-

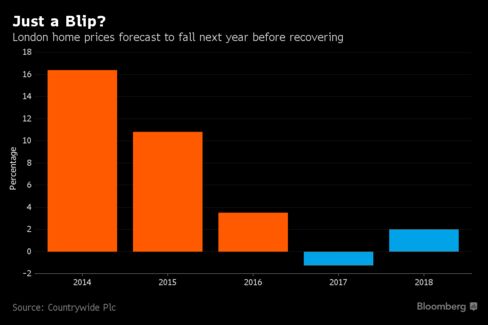

Countrywide sees home values falling for first time since 2009

-

Prime central London prices to drop as much as 6% this year

Home values in London will fall for the first time since 2009 next year on economic uncertainty resulting from the U.K.’s vote to leave the European Union, according to Countrywide Plc.

Price growth for homes in the capital will slow to 3.5 percent this year and drop by 1.25 percent in 2017, the country’s largest real estate broker said in a report on Monday. Countrywide in December forecast that values would increase by 4 percent this year and next. Prices for properties in prime central London will drop as much as 6 percent this year and be little changed in 2017, the report showed.

This is a preview of

London Housing Boom to End Next Year on Brexit, Broker Says

.

Read the full post (197 words, estimated 47 secs reading time)

-

Issuers using more future cost cuts to boost creditworthiness

-

Lenders agreeing to terms ‘they should be fighting off’

Riskier companies are increasingly getting credit agreements that allow them to raise the amount of future cost savings to appear more creditworthy, boosting potential losses for investors.

The tweaks make it easier for borrowers to stay in compliance with their loan terms and add more debt, according to Charles Tricomi, a senior analyst at covenant research firm Xtract Research.

This is a preview of

Yield Hunt Emboldens Companies to Chip Away Loan Safeguards

.

Read the full post (124 words, estimated 30 secs reading time)

The office asset fetched $13.7 million more than the last time it changed hands.

Plaza 100, Fort Lauderdale

Plaza 100, Fort Lauderdale

Fort Lauderdale, Fla.—Brookwood Financial Partners LLC has sold Plaza 100, a 166,098-square-foot, Class A office building in downtown Fort Lauderdale. The property fetched $46.2 million, the equivalent of $278 per square foot, or $13.7 million more than what Brookwood paid for the asset back in 2014. Zurich Alternative Asset Management was the buyer, according to data from Yardi Matrix.

The real estate private equity firm purchased Plaza 100 in April 2014 for $32.5 million, through its Brookwood U.S. Real Estate Fund.

This is a preview of

Brookwood Parts Ways with Plaza 100 in Fort Lauderdale

.

Read the full post (164 words, 1 image, estimated 39 secs reading time)

You already missed the buying opportunity.

Real estate stocks were a buying opportunity a few years ago, but at this point Goldman Sachs Group Inc. says the area is too risky for investors.

At the end of this month, Real Estate will separate from Financials to become its own sector in the S&P 500. While those stocks have outpaced the S&P 500 so far in 2016, analysts led by David Kostin at Goldman Sachs say there are a lot of challenges, and they are not recommending investors try to make up for the missed gains…

This is a preview of

Goldman Says It’s Too Late to Chase the Booming Real Estate Sector

.

Read the full post (107 words, estimated 26 secs reading time)

HFF arranged the refinancing for Sequoia Plaza on behalf of Foulger Pratt.

Sequoia Plaza, Arlington, Va.

Sequoia Plaza, Arlington, Va.

Arlington, Va.—Foulger Pratt has received $97 million in refinancing for Sequoia Plaza, a three building, Class A office complex totaling 369,215 square feet in Arlington, Va.

HFF secured the money for Foulger Pratt, with a three-year, floating-rate loan with Aareal Capital Corp.

“Sequoia Plaza offers an institutional-quality office campus located in the center of Arlington county, making it the ideal home for the essential public services that anchor-tenant Arlington county provides to its constituents on the premises,” Cary Abod, HFF managing director, told Commercial Property Executive. “The combination of the long-term lease with Arlington county, the tenant’s extraordinary creditworthiness, and rent growth opportunities from new leasing and contractual rent increases made this a highly sought after financing opportunity.”…

EU leaders meet at sea while Brexit threatens an end to London home-price growth

Sign up to receive the Brexit Bulletin in your inbox.

The leaders of Germany, France and Italy meet on board an Italian aircraft-carrier today as they try to ensure the EU doesn’t founder in the aftermath of the Brexit vote. The meeting aboard the Giuseppe Garibaldi, which usually patrols the Mediterranean in search of shipwrecked migrants, will be rich in symbolism, Bloomberg’s John Follain, Geraldine Amiel and Birgit Jennen report.

This is a preview of

Brexit Bulletin: The End of London’s House-Price Boom?

.

Read the full post (151 words, estimated 36 secs reading time)

-

Trump Mortgage launched as housing began to crack in 2006

-

It’s “a great time to start a mortgage company,” he said

Donald Trump had heard all the chatter, the idle talk about how the U.S. housing market was overheating and trouble was looming. He was unfazed. It was the spring of 2006 and he was pushing a new mortgage business, Trump Mortgage LLC.

This is a preview of

Donald Trump the Mortgage Broker Was in Trouble From Start

.

Read the full post (147 words, estimated 35 secs reading time)

The acquisition of 2100 Second St., S.W., marks the first step in the redevelopment of Buzzard Point.

Rendering of the future D.C. United Stadium in Buzzard Point

Rendering of the future D.C. United Stadium in Buzzard Point

Washington—A consortium headed by Western Development Corp. and Akridge has bought the former U.S. Coast Guard headquarters at Buzzard Point in the District of Columbia, the two companies announced late last week. The acquisition is the biggest step to date in redeveloping the site, at 2100 Second St. SW., into Riverpoint, a residential, retail and restaurant development.

In addition to Western Development and Akridge, the development group includes Orr Partners, Redbrick LMD LLC and Jefferson Apartment Group. EagleBank and Greenfield Partners provided financing for the project.

-

Three funds sell combined 10% stake in exchange operator

-

Pension funds to retain 5% stake after TMX shares rally

Three of Canada’s largest pension funds sold a combined 10 percent stake in TMX Group Ltd. for about C$312 million ($241 million), cutting by almost half their holdings in the operator of the Toronto Stock Exchange.

Alberta Investment Management Corp., on behalf of some of its clients, Caisse de Depot et Placement du Quebec and Ontario Teachers’ Pension Plan Board each agreed to sell 1.8 million common shares of TMX at C$57.70 a share through a group of banks led by Toronto-Dominion Bank’s TD Securities, according to a joint statement Monday.

This is a preview of

Alberta, Quebec, Ontario Pension Funds Sell TMX Group Shares

.

Read the full post (148 words, estimated 36 secs reading time)

In the aftermath of the financial crisis, a growing army of confidential informants — better known as whistle-blowers — has helped federal securities regulators identify and prosecute wrongdoers.

Now the same thing is happening at the state level: Securities regulators in two states (so far) are enlisting the aid of these informants to enforce their own fraud statutes and protect residents from financial harm. And the whistle-blowers are reaping rewards.

On Aug. 19, for example, an informant was awarded $95,000 for helping Indiana securities regulators bring an enforcement action against JPMorgan Chase for failing to disclose certain conflicts of interest to clients about the way the bank invested their money. The monetary award was the first given under that state’s whistle-blower program aimed at securities law violators…

This is a preview of

To Crack Down on Securities Fraud, States Reward Whistle-Blowers

.

Read the full post (136 words, estimated 33 secs reading time)

Renovations at the 272,000-square-foot L&C Tower will include interior and exterior upgrades.

L&C Tower, Nashville

L&C Tower, Nashville

Nashville, Tenn.—CIM Group announced plans for the renovation of the iconic L&C Tower, a 272,000-square-foot office building in Nashville, Tenn.

CIM acquired the iconic building last September. In addition to the office tower, the property includes approximately 14,000 square feet of ground- and second-floor retail and a nine-story, 94,000-square-foot office building connected to the tower on floors two through eight.

Already underway, the renovations for the 30-story tower include significant upgrades to the exterior, lobby, and new tenant amenities…

This is a preview of

CIM Group Launches Revamp of Iconic Nashville Tower

.

Read the full post (102 words, 1 image, estimated 24 secs reading time)

-

Multimanager fund is said to decline about 5% last month

-

The unit is struggling after posting a banner year in 2015

Senfina Advisors, the multimanager hedge fund at Blackstone Group LP, fell about 5 percent in July, according to three people with knowledge of the matter.

The performance widened the fund’s 2016 losses to roughly 20 percent, said the people, who asked not to be named because the information is private. Paula Chirhart, a Blackstone spokeswoman, declined to comment on the returns.

This is a preview of

Blackstone’s Senfina Fund Down 20% in 2016 After July Loss

.

Read the full post (148 words, estimated 36 secs reading time)

Jessica Clarke lost about $700,000 she had invested with Steve Wyatt, a Morgan Stanley broker. “I just never questioned that there’d be any monkey business,” she said. CreditAndrea Morales for The New York Times

Jessica Clarke lost about $700,000 she had invested with Steve Wyatt, a Morgan Stanley broker. “I just never questioned that there’d be any monkey business,” she said. CreditAndrea Morales for The New York Times

A troubling call came in to Morgan Stanley’s internal hotline in May 2010.

One of the company’s top financial advisers in Mississippi, Steve Wyatt, was struggling with medications and was “not sleeping, coming in 3 and 4 a.m.,” his assistant said on the call, according to notes taken by the person who answered the phone. Mr. Wyatt, a broker, was also trading client money “erratically,” the assistant said.

The 42-acre Landing at Oyster Point will be transformed into a $1 billion office and R&D campus.

Aerial view of The Landing at Oyster Point masterplan

Aerial view of The Landing at Oyster Point masterplan

San Francisco—Los Angeles, New York and now San Francisco. Greenland USA continues to further its goal of peppering the U.S. with monumental commercial real estate projects as it completes the acquisition of The Landing at Oyster Point, a 42-acre developable site in South San Francisco. Greenland USA partnered with Ping An Trust, Agile Group and Poly Sino Capital Ltd. on the $171 million purchase of the premier property from Shorenstein Properties and SKS Partners.

This is a preview of

Greenland USA Buys Land for Bay Area Biotech Behemoth

.

Read the full post (170 words, 1 image, estimated 41 secs reading time)

-

Paul Tudor Jones increases the amount of assets he runs

-

‘We have to think outside the box,’ Jones says in letter

Billionaire Paul Tudor Jones, who’s facing his worst performance since the global financial crisis, wants to show investors he hasn’t lost his mojo.

Jones, the legendary macro trader, told investors in an Aug. 16 letter that he will manage a larger chunk of their money himself. He also said managers at his $11 billion Tudor Investment Corp. will be forced to take more risk…

Tudor Demands Managers Take More Risk in Hedge Fund Shakeup

Permanent link to this post (97 words, estimated 23 secs reading time)

COLUMBIA, S.C. — Alex Szkaradek is a landlord who seems to have the best of both worlds.

Mr. Szkaradek, 36, collects rent, but he never has to pay for repairs on any of the more than 5,500 homes — many of them rundown — that his firm manages across the country.

The firm, Vision Property Management, blurs the line between what it means to be a renter and a homeowner. These companies do not offer regular leases or mortgages — they offer “rent to own” contracts on homes that require tenants to make all repairs, no matter how big or small…

This is a preview of

Rent-to-Own Homes: A Win-Win for Landlords, a Risk for Struggling Tenants

.

Read the full post (113 words, estimated 27 secs reading time)

Photographer: Abhijit Bhatlekar/Mint via Getty Images

-

Patel’s inflation hawk reputation seen reducing rate-cut odds

-

Bonds, stocks rallied over final weeks of Rajan’s term

Investors in Indian markets have a recent rally in bonds and stocks to thank for any nervousness Urjit Patel’s appointment as central bank boss is causing.

Benchmark 10-year bond yields dropped to a seven-year low and the S&P BSE Sensex has surged 5 percent since current governor Raghuram Rajan announced on June 18 that he won’t seek another term. Rupee forwards advanced 0.1 percent as of 8:21 a.m. in Singapore on Monday, after Patel’s appointment was announced Saturday. The currency fell 0.4 percent on Friday…

This is a preview of

India’s New Central Banker Faces Nervy Markets After Rajan Rally

.

Read the full post (121 words, 1 image, estimated 29 secs reading time)

The joint venture partners announced plans for a 2 million-square-foot office, retail and entertainment district in suburban Fort Worth.

Circle T concept masterplan

Circle T concept masterplan

Fort Worth, Texas—A mixed-use development featuring more than 2 million square feet of office, retail and entertainment space and anchored by the recently announced corporate campus for the Charles Schwab Corp. is coming to Westlake, Texas, as part of the Circle T Ranch master-planned community.

This is a preview of

Hillwood, Howard Hughes Team Up on Texas-Size Project

.

Read the full post (185 words, 1 image, estimated 44 secs reading time)

-

BBA chief Anthony Browne responds to earlier media report

-

FT reported banks had “given up hope” on EU market access

The City of London has not abandoned hope of maintaining full access to the European Union’s single market after Brexit, according to an industry lobby group.

“The banking sector unequivocally wants to maintain the current level of full access to the EU market, to ensure that businesses and customers across Europe can still be served by U.K.-based banks,” British Bankers’ Association Chief Executive Officer Anthony Browne said in a statement. Browne was responding to a Financial Times report earlier Friday that said banks had “given up hope” of maintaining universal access…

This is a preview of

Banks Still Aiming for Full EU Single Market Access Post-Brexit

.

Read the full post (123 words, estimated 30 secs reading time)

-

Countrywide sees home values falling for first time since 2009

-

Prime central London prices to drop as much as 6% this year

Home values in London will fall for the first time since 2009 next year on economic uncertainty resulting from the U.K.’s vote to leave the European Union, according to Countrywide Plc.

Price growth for homes in the capital will slow to 3.5 percent this year and drop by 1.25 percent in 2017, the country’s largest real estate broker said in a report on Monday. Countrywide in December forecast that values would increase by 4 percent this year and next. Prices for properties in prime central London will drop as much as 6 percent this year and be little changed in 2017, the report showed.

This is a preview of

London Housing Boom to End in 2017 as Brexit Bites, Broker Says

.

Read the full post (198 words, estimated 48 secs reading time)

The REIT recently acquired a retail center in Minnesota and a land parcel close to Cleveland.

3710 Minnesota 100, St Louis Park, Minn.

3710 Minnesota 100, St Louis Park, Minn.

Great Neck, N.Y.—One Liberty Properties has announced the recent purchase of two properties for a combined price tag of $28.1 million. The company carried out the payment with cash on hand and a $26 million withdrawal from its credit facility, expecting the new assets to bring in approximately $2.6 million in aggregate base rent on a period of 12 months.

Persistence is paying off.

Hedge fund long bets have snapped a streak of underperformance versus the wider index over the past few weeks, according to Goldman Sachs Group Inc., which issues a regular check-up of the industry.

“During the last six weeks our Hedge Fund VIP basket of popular long positions has led the S&P 500 by 470 basis points, ending the basket’s record 1500 bps stretch of underperformance since August 2015,” the team led by Ben Snider said in the note, which was based on an analysis of more than 800 funds with $1.8 trillion in gross equity positions…

Permanent link to this post (111 words, estimated 27 secs reading time)

Photographer: Takaaki Iwabu/Bloomberg

-

Simplex uses artificial intelligence to trade Japan futures

-

AI investors are outperforming as global hedge funds struggle

Yoshinori Nomura felt like weeping. It was the morning of June 24, Brexit day, and markets were moving against him.

Well, not against him, exactly. It was the hedge fund manager’s self-learning computer program that had placed the bet, selling Japanese stock-index futures before a sizable market advance. Nomura had anticipated a rally, but decided not to interfere, and his fund was paying the price.

This is a preview of

How This Hedge Fund Robot Outsmarted Its Human Master

.

Read the full post (158 words, 1 image, estimated 38 secs reading time)

Nick Denton, who founded Gawker in 2002. The sale will give the freewheeling company an outside owner for the first time since its start 14 years ago. CreditEve Edelheit/Tampa Bay Times, via Associated Press

Nick Denton, who founded Gawker in 2002. The sale will give the freewheeling company an outside owner for the first time since its start 14 years ago. CreditEve Edelheit/Tampa Bay Times, via Associated Press

Is it the end of an era? The bids are in, and it looks as if Gawker has been sold to Univision, a Spanish-language network with an appetite for online offerings in English. If a bankruptcy judge approves the sale this week, Gawker will come under outside ownership.

The gossipy, freewheeling company will join a much larger stable of publications at Univision that includes The Onion and The Root.

The office of Intesa Sanpaolo in Turin, Italy. Last year, the book seller Feltrinelli was able to secure a 50 million euro line of credit from a syndicate that included Intesa Sanpaolo.CreditMarco Bertorello/Agence France-Presse — Getty Images

The office of Intesa Sanpaolo in Turin, Italy. Last year, the book seller Feltrinelli was able to secure a 50 million euro line of credit from a syndicate that included Intesa Sanpaolo.CreditMarco Bertorello/Agence France-Presse — Getty Images

In Italy, where two decades of economic stagnation have created a long line of barely breathing companies, Feltrinelli, one of the country’s largest booksellers, stands out.

Since 2012, the company has chalked up three consecutive years of losses totaling nearly 11 million euros ($12.4 million).

This is a preview of

Italian Banks Continue to Lend to Stagnant Companies as Debt Pile Mounts

.

Read the full post (138 words, 1 image, estimated 33 secs reading time)

Lincoln Property Co. acquired Ellington Trade Center from KDC and Harbert Real Estate Fund III LLC, in a transaction facilitated by HFF.

Ellington Trade Center

Houston—

HFF recently closed the sale of a three-building industrial project totaling 513,800 square feet and 18.2 acres of developable land in southeast Houston. HFF represented the seller, a partnership between

KDC and Harbert Real Estate Fund III LLC.

The industrial asset was acquired by Lincoln Property Co., through its investment advisory affiliate Lincoln Advisory Group, on behalf of an institutional client.

This is a preview of

Lincoln Property Buys 513KSF Industrial Asset in Houston

.

Read the full post (168 words, 1 image, estimated 40 secs reading time)

London’s financial district on June 25, the Saturday after Britain’s surprising vote to leave the European Union. CreditMarco Kesseler for The New York Times

London’s financial district on June 25, the Saturday after Britain’s surprising vote to leave the European Union. CreditMarco Kesseler for The New York Times

LONDON — In late June, as Britons prepared to go to the polls to vote on the country’s membership in the European Union, about 800 hedge fund managers gathered at the opulent Cavalieri hotel on a hill overlooking Rome for an annual rite.

This is a preview of

Hedge Funds Avoided Big Losses Despite ‘Brexit’ Shock

.

Read the full post (149 words, 1 image, estimated 36 secs reading time)

The software company tripled its Newton, Mass., square footage in order to accommodate accelerated personnel growth.

Paytronix office, Newton, Mass.

Paytronix office, Newton, Mass.

Boston—Software company Paytronix recently moved its Newton headquarters to 80 Bridge St., tripling its Boston area footprint to 40,000 square feet.

Previously based in the nearby renovated mill building at 74 Bridge St., Paytronix worked with local firm ACTWO Architects to construct the new open office space. “The existing brick and timber building at 80 Bridge St. offered an ideal two-story backdrop for Paytronix’s vibrant and collaborative office culture,” said Thom White, project principal at ACTWO Architects, in a prepared statement.

-

Wall Street firm sees market odds of 2016 hike falling to 30%

-

Two-year yields will drop to 0.65 percent, strategists say

Morgan Stanley says investors are overestimating the chances of higher U.S. interest rates this year and should buy five-year Treasury notes.

From coin-flip odds of a rate increase by December, the New York-based bank’s strategists predict the probability will drop to 30 percent in coming weeks as inflationary pressures remain absent from the world’s biggest economy. Benchmark Treasuries held gains on Thursday after

minutes of the Federal Reserve’s July meeting published the previous day showed officials saw little risk of a sharp uptick in consumer prices…

Permanent link to this post (119 words, estimated 29 secs reading time)

Soon you will be able borrow money from a bank called Marcus.

Goldman Sachs, which has been rolling out its first foray into banking for the little guy, is going back to its history to name its big new push: an online lender for the masses.

After much internal discussion, the Wall Street firm has decided to call the retail banking operation Marcus — the first name of the company’s founder, Marcus Goldman.

Joseph, the first name of Mr. Goldman’s business partner, Joseph Sachs, lost out. (The two men met as youths in Germany before immigrating to the United States in the 1840s.)

This is a preview of

Meet Marcus, Goldman Sachs’s Online Lender for the Masses

.

Read the full post (143 words, estimated 34 secs reading time)

The online real estate crowdfunding marketplace has hit another milestone with the introduction of its first CRE fund.

Jilliene Helman, RealtyMogul.com

Jilliene Helman, RealtyMogul.com

Los Angeles—2016 is turning out to be a year of firsts for RealtyMogul.com. In May, the online marketplace for commercial real estate investing became the first commercial real estate crowdfunding platform in the U.S. to fully fund $200 million, and now it has broken new ground internally with the introduction of MogulREIT I, its first commercial real estate fund.

This is a preview of

RealtyMogul Enters New Territory with REIT Launch

.

Read the full post (134 words, 1 image, estimated 32 secs reading time)

The new hires at Colliers will handle leasing efforts for the 14 Class A office properties located throughout Tampa Bay and Sarasota.

Sarasota City Center

Sarasota City Center

Tampa—Osprey S.A. LTD has granted Colliers International Tampa Bay the exclusive leasing assignment of 1.3 million square feet of Class A office space in Sarasota, Tampa and St. Petersburg.

The Osprey portfolio consists of 14 office properties, with six located in and around the Tampa Bay area, and eight located in Sarasota. The Tampa/St. Petersburg assets total approximately 700,000 square feet and the ones in Sarasota roughly 630,000.

This is a preview of

Colliers Scores 1.3MSF Office Leasing Portfolio in Tampa Bay

.

Read the full post (175 words, 1 image, estimated 42 secs reading time)

The company paid $206 million to acquire the 400,000-square-foot University Station.

University Station, Boston

University Station, Boston

Boston—University Station’s strategic location is among the reasons cited by executives with American Realty Advisors for acquiring the 400,000-square-foot- retail center in a Boston suburb for $206 million from Westwood Marketplace Holdings LLC.

The retail center is a newly constructed asset within a 130-acre live/work/play development in Westwood, Mass., with 2.1 million square feet of retail, residential, office and hospitality uses. The retail portion of University Station is anchored by a Wegmans supermarket, Target and Lifetime Fitness. Other national tenants include Nordstrom Rack, Marshalls and PetSmart…

This is a preview of

American Realty Advisors Grabs Boston-Area Retail Center

.

Read the full post (108 words, 1 image, estimated 26 secs reading time)

The company placed the $78 construction loan with Bank of America.

Fulton West, Chicago

Fulton West, Chicago

Chicago—HFF has secured $78 million in construction financing for Fulton West Phase II in the city’s West Loop neighborhood. The company worked on behalf of the developer—a joint venture between Sterling Bayand institutional investors advised by J.P. Morgan Asset Management—to place the construction loan with Bank of America.

Source: CBS via Getty Images

Malibu, Calif. (AP) — Jan may have always played second fiddle to older sister Marcia on “The Brady Bunch,” but she may be tops when it comes to real estate investing.

The Los Angeles Times reports actress Eve Plumb, who played Jan on the 1970s sitcom, has sold a Malibu beach house for $3.9 million, 47 years after buying it for $55,300 at the age of 11 in 1969…

‘Brady Bunch’s’ Jan Sells Home Bought for $55K for $3.9M

Permanent link to this post (97 words, 1 image, estimated 23 secs reading time)

Broe’s latest deal is a 163,545-square-foot retail property leased to Home Depot.

2800 Forest Lane

Dallas—

Broe Real Estate Group recently completed the sale of a 163,545-square-foot retail property in Dallas for $19.5 million. Located at 2800 Forest Lane, the property is leased to Home Depot on a triple-net basis under a long-term lease.

“We are pleased to have completed this transaction which represents the second leg of a true 1031 Exchange, wherein Broe acquired Oceanview Village Shopping Center, a 98,406 square foot mixed-use development located in San Francisco and subsequently sold the Home Depot property to the same party,” said Doug Wells, CEO of Broe Real Estate Group, in prepared remarks. “This transaction represented a unique opportunity to exchange a stable asset at a good valuation for an attractive ‘value-add’ opportunity in a very strong infill location in a Gateway city.”

This is a preview of

Broe Real Estate Sells 163KSF Retail Asset for $19.5M

.

Read the full post (197 words, 1 image, estimated 47 secs reading time)

-

All-stock deal is expected to close in the middle of next year

-

Cardinal operates 30 branches in Washington, D.C., region

United Bankshares Inc. agreed to buy Cardinal Financial Corp. in an all-stock deal valued at about $912 million to expand in the Washington, D.C., region.

The buyer will pay 0.71 United share for each Cardinal share, a price that represents 2.24 times Cardinal’s tangible book value as of June 30, the companies said Thursday in a statement. The deal is expected to close in the middle of next year, according to the statement.

This is a preview of

United Bankshares Agrees to Buy Cardinal for $912 Million

.

Read the full post (143 words, estimated 34 secs reading time)

If you knew where to look inside the loan company, things were worse than anybody realized.

Lending Club CEO Renaud Laplanche on the floor of the New York Stock Exchange on Dec. 11, 2014.

Lending Club CEO Renaud Laplanche on the floor of the New York Stock Exchange on Dec. 11, 2014.

“You ready to see some crazy shit?”

Bryan Sims and I were sitting in the dining room of his modest home in Portland, Ore., in front of a laptop and a flatscreen monitor. A bulky home-built computer sat on the floor, with a handwritten warning taped on the side: “DO NOT TURN OFF. POST-APOCALYPTICAL FINANCIAL CRISIS WILL ENSUE.”

This is a preview of

How Lending Club’s Biggest Fanboy Uncovered Shady Loans

.

Read the full post (167 words, 1 image, estimated 40 secs reading time)

The Philadelphia-based REIT is moving forward with its portfolio optimization efforts.

Washington Crown Center

Washington Crown Center

Pittsburgh—PREIT has completed the sale of Washington Crown Center, a 676,136-square-foot regional retail center located in Washington, Pa., for $20 million. According to the Pittsburgh Business Times, the asset was acquired by New York-based mall owner Kohan Retail Investment Group.

Formerly known as the Franklin Mall, Washington Crown Center is located just outside the city of Washington and south of Pittsburgh. The center is anchored by Bon-Ton, Macy’s, Gander Mountain and Sears. According to PREIT, the asset generated sales per square foot of $313 and boasted non-anchor occupancy of 87.4 percent as of June 30, 2016….

This is a preview of

PREIT Completes $20M Sale of Pittsburgh Retail Center

.

Read the full post (119 words, 1 image, estimated 29 secs reading time)

HFF arranged the $121 million sale of The Crosslands and secured $49 million in financing for the new owner.

The Crosslands

The Crosslands

Orlando—HFF did double duty recently with the sale of The Crosslands, a 530,816-square-foot power center in Kissimmee, Fla. The firm closed on the $121 million sale and arranged $49 million in financing for the new owner.

HFF brokered the sale on behalf of the sellers,O’Connor Capital Partners and Tupperware Brands Corp., who jointly developed the 71-acre shopping center near Orlando. The Hampshire Cos., a Morristown, N.J.-based privately held real estate firm and real estate investment fund manager, was the buyer. O’Connor, which has its headquarters in New York City and offices in Palm Beach, Fla., and Mexico City, is retaining an interest in the property and continuing with leasing and management responsibilities…

-

Ford announces new partnerships to develop self-driving cars

-

Michigan governor wants to tout education, industrial skills

For the first time in America’s industrial history, the center for automotive technology is drifting away from Detroit.

Ford Motor Co., aiming to put fully autonomous vehicles into the economy by 2021, announced that it’s doubling the size of its office in Silicon Valley to 260 people and investing in four companies that are key to building self-driving cars. The carmaker’s move follows more than $1 billion in investments made by Detroit-based General Motors Co. in a pair of California technology companies earlier this year to keep up with Google’s autonomous-car project and Uber Technologies Inc.’s ride-hailing business…

This is a preview of

Detroit Hiring Talent in Silicon Valley for Race Against Google

.

Read the full post (126 words, estimated 30 secs reading time)

Millennials strongly influence the design of residential and commercial buildings, but this trend comes with some serious challenges.

Brad Capas, President of CapasGroup Realty Advisors

Brad Capas, President of CapasGroup Realty Advisors

Millennials are, officially, the largest living generation, according to the U.S. Census Bureau. Naturally, this fact influences all sides of the real estate market, particularly design. From office buildings to shops, everything is created to cater to the millennial, who puts comfort and time-efficiency above everything else.

This is a preview of

How Millennials Influence Office and Multifamily Design Trends

.

Read the full post (205 words, 1 image, estimated 49 secs reading time)

-

Kips Bay Court on east side of Manhattan has 894 rental units

-

Deal would follow $5.3 billion Stuyvesant Town purchase

Blackstone Group LP is close to an agreement to buy an eight-building apartment complex on Manhattan’s east side, for $620 million, cementing its position as one of New York’s largest residential landlords, according to a person with knowledge of the talks.

The New York-based firm, the world’s largest manager of alternative assets, is planning to buy Kips Bay Court from Phipps Houses, a developer of affordable housing, said the person, who asked not to be identified because negotiations are private. Paula Chirhart, a Blackstone spokeswoman, declined to comment…

This is a preview of

Blackstone Said Nearing $620 Million New York Apartment Purchase

.

Read the full post (118 words, estimated 28 secs reading time)

Chinese policymakers have resorted to traditional levers to juice the economy this year:investment, public-sector spending, and monetary expansion.

Housing construction, real estate, and public services helped to keep headline year-on-year growth on an even keel at 6.7 percent in the second quarter, offsetting falling financial sector output. But there are growing signs the property market has slowed down, while imbalances in the sector are growing, according to analysts.

“As of June, China’s property market, which has largely been supported by government policy changes, is no longer delivering what the economy needs,” wrote Bloomberg Intelligence economists Michael McDonough, Tom Orlik, and Fielding Chen in a research note today…

This is a preview of

There Are More Signs That China’s Property Market Is Cooling Off

.

Read the full post (117 words, estimated 28 secs reading time)

The firm’s new global headquarters at 500 W. Monroe will house approximately 800 employees.

500 W. Monroe St., Chicago

500 W. Monroe St., Chicago

Chicago—Motorola Solutions, together with Mayor Rahm Emanuel, recently opened its new global headquarters at 500 W. Monroe in Chicago’s West Loop neighborhood. The first employees moved into the office building on Monday, marking the company’s return to Chicago. Motorola Solutions was founded on Harrison Street back in 1928.

-

‘Remain’ and ‘Leave’ areas see diverging trends: Haart

-

Prices drop 5.6% in London, outpacing national decline

Brexit is having an uneven impact on the U.K. housing market, with pro-Remain areas such as London taking the brunt of falling confidence, according to estate-agency chain Haart.

Using data on registrations, sales and listing across 20 local branches, it found that regions that supported Britain exiting the European Union have seen more buoyant property-market activity, while areas that voted “Remain” have seen the reverse…

London Bears the Brunt as Brexit Divides U.K. Housing Market

Permanent link to this post (93 words, estimated 22 secs reading time)

-

New York Fed’s Dudley says September rate increase possible

-

Bonds have been on best run since 2011 as Fed seen on hold

William Dudley is giving Treasuries investors pause after the best run of any year since 2011.

U.S. sovereign debt held a two-day decline Wednesday, a day after the Federal Reserve Bank of New York president said the bond market looked “a little bit stretched,” and an interest-rate increase could come as soon as next month. Futures traders raised bets for tighter policy in 2016 above 50 percent for the first time since just before the U.K. voted to leave the European Union…

This is a preview of

Treasuries Stumble as Fed Rate Increase Odds Above 50%

.

Read the full post (115 words, estimated 28 secs reading time)

A joint venture between Onyx Equities and Garrison Investment Group acquired the 300,260-square-foot office campus in Paramus, N.J.

Country Club Plaza, Paramus, N.J.

Country Club Plaza, Paramus, N.J.

Paramus, N.J.—Onyx Equities LLC has just enhanced its growing New Jersey office portfolio by 300,260 square feet with the purchase of Country Club Plaza in Paramus, N.J. The private real estate investment and development firm partnered with Garrison Investment Group on the acquisition of the asset from Cornerstone Real Estate Advisers, an affiliate of MassMutual Financial Group.

-

New-home prices gained in 51 cities in July versus 55 in June

-

The value of homes sales in July was the lowest since March

Chinese home prices gained in fewer cities as local governments joined some of the nation’s largest hubs in imposing residential property curbs to quell soaring real estate values.

New-home prices excluding government-subsidized housing gained in 51 cities last month, from 55 in June, among the 70 the government tracks, the National Bureau of Statistics said Thursday. Prices dropped in more cities for a fourth consecutive month, declining in 16, compared with 10 a month earlier. They were unchanged in three…

This is a preview of

China Home-Price Gains Cool as Smaller Cities Impose Curbs

.

Read the full post (115 words, estimated 28 secs reading time)

After Qatar backed out, the family, facing a half-billion-dollar tax case, is putting the house back on the market.

In 2014, the Wildensteins thought they’d pulled off the biggest real estate coup in New York. The billionaire art dealing family, whose gallery, Wildenstein & Co. had owned its 21,000-square-foot townhouse on East 64th Street for more than 80 years, signed a deal with the government of Qatar to sell the limestone-clad building for a reported $90 million. Qatar planned to use the building as a consulate, and the Wildensteins, embroiled in a half-billion dollar tax case in France, would get a healthy injection of liquidity….

This is a preview of

Scandal-Plagued Wildenstein Mansion Back on Market for $100 Million

.

Read the full post (113 words, estimated 27 secs reading time)

The company advised on the recapitalization of three Class A office buildings in Orange, Calif.

Paul Jones, NGKF Los Angeles—NGKF Capital Markets has advised on the $108.5 million recapitalization of three high-quality Class A multi-tenant office buildings located in Orange, Calif., on behalf of Greenlaw Partners and Walton Street.

Paul Jones, NGKF Los Angeles—NGKF Capital Markets has advised on the $108.5 million recapitalization of three high-quality Class A multi-tenant office buildings located in Orange, Calif., on behalf of Greenlaw Partners and Walton Street.

Greenlaw and Walton originally purchased the buildings separately in 2014 and 2015 and have since achieved full occupancy on all three buildings.

Money managers’ lucrative 2-and-20 pricing model is under pressure.

Photographer: Daniel Acker/Bloomberg

Steve Eisman made his name and fortune by foreseeing the collapse of subprime mortgage securities. Now he’s betting against a different kind of Wall Street money machine. He thinks hedge fund fees are going to tumble.

Eisman works at Neuberger Berman, a money management firm he joined after closing his hedge fund two years ago. He invests in classic hedge fund style, buying stocks he expects will rise in price while betting on others to fall. His services for an investment of $1 million cost 1.25 percent of assets per year. That’s not exactly cheap—many long-only mutual funds charge far less—but it’s a far cry from prices in hedge fund land, where the standard is a 2 percent annual charge plus a performance fee of 20 percent of profit…

This is a preview of

Steve Eisman’s Next Big Short Is Hedge Fund Fees

.

Read the full post (152 words, 1 image, estimated 36 secs reading time)

Go to the South Pole without roughing it at all.

Travel to Antarctica has reached fever pitch.

You can go by yacht. You can come and go in a single day. You can even book a fly-around for New Year’s Eve. And now you can stay in a five-star hotel with bespoke furnishings and its own fleet of aircraft.

To be fair, the White Desert camp isn’t exactly new. And it’s no secret spot, either; the guest ledger includes such names as Prince Harry and Bear Grylls. But as a means of celebrating its 10th anniversary, the so-called most remote property in the world has gotten a complete luxury overhaul….

This is a preview of

Antarctica Now Has a Jaw-Dropping Luxury Hotel

.

Read the full post (115 words, estimated 28 secs reading time)

The new facility marks the largest and most notable expansion endeavor at Graceland since its introduction to the public in 1982.

Elvis Past, Present & Future

Elvis Past, Present & Future

Memphis, Tenn.—The King’s Memphis palace is about to get bigger. Elvis Presley Enterprises, manager and operator of Graceland, and its majority owner, Graceland Holdings LLC, have announced plans for the opening of a 200,000-square-foot entertainment complex at the King of Rock & Roll’s home. The facility, to be known as Elvis: Past, Present & Future, will cost $45 million to develop.

African officials say the arrest of a Gabonese man on bribery charges may help pull back the curtain on a long-running foreign corruption scandal that has ensnared the giant hedge fund founded by Daniel Och.

United States authorities on Tuesday arrested Samuel Mebiame, a consultant who worked for a joint venture involving Och-Ziff Capital Management Group, on charges that he paid bribes to foreign officials to secure mineral concessions in at least three African countries.

Prosecutors described Mr. Mebiame, the son of a former prime minister of Gabon, as a “fixer” who routinely paid bribes to officials in Niger, Guinea and Chad, according to a criminal complaint filed in the Federal District Court in Brooklyn…

This is a preview of

Bribery Arrest May Expose African Mining Rights Scandal Tied to Och-Ziff

.

Read the full post (127 words, estimated 30 secs reading time)

U.S. home construction unexpectedly accelerated in July to the fastest pace in five months, indicating the housing industry remains an area of support for the economy.

Residential starts increased 2.1 percent to a 1.211 million annualized rate, exceeding all forecasts in a Bloomberg survey, from 1.186 million in June, Commerce Department data showed Tuesday in Washington. Permits, a proxy for future construction, were little changed.

Builders are responding to the strongest home sales since the start of the economic expansion, made possible by robust hiring and cheap financing. More houses were under construction last month than at any time since the beginning of 2008, indicating homebuilders were making headway in filling orders…

This is a preview of

Housing Starts in U.S. Climbed to a Five-Month High in July

.

Read the full post (124 words, estimated 30 secs reading time)

-

Australia aims to rein in deficit, protect AAA credit rating

-

Prime Minister challenges Labor opposition to pass measures

Prime Minister Malcolm Turnbull will introduce an “Omnibus Bill” that bundles together savings proposals the opposition has indicated it will support, as he seeks to rein in Australia’s budget deficit and stave off rating agencies.

In extracts of a speech to be delivered Wednesday, Turnbull said the budget bottom line outlined by the Labor party during the election campaign relied on more than A$6 billion ($4.6 billion) of savings measures proposed by his government. He said he will test that commitment to balancing the budget by introducing the legislation after parliament resumes on Aug. 30…

This is a preview of

Turnbull Seeks $4.6 Billion in Budget Savings Via ‘Omnibus Bill’

.

Read the full post (124 words, estimated 30 secs reading time)

Steven A. Cohen, chairman and chief executive of Point72 Asset Management, formerly SAC Capital Advisors. In January, Mr. Cohen was barred from managing other people’s money for two years. Now he has agreed to refrain from commodities trading activities until 2018. CreditLucy Nicholson/Reuters

Steven A. Cohen, chairman and chief executive of Point72 Asset Management, formerly SAC Capital Advisors. In January, Mr. Cohen was barred from managing other people’s money for two years. Now he has agreed to refrain from commodities trading activities until 2018. CreditLucy Nicholson/Reuters

Steven A. Cohen, the billionaire hedge-fund manager, has agreed in a settlement to refrain from engaging in any activities overseen by federal commodities regulators until at least Dec. 31, 2017.

The settlement, announced Tuesday by the Commodity Futures Trading Commission, follows an action brought against Mr. Cohen by the Securities and Exchange Commission over insider trading at his firm, SAC Capital Advisors.

This is a preview of

Steven Cohen Barred From Commodities Trading Until 2018

.

Read the full post (174 words, 1 image, estimated 42 secs reading time)

-

Sale of Australian copper mine may fetch about $400 million

-

Glencore divesting assets, cutting spending to trim debt load

EMR Capital Advisors Pty, a natural resources private equity firm, is in late-stage talks to acquire Glencore Plc’s Cobar copper mine in Australia after other bidders dropped out of the process, people with knowledge of the matter said.

EMR Capital may pay about $400 million for the mine, said the people, asking not to be identified as the details are private. The talks may still fall apart, and Glencore could end up keeping the asset, the people said…

This is a preview of

EMR Capital Said in Advanced Talks to Buy Glencore Copper Mine

.

Read the full post (107 words, estimated 26 secs reading time)

Plaza 100, Fort Lauderdale

Plaza 100, Fort Lauderdale coth

coth Sequoia Plaza, Arlington, Va.

Sequoia Plaza, Arlington, Va. Rendering of the future D.C. United Stadium in Buzzard Point

Rendering of the future D.C. United Stadium in Buzzard Point L&C Tower, Nashville

L&C Tower, Nashville

Aerial view of The Landing at Oyster Point masterplan

Aerial view of The Landing at Oyster Point masterplan

Circle T concept masterplan

Circle T concept masterplan 3710 Minnesota 100, St Louis Park, Minn.

3710 Minnesota 100, St Louis Park, Minn.

Ellington Trade Center

Ellington Trade Center

Paytronix office, Newton, Mass.

Paytronix office, Newton, Mass. Jilliene Helman, RealtyMogul.com

Jilliene Helman, RealtyMogul.com Sarasota City Center

Sarasota City Center University Station, Boston

University Station, Boston Fulton West, Chicago

Fulton West, Chicago

2800 Forest Lane

2800 Forest Lane Lending Club CEO Renaud Laplanche on the floor of the New York Stock Exchange on Dec. 11, 2014.

Lending Club CEO Renaud Laplanche on the floor of the New York Stock Exchange on Dec. 11, 2014. Washington Crown Center

Washington Crown Center The Crosslands

The Crosslands Brad Capas, President of CapasGroup Realty Advisors

Brad Capas, President of CapasGroup Realty Advisors 500 W. Monroe St., Chicago

500 W. Monroe St., Chicago Country Club Plaza, Paramus, N.J.

Country Club Plaza, Paramus, N.J. Paul Jones, NGKF Los Angeles—

Paul Jones, NGKF Los Angeles—

Elvis Past, Present & Future

Elvis Past, Present & Future