The 223(a)(7) loan for City Market at O was the largest in HUD’s history.

City Market @ O, Washington, D.C.

City Market @ O, Washington, D.C.

Washington—Dwight Capital has funded a $128 million FHA/HUD loan on City Market @ O, a LEED Silver certified mixed-use building consisting of 400 luxury apartments, 182 Cambria Suite hotel rooms and an 86,236-square-foot retail component on the ground floor.

“The 223(a)(7) allowed us to modify the interest rate and MIP on the existing HUD,” Josh Sasouness, Dwight Capital managing principal, told Commercial Property Executive. “As a result, the owner was able achieve over $725,000 in annual debt service savings.”

-

Core consumer prices increased less than forecast in July

-

Beginning home construction outpaces building permits

What you need to know about Tuesday’s U.S. economic data:

CONSUMER-PRICE INDEX (JULY)

- Unchanged (matching forecast) after 0.2 percent gain

- Core CPI, which excludes food and fuel, rose 0.1 percent (forecast was 0.2 percent)

- CPI depressed by cheaper gas, hotel rates, airfares, groceries, used cars

- Medical-care costs increased by most since February

- CPI up 0.8 percent in year to July; core CPI up 2.2 percent

This is a preview of

Inflation Tame, Housing Starts Advance: U.S. Economic Takeaways

.

Read the full post (169 words, estimated 41 secs reading time)

Here’s a roundup of influential economic research from the past week

Photographer: David Paul Morris/Bloomberg

The world made it through the Great Recession. Now it’s entered what you might call the Great Reassessment.

High-profile researchers are publicly questioning the most basic tenets of monetary policy in the run-up to the Federal Reserve Bank of Kansas City’s economic symposium in Jackson Hole, Wyoming, which starts Aug. 25. San Francisco Fed President John Williams has issued a call for a major rethink among central bankers and fiscal policy makers, with an eye on scrapping low-inflation targeting. Former Fed Chairman Ben Bernanke analyzes why the Fed has been revising its economic projections. Meanwhile, a new IMF paper assesses both the effectiveness of, and the outlook for, Europe’s negative interest-rate policies…

This is a preview of

Monetary Policy Makers Rethink the Rules, and Other Economic Must-Reads

.

Read the full post (141 words, 1 image, estimated 34 secs reading time)

The equity commitments will allow the fund to assemble a portfolio of approximately $2.5 billion.

Oak Park Mall in Kansas City, acquired by TIAA-CREF in 2011

Oak Park Mall in Kansas City, acquired by TIAA-CREF in 2011

New York—After raising $1.25 billion from investors,TIAA Global Asset Management has successfully closed its T-C U.S. Super Regional Mall Fund LP, TIAA announced Monday. The U.S. SRM Fund reportedly has capital commitments from several domestic and foreign institutional investors and from TIAA’s General Account.

With leverage, these equity commitments will allow the fund to assemble a portfolio of approximately $2.5 billion. To date, the fund has invested roughly $685 million.

-

Retailer raises profit forecast and maintains sales projection

-

CFO says company is ‘very pleased’ with August results so far

Home Depot Inc., the world’s largest home-improvement retailer, posted second-quarter profit that rose 9.3 percent and boosted its earnings forecast for the year as Americans continued spending on their houses.

Net income increased to $1.97 a share in the fiscal second quarter, which ended July 31, the Atlanta-based company said Tuesday in a statement. That matched analysts’ average estimate.

This is a preview of

Home Depot Profit Rises 9.3% as Americans Keep Remodeling

.

Read the full post (146 words, estimated 35 secs reading time)

Bank of America’s survey of fund managers highlights an urgent request from investors.

Photographer: Luke Sharrett/Bloomberg

Photographer: Luke Sharrett/Bloomberg

Fund managers are begging for someone — anyone — to increase investment spending.

That’s the primary takeaway from Bank of America Merrill Lynch’s monthly survey of money managers.

A net 48 percent of investors surveyed thought fiscal policy was too tight around the world (that’s a record proportion who espouse that view), while 56 percent said they wanted companies to boost capital spending — a rise of 10 percentage points over the past four months…

Fund Managers Are Crying Out for Governments and Businesses to Invest

Permanent link to this post (99 words, 1 image, estimated 24 secs reading time)

The combined company will operate a portfolio of 105,000 multifamily units in 317 properties.

Dave Stockert of Post Properties

Dave Stockert of Post Properties

Washington and Atlanta—MAA has agreed to buy Post Properties Inc. for approximately $3.88 billion in stock, creating the largest Sunbelt-focused multifamily REIT with nearly 105,000 units across 317 properties, valued at $17 billion with equity market capitalization of $12 billion.

“The combination of MAA and Post will establish the leading apartment real estate platform focused on the high-growth Sunbelt region of the country with significant competitive advantages to drive superior value for our shareholders, residents and employees,” H. Eric Bolton, Jr., MAA chairman & CEO, said in a prepared release. “The combined company will capture a broader market and submarket footprint, with improved rental price-point diversification that will support an enhanced level of performance over the full real estate cycle.”…

London’s property market has lost some of its luster in recent months and it’s not just Brexit. The traditional summer lull is being compounded by payback after an investor rush at the start of the year to beat a tax change, a surge that sent price increases in the capital close to 15 percent. While U.K.-wide growth has continued, London’s internationally-driven property market is seeing a marked slowdown, with a recent survey showing it’s taking longer to sell homes…

London’s property market has lost some of its luster in recent months and it’s not just Brexit. The traditional summer lull is being compounded by payback after an investor rush at the start of the year to beat a tax change, a surge that sent price increases in the capital close to 15 percent. While U.K.-wide growth has continued, London’s internationally-driven property market is seeing a marked slowdown, with a recent survey showing it’s taking longer to sell homes…

London Property Takes the Brunt of U.K. Housing Slowdown: Chart

Permanent link to this post (89 words, 1 image, estimated 21 secs reading time)

-

Too many people put hands on stove and got burned, Arch says

-

Arch CEO Iordanou assures he won’t repeat rivals’ errors

Mortgage insurance, an industry that drove several companies to collapse or the brink of failure in the housing crisis, is again considered a safe bet as Arch Capital Group Ltd. Chief Executive Officer Dinos Iordanou reshapes his company by purchasing a loan guarantor from American International Group Inc.

“Hopefully the last war was fought and lost, and the new war is going to be fought and won,” Iordanou said Tuesday on a conference call, a day after agreeing to pay $3.4 billion to buy AIG’s United Guaranty Corp. “People are going to pay attention to properly price their business.”…

This is a preview of

Mortgage Risk Stellar Again With $3.4 Billion Wager on ‘New War’

.

Read the full post (133 words, estimated 32 secs reading time)

Confidence among U.S. homebuilders climbed in August as steady job growth and low interest rates boosted prospects for the residential real-estate market in the second half of the year, according to data Monday from the National Association of Home Builders/Wells Fargo.

Key Points

This is a preview of

Confidence Among U.S. Homebuilders Improved in August on Sales

.

Read the full post (111 words, estimated 27 secs reading time)

-

Biggest publicly traded apartment owner by units to be formed

-

Above-average job growth seen in Atlanta, Dallas, Charlotte

Post Properties Inc. shares rose the most in seven years after Mid-America Apartment Communities Inc. agreed to buy the real estate investment trust for about $3.9 billion, forming a company with about 105,000 multifamily units amid rising demand for rental housing.

Post Properties investors will get 0.71 of a Mid-America share for each of their shares, the companies said in a statement Monday. That equals about $72.53 a share, or a 17 percent premium, based on Friday’s closing prices. Annual gross synergies from the acquisition are expected to be about $20 million, the REITs said…

This is a preview of

Post Properties Surges on $3.9 Billion Deal With Mid-America

.

Read the full post (123 words, estimated 30 secs reading time)

-

Developers sold 1,091 units last month versus 536 in June

-

Government has said it is reluctant to ease curbs just yet

The number of new homes sold in Singapore rose to the highest in a year in July, with buyers snapping up new projects after almost three years of price declines.

Developers sold 1,091 units last month, compared with 536 in June, according to data released Monday by the Urban Redevelopment Authority. That’s the highest since July 2015, when 1,655 units were sold…

Singapore Home Sales at Highest in a Year as Prices Drop

Permanent link to this post (96 words, estimated 23 secs reading time)

-

Price includes $2.2 billion in cash, plus Arch securities

-

Arch to maintain North Carolina presence, consolidate overseas

American International Group Inc. agreed to sell mortgage insurer United Guaranty Corp. to Arch Capital Group Ltd. as Chief Executive Officer Peter Hancock works to simplify his company and free up capital to return to shareholders.

The deal is valued at $3.4 billion including $2.2 billion in cash and the rest in Arch securities, New York-based AIG said Monday in a statement. AIG will retain a portion of mortgage-insurance business originated from 2014 through 2016 through a previously disclosed intra-company risk transfer deal…

This is a preview of

AIG Set to Sell Mortgage Guarantor to Arch for $3.4 Billion

.

Read the full post (113 words, estimated 27 secs reading time)

Joseph Washington, who took out a federally insured mortgage in 2011 to buy a home in Queens, said his loan has been sold to a private investor, who he believes is trying to force him out of his property.CreditDamon Winter/The New York Times

Joseph Washington, who took out a federally insured mortgage in 2011 to buy a home in Queens, said his loan has been sold to a private investor, who he believes is trying to force him out of his property.CreditDamon Winter/The New York Times

For years, the federal government avoided insuring mortgages in black neighborhoods, a practice known as redlining that exacerbated racial divides throughout America’s cities.

Redlining has long been outlawed, but in New York City, the federal government is again disproportionately hurting black homeowners, according to a federal lawsuit filed by a nonprofit that represents low-income New Yorkers. This time, the suit says, the government is fueling racial disparities not through its lending policies but in how it handles foreclosures…

This is a preview of

Sale of Federal Mortgages to Investors Puts Greater Burden on Blacks, Suit Says

.

Read the full post (134 words, 1 image, estimated 32 secs reading time)

-

Realtor group cites affodability for drop in Vancouver sales

-

Home sales in Vancouver fell a third straight month in July

Canada’s hottest housing market may be cooling.

Home sales in Vancouver fell a third straight month in July, the Canadian Real Estate Association said Monday, with price gains also showing signs of slowing.

The data should be a relief to buyers and policy makers who have been growing increasingly worried about affordability in the city, and suggest Vancouver’s market was slowing even before the provincial government set a foreign buyers’ tax earlier this month. The realtor group cited lack of affordability for falling sales in a market where prices are growing at double-digit rates…

This is a preview of

Vancouver Housing Fever Shows Signs of Easing Even Before Tax

.

Read the full post (125 words, estimated 30 secs reading time)

-

Carrier may report net income fell 46% in first half of 2016

-

Airport levy threatens to depress fares already under pressure

Cathay Pacific Airways Ltd., the marquee Hong Kong airline, suffered millions of dollars in losses from fuel-hedges in the past two years. With the city’s government adding new fees on passengers to fund building a runway, the carrier faces more challenges to retain profit margins.

The charges to fund the expansion of the Chek Lap Kok airport follows the city government banning from February fuel surcharges airlines could levy after crude oil prices tumbled to as low as $26 a barrel…

This is a preview of

Cathay Profit Margin Strained as Fuel Hedging Losses Mount

.

Read the full post (111 words, estimated 27 secs reading time)

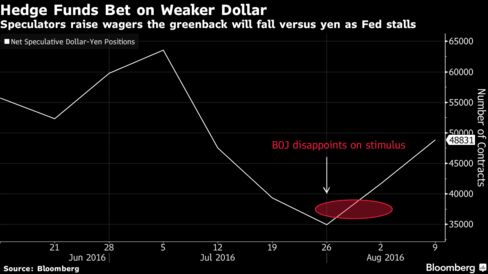

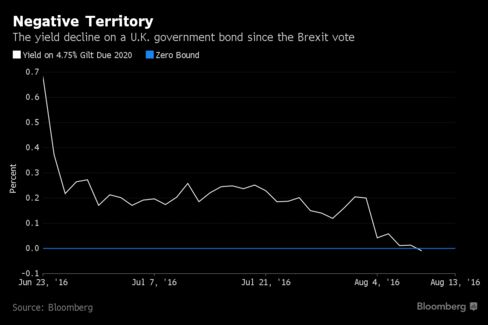

Hedge funds and other large speculators increased net bets the dollar will weaken against the yen to the highest level in a month, according to Commodity Futures Trading Commission data as of Aug. 9. Traders will focus on the meetings of the Federal Reserve and the Bank of Japan next month for direction, after disappointing stimulus announced last month by the BOJ failed to halt yen strength…

Hedge funds and other large speculators increased net bets the dollar will weaken against the yen to the highest level in a month, according to Commodity Futures Trading Commission data as of Aug. 9. Traders will focus on the meetings of the Federal Reserve and the Bank of Japan next month for direction, after disappointing stimulus announced last month by the BOJ failed to halt yen strength…

Hedge Funds Bet Dollar Will Lose More Ground Versus Yen: Chart

Permanent link to this post (79 words, 1 image, estimated 19 secs reading time)

Photographer: John Taggart/Bloomberg

Photographer: John Taggart/Bloomberg

-

Nonprofit investors are reducing allocations, survey finds

-

High fees, sagging performance of hedge funds are big concern

Following the lead of pensions, some U.S. endowments and foundations are souring on hedge funds.

Hedge fund fees and lagging performance are cause for concern for nonprofit investors, who are reducing their allocation, according to a survey published Monday by NEPC, a Boston-based consulting firm with 118 endowment and foundation clients with assets of $57 billion…

Hedge Funds Are Losing Endowments After Exodus of Pensions

Permanent link to this post (87 words, 1 image, estimated 21 secs reading time)

-

Thorell said to go to U.S. authorities, record conversations

-

Brokers at Janney, PrinceRidge said to aid alleged scheme

A former trader at Visium Asset Management LP told an ex-colleague that one of his first stops after leaving the firm was the SEC. What he didn’t say was that he had turned on his former co-workers and was secretly recording their conversations for the FBI.

This is a preview of

Visium Trader-Turned Whistle-Blower Tied to Hedge Fund’s Demise

.

Read the full post (139 words, estimated 33 secs reading time)

Private equity firms sure love cable operators

TPG on Monday agreed to a $2.25 billion deal for RCN Telecom Services and Grande Communications Networks, snapping up the two companies from a smaller buyout firm, Abry Partners.

It’s a deal that was likely inspired by TPG’s insight into growing demand for affordable, high-speed internet from its various content-related investments. These include music-streaming service Spotify, broadcast television network Univision and film and television studio STX Entertainment as well as talent agency CAA, which negotiates advertising and other deals for clients, including YouTube stars. Such is the demand for broadband that it gives cable companies such as RCN and Grande ample cover from cord cutters…

Permanent link to this post (112 words, estimated 27 secs reading time)

-

Foreign buying will slow down from some investors, Rieder says

-

Benchmark yields climb as factory shipments, new orders rise

BlackRock Inc. is reducing its exposure to long-dated U.S. Treasuries as increased hedging costs from Japan to Europe make the debt less alluring to some foreign investors.

Yields on benchmark U.S. 10-year notes are negative for Japanese buyers and about zero for euro-based investors who pay to eliminate currency fluctuations from their returns, even after yields climbed Monday as regional data showed increases in factory shipments and new orders. That’s caused life insurers and other long-term asset managers to turn to corporate securities or mortgage-backed obligations to lock in higher interest rates…

This is a preview of

BlackRock Cuts Treasuries Exposure on Hedging Cost as Bonds Fall

.

Read the full post (123 words, estimated 30 secs reading time)

Photographer: David Paul Morris/Bloomberg

-

‘Amateurs are playing’ in property: Colony Capital chairman

-

Billionaire investor advising Trump sees potential shakeout

Real estate investors could be in for a shock if interest rates rise or demand in some markets continues to fall because “amateurs” are plowing money in at high prices, betting on rent increases that may not continue, said Tom Barrack, the billionaire chairman of Colony Capital Inc.

This is a preview of

Barrack Says U.S. Real Estate Market Is Getting ‘Bubblicious’

.

Read the full post (156 words, 1 image, estimated 37 secs reading time)

Here’s what to expect in the week ahead.

ECONOMY

Consumer prices and housing starts are expected to have been steady.

Consumer prices for July will be announced on Tuesday, with no significant change from June expected. Data on housing starts in the United States will also be announced on Tuesday. Those numbers are expected to show little change in July from a month earlier, indicating slow progress in residential construction. Zach Wichter…

A Vote on the Tyco Merger and Earnings Reports From Target and Walmart

Permanent link to this post (86 words, estimated 21 secs reading time)

-

Rightmove says London homes taking longer to sell after Brexit

-

Tax increase and summer holidays also blamed for slowdown

London properties are taking longer to sell this month, despite a summer price cut, as Brexit uncertainty compounds the dampening effect of the holiday season.

Homes in the U.K. capital are staying on the market for five days more than in May, the month before Britons voted to leave the European Union, property website Rightmove Plc said in a report published Monday.

This is a preview of

Londoners Cut House Prices to Lure Buyers in Slowing Market

.

Read the full post (142 words, estimated 34 secs reading time)

-

World’s largest sovereign oil hedge started earlier than usual

-

Mexico spends about $1 billion a year locking in prices

Mexico started quietly buying contracts to lock in 2017 oil prices when futures were near their peak in June, signaling the start of what has in prior years been the world’s largest sovereign petroleum hedge, according to people familiar with the deal.

The Latin American country bought put options, which give it the right to sell crude at a predetermined price, in June and July, earlier than the usual period of late August to late September, said the people, who asked not to be identified because the process is private.

This is a preview of

Mexico Said to Begin Quietly Hedging 2017 Oil Price in June

.

Read the full post (171 words, estimated 41 secs reading time)

Stephen Emery, the managing director of sales and trading at Mission Capital Advisors. When he was asked by a financial adviser to join an investment trip to Silicon Valley, Mr. Emery jumped at the chance.CreditRoger Kisby for The New York Times

Stephen Emery, the managing director of sales and trading at Mission Capital Advisors. When he was asked by a financial adviser to join an investment trip to Silicon Valley, Mr. Emery jumped at the chance.CreditRoger Kisby for The New York Times

STEPHEN EMERY has a day job that positions him well to understand how to invest other people’s money. He is the managing director of sales and trading at Mission Capital Advisors, which focuses on real estate securities.

But investing his own money poses different challenges. So when asked this year by a financial adviser to join an investment trip to Silicon Valley, he jumped at the chance.

This is a preview of

A Firm Sells Its Contrarian Investments With Field Trips

.

Read the full post (159 words, 1 image, estimated 38 secs reading time)

-

Egypt needs $21 billion for growth-oriented three-year program

-

IMF has agreed in principle to lend Egypt $12 billion

The International Monetary Fund said it will help Egypt plug the remaining financing gap for its economic program before the fund’s executive board approves a $12 billion loan deal with the Arab country.

The government is targeting $21 billion over three years to revive growth and ease a crippling foreign-exchange shortage. In addition to the IMF loan, funds will come from the World Bank, the bond market, and bilateral accords.

This is a preview of

IMF Plans to Help Egypt Secure Remaining Money for Loan Deal

.

Read the full post (163 words, estimated 39 secs reading time)

Construction on the $1 billion, 58-story office tower will move forward as planned.

One Vanderbilt in Manhattan

One Vanderbilt in Manhattan

New York—SL Green Realty Corp. has reached an agreement with Midtown TDR Ventures to drop the litigation regarding SL Green’s One Vanderbilt office tower, currently under construction in Midtown Manhattan. The settlement thus resolves the legal claims against SL Green and the city of New York asserted by Midtown TDR regarding the rezoning amendment and special permit for the 58-story tower.

This is a preview of

SL Green, Midtown TDR Settle One Vanderbilt Lawsuit

.

Read the full post (179 words, 1 image, estimated 43 secs reading time)

-

Partnership with Chinese firm sets May deadline for financing

-

Blackstone’s loan on Billionaires’ Row tower matured last week

In a bid to keep its planned Central Park Tower afloat, Extell Development Co. agreed to a deal that might one day force it to part with the luxury condo project.

A joint venture with China’s SMI USA to build the $3 billion skyscraper on Manhattan’s Billionaires’ Row comes with a deadline: If a construction loan isn’t obtained by May 24, SMI can require Extell to buy out its stake in the partnership — about $300 million — with interest. And if Extell fails to do that, SMI can push the developer to sell the entire project, according to documents filed last week on the Tel Aviv Stock Exchange, where Extell sells debt to investors…

This is a preview of

Extell’s NYC Luxury Condo Project Gets Needed Cash — at a Price

.

Read the full post (147 words, estimated 35 secs reading time)

Mid-America Apartment Communities Inc., a real-estate investment trust, is close to a deal to buy Post Properties Inc. for about $4 billion as demand for rental properties booms, The Wall Street Journal reported.

Post Properties shareholders will get 0.71 share of new MAA stock for each share in a deal that could be announced Monday, according to the newspaper’s website, which cited people familiar with the matter that it didn’t name.

Apartment managers have benefited from a recovery in the housing market as rising home prices have turned many would-be buyers into renters, the Journal said. At the same time, growth in rents has begun to slow, creating an incentive for mergers that reduce costs…

This is a preview of

Mid-America Nears $4 Billion Post Properties Deal, WSJ Says

.

Read the full post (124 words, estimated 30 secs reading time)

Cushman & Wakefield orchestrated the deal, which is reportedly the largest single-asset trade in New Jersey year-to-date.

Hedge funds have made their biggest bearish bet on the pound before U.K. data due this week that will show the early effects of the nation’s decision to leave the European Union.

Sterling reached a one-month low Monday ahead of reports on inflation, retail sales and unemployment benefit claims for July, which will provide more detail on how the economy is faring after the June 23 referendum. The pound had its worst day on record when the vote for Brexit became clear, while losses deepened this month following the Bank of England’s decision to cut interest rates and boost its stimulus plan.

This is a preview of

Hedge Funds Make Record Bearish Pound Bets on Brexit Pessimism

.

Read the full post (165 words, estimated 40 secs reading time)

-

Market-wide circuit breakers cause rift in trading industry

-

Stock exchanges announced rare truce on other improvements

The trading industry can’t find consensus on when to apply the U.S. stock market’s brakes during times of turmoil.

On Thursday, the nation’s three major exchange operators upgraded their rules to help prevent a repeat of the chaos seen on Aug. 24, 2015, when many securities suddenly sank. But a major sticking point remains, according to an official who spoke at an event hours after NYSE Group, Nasdaq Inc. and Bats Global Markets Inc. announced their changes…

This is a preview of

Wall Street Can’t Agree on When to Halt the U.S. Stock Market

.

Read the full post (106 words, estimated 25 secs reading time)

The 365,000-square-foot mall will hold its grand opening on Aug. 16 and is expected to house more than 100 brands.

Westfield World Trade Center

Westfield World Trade Center

New York—Westfield World Trade Center, with 365,000 square feet of new shopping and dining options in Lower Manhattan, will hold its grand opening Aug. 16, when Australian-based retail giant Westfield Corp. will debut its $1.4 billion mall.

The opening of the retail center with more than 100 brands comes several months after the $3.7 billion World Trade Center Transportation Hub opened and one month shy of the 15th anniversary of the attack on 9/11. It has street-level space in WTC Towers 3 and 4, as well as galleries that run underground across the WTC campus, including 1 WTC…

This is a preview of

$1.4B Westfield World Trade Center Ready for Shoppers

.

Read the full post (131 words, 1 image, estimated 31 secs reading time)

Investors are flocking to sterling-denominated corporate debt.

Mark Carney has captured bond investors’ attention.

Investors just poured the most money ever into funds that buy investment-grade sterling-denominated bonds, as they wager a rally in the securities that was started by speculation of a Bank of England corporate bond-buying program — and sustained by its confirmation — still has room to run…

Bank of England Draws a Record Crowd to U.K. Corporate Bonds

Permanent link to this post (71 words, estimated 17 secs reading time)

The case of Gurbaksh Chahal, a prolific technology entrepreneur who allegedly attacked two women, represents “everything the public thinks is wrong with Silicon Valley.”

Photographer: Charley Gallay/Getty Images

Photographer: Charley Gallay/Getty Images

Gurbaksh Chahal wanted to be a role model for the sales team at his digital advertising startup and show them how to close a deal. But the co-founder and chief executive officer of Gravity4 Inc. knew he couldn’t be effective as the face of the business. In 2014, he had been removed from the last company he started following a fight with his girlfriend a year earlier, in which he hit and kicked her 117 times. The brutal ordeal, which had been caught on security-camera footage, resulted in probation for Chahal and shattered his reputation…

Bill Miller, center, at the headquarters of Legg Mason in 1996. In the 1990s and the early part of the 2000s, Mr. Miller was considered the Joe DiMaggio of mutual fund investors. CreditMarty Katz for The New York Times

Bill Miller, center, at the headquarters of Legg Mason in 1996. In the 1990s and the early part of the 2000s, Mr. Miller was considered the Joe DiMaggio of mutual fund investors. CreditMarty Katz for The New York Times

Bill Miller, the veteran stock picker whose market-beating wisdom defined an earlier era of mutual fund dominance, split ways on Thursday with Legg Mason, his professional home for 35 years.

This is a preview of

Bill Miller, Famed Investor, Breaks Ties With Legg Mason

.

Read the full post (139 words, 1 image, estimated 33 secs reading time)

-

Down-payment requirements for second homes are raised to 50%

-

Second-tier Xiamen, Hefei raised mortgage requirements earlier

Two cities in China’s eastern Jiangsu provinces unveiled a package of measures designed to stem a surge in property prices, adding to local authorities seeking to cool red-hot increases.

Nanjing, Jiangsu’s provincial capital, and Suzhou, a regional manufacturing base that’s a 30-minute train ride from Shanghai, will raise down-payment requirements for some buyers of second homes to 50 percent, the two city governments said in statements on official microblogs. Down-payment thresholds were 45 percent in Nanjing and 40 percent in Suzhou. Rules for both cities will take effect from August 12…

This is a preview of

China’s Nanjing, Suzhou Tighten Home-Buying Rules as Prices Soar

.

Read the full post (118 words, estimated 28 secs reading time)

-

Buyout firms target soured loans with eye on taking ownership

-

Drillers unload assets to stay afloat as cash crunch deepens

The long wait may finally be over.

Since the great crash of oil in mid-2014, more than $100 billion has been raised by buyout firms and distressed-debt funds eager to scoop up energy assets on the cheap. But as the months rolled by, few opportunities cropped up as cash-starved drillers limped along with the help of their bankers…

Investors Have $100 Billion to Spend on Oil Assets No One Else Wants

Permanent link to this post (93 words, estimated 22 secs reading time)

An Egyptian woman carried her son as she made her way past a shop window saying “great sale” in Arabic in downtown Cairo on Tuesday. CreditNariman El-Mofty/Associated Press

An Egyptian woman carried her son as she made her way past a shop window saying “great sale” in Arabic in downtown Cairo on Tuesday. CreditNariman El-Mofty/Associated Press

CAIRO — The International Monetary Fund said Thursday that it would grant Egypt a $12 billion loan over three years to help Egypt mend its ailing economy after years of unrest.

The I.M.F. said the loan, which is subject to approval by its executive board, comes in support of a government overhaul that aims to stabilize Egypt’s currency, reduce the budget deficit and government debt, and bolster growth and create jobs.

This is a preview of

I.M.F. Lends $12 Billion to Egypt to Fix Ailing Economy

.

Read the full post (174 words, 1 image, estimated 42 secs reading time)

-

Art incubator Watermill Center to host public event on Sunday

-

Blackstone’s Martin Brand likens it to camp or business school

Golf, tennis? No, said Blackstone senior managing director Martin Brand. His Hamptons pastime is — wait for it — work. “Sad, right?”

Don’t feel too bad for him: The 41-year-old who specializes in technology and financial companies at the world’s largest private equity firm was attending one of the biggest parties of the season, the Watermill Center benefit and auction…

At ‘Burning Man of the Hamptons,’ Artists and Wall Streeters Mix

Permanent link to this post (93 words, estimated 22 secs reading time)

-

Returns on investments can be withdrawn during holding period

-

Easier investment rules to boost participation fund inflow

For Indonesians seeking to bring back billions of dollars stashed overseas, the government just opened up more avenues to park their funds under a tax amnesty plan.

Individuals who sign up to the amnesty will be allowed to invest in assets such as gold, property and infrastructure projects, according to the Finance Ministry. Participants can also move funds between approved assets before a three-year holding period ends, the ministry said in rules notified on its website Wednesday…

This is a preview of

Indonesia Allows Tax Amnesty Seekers to Buy Gold, Property

.

Read the full post (104 words, estimated 25 secs reading time)

The Gateway Westlinks business park is located along Commonwealth Drive in Fort Myers, Fla.

Gateway Westlinks

Orlando—

Berkadia has lined up the financing for Gateway Westlinks, a 339,445-square-foot business park located off of Daniels Parkway along Commonwealth Drive, Westlinks Drive and Westlinks Terrace in Fort Myers, Fla.

Senior Managing Director Marc Sumner of the

Orlando office secured the 10-year loan through Bank United, one of Berkadia’s capital partners, on behalf of the borrower, SW International Office Park LLC. The deal was completed on July 29. The approximately $20.2 million permanent financing loan features a 25-year amortization schedule…

Permanent link to this post (104 words, 1 image, estimated 25 secs reading time)

-

Kiwi surges to highest since May 2015, even after rate cut

-

Markets trade on ‘end-of-cycle phenomenon,’ Normand says

Foreign-exchange traders are becoming convinced that monetary stimulus programs around the world have reached their limits in efforts to spark economic growth, according to JPMorgan Chase & Co.

The kiwi surged to its highest level since May 2015 after the Reserve Bank of New Zealand reduced borrowing costs Wednesday. The yen has strengthened against U.S. dollar since the Bank of Japan’s July 29 decision to expand monetary easing…

Central Banks’ Waning Appetite Seen in Currencies, JPMorgan Says

Permanent link to this post (97 words, estimated 23 secs reading time)

-

$3 billion in Singapore Dollar property bonds maturing in 2017

-

Investors not adequately rewarded, JP Morgan Private Bank says

Singapore’s real-estate firms are facing record debt maturities, just as home sales post their longest-ever losing streak, straining the finances of builders less prepared to weather the storm.

Singapore builders and trusts have an unprecedented S$1.8 billion ($1.3 billion) of local currency bonds maturing this quarter, S$1.2 billion in the final quarter and another S$3.7 billion in 2017. Credit Suisse Private Banking said it doesn’t recommend smaller builders due to “relatively high” leverage. JPMorgan Chase & Co. said these companies are “most exposed” to a further property market correction given their weakening financial profiles…

This is a preview of

Singapore Builders Confronting Maturity Wall as Home Prices Drop

.

Read the full post (123 words, estimated 30 secs reading time)

John Hancock Real Estate bought two interconnected office buildings in Boston’s Back Bay for more than $100 million.

535-545 Boylston St., Boston

535-545 Boylston St., Boston

Boston—For $100.5 million, John Hancock Real Estate has bought the two interconnected 13-story office buildings at 535-545 Boylston St., in Boston’s Back Bay area, John Hancock announced Tuesday. The buildings total 184,000 square feet and are home to a diversified roster of tenants.

The acquisition, according to John Hancock, builds on its commitment to Boston and the Back Bay, where the company currently owns 197 Clarendon and 200 Berkeley and recently announced a $350 million redevelopment at 380 Stuart St. The latter project will involve the construction of a Class A office tower on the site of a nine-story building…

This is a preview of

Clarion Partners Severs Ties with Boston Office Assets

.

Read the full post (130 words, 1 image, estimated 31 secs reading time)

-

Company requests Oct. 31 deadline for a firm offer to be made

-

Controlling shareholder Zhang in talks with financial investor

Zhang Zhi Rong, the controlling shareholder of Chinese property developer Glorious Property Holdings Ltd., plans to form a group of investors to help him take the company private, and will make a formal proposal by Oct. 31. The shares surged.

The consortium will include at least one financial institution that has expressed interest in participating, the company’s board said in a statement to the Hong Kong stock exchange late Thursday. Negotiations on seeking finance from a second financial institution were ongoing, according to the statement…

This is a preview of

Glorious Property Founder Forming Group for Privatization

.

Read the full post (114 words, estimated 27 secs reading time)

The company acquired seven grocery-anchored shopping centers located in Georgia, Florida, Texas and North Carolina.

Thompson Bridge Commons, Atlanta

Thompson Bridge Commons, Atlanta

Atlanta—Preferred Apartment Communities Inc.,through its wholly owned subsidiary New Market Properties LLC, has acquired seven grocery-anchored shopping centers consisting of a total of 650,400 rentable square feet, for $158 million.

The shopping centers are located in Georgia, Florida, Texas and North Carolina.

“This is a transformative transaction for us in that we now own 30 grocery-anchored centers across seven states, consistent with our strategy of acquiring well-positioned grocery-anchored centers in suburban Sunbelt markets anchored by strong market leaders,” Joel Murphy, New Market Properties president & CEO, said in a prepared release. “We are also excited about our initial expansion into both the North Carolina and South Florida markets.”…

This is a preview of

Preferred Apartment Communities’ $158M Shopping Spree

.

Read the full post (125 words, 1 image, estimated 30 secs reading time)

-

Forecasts for low U.S. inflation are outdated, Mandel says

-

Global bond-market inflation outlook jumps to eight-month high

J.P. Morgan Asset Management, overseeing $1.7 trillion, says U.S. inflation is picking up.

“U.S. inflation has actually come back,” Benjamin Mandel, a strategist for the company in New York, said Thursday on Bloomberg Television. “This idea that U.S. inflation is low and is always going to be low is an anachronism.”

This is a preview of

J.P. Morgan Asset Warns on Inflation as Bond Market Sees Uptick

.

Read the full post (137 words, estimated 33 secs reading time)

Westpac Banking Corp.’s investing unit will spend more than $50 million to buy a stake and provide initial investment capital in Hong Kong-based hedge fund Seyon Asset Management Ltd., which is led by former Nomura Holdings Inc. trader Pradeep Swamy.

The deal takes Ascalon Capital Managers Asian portfolio to four, and the total to seven across Sydney, Singapore and Hong Kong, it said in an e-mailed statement. Swamy, who was previously chief investment officer of an in-house hedge fund within Nomura’s Asian equities business, will lead a 12-member team in Hong Kong, it said…

This is a preview of

Westpac Unit to Buy Stake in Former Nomura Trader’s Hedge Fund

.

Read the full post (106 words, estimated 25 secs reading time)

-

Pension fund reduces VC fund commitments to 5 percent

-

It also sold 46 private equity fund stakes worth $2 billion

Venture capital was the worst performer for the California Public Employees’ Retirement System among its private-equity investments.

Returns for VC holdings at the nation’s largest public pension fund were 7 percent over the last five years and 5.6 percent over the last decade, according to a presentation prepared for the board. The investments lagged behind all other private-equity assets for Calpers, partly due to “modestly decreased” activity in venture-backed initial public offerings, the presentation said…

This is a preview of

Venture Capital Is Worst-Performing Asset for Calpers

.

Read the full post (103 words, estimated 25 secs reading time)

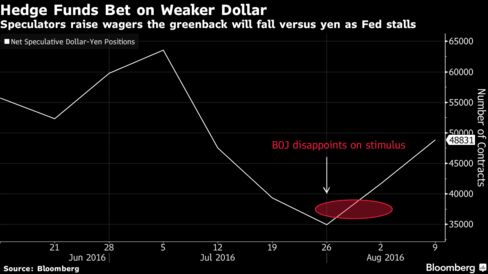

The flipside of low interest rates is a bunch of investors reluctant to part with sought-after securities.

You can’t always get what you want.

On Tuesday, the Bank of England didn’t manage to buy all the gilts it wanted at a reverse auction — the first such shortfall since it began its bond-buying program back in 2009. The ‘uncovered auction’ happened as investors proved reluctant to part with their holdings of longer-dated U.K. government bonds and could create a headache for policy makers seeking to offset the economic impact of the Brexit referendum by lowering borrowing costs…

The Bank of England Just Learned a Lot About Bond Market Liquidity

Permanent link to this post (104 words, estimated 25 secs reading time)

Turf Equipment and Supply will relocate to the new facility in the Birch Run Industrial Park in West Chester, Pa., later this fall.

16 Hagerty Blvd., in West Chester, Pa.

16 Hagerty Blvd., in West Chester, Pa.

West Chester, Pa.—Colliers International has arranged the sale of a 35,150-square-foot industrial facility situated in the Birch Run Industrial Park at 16 Hagerty Blvd., in West Chester, Pa.

Turf Equipment and Supply Co. paid approximately $2.8 million to acquire the 3.2-acre site, which formerly housed VF Technologies.

The company will occupy about 21,670 square feet of clear-span, crane-served space with contiguous offices. The balance of the building is a two-story office structure fully occupied by professional services tenants.

This is a preview of

Colliers International Closes Industrial Property Sale

.

Read the full post (169 words, 1 image, estimated 41 secs reading time)

-

Transaction includes assumption of debt, shareholder payout

-

Deal lets Wal-Mart de Mexico focus on core operation

Wal-Mart Stores Inc.’s Mexican unit agreed to sell its Suburbia clothing chain to El Puerto de Liverpool SAB, Mexico’s biggest department store chain operator, in a deal valued at 19 billion pesos ($1.03 billion).

The transaction, which involved 119 stores, is subject to regulatory approval, Wal-Mart de Mexico SAB and Liverpool said in statements Wednesday after markets closed. Liverpool will pay 15.7 billion pesos, assume 1.4 billion pesos of debt and distribute an additional 3.3 billion pesos to shareholders after the deal is completed. As part of the deal, Liverpool will also pay rent to Walmex for all 34 store locations where Suburbia stores stand alongside Wal-Mart stores…

This is a preview of

Wal-Mart Sells Mexico Clothing Chain to Liverpool for $1 Billion

.

Read the full post (136 words, estimated 33 secs reading time)

The investment bank Jefferies, which never took federal bailout money and is not hemmed in by the restrictions imposed on banks that did, has developed an appetite for risk. And it is matching its appetite with bold moves, bolstered by some helpful relationships.

Its interests in the field of financial technology have grown—it has repackaged loans from upstart lenders and is linked to Lending Club. Jefferies’s $37 billion in assets remain tiny next to giants like Goldman Sachs at $878 billion, but its share of Wall Street trading has doubled since 2006. It is also a subsidiary of, Leucadia National, which “can write a significant equity check at a moment’s notice,” said Chris Kotowski, an analyst at Oppenheimer. Read more about how the bank has used its room to maneuver here…

This is a preview of

Morning Agenda: Jefferies, Small and Emboldened

.

Read the full post (138 words, estimated 33 secs reading time)

The 280,000-square-foot Catonsville Plaza is 99 percent occupied by 16 tenants including Shoppers Food Warehouse and Dollar General.

Catonsville Plaza, Baltimore

Catonsville Plaza, Baltimore

Baltimore—Greysteel recently closed on the transaction of Catonsville Plaza in Baltimore on behalf of the seller, an affiliate of Hutensky Capital Partners. The team led by Greysteel Managing Director Gil Neuman also procured the buyer, Mosaic Realty Partners, who shelled out $28.6 million for the 280,000-square-foot property. According to the Washington Business Journal, the asset hit the market in February.

City Market @ O, Washington, D.C.

City Market @ O, Washington, D.C.

Oak Park Mall in Kansas City, acquired by TIAA-CREF in 2011

Oak Park Mall in Kansas City, acquired by TIAA-CREF in 2011 Photographer: Luke Sharrett/Bloomberg

Photographer: Luke Sharrett/Bloomberg Dave Stockert of Post Properties

Dave Stockert of Post Properties London’s property market has lost some of its luster in recent months and it’s not just Brexit. The traditional summer lull is being compounded by payback after an investor rush at the start of the year to beat a tax change, a surge that sent price increases in the capital close to 15 percent. While U.K.-wide growth has continued, London’s internationally-driven property market is seeing a marked slowdown, with a recent survey showing it’s

London’s property market has lost some of its luster in recent months and it’s not just Brexit. The traditional summer lull is being compounded by payback after an investor rush at the start of the year to beat a tax change, a surge that sent price increases in the capital close to 15 percent. While U.K.-wide growth has continued, London’s internationally-driven property market is seeing a marked slowdown, with a recent survey showing it’s ![By ??????? ?????? (http://www.herbalife.ru) [GFDL or CC BY 3.0], via Wikimedia Commons](https://dealbreaker.com/uploads/2016/07/hlf-300x450.jpg)

![This thing? Oh, pay no mind. By ????? (Own work) [Public domain or Public domain], via Wikimedia Commons](https://dealbreaker.com/uploads/2016/08/recorder-300x225.jpg) Don’t worry about it.

Don’t worry about it.

Hedge funds and other large speculators increased net bets the dollar will weaken against the yen to the highest level in a month, according to Commodity Futures Trading Commission data as of Aug. 9. Traders will focus on the meetings of the Federal Reserve and the Bank of Japan next month for direction, after disappointing stimulus announced last month by the BOJ failed to halt yen strength…

Hedge funds and other large speculators increased net bets the dollar will weaken against the yen to the highest level in a month, according to Commodity Futures Trading Commission data as of Aug. 9. Traders will focus on the meetings of the Federal Reserve and the Bank of Japan next month for direction, after disappointing stimulus announced last month by the BOJ failed to halt yen strength… Photographer: John Taggart/Bloomberg

Photographer: John Taggart/Bloomberg

One Vanderbilt in Manhattan

One Vanderbilt in Manhattan Novo Nordisk Headquarters, 800 Scudders, Plainsboro, NJ

Novo Nordisk Headquarters, 800 Scudders, Plainsboro, NJ Westfield World Trade Center

Westfield World Trade Center Photographer: Charley Gallay/Getty Images

Photographer: Charley Gallay/Getty Images

Gateway Westlinks

Gateway Westlinks 535-545 Boylston St., Boston

535-545 Boylston St., Boston Thompson Bridge Commons, Atlanta

Thompson Bridge Commons, Atlanta The U.K. already has negative interest rates, despite Bank of England Governor Mark Carney’s aversion to them. That’s because financial markets rather than central banks are

The U.K. already has negative interest rates, despite Bank of England Governor Mark Carney’s aversion to them. That’s because financial markets rather than central banks are  16 Hagerty Blvd., in West Chester, Pa.

16 Hagerty Blvd., in West Chester, Pa. Catonsville Plaza, Baltimore

Catonsville Plaza, Baltimore