Archive for Uncategorized

Money Markets Are Facing the Most Tumultuous Quarter-End Since the Financial Crisis

Posted by: | Comments-

Use of Federal Reserve’s reverse-repo facility ramps up

-

Oct. 14 deadline for money-fund overhaul magnifies pressures

The U.S. short-term financing markets and the $2.6 trillion money-fund industry are grappling with one of the most chaotic quarter-end stretches since the financial crisis. Repo rates are soaring and money-market funds are stashing more spare cash with the Federal Reserve.

SL Green Lands $1.5B Financing for One Vanderbilt

Posted by: | CommentsManhattan Luxury Rent Prices Are Growing at Their Slowest Pace Since 2010

Posted by: | CommentsRents are still rising, for the most part, but at a much slower pace.

Photographer: Michael Nagle/Bloomberg

Photographer: Michael Nagle/Bloomberg

Renters in the New York City area are finally catching a break. According to a new report from listings website StreetEasy.com, rental prices are rising much more slowly than in recent years, with luxury apartments leading the slump.

The price of Manhattan luxury rentals rose just 2.2 percent year-over-year in August, registering their slowest growth rate since 2010. That deceleration’s happening at a pace that’s caught even industry analysts by surprise. “I think we expected things to slowdown,” StreetEasy economist Krishna Rao said in a phone interview. Still, “the pace has been a little bit faster than we expected.”…

Whole Foods Debuts New Chicago Store

Posted by: | CommentsConcern Over Deutsche Bank’s Health Shakes Markets

Posted by: | Comments Deutsche Bank headquarters in Frankfurt. For the year, the bank’s shares are down 53 percent.CreditKai Pfaffenbach/Reuters

Deutsche Bank headquarters in Frankfurt. For the year, the bank’s shares are down 53 percent.CreditKai Pfaffenbach/Reuters

Stock markets were rattled on Thursday after reports emerged that some clients of Deutsche Bank, the struggling German lender, were reducing their exposure.

Its shares in the United States tumbled 6.7 percent for the day, after falling as much as 9 percent, in unusually heavy trading. The afternoon slide helped pull down financial stocks and the broader market…

C&W: Lower Oil Prices Have Mixed Effects on Global Office Market

Posted by: | CommentsJapanese Shares Drop as Lenders Slump on Deutsche Bank Concerns

Posted by: | CommentsJapanese shares slid, with the benchmark equity index erasing its gain for September, as escalating concerns over German lender Deutsche Bank AG’s capital troubles rippled across global markets.

The Topix index lost 1.7 percent as of 10:07 a.m. in Tokyo, heading for a 0.7 percent drop this month. Deutsche Bank’s New York-listed shares tumbled after Bloomberg News reported about 10 hedge funds doing business with the German lender have moved to reduce their financial exposure. The rout follows a request from U.S. authorities that Deutsche Bank pay $14 billion to settle claims the firm sold fraudulent mortgage-backed securities…

Och-Ziff to Pay Over $400 Million in Bribery Settlement

Posted by: | Comments Daniel S. Och, chief executive officer of Och-Ziff Capital Management Group.CreditRick Maiman/Bloomberg News

Daniel S. Och, chief executive officer of Och-Ziff Capital Management Group.CreditRick Maiman/Bloomberg News

Africa once represented a lucrative new market for a giant New York hedge fund.

More than a decade later, the hedge fund, Och-Ziff Capital Management, and its founder, Daniel Och, are paying the price for what the United States government has charged were more than $100 million in bribes paid to government officials in Libya, Chad, Niger, Guinea and the Democratic Republic of Congo to secure natural resources deals and other investments.

Pending Sales of U.S. Existing Homes Fall to Seven-Month Low

Posted by: | CommentsContracts to purchase previously owned U.S. homes fell to a seven-month low in August, held back by tight supply in the housing market, the National Association of Realtors said Thursday in Washington.

Key Points

- Pending home sales fell 2.4 percent (median forecast was for no change) after a revised 1.2 percent increase in July

- Index dropped to a seasonally adjusted 108.5, lowest since January, from 111.2 in July

- Contract signings rose 4 percent from August 2015 on an unadjusted basis…

Pending Sales of U.S. Existing Homes Fall to Seven-Month Low

Stocks Fall as Deutsche Bank Woes Roil Lenders; Treasuries Climb

Posted by: | Comments-

U.S. oil tops $47 as gains extended after OPEC freeze deal

-

Most Asian index futures retreat amid banking stock selloff

Stocks fell, while Treasuries climbed as mounting concern over Deutsche Bank AG’s finances roiled global lenders. Oil extended its surge.

Equities erased gains after Bloomberg News reported about 10 hedge funds that do business with the German lender have moved to reduce their financial exposure. Deutsche Bank’s shares traded in the U.S. tumbled to a record low, spurring a slump in American banking equities. Treasuries reversed losses as traders sought out haven assets, while the dollar rose against most of its major counterparts. U.S. crude climbed above $47 a barrel…

CBRE Arranged Financing for Suburban Indy Mixed-Use Asset

Posted by: | CommentsUS Pending Home Sales Slump in August

Posted by: | CommentsWashington (AP) — Fewer Americans signed contracts to buy homes in August, as a shortage of properties for sale is weighing on the market.

The National Association of Realtors said Thursday its seasonally adjusted pending home sales index fell 2.4 percent last month to 108.5, its lowest reading since January. The number of signed contracts slumped sharply in the South, the nation’s largest housing market. But pending sales improved in the Northeast, Midwest and West…

U.S. Stocks Retreat as Deutsche Bank Woes Hit Financial Shares

Posted by: | Comments-

Lenders in S&P 500 drop after Bloomberg report on German bank

-

Fears of contagion roil banking sector; drugmakers slump

U.S. stocks fell as banks retreated amid growing concern that Deutsche Bank AG’s woes will spread to the global financial sector. Health-care shares sank on speculation tighterregulations will crimp profits.

Financial shares erased gains and tumbled 1.5 percent after a Bloomberg News report that signaled growing concern among some Deutsche Bank AG clients roiled markets. A number of funds that clear derivatives trades with Deutsche withdrew some excess cash and positions held at the lender, according to an internal bank document seen by Bloomberg. Johnson & Johnson and Pfizer Inc. fell more than 1.7 percent, pacing declines among drug companies…

River City Power Center Sells for $81M

Posted by: | CommentsWhat Does a $5 Million Townhouse Look Like in Three Different Cities?

Posted by: | CommentsDipping our toes into the covetable and capricious global townhouse market.

The following properties are all townhouses in the same price range, but that’s where their similarities end…

What Does a $5 Million Townhouse Look Like in Three Different Cities?

Douglas Emmett, QIA Grab LA Ocean-View Office Gem

Posted by: | CommentsU.K. Pension Deficits Fall From Record as Challenge Remains

Posted by: | Comments-

Defined-benefit plans have 690 billion-pound funding gap: PwC

-

Low bond yields cut returns as firms consider closing funds

U.K. company pension deficits fell by 20 billion pounds ($26 billion) in September but remained close to the previous month’s record high of 710 billion pounds, a study showed.

The funding gap for defined-benefit pensions, which pay retirees fixed amounts based on factors including length of service, stood at 690 billion pounds as of September 29, according to PricewaterhouseCoopers LLP…

Here’s the Smoking Gun That China Has a Huge Housing Bubble

Posted by: | CommentsOne that will burst in 2018, Deutsche Bank reckons.

Speculative buyers have eschewed Chinese stocks in favor of property, prompting even the chief economist at the central bank of the world’s second largest economy to declare that housing was in a “bubble.”

But when strategists at UBS AG recently compiled a list of bubblicious housing markets, there weren’t any selections from mainland China due to the lack of reliable data on the subject, underscoring the continued difficulty in declaring Chinese real estate to be in overheated territory…

Gatehouse Capital Joins Virgin Hotels Project in Dallas

Posted by: | CommentsIn Caesars Bankruptcy Fight, Private Equity Owners Fold

Posted by: | CommentsCaesars may be defeated, but borrowers reign supreme.

Efforts by Caesars Entertainment’s private equity owners, Apollo Global Management and TPG Capital, to salvage something from their $30 billion casino buyout largely failed after creditors fought back. Under terms of a new deal, junior creditors would recover 66 cents on the dollar if a bankruptcy court approves. Most debt investors around the world are bowing to lame terms, however, meaning Caesars probably will be an exception.

London Property Stalls as Brexit Turns Sellers into Landlords

Posted by: | Comments-

14 percent of homes withdrawn from sale now offered as rentals

-

Some home owners opting to rent rather than accept price cuts

Gary Waller, a 41-year-old accountant, expected to negotiate a lower price on an apartment he wanted to purchase in London’s Putney district following the U.K.’s vote to leave the European Union. Instead, the vendor took the property off the market.

Home sales in the capital in the first seven months of 2016 were at their lowest level since 2012 as owners delayed offering properties for sale or chose to lease them rather than accept lower offers amid fears over the impact of the Brexit vote. Almost 54,900 residences were sold in London in the seven months through July, an analysis of preliminary Land Registry data shows…

This Former British Torpedo Facility Is Now a $9 Million Mansion

Posted by: | Comments

Come for the concrete blast walls, stay for the stainless-steel chef’s kitchen.

In the early days of the Cold War, the British Admiralty built a torpedo testing facility in the middle of Bushy Park, a royal park outside London. The facility had a 150-foot-wide pool reinforced with 4-foot-thick concrete blast walls, in which scientists spun torpedoes at the end of a metal arm…

This Former British Torpedo Facility Is Now a $9 Million Mansion

Rhode Island Cuts Hedge Fund Allocation by Half to Boost Returns

Posted by: | Comments-

Proposal approved Wednesday by state investmennt commission

-

Fund allocation will be cut to 6.5 percent from 15 percent

Rhode Island Treasurer Seth Magaziner said the state’s $7.7 billion pension fund is cutting its allocation to hedge funds in half over two years, as high fees eat into returns and some of the investment pools provide less diversification than expected.

Rhode Island will reduce its investments in hedge fund strategies by more than $500 million and reallocate the money to more traditional asset classes in low-fee index funds, Magaziner, 33, said in a news release. Rhode Island joins pension funds in New York City and California’s Public Employees Retirement System, the largest U.S. pension, in cutting hedge-fund investments…

Vancouver, London Top List of Cities at Risk of Housing Bubble

Posted by: | Comments-

UBS ranks real estate of 18 financial centers globally

-

Report warns of potential ‘rapid decline’ after price surge

Vancouver, London and Stockholm rank as the cities most at risk of a housing bubble after a surge in prices in the past five years, according to a UBS Group AG analysis of 18 financial centers.

Sydney, Munich and Hong Kong are also facing stretched valuations, UBS said in its 2016 Global Real Estate Bubble Index report, released Tuesday. San Francisco ranked as the most overvalued housing market in the U.S., while not yet at bubble risk…

Columbus Office Tower Earns Energy Star Certification

Posted by: | CommentsSome of America’s Hottest Housing Markets Are Cooling Off

Posted by: | Comments-

Denver, Austin, San Francisco see slowing gains in values

-

Affordability is drawing house hunters to outlying towns

The red-hot growth in home prices across the U.S. West is starting to slow in some cities as sticker shock and low inventory put off weary buyers.

Denver, Los Angeles and Austin, Texas, have seen gains in real estate values moderate after years of double-digit increases, according to Zillow. A slowdown in the tech epicenter of San Francisco is becoming even more pronounced, with the median home value in August rising less than 1 percent from a year earlier…

Erdogan Adviser Says Turkey Should Consider Buying Deutsche Bank

Posted by: | Comments-

Plan would turn Germany’s largest lender into ‘Turkish Bank’

-

Wealth fund or state bank conglomerate could buy, Bulut says

Deutsche Bank AG’s crashing share price is prompting takeover speculation from unexpected places.

Yigit Bulut, a chief adviser to Turkish President Recep Tayyip Erdogan, said the country must consider using a new wealth fund or a group of state-owned banks to buy the Frankfurt-based company. Bulut made the proposal on Tuesday via his Twitter account, saying Germany’s largest lender should be made into a Turkish bank…

Erdogan Adviser Says Turkey Should Consider Buying Deutsche Bank

CBRE Arranges Sale of Auburn Shopping Center

Posted by: | CommentsWells Fargo’s CEO Forfeits $41 Million in Fight to Keep Job

Posted by: | Comments-

Board orders review into handling of bogus customer accounts

-

‘We are deeply concerned by these matters,’ lead director says

Wells Fargo & Co. Chief Executive Officer John Stumpf, fighting to keep his job amid a national political furor, will forgo more than $41 million of stock and salary as the bank’s board investigates how employees opened legions of bogus accounts for customers.

Hedge Fund Legend Says the Industry Is Facing the Most Difficult Era Ever

Posted by: | Comments-

Longtime manager says ‘2 and 20’ structure isn’t sacrosanct

-

Industry can help shield portfolios in coming bubble, he says

Hedge funds are facing the most challenging time Tiger Management’s Julian Robertson said he’s seen in an investing career spanning several decades, and the industry pioneer cautioned that their days of charging hefty fees may be over.

“That type of business hasn’t worked lately, and it’s a tough business,” Robertson, 84, said Tuesday on a prime-time edition of Bloomberg Surveillance in New York. “It’s tougher to be a hedge fund investor than ever before.”…

NGKF Secures Financing for Greenwich Office Building

Posted by: | CommentsCalifornia Suspends ‘Business Relationships’ With Wells Fargo

Posted by: | Comments-

State is largest muni issuer, has $75 billion in investments

-

Bank is facing mounting criticism over bogus accounts

California, the nation’s largest issuer of municipal bonds, is barring Wells Fargo & Co. from underwriting state debt and handling its banking transactions after the company admitted to opening potentially millions of bogus customer accounts.

The suspension, in effect immediately, will remain in place for 12 months. A “permanent severance” will occur if the bank doesn’t change its practices, State Treasurer John Chiang said Wednesday. The state also won’t add to its investments in Wells Fargo securities. Chiang already replaced Wells Fargo with Loop Capital for two muni deals totaling about $527 million that will be sold next week…

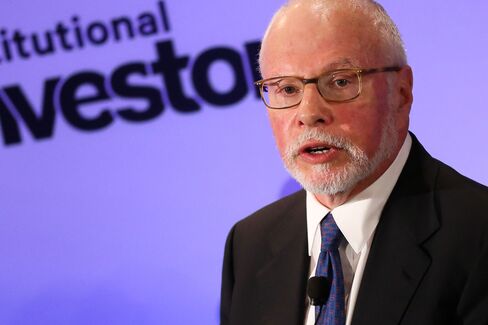

It’s Paul Singer Versus Citigroup in a Bitter Bankruptcy Feud

Posted by: | Comments

Paul Singer

-

Hedge funds fight for $1 billion in Peabody Energy assets

-

The contentious dispute pivots on an arcane accounting change

As Peabody Energy Corp. stumbled toward bankruptcy last year, its Wall Street adviser raised a red flag for management.

Two powerful and litigious distressed-debt hedge funds held Peabody bonds. “Both are bomb throwers and we should be very suspicious,” wrote Tyler Cowan, a restructuring expert at Lazard Ltd.

Hines Lands New Tenant in Hamburg

Posted by: | CommentsNGKF Closes $16M SoCal Office Sale

Posted by: | CommentsStandard Chartered’s U.S. Settlement Is Imperiled by New Claims

Posted by: | Comments The London-based bank Standard Chartered reported potential misconduct at MAXpower Group, an Indonesian power company in which it is an investor. CreditStefan Wermuth/Reuters

The London-based bank Standard Chartered reported potential misconduct at MAXpower Group, an Indonesian power company in which it is an investor. CreditStefan Wermuth/Reuters

LONDON — Standard Chartered said on Tuesday that it had received accusations of potential wrongdoing by officials at an Indonesian power company in which it is an investor.

The London-based bank, whose business is largely in Asia, said that it had referred the accusations to “appropriate authorities,” without identifying them.

The United States Justice Department’s foreign bribery unit is the authority looking into the accusations, a person briefed on the matter said…

San Francisco’s Tiffany Building Trades Hands

Posted by: | CommentsWall Street Shrinks Further in Asia With Goldman, BofA Cuts

Posted by: | Comments-

Bank of America said poised to cut senior bankers in Asia

-

Goldman Sachs also said to be planning steep reductions

Even a record acquisition spree by Chinese companies isn’t enough to ease pressure on investment banks to cut costs in Asia, with Goldman Sachs Group Inc. and Bank of America Corp. becoming the latest firms to prepare job reductions.

House Prices Lift U.K. Consumers Amid Residual Brexit Concerns

Posted by: | Comments-

Confidence index rises, yet remains below pre-Brexit levels

-

Job security and business activity outlook measures slide

U.K. consumer confidence is slowly recovering from a dip after the Brexit referendum, buoyed by a positive outlook for property prices and household finances.

An index of sentiment by YouGov and the Centre for Economics and Business Research rose for a second month in September. The gauge, based on 6,000 interviews, remains below the level it was before Britain’s vote to leave the European Union…

House Prices Lift U.K. Consumers Amid Residual Brexit Concerns

Citi Warns on Gold as Bank Boosts Odds of Trump Win to 40%

Posted by: | Comments-

U.S. ‘polls have started to tighten,’ Citigroup says in report

-

Presidential contest is ‘increasingly bizarre,’ bank says

Gold may be in for a bumpy ride in the final quarter as Republican candidate Donald Trump now has a 40 percent chance of winning the presidential election and investors will be preparing for the possibility of higher U.S. interest rates, according to Citigroup Inc.

Volatility in bullion and foreign-exchange markets may increase, according to a commodities report from the bank as it raised the odds on a Trump victory over Democrat Hillary Clinton in November from 35 percent. There would probably be a single U.S. hike by year-end, it said. A Bloomberg Politics poll has Trump and Clinton deadlocked before a debate later today…

Eastern Consolidated Arranges Sale of Manhattan Asset

Posted by: | CommentsFreeport’s $2 Billion Anadarko Sale Said to Face Lender Snag

Posted by: | Comments-

Bondholders are demanding more money, stronger covenants

-

Company CFO says it has ‘no reason’ to offer better terms

Freeport-McMoRan Inc.’s bondholders are creating a potential obstacle for a $2 billion asset sale designed to inject cash into the debt-laden commodities producer, according to people with knowledge of the matter.

Some of the creditors want more money and greater protection for allowing the sale of oil and gas assets to Anadarko Petroleum Corp. — a proposal that requires changes to Freeport’s existing agreement with the lenders. Freeport, which wants to keep the debt on its own balance sheet even as the assets shift to the buyer, is seeking majority approval from five sets of bondholders who together own $2.3 billion of notes to complete the asset sale…

Cushman & Wakefield Lands $18M Lease at One Biscayne Tower

Posted by: | CommentsRBS Will Pay $1.1 Billion in Settlement Over Mortgage Securities

Posted by: | Comments-

U.K.-based bank agrees to deal with credit-union regulator

-

U.S. agency says sales helped topple corporate credit unions

Royal Bank of Scotland Group Plc will pay $1.1 billion to settle National Credit Union Administration claims that it sold faulty mortgage-backed securities to U.S. credit unions.

The agreement with RBS is among the largest in a series of settlements in which banks have paid hundreds of millions over accusations stemming from sales that contributed to the collapse of corporate credit unions after the 2008 financial crisis. Tuesday’s accord closes 2011 lawsuits filed in California and Kansas on behalf of two corporate credit unions, the NCUA said in a statement Tuesday, and it follows an earlier RBS agreement to pay $129.6 million to resolve similar lawsuits over two other credit unions…

Hedge Funds Miss Alibaba Rally, Forgoing Millions in Gains

Posted by: | Comments-

Managers have reduced their positions every quarter since 2014

-

E-commerce giant soared after funds sold 2.2 million shares

Shares of Alibaba Group Holding Ltd. are headed toward their second best quarter since the e-commerce giant’s record-setting initial public offering two years ago. And hedge funds are missing out.

The Chinese company’s U.S.-traded stock jumped as much as 38 percent since the end of June to a 21-month high after hedge funds pared their holdings by 2.2 million shares in the previous three months, effectively foregoing around $61 million in profits, according to Bloomberg data…

Angelo Gordon Grabs Suburban Denver Office Campus

Posted by: | CommentsOne Small Hedge Fund Is Carrying On in The Fight Over Caesars

Posted by: | Comments-

Trilogy-led group holds $22 million claim in $17 billion case

-

Suit it filed in 2014 could still test Depression-era law

The titans of the investing world have settled their fight in bankruptcy court over the future of the Caesars casino empire. But one tiny band of lenders is pressing on and keeping alive a lawsuit they say is designed to protect small investors.

The bondholder group led by Trilogy Capital Management acknowledges that its case against Caesars Entertainment Corp. won’t upend the carefully negotiated settlement reached this week among creditors owed $17.3 billion. After all, they hold just $22 million in the casino giant’s unsecured bonds, says Barry Kupferberg, director of research for the investment fund…

Wells Fargo CEO Forfeits $41 Million as Board Orders Review

Posted by: | Comments

John Stumpf testifies before the Senate Committee on Sept. 20.

-

‘We are deeply concerned by these matters,’ lead director says

-

Board may seek more actions against executives after inquiry

Wells Fargo & Co. Chief Executive Officer John Stumpf will forfeit $41 million of stock, plus some salary, as the bank’s board investigates how employees opened legions of bogus accounts for customers, a scandal that set off a national political furor.

Deutsche Bank Denies Asking Germany to Help in U.S. Dispute

Posted by: | CommentsThere are sickly European banks. And then there is Deutsche Bank.

Shares of the German banking giant, like those of a number of its peers in Europe, have swooned over the last year as investors reject banking models that rely on volatile market activities as opposed to collecting deposits or managing investor accounts.

The latest turbulence came on Monday. Shares of Deutsche Bank touched new lows after a German magazine reported that Berlin had ruled out providing government aid to Deutsche Bank…

MetLife, Norges Bank Buy Big in DC

Posted by: | CommentsDeutsche Bank Slumps as Investors Question Lender’s Health

Posted by: | Comments-

Bank says it’s “determined to meet challenges on its own”

-

Focus reports that German government has ruled out state aid

Deutsche Bank AG shares dropped to a record low and its riskiest bonds declined after a media report said the German government wouldn’t step in to back the lender, fueling investor concerns about its weakened finances.

The shares slumped 6 percent to 10.73 euros at 1:55 p.m. in Frankfurt, bringing losses to about 52 percent this year. The lender’s 1.75 billion euros ($2 billion) of 6 percent additional Tier 1 bonds, the first notes to take losses in a crisis, fell about 2 cents on the euro to 73 cents, near a seven-month low, according to data compiled by Bloomberg…

S.E.C. Takes Different Strategy in Insider Trading Case

Posted by: | CommentsThe Securities and Exchange Commission’s latest insider trading case, against the prominent hedge fund manager Leon G. Cooperman, will test whether the old proverb “where there’s smoke, there’s fire” is enough to prove a violation.

The S.E.C.’s complaint seemingly paints a picture of a classic violation in which an investment manager receives news from someone inside the company and then rushes to trade on it. But the case is hardly typical, and Mr. Cooperman vowed to fight the charges in a five-page letter to his investors that said, “We have done nothing improper and categorically deny the commission’s allegations.”…

HFF Arranges $210M Financing for National Retail Portfolio

Posted by: | CommentsBanks to Need Billions More Capital in Tests Under Fed Plan

Posted by: | Comments-

Fed overhaul of stress tests would be tougher on big banks

-

Agency will let banks assume lower dividends during duress

Wall Street would have to come up with billions of dollars in additional capital in a proposed revamp of the Federal Reserve’s annual stress tests that could also scrap some provisions that lenders have criticized.

As the Fed has signaled for months, it is considering changes that would raise the minimum capital that the biggest banks need for a passing grade, Fed Governor Daniel Tarullo said Monday. But the Fed is also mulling concessions that Wall Street has sought, such as eliminating its assumption that lenders would continue to pay out the same level of dividends and buy back shares during periods of financial duress, he said…

C&W Closes $27M Deal in Tampa Business District

Posted by: | CommentsWells Fargo Sued by Shareholders Over Cross-Selling Scandal

Posted by: | Comments-

CEO accused of misleading investors about Tolstedt retirement

-

Investor seeks class action status for others over 2 1/2 years

Wells Fargo & Co. was accused of misleading shareholders about its opening of unauthorized accounts and blamed for a 9 percent drop in the bank’s stock price when details became public this month.

The San Francisco-based bank deceived investors for years about its fraudulent practice of cross-selling financial products and misrepresented the success of its model, according to the complaint filed Monday in San Francisco federal court. The investor who sued seeks class-action status on behalf of all shareholders from Feb. 26, 2014, to Sept. 15, 2016…

Pinching Pennies in the Hedge-Fund Capital of America

Posted by: | Comments-

Tastes and risk levels have gone through the wringer

-

‘One doesn’t want to become the next episode of “Billions”’

The lonely $250,000 S-Class coupe at Mercedes-Benz of Greenwich says it all. For six months, it’s been sitting in the showroom, shimmering in vain while models priced at only $70,000 fly out the door.

“We haven’t had anyone come in and look at it,” says Joey Licari, a sales consultant at the dealership, looking over his shoulder at the silver beauty. “I feel like normally they would, maybe a few years ago.”…

Former GM HQ in SoCal Signs New Tenants

Posted by: | CommentsA Viral Homebuyer Stampede Suggests China’s Real Estate Policies Are Askew

Posted by: | CommentsNew rules create a buying frenzy.

In China, even getting crushed under a giant door won’t deter at least one aspirant homeowner from pursuing his dream. (Wait for the 14-second mark.)

This viral video was caught on a surveillance camera last Saturday and posted online by the People’s Daily,which reported that this enthusiastic group of buyers was intent on snapping up new real estate in the Chinese city of Hangzhou. The mad frenzy was prompted by an effort to get in ahead of new restrictions taking effect on Monday that would ban those born outside the city from buying more than one property…

A Viral Homebuyer Stampede Suggests China’s Real Estate Policies Are Askew

Anbang Said to Complete Most of $6.5 Billion U.S. Hotels Deal

Posted by: | Comments-

Takeover helps bolster Anbang’s dealmaking credibility

-

Deal includes Essex House in New York, Four Seasons in D.C.

Anbang Insurance Group Co. completed most of its $6.5 billion acquisition of Strategic Hotels & Resorts Inc., helping to bolster the Chinese company’s credibility as a global buyer after its abrupt withdrawal from the bidding war for Starwood Hotels & Resorts Worldwide Inc. earlier this year.

One Vanderbilt, Manhattan

One Vanderbilt, Manhattan Whole Foods Market headquarters, Austin, Texas

Whole Foods Market headquarters, Austin, Texas Kevin Thorpe

Kevin Thorpe 116th St. Centre in Carmel, Ind.

116th St. Centre in Carmel, Ind. Alamo Drafthouse – Park North

Alamo Drafthouse – Park North 233 Wilshire Blvd., courtesy of Equity Office Properties

233 Wilshire Blvd., courtesy of Equity Office Properties Virgin Hotels Dallas

Virgin Hotels Dallas Town Center, 140 E. Town St., Columbus, Ohio

Town Center, 140 E. Town St., Columbus, Ohio Fingerlakes Crossing Center, Auburn, N.Y.

Fingerlakes Crossing Center, Auburn, N.Y. 500 West Putnam Ave.

500 West Putnam Ave. Virginia Building at Überseequartier Nord in Hamburg

Virginia Building at Überseequartier Nord in Hamburg 2860 Michelle Drive Irvine, Calif.

2860 Michelle Drive Irvine, Calif. The Tiffany Building

The Tiffany Building 84 Bowery, Manhattan, New York

84 Bowery, Manhattan, New York One Biscayne Tower

One Biscayne Tower CH2M Global Headquarters, Denver

CH2M Global Headquarters, Denver Constitution Square, Washington, D.C.

Constitution Square, Washington, D.C. Kevin MacKenzie, HFF

Kevin MacKenzie, HFF TriPointe Plaza, Tampa, Fla.

TriPointe Plaza, Tampa, Fla. Valle Vista, 515 Marin Street, Thousand Oaks, Calif.

Valle Vista, 515 Marin Street, Thousand Oaks, Calif.