Back in the carefree days of Summer 2016, we at Dealbreaker wrote that should Donald Trump win the presidency, you’d have Renaissance Technologies to thank. Well, he did, and you do. So now that his man is in the White House (at least Monday through Friday), what is Mercer most anxiously awaiting? Since Mercer lets his millions do most of the talking for him, it’s hard to say exactly. But a big New Yorker profile out this week suggests there’s at least one eventuality Trump seems to be encouraging that Mercer could get behind: atomic war…

Back in the carefree days of Summer 2016, we at Dealbreaker wrote that should Donald Trump win the presidency, you’d have Renaissance Technologies to thank. Well, he did, and you do. So now that his man is in the White House (at least Monday through Friday), what is Mercer most anxiously awaiting? Since Mercer lets his millions do most of the talking for him, it’s hard to say exactly. But a big New Yorker profile out this week suggests there’s at least one eventuality Trump seems to be encouraging that Mercer could get behind: atomic war…

Archive for Uncategorized

U.S. New-Home Sales Climbed to a Seven-Month High in February

Posted by: | CommentsPurchases of new homes increased in February to a seven-month high, indicating the effects of the recent rise in borrowing costs on the U.S. residential real estate market have been modest.

Sales rose 6.1 percent to a 592,000 annualized pace, Commerce Department data showed Thursday. The median forecast in a Bloomberg survey called for a 564,000 rate. Warmer winter weather probably played a role in boosting demand as purchases in the Midwest surged by the most since October 2012…

U.S. New-Home Sales Climbed to a Seven-Month High in February

Hedge Fund Eton Park Is Shutting Down After a Decade

Posted by: | Comments-

Founder cites disappointing 2016, tough market environment

-

Decision to return funds follows fellow Goldman alum Perry

Eric Mindich at the CNBC Institutional Investor Delivering Alpha Conference in New York on July 15, 2015.

Photographer: Heidi Gutman/CNBC/NBCU Photo Bank via Getty Images

Eric Mindich, a one-time Goldman Sachs star trader who jumped into the hedge fund industry during its heyday, is throwing in the towel on his $7 billion firm.

Eton Park to Shut Down as $3 Trillion Hedge Fund Industry Faces Turmoil

Posted by: | Comments Eric Mindich said disappointing results in 2016 were a factor in his decision to return capital to investors.CreditChristian Hartmann/Reuters

Eric Mindich said disappointing results in 2016 were a factor in his decision to return capital to investors.CreditChristian Hartmann/Reuters

A well-known money manager is shutting down his firm after a year of disappointing results — the latest sign of turmoil in the $3 trillion hedge fund industry.

Eric Mindich, 49, was once a Wall Street wunderkind, becoming the youngest ever partner at Goldman Sachs more than 20 years ago. He launched Eton Park Capital Management in 2004, expanding it to manage as much as $14 billion.

Louisiana Triple Net Leased Property Changes Hands

Posted by: | Comments

Shreveport, La.—The Boulder Group completed the sale of a Dollar General building in Grand Cane, La. The single tenant property traded for approximately $1.2 million.

“The market for new construction net leased dollar stores remains active as these assets are in high demand among private investors,” Jimmy Goodman, partner of The Boulder Group, said in prepared remarks.

China’s Big-City Homeowners in Austerity Mode Are Weighing on Retail

Posted by: | Comments-

Big mortgages, big down payments zap spending in big cities

-

Beijing service sector corporate profits tumbled 11% in 2016

Last December, Li Qinglei and his wife purchased a 114-square-meter home in western Beijing by taking out a 5.5 million yuan ($800,000) home loan and borrowing more than 1 million yuan from family and friends.

Then, they shifted into full-on austerity mode.

Moapa Southern Paiute Solar Project Begins Operation

Posted by: | Comments

Moapa, Nev.—Moapa Southern Paiute Solar Project, a 250-megawatt AC solar energy facility located approximately 30 miles north of Las Vegas on the Moapa River Indian reservation,is now fully operational. The solar power plant is estimated to generate enough energy to power around 111,000 homes while avoiding the use of approximately 341,000 metric tons per year of carbon dioxide emissions. The prevention of carbon dioxide emissions is estimated to amount to the equivalent of taking nearly 73,000 cars off the road.

North Korea Link Probed in $81 Million Theft of Fed Funds: Sources

Posted by: | Comments-

$81 million taken from Bangladesh central bank account in 2016

-

Malware linked to that in 2014 Sony hack blamed on North Korea

The Federal Reserve Bank building in New York.

Photographer: Scott Eells/Bloomberg

The U.S. is investigating whether the theft of $81 million from a Bangladesh central bank account at the New York Fed is linked to North Korea because of the similarity of the hack to an earlier breach of Sony Pictures Entertainment, two people familiar with the matter said.

Today’s Installment Of ‘Bad News At Deutsche Bank’

Posted by: | Comments Is really not that bad! Sure, John Cryan & co. will be cutting another novelty-sized check at the conclusion of yet another probe into alleged wrongdoing. But that’s one less challenge—not that there aren’t still plenty more!—and they won’t even be writing it out to the Justice Department, which has decided to let this one go, possibly to focus more attention on its other criminal investigation into the bank over violating sanctions on Russia.

Is really not that bad! Sure, John Cryan & co. will be cutting another novelty-sized check at the conclusion of yet another probe into alleged wrongdoing. But that’s one less challenge—not that there aren’t still plenty more!—and they won’t even be writing it out to the Justice Department, which has decided to let this one go, possibly to focus more attention on its other criminal investigation into the bank over violating sanctions on Russia.

The German lender said Monday that the U.S. Justice Department had closed a criminal inquiry into its currency-trading activities without action.

Bohannon Earmarks $145M for Menlo Park Project

Posted by: | CommentsNorthMarq arranged the construction loan originated by Square Mile Capital Management.

Menlo Park, Calif.—The Bohannon Cos. has received $145 million in financing to develop Menlo Gateway, an eight-story, 210,000-square-foot office building in Menlo Park.

The mixed-use project also consists of a 1,040-space parking structure and a 41,000-square-foot fitness center.

Square Mile Capital Management LLC originated the construction loan, which was arranged by John Kerslake and Briana Smith of NorthMarq Capital…

Myanmar Luxury Property Hampered by Confusion Over Law on Foreign Buyers

Posted by: | Comments-

Law allowing overseas purchases leaves questions unanswered

-

Local developer Yoma says clarfications due this year may help

Confusion over a law allowing foreigners to buy condominiums in Myanmar is prolonging a slowdown in its residential property sector, highlighting the challenges of regulatory flux in the frontier market.

The legislation adopted in January 2016 leaves unanswered questions such as whether it applies to existing apartments, hurting efforts to woo investors. The outlook now depends partly on bylaws the government is working on to clarify the legislation, according to local developer Yoma Strategic Holdings Ltd...

The Bay Area tech driven frenzy continues to march forward with no stopping in sight. If you thought $1 million was too much for a crap shack then $1.3 million is going to be out of your price range. The tech gentrification is getting more aggressive and is pricing out people at an astonishing pace. We’ve noted the out migration of native Californiansto other states is much larger than people suspect. Foreign money and high income households are the power players in these niche markets. This is simply a fact but also is tied to the bull market that has now entered into its eight year. There are now signs that we are reaching a plateau but this system only understands two states: boom and bust. There is nothing calm about the way our real estate system is now structured. It is about fast gains or big losses. All or nothing. You are either riding the big wave or crashing in fantastic fashion. People forget cycles and have the long-term memory of a gnat when it comes to these things. The Bay Area continues to drink from the cup of housing mania.

Target Comes to Manhattan’s Herald Square

Posted by: | CommentsNew York—Target plans to open a 43,000-square-foot small-format store in Manhattan’s Herald Square. The company signed a lease for the property with Empire State Realty Trust.

Located just west of the 34th Street and Broadway intersection, the store is set to open in October 2017 and is one of three locations in Manhattan, joining the Harlem and Tribeca stores. Target also plans to expand in the East Village and Hell’s Kitchen, with locations set to open in 2018 and 2019, respectively…

Alternative Endings Seen for Sears and Its Hedge Fund Chief

Posted by: | CommentsThe last chapter for Sears looks to be at hand.

The troubled retailer warned that it could be headed for bankruptcy if it cannot reverse a brutal decline in annual sales and rising losses. The long quest by Edward S. Lampert, the chief executive, to turn Sears around seems destined to fail. The fate of investments made over the years by Mr. Lampert, a hedge fund boss, may be different.

CBRE Report: World’s Highest Office Rents

Posted by: | Comments

Los Angeles—Three Manhattan submarkets in New York City are among the top 20 most expensive office rent markets in the United States in a new Global Prime Office Rents survey from CBRE Group. The survey named Hong Kong as the world’s highest-priced office market.

The CBRE report, which tracks office rents for prime office space in 121 markets, also found that Chicago had the second fastest-growing prime office rents in the world, with a 19.9 percent increase from 2015 to 2016…

Li Ka-Shing Signals Hong Kong Property Rebound Could Last Years

Posted by: | Comments-

Tycoon says demand is strong despite government property curbs

-

Li dodges questions as to who he’ll back in upcoming elections

Billionaire Li Ka-shing, chairman of CK Hutchison Holdings Ltd. and Cheung Kong Property Holdings Ltd., waves as he leaves a news conference in Hong Kong, China, on Wednesday.

Photographer: Justin Chin/Bloomberg

Hong Kong’s richest man signaled that the property rebound that’s been pushing up prices in the world’s most expensive housing market could persist for as long as two years as growing demand outweighs government curbs.

Raleigh’s Now Twice as Nice for Avison Young

Posted by: | Comments

Raleigh, N.C.—Avison Young puts another checkmark in the Raleigh column. Five years after establishing a footprint in the North Carolina city, the Toronto-based commercial real estate services firm has expanded its presence there with the acquisition of Hunter & Associates LLC. Hunter is now operating as Avison Young.

It’s not just about tier-one markets for Avison Young. “We had a significant presence in Raleigh to begin with, but as the city is a major home to owners and occupiers, expansion is natural to Avison Young,” Mark Rose, CEO of Avison Young, told Commercial Property Executive…

Dublin Is Best EU City for Bankers Fleeing Brexit, Study Says

Posted by: | Comments-

Frankfurt came in sixth place in relocation company’s index

-

Cities ranked for rental costs to price of evening cocktail

Dublin is the best destination in the European Union for London-based bankers forced to move after Brexit, according to an index of 15 cities compiled by a relocation company.

Though Ireland tied for the highest top income tax rate, at 52 percent, it benefits from being the only other English-speaking destination in the EU and the cost of renting a flat in Dublin is markedly cheaper than in Paris, Frankfurt or Luxembourg, Movinga said on its website. Amsterdam is the next-best destination for Brexit exiles, while Frankfurt languished in sixth place and Paris in ninth, below Valletta in Malta and Brussels, the index showed…

New England Industrial Asset Trades for $13M

Posted by: | Comments

Milford, Conn.—Massachusetts-based Calare Properties recently announced that it has sold 40 Pepe’s Farm Road, a 200,000-square-foot industrial warehouse property located in Milford. The asset was acquired by an undisclosed large institutional buyer for $13.3 million.

The seller purchased the 50 percent occupied property in 2014, with a strategy for capital improvements designed to drive tenant demand and increase value. Currently, after extensive property upgrades, including updates to the exterior dock doors, new LED lighting and landscaping improvements, the asset is fully occupied on a 10-year term by a global transportation solutions company…

Sales of Previously Owned U.S. Homes Fell 3.7% in February

Posted by: | CommentsSales of previously owned U.S. homes declined in February after rising a month earlier to the highest level in a decade, according to figures released Wednesday from the National Association of Realtors in Washington.

Key Points

- Contract closings dropped 3.7 percent to a 5.48 million annual rate (forecast was 5.55 million)

- Median sales price jumped 7.7 percent from a year earlier to $228,400

- Inventory of available properties fell 6.4 percent from February 2016 to 1.75 million, making it the 21st straight year-over-year decline…

This Hedge Fund Manager Bets He Can Dull Your Sweet Tooth

Posted by: | Comments Courtesy Crave Crush

Courtesy Crave CrushIt started with a Nestlé Crunch bar. One night in 2012, Rob Goldstein returned from a New York kickboxing gym to his Upper East Side apartment and ate a healthy dinner. Then he saw the chocolate, which his son had left on the kitchen table. One bite quickly turned into eight. “I don’t know what came over me,” he says. He decided to find out. If he could reset his taste buds to how they were before that first bite, he thought, his willpower ought to stand a better chance.

Sares-Regis Inks Leases for 972 KSF near Ontario Int’l Airport

Posted by: | Comments

Los Angeles—Sares-Regis Group leased four new distribution buildings totaling 972,000 square feet within the Meredith International Centre in Ontario, Calif. The new tenants of the 127,000 to 552,000-square-foot buildings are Arvato, Metro Air Service, The Wheel Group and Metropolitan Logistics Services. Joe McKay and Chris Morrell of Lee & Associates represented the company in the lease negotiations.

Estate Agents Aren’t Having a Great Time in Britain

Posted by: | Comments-

Gap widens between home values and wages, hurting deal volumes

-

Weak demand in prime central London is now spreading outward

Britain’s largest property brokers are cutting jobs, closing branches and raising capital even as homes sell for record amounts. While some companies have blamed Brexit and tax hikes for a drop in transactions, high values have put off many other buyers.

Demand for housing dropped to a six-month low in February, according to the Royal Institution of Chartered Surveyors. The widening gap between home values and wages means brokers including Countrywide Plc and Foxtons Group Plc are closing fewer deals while being undercut on fees by online companies….

Robert Mercer Is Pumped For Nuclear Annihilation

Posted by: | CommentsFlorida’s Space Coast Lands New Addition

Posted by: | Comments

Merritt Island, Fla.—OneWeb Satellites LLC broke ground on an estimated $85 million manufacturing project in Exploration Park, Fla. If everything stays on schedule, the facility will be engaged, by year-end, in high-volume assembly line production of orbital satellites, the first such facility in the world.

The developer is a joint venture between OneWeb, a satellite-based Internet provider, and Airbus Americas, the U.S.-based operation of Airbus, the European aerospace and defense giant.

Goldman, Morgan Stanley Signal London Job Moves Ahead of Brexit

Posted by: | Comments-

Top Goldman banker says firm to relocate hundreds, hire in EU

-

Morgan Stanley’s Kelleher says there ‘certainly’ will be moves

Senior Goldman Sachs Group Inc. and Morgan Stanley executives said they’re preparing to shift staff and operations from London to elsewhere in the European Union as Prime Minister Theresa May sets up the U.K.’s exit from the bloc.

A day after May’s office announced she will open two years of divorce talks with the EU on March 29, Richard Gnodde, co-head of investment banking at Goldman Sachs, told CNBC on Tuesday that his bank will initially relocate hundreds of London-based employees to expand other offices after the split…

Bill Ackman’s $4 Billion Valeant Loss May Be Just The First Two-Thirds Of It

Posted by: | Comments Losing the first $4 billion may be the hardest. Losing the next $2 billion on a stock you don’t even own anymore, due to an insider-trading lawsuit that you’ve called “baseless,” “shameless” and a waste of money, after spending half a day in the dock under hostile questioning by lawyers from the company that bested him and started this whole damned downward Valeant spiral in the first place? That’s liable to the most painful.

Losing the first $4 billion may be the hardest. Losing the next $2 billion on a stock you don’t even own anymore, due to an insider-trading lawsuit that you’ve called “baseless,” “shameless” and a waste of money, after spending half a day in the dock under hostile questioning by lawyers from the company that bested him and started this whole damned downward Valeant spiral in the first place? That’s liable to the most painful.

This is not just any lawsuit. Damages in the case may be $2 billion, as noted by the judge who certified the litigation as a class action Wednesday….

HFF Leads $35M Sale of St. Louis Shopping Center

Posted by: | Comments

St. Louis—HFF has closed on the $35.4 million sale of and arranged $23.1 million in acquisition financing for Lincoln Place, a retail center located in Fairview Heights, Ill. HFF represented the seller, Spirit Realty Capital, which sold the asset to Acadia Strategic Opportunity Fund IV.

Located at 5905-6109 N. Illinois St., on 17 acres, the 272,060-square-foot shopping center is 14 miles east of downtown St. Louis. At the time of the deal, the asset was at almost 100 percent occupancy, with a tenant mix including Kohl’s, Ross Dress for Less, Old Navy, Marshalls, Famous Footwear and Five Below. Lincoln Place was completed in 1999, and refurbished in 2005…

RBA Warns Over Aussie Housing Risks as Global Reflation Emerges

Posted by: | CommentsAustralia’s central bank highlighted threats in the property market and an acceleration of domestic household debt even as it lent credence to the global reflation story.

“Data continued to suggest that there had been a build-up of risks associated with the housing market,” the Reserve Bank of Australia said in minutes released Tuesday of this month’s meeting where it held interest rates at a record-low 1.5 percent. “Growth in household debt had been faster than that in household income.”

Morgan Stanley Adds Noted Singing Financial Adviser

Posted by: | Comments![By Steve Jurvetson [CC BY 2.0], via Wikimedia Commons](https://dealbreaker.com/uploads/2017/03/linmanuel-300x233.jpg)

By Steve Jurvetson [CC BY 2.0], via Wikimedia Commons

BriMo may have gotten the best of James Gorman & co. recently, snatchingMorgan Stanley financial institutions banking co-chief Eric Bischof to co-lead its own global financial institutions group. But does Bank of America have the musical reincarnation of our nation’s first Treasury secretary slinging clichéd bromides about financial literacy on its stage?

No. No it does not.

When you are focused on doing what you love, it can be easy to brush aside the need to understand the monetary implications of upcoming milestones. However, regardless of who you are and what you are most passionate about, everyone should master the fundamentals in order to find and fulfill your own greater purpose….

Why Won’t Anyone Buy the Most Expensive House in New Jersey?

Posted by: | CommentsHint: It’s the most expensive house in New Jersey.

When real estate developer Richard Kurtz put his 30,000-square-foot, 12-bedroom, 19-bath home on the market for $68 million in 2010, it was the most expensive property in New Jersey. Seven years later, the house, which sits on a little more than six acres in Alpine, a suburb about eight miles from New York City, remains both unsold and at the top of the market. The only change is its price: It will soon be relisted for a mere $48 million.

After Exiting Capital Controls, Iceland Still Wary of Private Investors

Posted by: | Comments A branch of Kaupthing bank in Reykjavik, Iceland, in 2008, the year the lender went bust. On Sunday, it said it had sold a 30 percent stake in its “good bank,” Arion, to hedge funds including Och-Ziff.CreditOlivier Morin/Agence France-Presse — Getty Images

A branch of Kaupthing bank in Reykjavik, Iceland, in 2008, the year the lender went bust. On Sunday, it said it had sold a 30 percent stake in its “good bank,” Arion, to hedge funds including Och-Ziff.CreditOlivier Morin/Agence France-Presse — Getty Images

Iceland and Greece are rare examples of European countries experimenting with capital controls. Their approach to wooing back private investors is somewhat different. Iceland, which ended eight years of controls last week, seems altogether less starry-eyed.

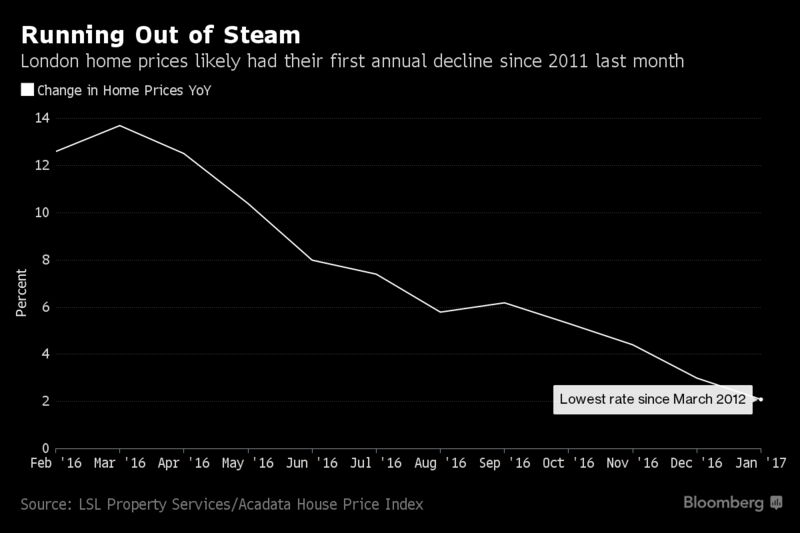

London’s Six-Year Home Price Boom May Finally Be Over: Chart

Posted by: | Comments Greater London home prices will probably show their first annual decline since June 2011 when February’s data is published next month, according to Peter Williams, chairman of researcher Acadata. Prices in the city have fallen in six of the past 12 months, with the average home in the U.K. capital valued at almost 598,000 pounds ($739,500) in January. Sellers, by contrast, are betting the boom has further to run with asking prices rebounding to an all-time high this month…

Greater London home prices will probably show their first annual decline since June 2011 when February’s data is published next month, according to Peter Williams, chairman of researcher Acadata. Prices in the city have fallen in six of the past 12 months, with the average home in the U.K. capital valued at almost 598,000 pounds ($739,500) in January. Sellers, by contrast, are betting the boom has further to run with asking prices rebounding to an all-time high this month…

London’s Six-Year Home Price Boom May Finally Be Over: Chart

Real Estate Hot Spots

Posted by: | CommentsA few blocks may make all the difference in the price you pay for a home in Manhattan and Brooklyn. Our map, which updates quarterly, shows how values vary by neighborhood, what kinds of deals buyers are negotiating or even whether it makes more sense to rent. On Manhattan’s West Side, the median resale price slipped in almost all areas in the last three months of 2016, but the East Side fared better. Brooklyn buyers didn’t have much bargaining power if they were looking in areas close to Manhattan, while those willing to venture farther out got bigger discounts…

Oil’s Bad Timing Puts Pressure on Drillers as Banks Review Loans

Posted by: | Comments-

Slide in oil prices could deter lenders from opening up credit

-

‘The next month is going to be absolutely critical’: analyst

Photographer: Brittany Sowacke/Bloomberg

Photographer: Brittany Sowacke/Bloomberg

The rally in global oil prices has stalled at the worst possible time for explorers, just as banks reassess credit lines crucial to their growth.

This year’s reviews, due to start next month, will arrive with the industry nursing a nasty case of whiplash. Spot prices surged late last year on OPEC’s pledge to cut output, hitting $54.06 a barrel in New York. Since then, they’ve fallen 12 percent, undercut by rising U.S. rig counts. Futures contracts show longer-term prices deteriorating as well…

Payless Is Said to Be Filing for Bankruptcy as Soon as Next Week

Posted by: | Comments-

Retailer plans to initially close several hundred stores

-

Shoe chain has more than 4,000 locations in 30 countries

Payless Inc., the struggling discount shoe chain, is preparing to file for bankruptcy as soon as next week, according to people familiar with the matter.

The company is initially planning to close 400 to 500 stores as it reorganizes operations, said the people, who asked not to be identified because the deliberations aren’t public. Payless had originally looked to shutter as many as 1,000 locations, and the number may still be in flux, according to one of the people…

GBT to Develop 2 Retail Centers in Southeast

Posted by: | CommentsThe company has acquired two sites for $1.7 million, on which it plans to develop two unanchored shopping centers.

Baton Rouge, La. & Broken Arrow, Okla.—GBT Realty Corp. acquired two undeveloped sites for a collective $1.66 million. The company intends to develop two unanchored shopping centers in Baton Rouge, La. and Broken Arrow, Okla.

GBT purchased a .86-acre site from Target along Millerville Road in Baton Rouge, La. The 6,600-square-foot center shadow-anchored by Target, Best Buy and Office Depot was 100 percent pre-leased at the time of the deal. The site located at the nexus of 2001 Millerville Road and I-12 traded for $810,000…

Even San Francisco, Flush With Tech Wealth, Has Pension Problems

Posted by: | Comments-

Pension cost to rise more than three times faster than revenue

-

With retirees living longer, pension shortfall has swelled

The skyline of downtown San Francisco.

Photographer: David Paul Morris/Bloomberg

The technology industry has transformed San Francisco with a boom other cities can only envy. But it hasn’t eradicated a problem well known to industrial-era towns: the rising cost of pensions.

ORION Scoops Up Phoenix Office Building

Posted by: | Comments

Phoenix—Scottsdale-based ORION Investment Real Estate has announced the $2 million sale of Indian School Plaza, a 65,000-square-foot office building in Phoenix. The brokerage firm represented the seller, Arizona-Cal Note Investments 4.5 LLC, while West USA Realty represented the buyer, 3001 W Indian School LLC. This was an all-cash transaction.

Vista Office Underway at Cordillera Ranch

Posted by: | CommentsSan Antonio—The Cordillera Ranch luxury community in the San Antonio metro area is further expanding with the development of a new office facility. Construction on the Vista Office is already underway, with completion aimed for this fall. DH Investments, Pasadera Builders, Cordillera Ranch Visitor Center and the Cordillera Property Owners Association will occupy the new 10,000-square-foot facility.

The new office facility, designed by J. Terrian Designs, will offer conveniences such as digital kiosks and multi-media screens offering Cordillera Ranch information. “The Vista Office will serve both as a workspace and welcome center for guests of our community,” DH Investments President & COO Charlie Hill said in a prepared statement…

Regulators Said to Weigh Appraisal Change That May Spur Lending

Posted by: | Comments-

Banking agencies rethinking threshold for commercial property

-

Discussed change would boost trigger to $400,000 from $250,000

As President Donald Trump seeks to knock down government constraints on business loans, U.S. bank regulators have tentatively agreed to ease an appraisal requirement that could help commercial real estate borrowers, said people familiar with talks among the agencies.

Regulators have decided the threshold for requiring appraisals on commercial property should be increased to $400,000 from $250,000, according to two people who asked that they not be identified because the discussions aren’t public. The threshold for residential real restate would remain at $250,000, they said…

Bank of America Hires Top Banker Away From Morgan Stanley

Posted by: | Comments Bank of America’s hiring of Eric Bischof comes amid a potential rise in mergers among financial institutions.CreditCarlo Allegri/Reuters

Bank of America’s hiring of Eric Bischof comes amid a potential rise in mergers among financial institutions.CreditCarlo Allegri/Reuters

Bank of America has poached a top rainmaker for financial services companies from Morgan Stanley.

Eric Bischof, who helped advise the Federal Reserve Bank of New York on matters related to the American International Group, will join Bank of America as co-head of its global financial institutions group, serving alongside Jim O’Neil in New York.

The hiring, announced in an internal memorandum on Monday, comes amid a potential rise in mergers among financial institutions as the Trump administration signals it will loosen regulations governing such combinations…

Transwestern Arranges Financing for Boston Landing Component

Posted by: | Comments

Boston—Transwestern arranged a short-term construction loan on behalf of NB Development Group for 80 Guest St. in Brighton, Mass., a part of New Balance’s $500 million Boston Landing mixed-use development. The financing, which was arranged through a syndication between U.S. Bank and TD Bank, will be used for the remaining construction on the property’s 265,000-square-foot office and laboratory section. The building also includes the Warrior Ice Arena, which serves as Boston Bruins’ new training and practice facility.

`Bubbly’ Australia Housing Market May Lead to More Lending Curbs

Posted by: | Comments-

Surging prices, record debt create heightened risk, APRA says

-

Prices ‘out of whack’ with historical norms, ASIC head says

Australia is facing a period of “heightened risk” in the housing market, the nation’s top banking regulator said, amid rising speculation further lending curbs may be imposed to cool runaway housing prices.

Australian Prudential Regulation Authority Chairman Wayne Byres said that while he refused to ever use the “B-word” — referring to a bubble — “if everyone isn’t careful, the risk in the system is going to rise.”…

`Bubbly’ Australia Housing Market May Lead to More Lending Curbs

Interest Rates After Inflation May Be a Real Bubble

Posted by: | Comments-

Deutsche Bank says Fed has driven mispricing of real yields

-

Diverence from real GDP seen unsustainable, German bank says

U.S. equity and debt markets have ridden a reflationary wave this year, thanks to optimism over the momentum of the U.S. economy.

However, some key gauges for growth sit awkwardly with this narrative. Nominal yields on five-year Treasuries are negative when adjusted for the price outlook. And on Treasury Inflation Protected Securities five years forward, a metric the Federal Reserve uses to gauge long-term inflation expectations, the rate projected for 2022 is falling.

Hedge Fund Titan’s Surefire Bet Turns Into a $4 Billion Loss

Posted by: | Comments William A. Ackman in 2015. Last week, he and his investors in funds run by Pershing Square Capital Management swallowed a $4 billion loss on Valeant Pharmaceuticals International.CreditAxel Dupeux/Redux Pictures

William A. Ackman in 2015. Last week, he and his investors in funds run by Pershing Square Capital Management swallowed a $4 billion loss on Valeant Pharmaceuticals International.CreditAxel Dupeux/Redux Pictures

A little over two years ago, William A. Ackman, one of Wall Street’s brashest and most self-assured hedge fund managers, was on top of the world. A billionaire before he hit 50, he was generating double-digit gains for his investors and raking in hundreds of millions in fees for his firm and himself.

Mack-Cali Snaps Up $368M Office Portfolio

Posted by: | Comments

Madison, N.J.—HFF recently played a role in making history in the New Jersey commercial real estate market, arranging the disposition of a 1.1 million-square-foot office portfolio. Acting on behalf of RXR Realty, the commercial real estate and capital markets services provider sold the group of six assets to Mack-Cali Realty Corp. for $368 million, marking one of the largest office portfolio trades ever in the Garden State.

Toronto Home Prices May Jump 25% This Year, TD Says

Posted by: | Comments-

conomist says signs show ‘speculative forces’ driving market

-

Caranci had previously seen 2017 price growth of 10% to 15%

Toronto’s housing market is likely to stay strong for the rest of the year, with home prices jumping as much as 25 percent, amid hints that speculators are fueling demand and posing a potential risk to the economy, TD Economics Chief Economist Beata Caranci said.

A “strong Toronto home-price forecast is not a vote of confidence in market fundamentals,” Caranci wrote Monday in a note to clients. “It’s getting harder to ignore warning signs that market demand pressures are increasingly reflecting speculative forces.”…

Odd Lots: How a Fund Manager Teaches His Kids About Money and Banking

Posted by: | Comments

Coins surround a piggy bank.

Photographer: Ron Antonelli/Bloomberg

Every week, hosts Joe Weisenthal and Tracy Alloway take you on a not-so-random walk through hot topics in markets, finance

Plenty of people pay their kids an allowance to teach them the value of hard work and earning money. But our guest on this week’s Odd Lots podcast takes it to the next level. Toby Nangle is a fund manager at Columbia Threadneedle Investments, who also happens to be fascinated with the question of how money and banking really work…

Revere Capital Launches $350M Fund

Posted by: | Comments

Dallas—Dallas-based private equity lender Revere Capital has launched its third fund for the origination and acquisition of commercial real estate debt, known as Revere Credit Opportunities Fund III LP (Fund 3). Targeted to originate two- to five-year loans to real estate investors and developers for all categories of commercial real estate except land, the new $350 million fund is expected to originate loans ranging from $3 million to $30 million. Through this fund, the firm seeks to provide investors with capital preservation and attractive risk-adjust yield.

Ultramodern River Point Tower Opens in Chicago

Posted by: | Comments

Chicago—Leandlease recently celebrated the grand opening of River Point, Chicago’s largest and most anticipated commercial real estate project since 2009.

Construction at the 52-story ultra-modern office tower kicked off in early 2013 as a $400 million joint venture between Hines, Canada-based real estate investment firm Ivanhoé Cambridge, and local business leader Larry Levy. Lendlease provided construction management services for the 1.4 million-square-foot project, while Pickard Chilton Architects designed the building.

Manhattan & Brooklyn Real Estate Hot Spots

Posted by: | CommentsA few blocks may make all the difference in the price you pay for a home in Manhattan and Brooklyn. Our map, which updates quarterly, shows how values vary by neighborhood, what kinds of deals buyers are negotiating or even whether it makes more sense to rent. On Manhattan’s West Side, the median resale price slipped in almost all areas in the last three months of 2016, but the East Side fared better. Brooklyn buyers didn’t have much bargaining power if they were looking in areas close to Manhattan, while those willing to venture farther out got bigger discounts…

China’s HNA Is Buying a NYC Office Tower for $2.21 Billion

Posted by: | Comments-

Purchase of 245 Park Ave. would be one of Manhattan’s priciest

-

Sellers are Brookfield Property, New York teachers pension

Ave. for $2.21 billion, one of the highest prices ever paid for a New York skyscraper, two people with knowledge of the negotiations said.

HNA may be involved with at least one partner on the purchase, said the people, who asked not to be identified because the transaction is private. The 1.7 million-square-foot (158,000-square-meter) office tower, with tenants including JPMorgan Chase & Co., is being sold by Brookfield Property Partners LP and its 49 percent partner in the property, the New York State Teachers’ Retirement System…

Bridge Development Sells Industrial Assets in Miami

Posted by: | CommentsMiami—Bridge Development Partners has completed the sale of two Class A industrial buildings: Bridge Point Davie at 3501 Burris Road in Davie, Fla., and Bridge Point Crossroads West at 10901 NW 46th St. in Hialeah Gardens, Fla. TA Realty purchased the assets for $53.7 million.

CBRE’s Capital Markets team led by Chris Riley, vice chairman in Atlanta; Christian Lee, vice chairman in Miami and Jose Antonio Lobon, senior vice president in Miami, represented Bridge Development in the sale…

Shadow Lending Threatens China’s Economy, Officials Warn

Posted by: | Comments Shanghai’s financial district of Pudong. Chinese financial officials warned on Saturday about the dangers of shadow banking. CreditAly Song/Reuters

Shanghai’s financial district of Pudong. Chinese financial officials warned on Saturday about the dangers of shadow banking. CreditAly Song/Reuters

BEIJING — The chairman of China’s biggest bank and a senior Chinese insurance regulator issued strong warnings on Saturday about the dangers of shadow banking to the Chinese economy, in the latest signs of growing top-level concern here about a rise in highly speculative, poorly regulated lending.

Shadow banking, or lending that takes place outside official banking channels, plays a major role in the Chinese economy, where big government-controlled banks are often slow to lend to private businesses and entrepreneurs. But experts worry that untrammeled shadow lending could lead to ticking time bombs that could threaten the financial system of the world’s second-largest economy…

Divaris to Manage Class A Office Asset in Norfolk CBD

Posted by: | Comments

Norfolk, Va.—Divaris will manage Town Point Center, a 12-story Class A office building in Norfolk, the company recently announced. The Hampton Roads asset is owned by the Cohen Investment Group, which bought the building in 2014 from Harbor Group for $14.5 million, The Virginian-Pilot reports. Town Point Center previously changed hands in 2008, for roughly $12.8 million.

China Home-Price Rises Regain Speed, Defying Purchase Curbs

Posted by: | Comments

-

February new home prices rise in 56 cities versus January’s 45

-

Beijing and Guangzhou stepped up home purchasing restrictions

Pedestrians cross a road in front of residential buildings in Beijing, China.

Photographer: Qilai Shen/Bloomberg

China home prices rose last month in more cities despite increased restrictions on property transactions by local authorities.

New home prices, excluding subsidized housing, gained in February in 56 out of 70 cities tracked by the government, compared with 45 in January, the National Bureau of Statistics said Saturday. Prices climbed in 67 out of 70 cities from a year earlier, compared with 66 in January…

Barings Inks 32 KSF Lease in Downtown LA

Posted by: | Comments

Los Angeles—International specialty insurance group Tokio Marine HCC has signed an 11-year lease for approximately 32,000 square feet of office space at 801 South Figueroa St. in Los Angeles.

Mike Catalano and Luke Raimondo at Savills Studley represented the tenant, while John Eichler and Tyler Stark with Cushman & Wakefield represented the landlord, Barings Real Estate Advisers.

The company will be relocating from 601 S. Figueroa St. to 801 Tower in May 2017. The 462,626-square-foot office tower is located at the corner of 8th Street and South Figueroa in downtown Los Angeles…

How ‘Consumer Relief’ After Mortgage Crisis Can Enrich Big Banks

Posted by: | Comments A home in Henderson, Nev., that was foreclosed. Some deals by big banks to provide mortgage relief for borrowers have a built-in profit incentive. CreditMax Whittaker for The New York Times

A home in Henderson, Nev., that was foreclosed. Some deals by big banks to provide mortgage relief for borrowers have a built-in profit incentive. CreditMax Whittaker for The New York Times

In every multibillion dollar settlement with a big bank that peddled faulty mortgage securities, a major provision has been a requirement that the bank provide “consumer relief.”

In the case of JPMorgan Chase, for instance, the nation’s largest bank satisfied its requirement to provide $4 billion in consumer relief in September by modifying and restructuring mortgages for about 169,000 borrowers — many of them the bank’s own customers.

Allegiant Real Estate Attracts New Attention

Posted by: | CommentsNew York—Six months after its launch, Allegiant Real Estate Capital LP has reeled in strategic investments from three players in the real estate industry. Anthony Tufariello, former co-CIO of real estate at Fortress Investment Group, and New York City developers Ziel Feldman and Nir Meir recently contributed capital to the commercial real estate investment management and advisory company…

Wanted: Credit Experts for $28 Billion Australian Pension Fund

Posted by: | Comments-

CBUS looks to boost credit, infrastructure and property teams

-

Fund receives A$1.75 billion in new contributions each year

An Australian pension fund overseeing A$37 billion ($28 billion) in assets is looking to hire investment staff to bolster its credit, infrastructure and property teams as it diversifies away from Australian equities.

Melbourne-based Construction & Building Unions Superannuation, which managed Australia’s second-best performing pension strategy in 2016, aims to bring more of its asset management in-house. It joins the nation’s biggest pension fund, the A$100 billion AustralianSuper Pty Ltd., and UniSuper Management Pty Ltd., in growing their internal investment businesses…