Archive for Uncategorized

LEED Gold Office Tower Trades for $113M in Ft. Lauderdale

Posted by: | CommentsWhy the Dollar Bond Rally of Chinese Property Developers Might Be Short-Lived

Posted by: | CommentsA victim of its own success?

It’s no secret that China’s inflating property bubble is a growing headache for the country’s leadership.

But concern about overheating real estate hasn’t yet translated into pain in the international bond market where Chinese property developers raise a chunk of their funding. Having recorded negative net U.S. dollar-denominated bond issuance for four quarters in a row, Chinese property developers — a staple of the Asian high-yield bond market — finally saw the number turn positive in the third quarter of 2016, according to data compiled by CreditSights Inc…

Why the Dollar Bond Rally of Chinese Property Developers Might Be Short-Lived

Wells Fargo Steps Up Scandal Damage Control With TV Ad Push

Posted by: | Comments-

Ad features a stagecoach in slow motion and piano music

-

Poll shows 14% of customers intend to leave the bank

Wells Fargo & Co., trying to quell a scandal that has engulfed its consumer bank, will start broadcasting nationwide television commercials Monday night, outlining steps it has taken to halt abuses.

The spot — featuring a stagecoach in slow motion, and a narrator talking over piano music — escalates a public-relations campaign that already includes Internet and newspaper advertisements, as the firm tries to convince customers it’s putting their interests first. Authorities fined the bank $185 million last month, saying branch workers may have opened more than 2 million unauthorized deposit accounts and credit cards over half a decade…

MLB Offices Moving to Rockefeller Center

Posted by: | CommentsFake Divorce Is Path to Riches Buying Hot China Real Estate

Posted by: | Comments

A couple look out in front of a window at mall in Beijing.

-

Red-hot property market inspires desperate home-buying tactics

-

Curbs have cooled some markets, although prices still surging

Earlier this year, Mr. and Mrs. Cai, a couple from Shanghai, decided to end their marriage. The rationale wasn’t irreconcilable differences; rather, it was a property market bubble. The pair, who operate a clothing shop, wanted to buy an apartment for 3.6 million yuan ($532,583), adding to three places they already own. But the local government had begun, among other bubble-fighting measures, to limit purchases by existing property holders. So in February, the couple divorced….

New York’s Latest Must-Have Luxury Apartment Craze Is Driveways

Posted by: | CommentsThis ultra-rare city amenity offers privacy, security, and convenience. So to developers, it’s worth sacrificing precious square feet of ground space.

Jardim is the first New York project from Brazilian starchitect Isay Weinfeld: two, 11-story buildings in Manhattan’s West Chelsea. Named after the Portuguese word for garden, the towers feature indoor-outdoor living, with roomy balconies and a shared courtyard, yet these aren’t the features that set it apart from nearby projects—at least, according to its developer, Harlan Berger. The killer amenity here seems more prosaic: a private driveway that runs the entire length of the lot between 27th and 28th streets…

Leon G. Cooperman, the founder of Omega Partners, made news in September when the Securities and Exchange Commission charged him and his firm with insider trading. CreditChristopher Goodney/Bloomberg

Leon G. Cooperman, the founder of Omega Partners, made news in September when the Securities and Exchange Commission charged him and his firm with insider trading. CreditChristopher Goodney/Bloomberg

It has been a bruising year for hedge funds. Big bets have been disastrous, investors have voiced discontent and some managers have been forced to rewrite their playbooks or call it quits.

And now, there is new data to rub salt into the industry’s wounds: Over the last three months, investors pulled $28 billion out of hedge funds, according to the research firm Hedge Fund Research. It is the biggest quarterly outflow of dollars since the depths of the financial crisis in 2009…

Unaffordable Australian Housing in Government Sights, Morrison Says

Posted by: | Comments

Scott Morrison.

-

Lack of land supply in big cities is pushing up housing prices

-

Dwelling prices in Sydney have almost doubled since 2008

Australian states need to remove or simplify residential land planning regulations that have made homes “increasingly unaffordable” in the nation’s biggest cities, Treasurer Scott Morrison said.

Insufficient land releases and complex development regulations must be addressed, Morrison said in the text of a speech being given in Sydney Monday. He’ll use a December meeting with his state counterparts to urge a freeing up of housing supply, an issue which will be a key focus of Prime Minister Malcolm Turnbull’s government, he said…

Who’s Behind the Deal Between AT&T and Time Warner

Posted by: | CommentsAT&T’s blockbuster $84.5 billion takeover of Time Warner means many things — including rich fees for the bankers and lawyers who helped craft the deal.

Freeman & Company, a merger advisory and consulting firm, estimates that there will be $80 million to $120 million in advisory fees for each side.

It’s a familiar list of advisers for each company. Last year, Perella Weinberg Partners poached George H. Young III, a veteran telecommunications banker, from Lazard — and gained a close relationship with AT&T in the process. Mr. Young had advised the telecommunications company on its $48.5 billion takeover of DirecTV, as well as on many of the earlier deals that built the modern-day AT&T…

Construction Begins on Brooklyn Waterfront Office Campus

Posted by: | CommentsBusy Weekend for Bankers; U.K. Banking Exodus: Sunday Wrap

Posted by: | Comments-

Deals seen or announced in brokerage, aerospace, insurance

-

Iraq resisting OPEC efforts to coordinate production cuts

Here are highlights of Sunday’s top breaking stories from around the world:

The $85.4 billion AT&T-Time Warner media megadeal announced Saturday night was just the beginning of a wave of multi-billion-dollar acquisitions.

TD Ameritrade and Toronto-Dominion Bank are closing in on a $4 billion deal for Scottrade Financial that would combine two of the largest online brokerages at a time the sector is struggling with lower volume and revenue…

Berkadia Appoints New Managing Director in KC Office

Posted by: | CommentsIndian Stocks Decline to Pare Weekly Advance as Lenders Retreat

Posted by: | Comments-

Reliance slides as concerns about telecom outweigh 2Q profit

-

Bank index caps best week since July after Essar’s $13b deal

Indian stocks dropped, with the benchmark gauge paring a weekly gain, as some investors sold lenders and energy companies after recent advances.

Reliance Industries Ltd., which has a 7 percent weighting on the S&P BSE Sensex, was the biggest drag on the gauge. The stock dropped 2.2 percent, the most in a week. Axis Bank Ltd. was the top loser on the Sensex, while a gauge of lenders capped its best week since July after Essar Group’s $13 billion deal with a group involving Russia’s Rosneft PJSC improved prospects for loan recoveries at local banks…

Hedge Fund Managers Struggle to Master Their Miserable New World

Posted by: | Comments-

Average returns over past three years were only 2 percent

-

‘This feels like cancer to many people, a slow death’

Howard Fischer, wearing a white shirt and khakis, leans back into a window seat at a juice bar in Greenwich, Connecticut, sips a cold-brewed Mexican mocha and shares his angst.

“It’s miserable, miserable,” the 57-year-old manager of $1.1 billion Basso Capital Management says of hedge fund returns over the past few years. “If that’s the normal expectation, I don’t have a business.”

Berkadia Closes $92M Loan for New American Greetings HQ

Posted by: | CommentsReal Estate Titan Robert Olnick’s Huge Art Collection Goes to Auction

Posted by: | CommentsRobert S. Olnick built a real estate empire and a 60-piece art collection.

Robert S. Olnick created a real estate empire that stretched across New York City, Westchester, and New Jersey, comprising dozens of buildings that spanned millions of square feet. Simultaneously, he and his wife Sylvia began to develop a robust collection of modern art, filling their New York and Palm beach homes with works by such 20th century masters as Alexander Calder, Willem De Kooning, and Cy Twombly. Robert died in 1986 at the age of 74, and for the next 30 years Sylvia continued to collect, gravitating increasingly to contemporary artists, including Barbara Kruger, Cindy Sherman, and Vik Muniz…

Fake Divorce Is Path to Riches in China’s Hot Real Estate Market

Posted by: | Comments

A couple look out in front of a window at mall in Beijing.

-

Red-hot property market inspires desperate home-buying tactics

-

Curbs have cooled some markets, although prices still surging

Earlier this year, Mr. and Mrs. Cai, a couple from Shanghai, decided to end their marriage. The rationale wasn’t irreconcilable differences; rather, it was a property market bubble. The pair, who operate a clothing shop, wanted to buy an apartment for 3.6 million yuan ($532,583), adding to three places they already own. But the local government had begun, among other bubble-fighting measures, to limit purchases by existing property holders. So in February, the couple divorced.

Berkshire Group Invests in Leggat McCall Properties

Posted by: | CommentsCanada Targets Banks With Risk-Sharing Plan as Housing Booms

Posted by: | Comments-

Finance department releases proposal for mortgage risk-sharing

-

Government proposes two programs where banks would pay more

Canada’s banks could see their costs rise by as much as 30 basis points under government proposals that would force them to take on a greater share of mortgage defaults, as policy makers seek to engineer a soft landing in the country’s housing market.

Wall Street’s $40 Billion AT&T Pledge Offers Fees and Risks

Posted by: | Comments-

While ‘lucrative’ for banks, regulatory uncertainty exists

-

Markets can swing while regulators dwell on deal approval

Wall Street banks are writing some of their biggest checks ever to fund AT&T Inc.’stakeover of Time Warner Inc. as they seek a bonanza of fees. But there’s a dose of concern that the $40 billion loan pledge may get caught up in a regulatory impasse.

JPMorgan Chase & Co. has pledged $25 billion of the financing, with Bank of America Corp. providing the rest, according to a person with knowledge of the matter who asked not to be identified without authorization to speak publicly. That’s believed to be the most JPMorgan has ever promised for a deal, the person said…

Online Lenders Seek to Shape Industry Before Regulators Do

Posted by: | Comments Nat Hoopes, executive director of the Marketplace Lending Association, a trade group in Washington that represents online lenders. CreditAndrew Mangum for The New York Times

Nat Hoopes, executive director of the Marketplace Lending Association, a trade group in Washington that represents online lenders. CreditAndrew Mangum for The New York Times

WASHINGTON — Online lenders are drawing from a familiar playbook in Washington as scrutiny of the business heats up.

A central plank of their strategy is to prove that the industry can tame itself without the need for additional government intervention. By distancing themselves from payday lenders and other businesses whose predatory tactics have drawn regulatory fire, online lenders hope to avoid a similar crackdown…

Carr Properties Kicks Off NoVa Office Tower Construction

Posted by: | CommentsA Equity Volatility Calm Settles Over Most Industries: Chart

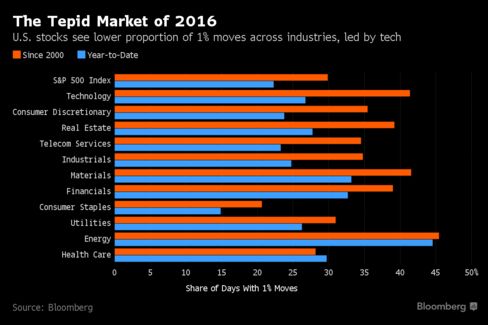

Posted by: | Comments Calm enough for you yet? Price swings have slowed among S&P 500 Index groups, with 10 of 11 notching fewer moves of at least 1 percent on a closing basis this year than the average over the prior 15 years. The tranquility is especially pronounced for technology stocks, which have moved by that magnitude 27 percent of the time in 2016, 14 points less than the long-term average. Health-care stocks, 2016’s laggard in the S&P 500, are the outlier…

Calm enough for you yet? Price swings have slowed among S&P 500 Index groups, with 10 of 11 notching fewer moves of at least 1 percent on a closing basis this year than the average over the prior 15 years. The tranquility is especially pronounced for technology stocks, which have moved by that magnitude 27 percent of the time in 2016, 14 points less than the long-term average. Health-care stocks, 2016’s laggard in the S&P 500, are the outlier…

A Equity Volatility Calm Settles Over Most Industries: Chart

Hedge Funds Hurt as Investors Remove $28 Billion in 3 Months

Posted by: | Comments Leon G. Cooperman, the founder of Omega Partners, made news in September when the Securities and Exchange Commission charged him and his firm with insider trading. CreditChristopher Goodney/Bloomberg

Leon G. Cooperman, the founder of Omega Partners, made news in September when the Securities and Exchange Commission charged him and his firm with insider trading. CreditChristopher Goodney/Bloomberg

It has been a bruising year for hedge funds. Big bets have been disastrous, investors have voiced discontent and some managers have been forced to rewrite their playbooks or call it quits.

And now, there is new data to rub salt into the industry’s wounds: Over the last three months, investors pulled $28 billion out of hedge funds, according to the research firm Hedge Fund Research. It is the biggest quarterly outflow of dollars since the depths of the financial crisis in 2009…

PAC Grabs Hines REIT’s Last Retail Property

Posted by: | CommentsHedge Fund Investors Withdrew $28.2 Billion in Third Quarter

Posted by: | Comments-

Redemptions are most since aftermath of financial crisis

-

Industry assets climb to a record $2.97 trillion on profits

Hedge fund investors pulled $28.2 billion from the industry in the third quarter, the most since the aftermath of the global financial crisis, according to Hedge Fund Research Inc.

The net outflows, which amount to 0.9 percent of the industry, are the largest since the second quarter of 2009, the firm said Thursday. Investors redeemed $51.5 billion in the first nine months of the year, even as industry assets rose to a record $2.97 trillion, it said…

Agree Realty Acquires Retail Center on the Texas Gulf Coast

Posted by: | CommentsChina Construction Slows, in Potential Sign of Turn in Property

Posted by: | Comments-

Construction sector output rose 6% on year in third quarter

-

Real estate services led growth while financial sector lagged

China’s construction growth slowed in the third quarter, signaling that developers might have turned more cautious toward a property market seen at risk of becoming a bubble.

Construction output rose 6 percent from a year earlier in the quarter, the National Bureau of Statistics said Thursday. That was down from 7.3 percent in the second quarter, and marked a second straight period of slower growth…

China Construction Slows, in Potential Sign of Turn in Property

Deutsche Bank Investors Press Lender to Sharpen Focus

Posted by: | Comments

The Deutsche Bank AG headquarters in Frankfurt.

-

Bank should consider shrinking securities unit, investor says

-

Deutsche Bank should cut workforce up to 20%, investor says

Deutsche Bank AG should shrink its securities business and eliminate more jobs to help lower costs further, according to some of the German lender’s largest investors.

The lender should reduce its global workforce by up to 20 percent, or double announced cuts, according to one of the top 20 investors, who asked not to be identified in line with company policy that bars managers from speaking about individual stocks. Deutsche Bank could also trim equities trading while focusing on its larger fixed-income business, the person said. A spokesman for Deutsche Bank declined to comment…

CBRE Secures $140M Refi of Ohio Office Tower

Posted by: | CommentsLuxury Market Stagnates as Wealthy Chinese Shoppers Stay at Home

Posted by: | Comments-

Recovery undermined by weak tourism in light of terrorism

-

Bain & Co. survey says flatter sales represent ‘new normal’

The world’s luxury-goods market stopped growing this year, according to a forecast from researcher Bain & Co., as the industry struggles to emerge from one of its weakest periods since the global recession.

Sales of personal luxury goods from Louis Vuitton coats to Hermes handbags are projected to linger at about 249 billion euros ($273 billion) in 2016, the weakest performance since 2009 at constant exchange rates. At actual rates, sales are set to slip 1 percent, Bain predicts…

Hedge Fund Managers Expect ‘Massive’ 34% Pay Cut, Survey Says

Posted by: | Comments-

Odyssey Search surveyed 500 hedge fund professionals

-

Firms with outflows expected to pay 37% less in bonuses

Portfolio managers at hedge funds, facing an exodus of investors frustrated with high fees, are about to feel the pain from an estimated 34 percent reduction in their compensation.

While fund managers may take the biggest pay cut in the industry, professionals with seven or more years of experience see their total compensation declining by 14 percent on average for 2016, recruiter Odyssey Search Partners said in a report this week following a September survey of 500 hedge fund professionals…

Top Software Company Moves HQ to Phoenix

Posted by: | CommentsSales of Existing Homes in U.S. Increase More Than Forecast

Posted by: | CommentsSales of previously owned U.S. homes increased more than projected in September, showing residential real estate continues to contribute modestly to growth, National Association of Realtors data showed Thursday.

Key Points

- Contract closings rose 3.2 percent to a 5.47 million annual rate (forecast was 5.35 million)

- Sales climbed 2.8 percent from September 2015 before seasonal adjustment

- Median sales price increased 5.6 percent from September 2015 to $234,200

- Inventory of available properties dropped 6.8 percent from a year earlier to 2.04 million…

Squeezing Hedge Funds Is Path to Profit at Three Big Banks

Posted by: | Comments-

Morgan Stanley, Goldman Sachs, JPMorgan market share climbs

-

Citigroup, Bank of America post drop in stock-trading revenue

In the battle for supremacy on Wall Street’s equity trading desks, the most successful banks are dangling a precious resource in front of hedge-fund clients: a balance sheet.

Morgan Stanley, Goldman Sachs Group Inc. and JPMorgan Chase & Co. grabbed a bigger share of the market last quarter by forcing hedge funds hungry for financing to send more stock-trading business their way. The three firms booked $5.1 billion from equities in the third quarter, or 76 percent of the total posted by the five largest U.S. investment banks, according to their financial statements. That was the most for the period since 2012…

Steven Cohen May Return to Hedge Fund Industry When Ban Expires

Posted by: | Comments Steven A. Cohen, the billionaire investor, in Los Angeles. CreditColey Brown for The New York Times

Steven A. Cohen, the billionaire investor, in Los Angeles. CreditColey Brown for The New York Times

Steven A. Cohen, a billionaire investor barred from managing money for others, is one step closer to making his return to the hedge fund industry.

Mr. Cohen, whose former hedge fund pleaded guilty to insider trading charges, has confirmed that a new investment firm he opened this year will probably begin raising money from outside investors in early 2018.

“I think we’re leaning that way,” Mr. Cohen, 60, said in a recent interview at his office in Stamford, Conn. “But we haven’t made a final decision.”…

Consolidated Tomoka Lands $30M Office Building

Posted by: | CommentsBrexit Volatility May Pay Off for Private Equity Firms, BCG Says

Posted by: | Comments-

Funds looking at the U.K. will need to increase due diligence

-

Industrial firms, private medical clinics are attractive

In a post-Brexit market, private equity firms are finding unique opportunities in the U.K. that give them an edge over rival, corporate bidders as buyout targets look for ways to cope with new volatility, according to the Boston Consulting Group.

Companies with close ties with the European Union for trade, workers and regulations may experience the most upheaval, the Boston Consulting Group said in a report Thursday. Industrial distribution companies, private medical clinics and laboratories, aerospace manufacturing and employment and recruitment services are sectors that present some of the best investments, the report said…

SoFi, an Online Lender, Is Looking for a Relationship

Posted by: | Comments SoFi members mingle at an invitation-only singles cocktail party hosted by the online banking company.CreditAdrienne Grunwald for The New York Times

SoFi members mingle at an invitation-only singles cocktail party hosted by the online banking company.CreditAdrienne Grunwald for The New York Times

SAN FRANCISCO — Alyson Casey recently received an invitation to a singles event in Manhattan from a start-up. But it didn’t come from a dating service. It came from the company that had recently refinanced her student loan: SoFi.

The idea of a financial firm playing matchmaker initially struck Ms. Casey, a 35-year-old software saleswoman, as rather unorthodox. But the invitation promised an even split of men and women, and free drinks at the rooftop bar of the James hotel…

Mesa West Funds $91M Loan for Austin Office Campus

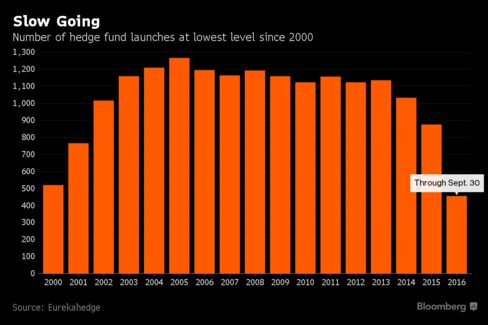

Posted by: | CommentsHedge Fund Launches Dwindle to 16-Year Low as Returns Lag: Chart

Posted by: | Comments Hedge fund startups, which were surging a decade ago, have fallen off a cliff in 2016 and are heading for their worst year since 2000, according to Eurekahedge. Globally, there have been just 457 fund launches through the first nine months of this year, compared to 876 in 2015, the Singapore-based data provider said. “The capital raising environment for newer launches is quite difficult to put it mildly and with existing offerings out there returning low-single digits over the last three years, investor appetite is quite selective to say the least,” said Mohammad Hassan, senior analyst at Eurekahedge…

Hedge fund startups, which were surging a decade ago, have fallen off a cliff in 2016 and are heading for their worst year since 2000, according to Eurekahedge. Globally, there have been just 457 fund launches through the first nine months of this year, compared to 876 in 2015, the Singapore-based data provider said. “The capital raising environment for newer launches is quite difficult to put it mildly and with existing offerings out there returning low-single digits over the last three years, investor appetite is quite selective to say the least,” said Mohammad Hassan, senior analyst at Eurekahedge…

NGFK Arranges $47M Sale of East Bay Office Complex

Posted by: | CommentsChicago “Building of the Year” Commands $468M

Posted by: | CommentsThe Closer to Antarctica, the Hotter the Property Market Gets

Posted by: | CommentsThey come for the skiing, wine and occasional polar blast.

Tourists take a ride on a jetboat around Lake Wakatipu in Queenstown, New Zealand.

Move over Sydney and Auckland, there’s a hotter property market in the southern hemisphere and it’s only 1,500 miles from Antarctica.

In Queenstown, New Zealand’s adventure tourism mecca and playground for the rich and famous, house prices rocketed 31 percent in the year through September to an average price of NZ$959,000 ($690,000). That’s twice the 15 percent rate of increase in Auckland, the nation’s largest city. In Sydney, prices climbed a mere 10 percent…

Comcast to Open New Office in Baltimore City

Posted by: | CommentsU.S. Housing Starts Unexpectedly Drop on Multifamily-Unit Slide

Posted by: | Comments-

Permits jump 6.3 percent to the fastest pace since November

-

Data suggest homebuilding dragged down third-quarter growth

New-home construction in the U.S. unexpectedly fell in September on a plunge in multifamily building while permits rose more than forecast, in signs of fitful progress in residential real estate.

Residential starts declined 9 percent to a 1.05 million annualized rate, the lowest since March 2015, a Commerce Department report showed Wednesday in Washington. The median forecast of economists surveyed by Bloomberg called for a rise to 1.18 million. Permits, a proxy for future construction, jumped 6.3 percent to the fastest pace since November…

Wall Street Is Doing Just Fine With Fewer Workers

Posted by: | Comments-

Morgan Stanley revenue surges after axing 25% of unit’s staff

-

Goldman fixed-income revenue jumps 49% after firm cut jobs too

To the thousands of traders and salespeople who’ve lost their jobs since the financial crisis, Wall Street has a message: We’re doing OK without you.

The five biggest U.S. investment banks reaped $20.7 billion in revenue from bond and stock trading in the third quarter, the most for the typically slow summer period since 2009. The gains came even after the world’s 10 biggest firms, including European banks that haven’t yet reported third-quarter results, sliced more than 5,000 front-office trading and investment-banking jobs in the past seven years, according to Coalition Ltd…

Consumer Spending Leading Economic Growth, Says Moody’s

Posted by: | CommentsBank of Canada Puts Price Tag on Morneau Housing Measures

Posted by: | CommentsThe Bank of Canada, which has expressed worries about vulnerabilities posed by high household and elevated real estate prices, has put a price tag on the recent measures to rein in the market.

In the release of its quarterly Monetary Policy Report on Wednesday, the central bank estimated changes announced by Finance Minister Bill Morneau on Oct. 3 would reduce housing’s contribution to growth over the next two years and leave the economy 0.3 percent smaller than it otherwise would have been by the end of 2018. That’s worth more than C$6 billion ($4.6 billion) in lost income…

Look Who’s Driving the U.S. Housing Market

Posted by: | CommentsMillennials! What, you thought they’d stay away forever?

Not very long ago, it was fashionable to ask if millennials would ever crawl out of their parents’ basements and into a realtor’s office. Enthusiasm for that view, which had gained wide exposure by 2012, lost steam as mortgages got easier to come by and millennials kept insisting that no, actually, they do want to own a home.

A flurry of reports released yesterday should further dispel the notion that millennials are allergic to homeownership…

AC Buckhead at Phipps Plaza Opens Doors in Atlanta

Posted by: | CommentsPinnacle to Manage 281-Unit Dallas Property

Posted by: | CommentsGoldman’s Earnings Impress but Don’t Fully Convince

Posted by: | CommentsGoldman Sachs is charting a frustrating path back to the top.

Trading, share buybacks and operating leverage all helped the investment bank earn $2.1 billion in the third quarter, its best showing in a year and a half. The way it beat its cost of capital, though, fails to inspire full confidence.

More than half the $1.3 billion increase in revenue from a year ago came fromfrom from the company’s investing and lending division. Gains on equity investments accounted for most of it. That is fine, as far as it goes. Results in this area fluctuate wildly, however. And new regulations are curbing how large this part of the business can be…

Silicon Valley Cozies Up to Washington, Outspending Wall Street 2-1

Posted by: | Comments-

Big tech is outspending banks, alumni get government jobs

-

Wishlist from trade to antitrust poses challenge to regulators

A political weather map of America would show Wall Street under a cloud, and Silicon Valley bathed in sunshine.

Over the Obama administration’s eight years, the technology industry has embedded itself in Washington. The president hung out with Facebook Inc.’s Mark Zuckerberg and hired the government’s first chief tech officer. At least at the lower levels of officialdom, the revolving door with companies such as Google is spinning ever faster — as it once did with Wall Street…

A $56 Billion Pile of Cash Seeks Home as Distressed Debt Shrinks

Posted by: | Comments-

Low rates, rising commodity prices translate to less distress

-

‘Low interest rates are letting companies prolong problems’

They raised the money, and now they have few places to put it.

U.S. distressed debt managers have $56 billion to invest, the most dry powder for the industry ever, according to research firm Preqin. But there just aren’t enough bad loans and bonds for them to buy: the amount of outstanding troubled debt has fallen by more than two-thirds since peaking in March, Bank of America Merrill Lynch index data show.

Labor Board Challenges Secrecy in Wall Street Contracts

Posted by: | Comments Wall Street in New York. The National Labor Relations Board is reviewing employment contracts used by the financial industry. CreditSeth Wenig/Associated Press

Wall Street in New York. The National Labor Relations Board is reviewing employment contracts used by the financial industry. CreditSeth Wenig/Associated Press

On Wall Street, moneymaking companies have long relied on confidentiality agreements to prevent employees from divulging their secrets.

But now, the nation’s labor board has challenged some provisions in the contracts that Bridgewater Associates, the world’s biggest hedge fund firm, requires each full-time employee to sign.

The unusual action is calling into question longstanding practices and prompting some companies to re-examine their employment agreements…

Confidence Among Homebuilders in U.S. Falls From 11-Month High

Posted by: | CommentsConfidence among U.S. homebuilders cooled in October from an 11-month high, reflecting a pause in the market for single-family houses, according to data from the National Association of Home Builders/Wells Fargo.

Key Points

- Builder sentiment gauge dropped to 63 (matching forecast) from the prior month’s 65 that was the highest since October 2015; readings greater than 50 mean more respondents reported good market conditions

- Index of prospective buyer traffic fell to 46 from 47

- Measure of six-month sales outlook rose to 72, the highest in a year, from 71

- Gauge of current sales decreased to 69 from an almost 11-year high of 71…

China’s Housing Market Isn’t in a Bubble After All

Posted by: | Comments

Chinese consumers and salesmen study models of housing projects in Qingdao.

China’s housing market is starting to resemble a Bermuda triangle for economists: time and again the smartest forecasters wade in only to get it wrong.

That’s the view of Larry Hu, head of China economics at Macquarie Securities Ltd. in Hong Kong, who describes the latest talk of a housing bubble in the world’s second biggest economy as a recurring myth. Instead, rapid price gains in the biggest cities merely reflect underlying demand and a supply shortage, fundamentals that are very different to the kind of credit-fueled property boom-and-bust cycle seen elsewhere…

SL Green Breaks Ground on NYC’s 2nd Tallest Tower

Posted by: | CommentsMGIC Jumps Most Since July as Housing Rebound Boosts Profit

Posted by: | Comments-

Operating profit climbs as underwriting margin improves

-

BofA analyst advises investors to buy insurer’s shares

MGIC Investment Corp., one of the U.S. mortgage guarantors that survived the financial crisis, posted the biggest gain since July as third-quarter operating profit advanced on lower costs tied to soured home loans.

The insurer rose 41 cents, or 5.1 percent, to $8.44 at 4:02 p.m. in New York trading, narrowing its loss for the year to 4.4 percent. Operating income rose to $102.2 million from $83.2 million a year earlier, the Milwaukee-based company said in a statement Tuesday…

110 Tower

110 Tower

1271 Avenue of the Americas, New York City

1271 Avenue of the Americas, New York City Red Hoek Point, New York, rendering

Red Hoek Point, New York, rendering John Schorgl

John Schorgl American Greetings Headquarters, Westlake, Ohio

American Greetings Headquarters, Westlake, Ohio Mahmood Malihi, co-president, Leggat McCall Properties

Mahmood Malihi, co-president, Leggat McCall Properties 2311 Wilson Blvd., Arlington, Va.

2311 Wilson Blvd., Arlington, Va. Champions Village, Houston

Champions Village, Houston Port Arthur Center

Port Arthur Center Huntington Center in Columbus, Ohio

Huntington Center in Columbus, Ohio 111 W Monroe St., Phoenix, Ariz.

111 W Monroe St., Phoenix, Ariz. The property located at 3600 Peterson Way in Santa Clara, Calif.

The property located at 3600 Peterson Way in Santa Clara, Calif. Stonebridge Plaza I & II

Stonebridge Plaza I & II Diablo Technology Center

Diablo Technology Center AMA Plaza, Chicago

AMA Plaza, Chicago 1215 East Fort Avenue, McHenry Row, Baltimore

1215 East Fort Avenue, McHenry Row, Baltimore Source: Moody’s Analytics

Source: Moody’s Analytics AC Hotel Atlanta Buckhead at Phipps Plaza

AC Hotel Atlanta Buckhead at Phipps Plaza The Mallory Eastside Apartments, Richardson, Texas

The Mallory Eastside Apartments, Richardson, Texas City officials and the One Vanderbilt project team at the groundbreaking ceremony.

City officials and the One Vanderbilt project team at the groundbreaking ceremony.