering of an interior lounge at Roulston House, where tenants of all sizes can comfortably set up shop

Architectural rendering of an interior lounge at Roulston House, where tenants of all sizes can comfortably set up shop

New York– Industrie Capital Partners has unveiled a leasing campaign for the largest mixed-use office development Brooklyn’s Gowanus neighborhood has ever seen. Roulston House will deliver 200,000 square feet of class A office space to a growing constituency of TAMI (technology, advertising, media and information) tenants.

OCBC Cites Compliance Burden as Reason to Expand Private Bank

Posted by: | Comments-

Bank needs wealthy clients to offset surging regulatory costs

-

Compliance costs are rising by 35 percent a year, CEO says

Oversea-Chinese Banking Corp.’s Chief Executive Officer Samuel Tsien said surging compliance costs are one factor spurring him to expand his Asian wealth-management business, at a time when some overseas competitors are retreating.

That’s because the rapidly expanding costs of complying with anti-money laundering, tax-compliance and other regulatory requirements — rising by 35 percent annually across the whole bank — need to be spread out across as many fee-generating clients as possible, according to Tsien…

Was Alan Greenspan Motivated by Politics More Than Economics?

Posted by: | Comments Alan Greenspan in his New York office, 1974. CreditJohn Sotomayor/The New York Times

Alan Greenspan in his New York office, 1974. CreditJohn Sotomayor/The New York Times

THE MAN WHO KNEW

The Life and Times of Alan Greenspan

By Sebastian Mallaby

Illustrated. 781 pp. Penguin Press. $40.

In 1959, at the annual meeting of the American Statistical Association, a 33-year-old economist named Alan Greenspan argued that central banks should beware of letting financial markets get too comfortable. The Federal Reserve’s success in smoothing economic fluctuations in the 1920s, he said, had led to the dangerous belief that “the business cycle is dead.” The crash and depression that followed were “inevitable” consequences of that cavalier attitude toward risk…

CBRE Global Investors Grabs Suburban SF Office Tower

Posted by: | Comments California Plaza, Walnut Creek, Calif., courtesy of CBRE Global Investors

California Plaza, Walnut Creek, Calif., courtesy of CBRE Global Investors

San Francisco—CBRE Global Investors caps off a busy month of acquisitions with the purchase of California Plaza, a Class A office asset in Walnut Creek, Calif. A fund advised by the global real estate investment management firm snapped up the 394,000-square-foot metropolitan San Francisco property from Tishman Speyer.

Both buyer and seller are keeping mum on the price tag on the 31-year-old California Plaza, which last traded in the fourth quarter of 2013 when Tishman bought it from Heitman Financial for $102 million…

Saudi Finance Minister Replaced With Capital Markets Head

Posted by: | Comments

Ibrahim al-Assaf in Tokyo, on Sept. 1, 2016.

-

Royal order excuses Al-Assaf, long-time finance minister

-

Former Capital Markets chief Mohammed Al-Jadaan his successor

Saudi Arabia’s finance minister for two decades was replaced on Monday, the latest in a series of government shake-ups as the world’s largest oil exporter tries to remake its economy.

A royal order published by the official Saudi Press Agency excused Ibrahim Al-Assaf from his post and replaced him with Mohammed Al-Jadaan, formerly head of the kingdom’s Capital Markets Authority. Al-Assaf was appointed a state minister and will remain a member of the cabinet…

TeamHealth Agrees to Be Sold to Blackstone

Posted by: | Comments Blackstone’s deal to acquire TeamHealth is a return trip for the private equity firm, which bought TeamHealth in 2005 and took it public four years later. CreditBrendan Mcdermid/Reuters

Blackstone’s deal to acquire TeamHealth is a return trip for the private equity firm, which bought TeamHealth in 2005 and took it public four years later. CreditBrendan Mcdermid/Reuters

Almost exactly a year ago, TeamHealth Holdings, a provider of physician outsourcing services, rebuffed a takeover offer from its rival AmSurg for nearly $8 billion, saying the proposed valuation was too low.

Shareholders balked, and the stock price tumbled. Now, TeamHealth has finally agreed to be sold, but at a large discount to that offer, which was made Nov. 2, 2015…

German $82 Billion Pension Giant Seeks Outside Help to Grow

Posted by: | Comments-

Bayerische Versorgungskammer steers clear of zero-yield bonds

-

Specialist third-party managers needed to diversify assets

Bayerische Versorgungskammer, Germany’s biggest pension fund, is hiring more external managers as it diversifies away from low-yielding government and covered bonds.

“We will invest more in assets such as high-yield, emerging-market debt and infrastructure where we rely on external experts,” Andre Heimrich, who helps oversee 75 billion euros ($82 billion) as BVK’s chief investment officer, said in an interview in Munich. “We will increase the share of third-party funds managing our investments to 65 percent over the next three years from 45 percent.”..

There Are 5.6 Million Cheap Apartments in America. Not for Long

Posted by: | Comments“If someone can’t afford it, they can move into something older or more vanilla and pay the lower rent. Usually the only option is to move out of the neighborhood.”

The Hidden Villa Apartments, a 61-unit complex in Beaverton, Ore., is the kind of property investors love and affordable-housing activists ignore.

Built in 1968, it was acquired recently by an out-of-town developer who plans to tear up the old carpeting and roll in some stainless steel appliances. The idea is to attract the wealthier workers flocking to knowledge industry jobs in the Portland, Ore., metropolitan area and charge higher rents…

Stan Johnson Closes Sale of Texas Medical Center

Posted by: | Comments Midtown Medical Office Building, 900 Jerome St., Fort Worth, Texas

Midtown Medical Office Building, 900 Jerome St., Fort Worth, Texas

Fort Worth, Texas—Stan Johnson Co. has recently closed the sale of a multi-tenant medical office building in Fort Worth, Texas. Ridgeline Capital Partners sold the 57,404-square-foot Midtown Medical Office Building to Roque Properties for $19.2 million.

The company represented both the seller and the buyer in the transaction. Toby Scrivner, Jeff Matulis, Grant Wilkins and Colin Cornell of the Healthcare Net Lease Group of Stan Johnson Co. represented the seller. The team received multiple offers and narrowed it down to two potential buyers, a 1031 investor and an institutional buyer. The final price represented a sales cap rate with 75-100 basis points over the market.

Akbank Joins Isbank in Home Loan Cut as Erdogan Push Obeyed

Posted by: | Comments-

Largest Turkish lender cuts rates second time in three months

-

President warned banking industry to curb costs in August

Akbank TAS, Turkey’s second-largest lender by market value, followed rival Isbank in cutting mortgage rates for a second time in three months after the nation’s president called on lenders to ease borrowing costs.

Turkiye Is Bankasi AS, as Isbank is more formally known, is reducing loan rates by 5 basis points to 0.90 percent a month, Chief Executive Officer Adnan Bali said at a news conference Monday in Istanbul, adding that he hoped others would follow suit. They did: just hours later, Akbank said it would match that rate on loans of up to two years maturity…

GE Creates $32 Billion Oil-Services Giant With Baker Hughes Deal

Posted by: | Comments-

Transaction expands offerings as slump in crude price endures

-

Immelt says diversified portfolio will help weather cycles

General Electric Co. is creating a $32 billion oil business by combining its petroleum-related operations with Baker Hughes Inc., betting on a rebound for an industry mired by a historic slump in crude prices.

The new company will be one of the industry’s largest players, bringing together a portfolio of capabilities spanning oilfield services, equipment manufacturing and technology. GE will own 62.5 percent of the merged entity, which will be publicly traded, the companies said Monday. The deal is expected to close in the middle of next year…

Inland Securities Announces Two New VP’s

Posted by: | CommentsIn their new roles, Jeff Spah and Ronald Cole will work with an Inland Securities internal wholesaler to build relationships with current and new financial advisors.

Jeff Spah

Jeff Spah

Oak Brook, Ill.—Inland Securities Corp. has announced the appointments of Jeff Spah and Ronald Cole as their new vice presidents. Both Spah and Cole will act as external wholesalers working in partnership with an Inland Securities internal wholesaler to build relationships with current and new financial advisors. Spah will be responsible for relationships in Minnesota, Iowa, North Carolina, South Dakota and Nebraska, while Cole will oversee Connecticut, Massachusetts, Maine, Rhode Island, Vermont and New Hampshire.

U.K. Mortgage Approvals Rose to Three-Month High in September

Posted by: | CommentsU.K. mortgage approvals rose in September to a three-month high, the Bank of England said.

Almost 63,000 loans for house purchase were granted, up from a revised 60,984 in August, it said in a report in London on Monday. Economists in a Bloomberg survey had forecast a figure of 61,500.

The report also showed that consumer credit rose 1.4 billion pounds in September after a 1.6 billion-pound increase the previous month…

U.K. Mortgage Approvals Rose to Three-Month High in September

JPMorgan Will Close Accounts of Argentines With Undeclared Funds

Posted by: | Comments-

Bank urges clients to participate in tax-amnesty program

-

Citizens have until Monday to open special amnesty accounts

JPMorgan Chase & Co. warned its Argentine clients with undeclared funds to participate in the government’s tax-amnesty program or risk losing their accounts.

“Big banks like JPMorgan will require that all funds be duly declared, and if not, we will close the accounts,” Facundo Gomez Minujin, who heads the New York-based bank’s Argentina unit, said in an interview…

JPMorgan Will Close Accounts of Argentines With Undeclared Funds

Clarks Americas Debuts New US Corporate Headquarters

Posted by: | Comments 60 Tower Road, Waltham, Mass.

60 Tower Road, Waltham, Mass.

Waltham, Mass.—Clarks Americas Inc. has opened its new U.S. corporate headquarters in the historic Polaroid building, a four-story office property in Waltham, Mass.

“As our company continues to grow regionally and globally, we needed to accommodate our expanding teams,” Christopher Scinto, Clarks Americas senior vice president of marketing, told Commercial Property Executive. “Our Newton location served us very well for nearly 18 years, but as our business grew our requirements have changed. We needed a larger more modern space that would foster talent, collaboration, and creativity throughout all of our departments.”…

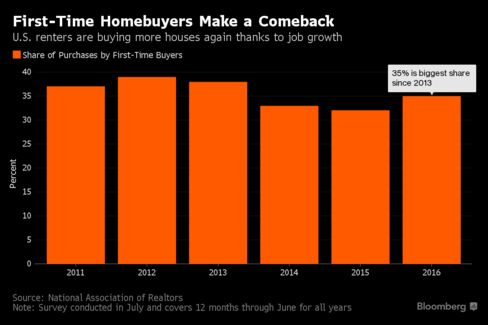

First-Time Buyers Are Coming Back to U.S. Housing Market: Chart

Posted by: | Comments The share of first-time buyers in the U.S. housing market rose for the first time in three years, driven in part by robust job growth for college graduates, according to a survey released Monday by the National Association of Realtors. New buyers made 35 percent of purchases in the 12 months through June, up from 32 percent in the prior year but still below the average over the survey’s 35-year history, which is 40 percent…

The share of first-time buyers in the U.S. housing market rose for the first time in three years, driven in part by robust job growth for college graduates, according to a survey released Monday by the National Association of Realtors. New buyers made 35 percent of purchases in the 12 months through June, up from 32 percent in the prior year but still below the average over the survey’s 35-year history, which is 40 percent…

First-Time Buyers Are Coming Back to U.S. Housing Market: Chart

How a Smooth Talker Convinced Bankers to Invest $32 Million, Then Vanished

Posted by: | Comments

The American Club’s Country Club in the Tai Tam area.

-

Citi, Morgan Stanley bankers burned by GMF cash-advance firm

-

Directors unreachable; police probe possible misappropriation

Inside Hong Kong’s posh American Club, few worked a room quite like Avery Stone.

Over steak dinners and cigars, Stone charmed a Who’s Who of financiers into investing millions in his fledgling business. Then, earlier this year, everything unraveled–and he vanished.

Left behind are the questions, including the big one: How did Stone and his partners at Global Merchant Funding Ltd. apparently dupe Hong Kong’s princes of finance into believing their business was on solid-footing? Accountants are still trying to piece together the answers…

Chipotle Has Some Special Burritos For Bill Ackman

Posted by: | Comments![Eat up! By Guillaume Capron from Issy les Moulineaux, France [CC BY-SA 2.0], via Wikimedia Commons](https://dealbreaker.com/uploads/2016/10/burrito-300x300.jpg) Eat up! By Guillaume Capron from Issy les Moulineaux, France [CC BY-SA 2.0], via Wikimedia Commons

Eat up! By Guillaume Capron from Issy les Moulineaux, France [CC BY-SA 2.0], via Wikimedia Commons

The beleaguered Mexican chain has been testing a new kind of poison pill in case the Pershing Square chief isn’t just a huge fan of their carnitas and instead has friskier plans. Call it a page out of Simeon Ecuyer’s well-worn playbook. Also, it’s taking some more conventional steps to defend itself against potential activist assault.

Investment banks Goldman Sachs Group Inc and Morgan Stanley, as well as law firm Wachtell, Lipton, Rosen & Katz LLP, are now working for the U.S. restaurant chain, the people said. Chipotle has also hired crisis public relations firm Joele Frank, they added….

It appears that rental Armageddon has now gone mainstream. Nearly a decade ago when the first housing bubble was taking off, cautious buyers lamented about the high prices in many coastal areas as they do today. “But real estate is the only way to get rich!” Okay. Then why not buy rental properties out of state? Of course this largely fell on deaf ears since house horny people only wanted to out compete their neighbors in the race to foreclosure glory. After 7,000,000 foreclosures and with 1,000,000 of those happening in California, most people have forgotten the past. Now we’re left with wonderful selection bias where those who timed the market (either by luck or foresight) are telling others that timing the market is impossible. Some people did buy investment properties out in Nevada and Arizona during the early days of the last bubble but these were largely flippers or people who thought they were wealthy enough to have a second home. Rare was the person looking to buy-and-hold for income purposes. So it comes as no surprise that there are now companies catering to high income coastal investors who realize a bubble is occurring but still want the benefits of owning real estate…

Baker Hughes Could Be a Good Fit for General Electric

Posted by: | CommentsGeneral Electric says it is not planning to acquire the $23 billion oil-services company Baker Hughes, contrary to news reports. But shareholders should not be shocked by the idea that G.E. might take a look.

Since the panic of 2008 raised an existential crisis at G.E., the $258 billion company has been on an enormous diet plan. Today, the company, led by Jeffrey R. Immelt, is fit for an offensive…

Beverage Leader Invests $16M in NC Distribution Center

Posted by: | Comments Pepsi Bottling Ventures’ headquarters in Raleigh, N.C.

Pepsi Bottling Ventures’ headquarters in Raleigh, N.C.

St. Pauls, N.C.—Pepsi Bottling Ventures, the largest privately held bottler for Pepsi-Cola products in North America, will generate 50 jobs over the next five years at a new $16.5 million distribution center in Robeson County, N.C. The project was made possible in part by a performance-based grant of up to $150,000 from the One N.C. Fund. A $400,000 grant from the state’s Economic Infrastructure Program, will also support Pepsi Bottling’s expansion.

California Wins $15 Million From Madoff-Tied Settlement

Posted by: | CommentsSACRAMENTO, Calif. — California will recover $15 million related to the vast Ponzi scheme engineered by Bernard Madoff as part of an agreement liquefying the $277 million estate of a Beverly Hills investment adviser, officials said on Friday.

The settlement ends a seven-year-old lawsuit filed by the state attorney general against Stanley Chais, a Beverly Hills investment adviser. Officials said he charged astronomical fees to invest hundreds of millions of dollars from more than 460 victims…

Anaheim Industrial Asset Trades for $188M

Posted by: | CommentsBentall Kennedy has acquired a 965,255-square-foot industrial asset from Clarion Partners and Panattoni Development.

Anaheim Concourse

Anaheim Concourse

Anaheim, Calif.—In one of the largest industrial deals in Orange County this year, CBRE Group arranged the sale of the recently constructed 965,255-square-foot Anaheim Concourse industrial property in Anaheim, Calif., to Bentall Kennedy for $188.2 million.

The property on North Miller Street in the hot North Orange County submarket was completed last year by Panattoni Development Co. and Clarion Partners LLC. It consists of seven Class A industrial buildings that are 86 percent leased. The lease rollover is staggered with the first set to expire in January 2021 and less than 20 percent of the development’s square footage to roll in any year through 2026…