Archive for Uncategorized

Mumbai Home Price Recovery Is Two Years Away, Indiabulls Says

Posted by: | Comments-

A glut of new properties is weighing on prices, firm says

-

Indiabulls Asset seeks to raise $300 million in property fund

Home prices in Mumbai may take a couple of years to resume gains amid a glut of unsold properties, according to Indiabulls Asset Management Co., an investor in residential projects.

Mumbai’s property sales have been sluggish as prices in India’s most expensive market continue to hover near a record reached in December 2014, crimping affordability and denting demand. Even as sales picked up in the first quarter, Mumbai still had 266 million square feet of unsold homes, according to Liases Foras Real Estate Ratings & Research Pvt…

Fosun Plans Asset Sales in Reversal of $15 Billion M&A Spree

Posted by: | Comments-

Chinese group could sell up to $6 billion in assets, CEO says

-

Retrenchment makes Fosun outlier in record year for China M&As

Fosun Group, one of China’s most acquisitive conglomerates, is preparing to sell as much as 40 billion yuan ($6 billion) in assets as it turns its focus towards raising its credit rating to above junk.

As it steps back from the more than $15 billion in overseas purchases made or announced since 2010, the group plans to disclose the disposals between now and the end of 2017, Liang Xinjun, chief executive officer of flagship unit Fosun International Ltd., said in an interview aired on Bloomberg Television on Monday.

JLL Tapped to Lease 5-Building Suburban Complex

Posted by: | CommentsIndia IPO Returns Beat U.S. as Funds Chase High-Growth Companies

Posted by: | Comments-

Forty-seven IPOs raise $1.5b this year, twice the sum in 2015

-

Companies tapping growing assets with funds amid market rally

Amid India’s bull market celebration, it’s the newcomers that are having the biggest parties.

The 47 IPOs priced this year have returned an average 41 percent, more than four times the climb in the benchmark S&P BSE Sensex, data compiled by Bloomberg show. The gain is double the 19 percent mean for U.S. deals, and ahead of the 9 percent offered by first-time sales in Europe, the figures show.

Former Irish Bankers Go to Prison After Longest Trial

Posted by: | Comments-

hree sentenced to eight years and three months in total

-

All three convicted of conspiring to defraud customers

Three former senior Irish bankers were sentenced to a total of more than eight years in prison in Dublin after being convicted of conspiring to defraud customers and investors during the financial crisis.

Irish Life & Permanent Plc’s former chief executive officer, Denis Casey, and two former executives at Anglo Irish Bank Corp., Willie McAteer and John Bowe, were convicted in June after the longest criminal trial in the country’s history. All three had pleaded innocent to charges they helped created a false impression of the financial health of Anglo Irish Bank through facilitating a circular payment in 2008…

Office Tower Trades Near Downtown Dallas

Posted by: | CommentsU.K. Business Lending Forecast to Shrink Until 2019, EY Says

Posted by: | Comments-

Financial services outlook hurt by post-Brexit vote economy

-

Stock of company loans seen falling to lowest since 2005

Business loans in the U.K. will shrink to the lowest in more than a decade in the next couple of years as weaker economic prospects in the aftermath of the vote to leave the European Union damp demand, according to the EY ITEM Club.

Total lending to companies will contract 1.8 percent next year and another 1 percent in 2018 before finally recovering the following year, the organization said in a report released on Monday. By then, the total stock of business loans will have dropped to 376 billion pounds ($497 billion), the lowest since 2005, EY said…

China Factory Gauge Signals Deterioration as Property Boost Ebbs

Posted by: | CommentsChina’s official factory gauge unexpectedly fell below the dividing line between improvement and deterioration, signaling a debt-fueled growth rebound may be losing steam.

The manufacturing purchasing managers index fell to 49.9 last month, the statistics bureau said Monday, below June’s 50, which was also the median estimate in a Bloomberg survey of economists. The non-manufacturing PMI was at 53.9 compared with 53.7 in June. Numbers below 50 indicate conditions are getting worse.

The sub-50 reading was the first since February, casting doubt on the durability of an economic stabilization that’s been boosted by a property market recovery and state-led investment…

Morning Agenda: Consumer Agency Proposes New Rules for Debt Collectors

Posted by: | CommentsCONSUMER AGENCY PROPOSES NEW RULES FOR DEBT COLLECTORS There will be some respite for people being hounded for debt as federal regulators are preparing to significantly strengthen the rules that govern debt collection for the first time in nearly 40 years.

Under proposed regulations, debt collection companies will have to provide fuller documentation of the debt they are trying to collect. They must also make it clear how a consumer can dispute the debt and observe state statutes of limitations that bar them from legally pursuing older debts.

Plans Take Shape for $1.5B Gulf Coast Service Port

Posted by: | CommentsCredit Suisse Defeats Lawsuit Over Loans to High-End Resorts

Posted by: | Comments-

Property owners said banks relied on inflated appraisals

-

Judge rules bank can’t be blamed for defaults on loans

Credit Suisse Group AG won a lawsuit by property owners in four upscale resorts in the western U.S. who alleged that the investment bank funded loans based on inflated appraisals of the developments that caused their financial ruin.

A federal judge in Boise, Idaho, agreed with Credit Suisse and the appraiser, Cushman & Wakefield Inc., that the property owners had failed to produce evidence that the loans or the appraisals from 2004 to 2006 caused the resorts to fail and that there was no need for the case to proceed to trial…

Hedge Fund Calls New York Times Article a ‘Distortion’

Posted by: | Comments Ray Dalio, the founder and chairman of Bridgewater Associates. CreditLucy Nicholson/Reuters

Ray Dalio, the founder and chairman of Bridgewater Associates. CreditLucy Nicholson/Reuters

Bridgewater Associates, the world’s largest hedge fund, released a statement on Thursday taking issue with what it called “significant mischaracterizations” and a “distortion” of some of its business practices and culture that were described in an article in The New York Times.

Co-Working Goes Viral in SoCal

Posted by: | CommentsHomeownership Rate in the U.S. Drops to Lowest Since 1965

Posted by: | Comments-

Share fell to 62.9% in second quarter from 63.5% in the first

-

Rising prices putting purchases out of reach for many renters

The U.S. homeownership rate fell to the lowest in more than 50 years as rising prices put buying out of reach for many renters.

The share of Americans who own their homes was 62.9 percent in the second quarter, the lowest since 1965, according to a Census Bureau report Thursday. It was the second straight quarterly decrease, down from 63.5 percent in the previous three months…

Montecito Adds 276 KSF to Medical Building Portfolio

Posted by: | CommentsBill Gross Is Running His $1.5 Billion Mutual Fund by Himself — Again

Posted by: | Comments

Bill Gross

-

Kumar Palghat will co-run Janus Short Duration Income Fund

-

Gross’s global fund is up 3.7% in 2016, beating 65% of peers

Bill Gross is running his $1.5 billion Janus Global Unconstrained Bond Fund by himself — again.

The legendary money manager is losing his No. 2, Kumar Palghat, who joined Gross as co-manager last July. Palghat will become co-manager of a new exchange-traded fund, Janus Short Duration Income ETF, while continuing to oversee other mutual funds, according to a statement Thursday.

JCDecaux Moves North American HQ to Empire State Building

Posted by: | CommentsThe world’s number one outdoor advertising agency takes a top spot in New York’s most iconic building.

The Empire State Building

The Empire State Building

New York—Empire State Realty Trust announced thatJCDecaux, the world’s top outdoor advertising company, has leased two full floors, totaling roughly 47,000 square feet, in the iconic building. The firm is moving its North American headquarters into the 73rd and 74th floors of the 102-story tower.

The French advertising giant was represented by Snezana Anderson, Brad Needleman and Bernhard Weinstabel of CBRE, while Ryan Kass, Fred Posniak and Shanae Ursini of ESRT, along with Paul Glickman, Jonathan Fanuzzi, Simon Landmann, Kip Orban and Harley Dalton of JLL negotiated the lease on behalf of the landlord…

Home Capital Drops Most Since Facing Mortgage-Fraud Pain in 2015

Posted by: | Comments-

Lender’s earnings hurt by operating losses at CFF Bank

-

Company results miss analysts’ estimates for second quarter

Home Capital Group Inc. slipped the most in a year after reporting second-quarter earnings that missed analysts’ estimates.

The non-bank mortgage lender tumbled 6.7 percent to C$29.42 at 1:32 p.m. in Toronto trading after earlier falling as much as 9.8 percent. That was the biggest decline since the shares fell 21 percent in July 2015, when Home Capital announced a drop in originations after it sidelined brokers who submitted loan documents with falsified data…

Brooklyn Office Developers Chasing Tech Tenants Face a Slowdown

Posted by: | Comments-

VC financing for New York firms fell 40% in the second quarter

-

Projects include former Domino Sugar plant, Schlitz Brewery

Developers racing to turn Brooklyn into a thriving technology office market may be finding Manhattan a less-fruitful target for poaching tenants.

Leasing in Manhattan by tech, advertising, media and information tenants — known to real estate brokers by the acronym TAMI — fell in the second quarter to the lowest level in more than three years, according to Cushman & Wakefield. Such firms added just 1.21 million square feet (112,400 square meters) in the borough. That’s a 43 percent drop from the space leased in the first quarter…

Industry Veteran Joins Paragon in B’More

Posted by: | CommentsTempur Sealy Surges After U.S. Housing Market Helps Fuel Results

Posted by: | Comments-

Mattress company’s second-quarter earnings top estimates

-

U.S. housing starts reached a four-month high in June

Tempur Sealy International Inc. shares jumped the most in almost four years after the mattress company’s earnings topped estimates, helped by a rise in U.S. home construction.

Second-quarter profit rose to 92 cents a share, excluding some items, the Lexington, Kentucky-based company said on Thursday. That beat the 69 cents estimated by analysts, according to data compiled by Bloomberg…

Tempur Sealy Surges After U.S. Housing Market Helps Fuel Results

An Auction House Learns the Art of Shadow Banking

Posted by: | Comments

Jho Low.

-

Lending by Sotheby’s tripled to $682 million in four years

-

Malaysian financier in money-laundering probe got a loan

A year before he got caught up in a U.S. money-laundering investigation, Malaysian financier Jho Low was looking to borrow more than $100 million without having to answer all the nosy know-your-customer questions required by U.S. banks such as JPMorgan Chase & Co.

LionTree Hires JPMorgan Banker to Lead European Division

Posted by: | CommentsFresh off helping Verizon buy Yahoo for $4.8 billion, the boutique investment bank LionTree Advisors has added a senior banker to its organization.

The firm has hired Jake Donavan, a high-ranking banker at JPMorgan Chase, as the president of its European operation.

The move is the latest by LionTree as it seeks to capitalize on a number of prominent assignments. The firm, founded by the former UBS senior banker Aryeh Bourkoff four years ago, has played a role in major takeovers like Charter Communications’s acquisition of Time Warner Cable, Starz’s sale to Lionsgate and Outerwall’s sale to Apollo Global Management…

Pending Sales of U.S. Existing Homes Rise Less Than Forecast

Posted by: | Comments-

Gain led by rebound in Northeast after weakness in May

-

Lack of supply, rising prices limiting demand, NAR’s Yun says

Contracts to purchase previously owned U.S. homes rose less than forecast in June as a lack of supply and rising prices offset the benefits from historically low mortgage rates, according to figures released Wednesday from the National Association of Realtors in Washington.

Key Points

- Pending home sales gauge rose 0.2 percent after falling 3.7 percent the prior period (median forecast in a Bloomberg survey of economists was 1.2 percent gain)

Harvard Endowment’s Blyth Resigns From $37.6 Billion Fund

Posted by: | Comments

Stephen Blyth.

-

Chief operating officer Robert Ettl continues as interim CEO

-

David Barrett Partners hired to find replacement, school says

Stephen Blyth, who was named the investing chief of Harvard University’s $37.6 billion endowment 18 months ago to improve the fund’s lackluster performance, resigned for personal reasons, the university said.

Blyth, 48, who has been on an unspecified temporary medical leave since May 23, departs immediately, Harvard Management Co., the school’s investment management arm, said in a statement Wednesday. Chief Operating Officer Robert Ettl will remain as interim chief executive officer, and HMC said its board has hired David Barrett Partners to conduct a search for Blyth’s replacement…

Carlyle Names First Woman as Co-Leader of Buyout Arm

Posted by: | Comments Sandra J. Horbach will be promoted from managing director. CreditYana Paskova for The New York Times

Sandra J. Horbach will be promoted from managing director. CreditYana Paskova for The New York Times

Early in her career, Sandra J. Horbach earned the distinction of being the first woman to be named a partner at a major American private equity firm when she ascended to that role at Forstmann Little & Company.

Halcon Resources, U.S. Oil Explorer, Files for Bankruptcy

Posted by: | CommentsHalcon Resources Corp., the oil and gas explorer founded by wildcatter Floyd Wilson, filed for bankruptcy as part of a restructuring agreement reached with key lenders in May.

The agreement would eliminate $1.8 billion in debt and $222 million in preferred stock, the Houston-based company said at the time. On June 10, Halcon said a majority of holders had accepted the restructuring, which will be implemented through a Chapter 11 bankruptcy.

The filing Wednesday in Delaware federal bankruptcy court listed $3.12 billion in debt and $2.85 billion in assets…

Here’s What Wall Street Is Saying About Apple’s Earnings Report

Posted by: | CommentsOptimistic overall, but not without some caution.

Apple Inc. released its highly-anticipated quarterly results after the bell yesterday, and analysts and investors seem to like what they see.

The company reported fiscal third-quarter revenue that beat expectations, and while iPhone unit sales fell 15 percent from a year earlier, that exceeded the average estimate on Wall Street. Shares are trading about 7 percent higher in the pre-market, showing signs of making a bigger move higher following a tough few months…

Here’s What Wall Street Is Saying About Apple’s Earnings Report

Workspace Property Trust Buys Office, Flex Portfolio for $969M

Posted by: | CommentsHedge Fund Wins Vote for Aussie Money Manager to Shut China Fund

Posted by: | Comments-

AMP Capital will use KPMG to help formulate wind-up strategy

-

LIM has been pushing to narrow the China fund’s discount

Hedge fund LIM Advisors is set to succeed in its year-long push to force AMP Capital Investors Ltd., one of Australia’s largest money managers, to shutter its China fund that has been trading at a steep discount.

LIM, a Hong Kong-based firm which owns 10 percent of the AMP Capital China Growth Fund, is set to win the vote at an extraordinary general meeting Thursday, based on proxy results, AMP Capital said in a statement Wednesday. The China fund has a market value of A$434 million ($326 million)…

Turkey Extends Crackdown on Dissent to Coup Analysis by Brokers

Posted by: | Comments-

Capital Markets Board files criminal complaint for report

-

Ak Investment strategist accused of insulting Turkish leader

Turkey is widening its crackdown on dissent since a failed coup to include commenting on how much damage it’s causing.

The head of research at one of Turkey’s largest brokerages was stripped of his license over a report analyzing the impact of the July 15 putsch. The Capital Markets Board said Mert Ulker failed to “fulfill his responsibilities” in publishing his analysis for Ak Investment, the brokerage arm of Turkey’s second-largest bank. He also faces criminal charges, including under articles of the penal code against insulting the president, the nation or its institutions…

The Stein Mart Building Changes Hands in Jacksonville

Posted by: | CommentsEquity Residential Falls After Third Revenue-Forecast Cut

Posted by: | Comments-

Landlord cites weakness in New York, San Francisco markets

-

Apartment owners dealing with more supply, sluggish job growth

Shares of apartment landlord Equity Residential fell the most since March after the company cut its revenue forecast for the third time this year, citing greater weakness than it anticipated in the Manhattan and San Francisco rental markets.

Equity Residential expects revenue growth from properties open at least a year to be 3.5 percent to 4 percent in 2016, according to the company’s second-quarter earnings statement Tuesday. The Chicago-based real estate investment trust in late April lowered the upper limit to 5 percent, then reduced it again in June to 4.5 percent…

Silicon Valley Elites Get Home Loans With No Money Down

Posted by: | Comments-

Lenders are courting tech workers in the most expensive market

-

Worries by some about fueling another bubble, and inequality

It turns out that even the well-off need help in a housing market as crazy as the one in the San Francisco Bay area, and lenders are elbowing each other in a rush to provide it.

They’re courting Silicon Valley workers with tailored loans, guaranteed 24-hour approval and financial-planning services. Social Finance Inc. has deals with Google and other top technology companies that allow it to market to new hires. First Republic Bank — which gave Facebook Inc. billionaire Mark Zuckerberg a 1.05 percent interest-rate mortgage — has opened branches in Facebook and Twitter Inc. headquarters. San Francisco Federal Credit Union will finance 100 percent of houses costing up to $2 million…

Equus Capital Buys Suburban Philly Trophy Asset

Posted by: | CommentsFund Lawyer Who Worked With Goldman Holds 1MDB Clues, U.S. Says

Posted by: | Comments-

1MDB officer who arranged bond deals is said to be Jasmine Loo

-

Singled out by U.S. for $5 million diverted to her from fund

She was the general counsel for Malaysia’s 1MDB investment fund. She was also 1MDB’s liaison to Goldman Sachs Group Inc., the global bank that helped it raise $6 billion.

After one of the big sales led by Goldman Sachs, $5 million of the cash raised for 1MDB traveled through shell companies and ended up in her Swiss bank account, the U.S. said in complaints filed last week.

Wall Street’s Mr. Risk Thrives on Traders’ Ignorance of Politics

Posted by: | Comments

Ian Bremmer.

-

Ian Bremmer recast academic discipline as financial product

-

Growing cottage industry turns instability into income source

It was 1998 and Russia was on the verge of gaining investors’ confidence when oil tumbled to nearly $10 a barrel.

Foreign creditors dismissed talk of a collapse. Russia had the money to pay its debts, they said, and it wouldn’t sacrifice its credibility. Then-President Boris Yeltsin’s appointment of a young reformer to manage the crisis was proof.

Morning Agenda: Both Parties Want to Rein In Big Banks

Posted by: | CommentsBOTH PARTIES WANT TO REIN IN BIG BANKS The Democratic convention has not started with quite the display of unity that Hillary Clinton would have hoped for to stand in contrast to the Republican convention last week, but that’s not the only thing the two parties have in common. Both have inserted the Glass-Steagall rule into their platforms. The act has only a slim chance of returning and it would probably lead to a loss of jobs as lending slows, Andrew Ross Sorkin writes.

D.R. Horton Adds Lower-Cost Freedom Homes Brand for Retirees

Posted by: | CommentsD.R. Horton Inc., the largest U.S. homebuilder, has added affordable homes for seniors to its lineup of brands, which already includes entry-level and luxury properties.

Freedom Homes will begin in Florida, Texas and Arizona and be open in at least eight markets by the end of fiscal 2016, according to a statement Tuesday. The company didn’t provide details on pricing.

D.R. Horton has been having success with its lower-cost Express homes that, while geared to younger people, are gaining popularity with seniors in retiree markets such as Florida, the company said on its earnings conference call last week…

Home Prices in 20 U.S. Cities Rose Less Than Forecast in May

Posted by: | Comments-

Pacific Northwest region takes over lead in price appreciation

-

San Francisco led six cities seeing monthly price decreases

Home prices in 20 U.S. cities rose less than projected in May from a year earlier, signaling both buyers and sellers had the potential to benefit during the busy selling season, according to S&P CoreLogic Case-Shiller data reported Tuesday.

Key Points

- 20-city property values index increased 5.2 percent from May 2015 (forecast was 5.5 percent) after climbing 5.4 percent in the year through April

- National home-price gauge rose 5 percent from 12 months earlier

At World’s Largest Hedge Fund, Sex, Fear and Video Surveillance

Posted by: | CommentsRay Dalio, the billionaire founder of the world’s largest hedge fund, Bridgewater Associates, likes to say that one of his firm’s core operating principles is “radical transparency” when it comes to airing employee grievances and concerns.

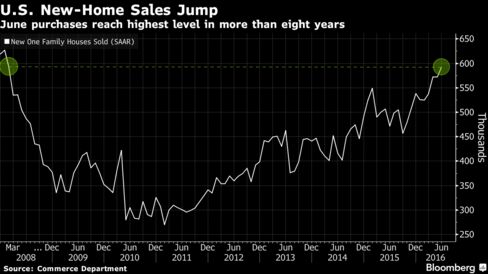

Firm U.S. Housing Market Seen in June New-Home Sales: Chart

Posted by: | Comments Sales of new U.S. homes climbed 3.5 percent to a 592,000 annualized pace, the fastest since February 2008, Commerce Department data showed Tuesday in Washington. The median forecast in a Bloomberg survey called for a 560,000 rate. Figures for May were revised higher to a 572,000 pace…

Sales of new U.S. homes climbed 3.5 percent to a 592,000 annualized pace, the fastest since February 2008, Commerce Department data showed Tuesday in Washington. The median forecast in a Bloomberg survey called for a 560,000 rate. Figures for May were revised higher to a 572,000 pace…

NYC, San Francisco Rental Slowdowns Hit Biggest Apartment REITs

Posted by: | Comments-

Equity Residential lowers revenue guidance for third time

-

Landlords contending with more supply, sluggish job growth

Apartment construction in New York and San Francisco is taking its toll on landlords, with Equity Residential, the largest publicly traded U.S. multifamily owner, cutting its revenue forecast for the third time this year.

Equity Residential expects revenue growth from properties open at least a year to be 3.5 percent to 4 percent in 2016, according to the company’s second-quarter earnings statement Tuesday. The Chicago-based real estate investment trust in late April lowered the upper limit to 5 percent, then reduced it again in June to 4.5 percent…

Historic Boston CBD Office Building Trades for $42M

Posted by: | CommentsHome Sales Jump, Confidence Stable: U.S. Economic Takeaways

Posted by: | Comments-

Demand for new houses climbs to more than eight-year high

-

Consumers more confident about current state of economy

What you need to know about Tuesday’s U.S. economic data:

NEW-HOMES SALES (JUNE)

- Rose 3.5 percent to 592,000 annualized pace (forecast was 560,000), strongest since February 2008

- Regionally, sales up 10.9 percent in West and 10.4 percent in Midwest to highest level since November 2007

- Previously reported decrease in May was revised away, now unchanged at 572,000 rate

- Supply of homes dropped to 4.9 months, leanest since February 2015…

The Latest Housing Data Is Bad News for People Predicting Recession

Posted by: | CommentsNo need to lose sleep over this.

While some think a recession could be looming for the U.S., fresh housing data says the opposite.

Purchases of new U.S. single-family homes just hit their highest level in more than eight years, representing what Wall Street is calling a strong market.

“Today’s report confirms the considerable strength in the housing market over the past few months,” Rob Martin, an economist at Barclays Plc, said in a note. “We expect housing to continue to firm, on average, over the medium term, with a buoyant household sector supporting both prices and volumes.”…

Akridge, Stars Investments Plan Trophy Office Project in DC

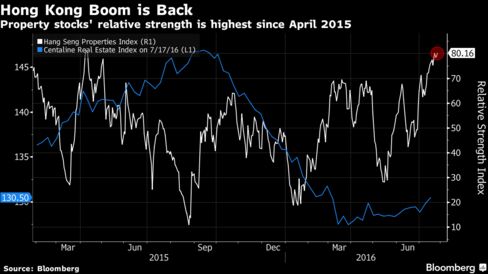

Posted by: | CommentsHong Kong Property Stocks Overheat as Outlook Improves: Chart

Posted by: | Comments As far as stock investors are concerned, talk of a plunge in Hong Kong property prices is overdone. An index of real estate companies listed in the city has surged 35 percent from a three-year low in January as traders scale back bets for higher U.S. borrowing costs and home prices rebound from a 13 percent slump. Such exuberance has lifted the relative strength index of property stocks to 80.2, far above the 70 level that signals to some traders shares are overbought…

As far as stock investors are concerned, talk of a plunge in Hong Kong property prices is overdone. An index of real estate companies listed in the city has surged 35 percent from a three-year low in January as traders scale back bets for higher U.S. borrowing costs and home prices rebound from a 13 percent slump. Such exuberance has lifted the relative strength index of property stocks to 80.2, far above the 70 level that signals to some traders shares are overbought…

Hong Kong Property Stocks Overheat as Outlook Improves: Chart

End of an Era as China’s Love Affair With U.S. Real Estate Fades

Posted by: | Comments-

Sales to Chinese buyers fell for the first time since 2011

-

Capital controls, currency depreciation seen among drags

For David Wong, the business of selling homes isn’t as good this year as it was in 2015, and he’s blaming that on a decline in customers from China.

“The residential-property market here, especially for those priced between $2.5 million to $3 million, has been affected by China’s measures to control capital flight,” said the New York City-based Keller Williams Realty Landmark broker. “You need to cut the price, or it may take a real long time.”…

Opus Completes Xcel Energy HQ Annex in Minneapolis

Posted by: | CommentsNew-Home Sales in U.S. Jump to Highest Level Since February 2008

Posted by: | CommentsPurchases of new U.S. single-family homes rose in June to the highest level in more than eight years, indicating a firm and resilient housing market.

Sales increased 3.5 percent to a 592,000 annualized pace, the fastest since February 2008, Commerce Department data showed Tuesday in Washington. Figures for May were revised higher. The median forecast in a Bloomberg survey called for a 560,000 rate.

While the government’s new-home purchase data are subject to big swings from month to month, the broader picture for residential real estate shows steady gains fueled by stable employment and low borrowing costs. Faster wage growth and construction of properties priced for entry-level buyers have the potential of further stoking the market…

How Does This Hedge-Fund Manager Make So Much Money?

Posted by: | Comments-

Fund reports annual returns as high as 91% since 2013

-

Meyer guarantees clients will never lose money with his system

Ten miles south of downtown Atlanta, in an anonymous business center overlooking the airport, sits the headquarters of what, on paper, is a hedge-fund powerhouse.

The numbers coming out of the part-time office at One Hartsfield Centre are remarkable: annual returns of 13 percent, 24 percent, even 91 percent since 2013.

Finra Sides With Brokers in Battle Against Credit Suisse

Posted by: | CommentsDozens of former Credit Suisse advisers who have been fighting for their deferred compensation after leaving the bank last year scored a partial victory on Friday when the brokerage industry’s main regulator said member firms cannot make workers waive their rights to settle disputes in the regulator’s own arbitration forum.

The advisers had been forced by Credit Suisse to use two other arbitration services they didn’t want. Now the Financial Industry Regulatory Authority says members have the right to request arbitration at Finra “at any time and do not forfeit that right” by signing an agreement saying they must choose otherwise…

SyncHR Makes the Move to Downtown Denver

Posted by: | CommentsSingapore Banks Facing Earnings Stumble as Bad Loans, Sibor Bite

Posted by: | Comments-

Largest lenders may boost provisions for nonperforming loans

-

Drop in interbank borrowing costs may drag on interest margins

Earnings reports due soon from Singapore’s largest banks may show their second-quarter profits were crimped by higher buffers for soured loans and a faltering rally in domestic interest rates.

Here are five charts illustrating the themes that may emerge out of the reports from DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. and United Overseas Banking Ltd.:

Singapore Banks Facing Earnings Stumble as Bad Loans, Sibor Bite

One Thing Both Parties Want: Break Up the Banks Again

Posted by: | Comments Former President Bill Clinton in 1999 signed the law that undid much of the Glass-Steagall Act, freeing banks to form all-in-one financial services shops. CreditJustin Lane

Former President Bill Clinton in 1999 signed the law that undid much of the Glass-Steagall Act, freeing banks to form all-in-one financial services shops. CreditJustin Lane

Could the Glass-Steagall Act — the Depression-era legislation that forced the separation of investment banking from commercial banking, among other things — be coming back?

Hines JV to Recapitalize Chicago’s Citadel Center

Posted by: | CommentsHas Wall Street Been Tamed?

Posted by: | CommentsFines, job cuts and anger have taken a toll. Traders and brokers are struggling to adapt to stark new realities.

Chris Hentemann has two pieces of art on the walls of his corner office in midtown Manhattan. One is an oversize photograph of the cockpit of his twin-engine Beechcraft Baron. The other is an Andy Warhol print of Muhammad Ali with his fists cocked.

Chris Hentemann has two pieces of art on the walls of his corner office in midtown Manhattan. One is an oversize photograph of the cockpit of his twin-engine Beechcraft Baron. The other is an Andy Warhol print of Muhammad Ali with his fists cocked.

For Hentemann, a rail-thin money manager who has spent 25 years in finance, the two pictures capture the duality of Wall Street. It’s an industry where you need to manage risk with precision and discipline, but it’s also one driven by audacity, ego and the killer instinct. Or at least it used to be…

La Quinta Inn & Suites Pearsall Expands HMC’s Management Portfolio

Posted by: | CommentsQIA Makes Good on US Investment Promise—Again

Posted by: | Comments 12100 Wilshire Blvd., Los Angeles

12100 Wilshire Blvd., Los Angeles

Los Angeles—In January 2015, visiting officials of the State of Qatar told the U.S. Chamber of Commerce that the country would invest $35 billion in the U.S. over the next five years, and it continues to do just that, with its latest investment being Qatari Investment Authority’s acquisition of the office tower at 12100 Wilshire Blvd. in Los Angeles. QIA, the sovereign wealth fund of Qatar, and joint venture partner Douglas Emmett Inc. recently acquired the 365,000-square-foot property, located in the prestigious Brentwood submarket, from Hines for $225 million.

Centre Pointe II, West Chester, Ohio

Centre Pointe II, West Chester, Ohio One Victory Park, Dallas

One Victory Park, Dallas Port Cameron, La.

Port Cameron, La. BioLabs San Diego

BioLabs San Diego Stanley Meros, Paragon Commercial Property Management

Stanley Meros, Paragon Commercial Property Management Thomas Rizk of Rizk Ventures

Thomas Rizk of Rizk Ventures The Stein Mart Building

The Stein Mart Building 1000 Chesterbrook Blvd. in Berwyn, Pa.

1000 Chesterbrook Blvd. in Berwyn, Pa. 70 Franklin Street, Boston

70 Franklin Street, Boston 1101 & 1111 16th St., NW., Washington, D.C.

1101 & 1111 16th St., NW., Washington, D.C. Xcel Energy’s new office at 401 Nicollet, Minneapolis

Xcel Energy’s new office at 401 Nicollet, Minneapolis 1099 18th St., Denver

1099 18th St., Denver Citadel Center Chicago (on the right)

Citadel Center Chicago (on the right) La Quinta Inn & Suites Pearsall

La Quinta Inn & Suites Pearsall